This Week:

- Precious Metals Continue Upwards

- What if Inflation Surprises? Impact on Interest Rates, Aussie and NZ

- Why Gold is Not “Just Another Commodity”

- What Causes Gold Prices to Rise?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1710.90 | + $46.87 | + 2.81% |

| USD Gold | $1240.40 | + $31.15 | + 2.57% |

| NZD Silver | $24.56 | + $0.44 | + 1.82% |

| USD Silver | $17.81 | + $0.28 | + 1.59% |

| NZD/USD | 0.7250 | – 0.0017 | – 0.23% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1643 |

| Buying Back 1kg NZ Silver 999 Purity | $750 |

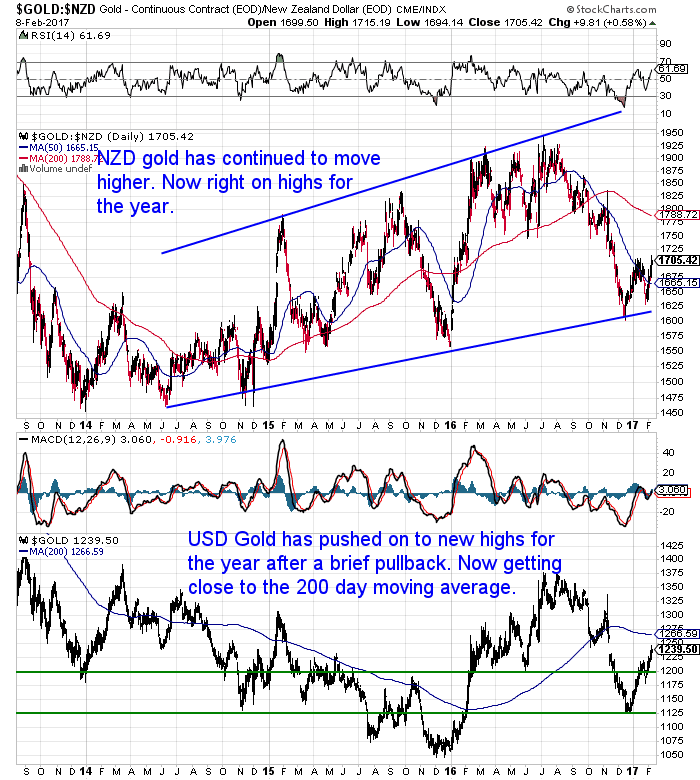

Precious metals have continued their move upward from last week.

Gold in NZ dollars is right on the highs for 2017. While in US Dollars (lower half of the below chart), it is clearly at new highs and a “higher low” looks to have formed in gold in both currencies.

But even after this move higher, gold is not too far above the rising trendline dating back from 2014. So while the chance to buy on the lows of late December has gone, this remains a great buying zone.

