What do Buzz Lightyear from Toy Story and Ben Bernanke have in common? “To Infinity and Beyond” is their shared catch phrase it seems. With the US Federal Reserve’s Chairman’s announcement last week of open ended quantitative easing (QE), Jim Sinclair’s (of JSmineset.com) long time call of QE to infinity seems to now be in […]

Category Archives: Monetary System

This category is our catch all for some deep navel gazing!

We cover the gold standard and what transformations the global monetary system may take in the coming years. And how these changes would affect New Zealand.

Plus some random stuff like housing and money printing in New Zealand.

Must read articles about the Monetary System

If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

What’s the chance of a new gold standard happening? Read this and you’ll learn how a return to a gold standard would affect New Zealand and what you could do about it.

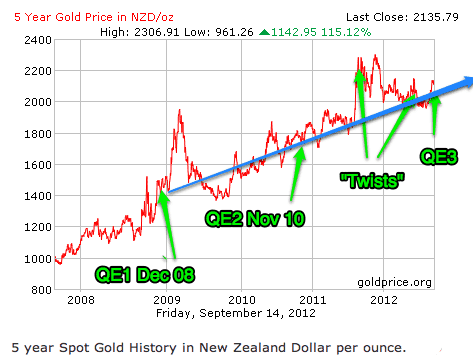

In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains?

If the New Zealand Dollar were to keep rising against the US Dollar, how wil this affect any gains in gold and silver? Read on to find out…

Australia has 80 Tonnes of Gold, How Much Gold Does New Zealand Have?

Is the level of a countries gold reserves important? Learn how New Zealand’s gold reserves compare to Australia and what this means!

RBNZ: Now Actively Researching a Central Bank Digital Currency – Reading Between the Lines

See how the Reserve Bank of New Zealand is currently investigating central bank issued digital currencies. You’ll also learn what other central banks are up to in this space.

Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Why should you become your own central bank? Does it depend on how much gold your own nations central bank holds? You’ll discover the answer in this article along with other ways to mimic central banks in protecting your finances.

RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

See how a Reserve Bank of New Zealand (RBNZ) bulletin outlines 5 unconventional monetary policy plans they could implement in case of a crisis, including negative interest rates and quantitative easing.

Latest Articles

We read a Bloomberg article yesterday looking at the Aussie and Kiwi dollars and the fact they have been the best performing major currencies against the US dollar in recent months. In fact it noted the returns on New Zealand’s securities surged to sixth in the second-quarter, up from 13th in the first three months […]

Today we have a bit of a comparison of little old New Zealand in a number of measures, from various odds and ends we’ve come across in the past week. So we’ll get to have a look at where we rank globally on a range of topics such as: Our currency Ease of doing business […]

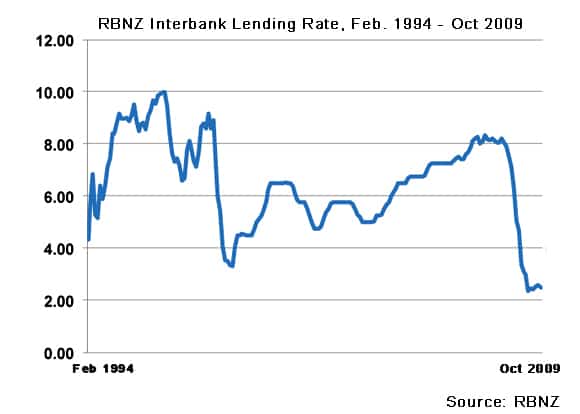

This interview is very timely following Fed Head Bernanke’s comments this week on it’s options for further stimulation. He spoke about how the Fed had the option if the economy worsened to lower the interest rate that it pays banks to keep their reserves deposited with the Fed. Read on to discover the impact this would have […]

We know we’re not part of Australia – even if the rest of the world doesn’t – but we’ve posted this article under the “New Zealand Articles” heading, as where the Aussie housing market goes generally so does ours. It also discusses the NZ housing market in terms of affordability or rather it’s unaffordability. NZ may […]

Today we have a very informative article from an aquaintance of ours who publishes some great information on “Crisis Investing”. We follow J.S.’s thoughts closely and highly recommend his newsletter especially if you are interested in some very close guidance on investing in the stock market with far more detail that virtually any other newsletter around. […]

Is there an Australian in the house? Today, yes there is. For any of our Australian brethren reading we feature some thoughts from one of your countrymen. Steve Keen was one of the very few academic economists worldwide that predicted the current debt fueled financial crisis as far back as 2005. He writes regularly on his blog here. […]

As we discussed in “Green Shoots? – Don’t believe the hype”, we believe comments coming from world and central bank leaders and economists that the worst of the recession may be behind us are likely very premature. They’re still coming though. For example here in New Zealand, BNZ bank economists recently stated that the housing […]

The 6 August 2009 Statistics New Zealand press release for the Household Labour Force Survey told us that… In seasonally adjusted terms, the unemployment rate continued to rise, reaching 6.0 percent during the June 2009 quarter… Both the number of people unemployed and the unemployment rate have been increasing for the past six quarters. The […]