It’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2018 and then finish off by making a few guesses as to what 2019 may hold for us. 2018 was quite a change from 2017 overall in […]

Category Archives: When to Buy Gold and Silver

Timing is helpful in ensuring you get the best price when buying gold and silver. This category covers topics such as seasonality and how this affects the gold price. Along with some guides on technical analysis (simple indicators on gold and silver charts to help you choose better times to buy), along with understanding the relationship between the NZ Dollar, US Dollar and gold and silver.

This is also the place where you’ll also find us writing about what we think the prices of both precious metals may do.

If you’d like more guidance on picking lower risk times to buy, then you should definitely get free access to our gold and silver daily price alert email service.

Must read articles about When to Buy Gold and Silver

When to Buy Gold or Silver: The Ultimate Guide

Learn about fundamental reasons for buying such as how the economy is doing, the risk of financial panics or currency devaluations. But also technical reasons or rather just purely timing when to buy gold or silver depending on the price. Plus finally whether to choose to buy gold over silver or vice versa.

Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation?

This article covers: Has NZ property peaked? The 18 Year Real Estate Cycle, the gold bull market 1970’s vs 2000 to date. When will gold and silver reach their peak valuations? And how property cycles and gold cycles might play out in the years to come.

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Once you’ve read this ultimate guide here’s what you’ll know: What is technical analysis? What are the benefits of technical analysis in gold and silver? Is technical analysis any use in manipulated markets? The different types of charts available and where to get them for free. Plus 6 different types of technical indicators for use in gold and silver analysis.

Where Are We in the Psychology of the Silver Market Cycle?

This article looks at the phases of investor psychology in market cycles. Then compares these phases to the silver market cycle over the past 8 years or so, to see where the silver market is currently. Therefore helping to indicate where silver is going from here and aiding with deciding when to buy silver…

The Yield Curve Recession Predictor: Impact on Gold?

The best predictor of a recession we have seen is the yield curve. While the yield curve may sound like something only economists would know about and discuss, it’s actually a surprisingly simple measure. In this post we’ll cover how the yield curve predicts recessions, how far away the next one may be and how the yield curve impacts gold.

Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

This post will help you if you’re worried about the impact of rising interests rates on gold. It covers: A common misconception about gold and rising interest rates; Rising interest rates in the 1970’s and the effect on gold; How the last 6 Federal Reserve Interest rate hikes have impacted the gold price; What might the future hold for interest rates and gold?

Latest Articles

The New Zealand share market index, the NZX50 reached a new all time high earlier this month of 9084.04. Today the index is only just down from all time highs at 8953. So surely this is an indicator of a robust economy? And given share markets are meant to be forward thinking, a sign that […]

Last week the US Central Bank again raised interest rates. This is in response to the US economy being so strong. Will gold rise after the latest Fed rate hike and surprise everyone again? Gold and Previous Fed Rate Hikes The chart below shows that gold has risen straight after each of previous US […]

Gold volatility and silver volatility are at record lows. See what demand for gold and silver is like around the world and also in New Zealand. Gold is boring – does this mean it’s time to buy? Silver volatility is the lowest it has been since 2001. Source. But volatility in gold is even […]

The New Zealand Dollar has been falling in value lately compared to the US dollar. The Kiwi dollar has also been losing value against its fellow commodity currencies, the Australian and Canadian dollars. Looking at the chart of the NZ dollar against the US dollar, the Kiwi dollar is getting close to the next level […]

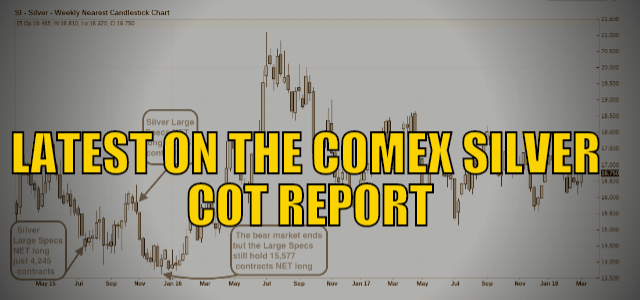

In last weeks newsletter we explained “What is COT’s?” Here is the latest on the positioning of silver futures traders and what it might mean for the silver price. As the author states “the CoT is often a lagging indicator of future trend”. So the numbers detailed below may not mean a jump in silver […]

Sorry we can’t stop publishing posts outlining why silver is likely such a good buy currently. In recent weeks we’ve had, Silver: Black Swans, 2018 and Beyond and Why Silver May Not Be “Off the Radar” For Much Longer. We have another post this week from technical analyst Clive Maund. He takes a close look […]

We’ve been “banging the drum” on silver lately. Pointing out in our weekly newsletter for the last couple of weeks here and here, that silver is currently very cheap compared to gold. But that may not last too much longer if the technical analysis in this post proves to be correct. While silver may have had no […]

Here’s a few reasons from our favourite newsletter writer Chris Weber as to why silver is lagging gold: “First is that gold has a strong monetary reserve place in the vaults of the central banks the way silver does not have. Further, wealthy people, whose distance from normal people is far larger today than it […]

We pointed out late last year that it was likely a good time to buy gold and silver as it appeared they might have bottomed already. And that buying at the end of the year had historically been a good time to buy as the price of gold was usually higher at the end of […]