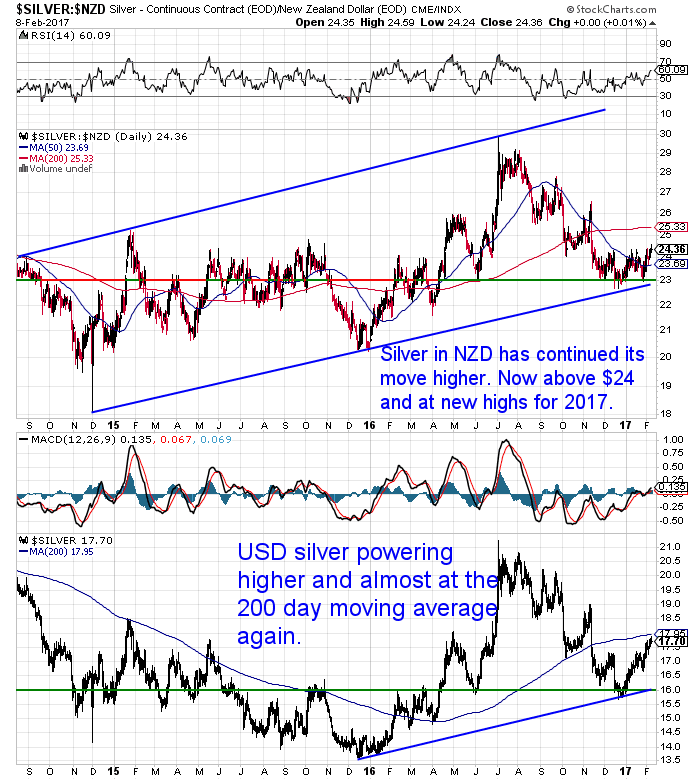

Silver has also continued to push higher this week. It is now above NZ$24 after also making a higher low at $23. Just like gold, silver in NZ dollars is also still not that far above the rising trendline. So silver also remains in what looks to be an excellent buying zone. Particularly if 2017 sees somewhat of a repeat of the price action from last year.

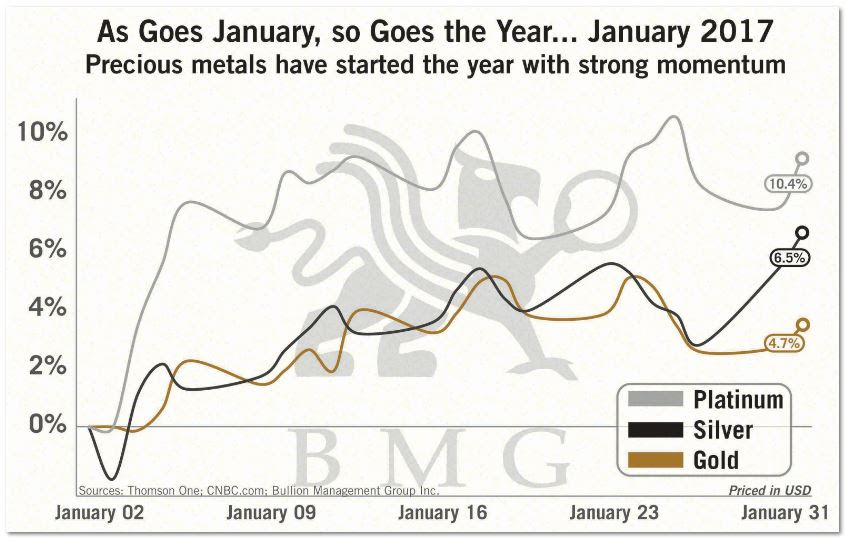

Gold, silver (and platinum) are off to fliers to begin 2017. For gold in NZ dollars the past 3 years have been the same. Strong starts have led to eventual gains at the conclusion of the year.

As alluded to last week, the NZ dollar does look to have started to correct and has moved lower today. This has helped boost local gold and silver prices. The Kiwi dollar could well come back to around 0.71 yet too. So about 150 basis points lower from here.

What if Inflation Surprises? Impact on Interest Rates, Aussie and NZ

The NZ dollar fell around half a cent, when the RBNZ announced no change to the overnight cash rate (OCR). Not that this was a big surprise. However a rate rise is still assumed to be a long way off. ASB reported:

“The RBNZ’s own OCR projections show the OCR remaining at 1.8% well into 2019, effectively a neutral stance. The RBNZ’s outlook has a 25bp hike built in by early 2020.

The flagging of a distant tightening is more realistic. But it should not be taken as a sign of an imminent tightening, given the RBNZ remains concerned about the high NZ dollar and sees the lift in long-term interest rates as an effective tightening.

We continue to view OCR increases as a long way off, towards the end of 2018. The RBNZ also noted premature tightening could undermine growth and stall the expected increase in inflation. In contrast, market pricing implies an early 2018 start, though has taken some heed of the RBNZ’s caution.”

Here’s something to ponder though.

As noted in an article on the website this week (How You Could Have Beat the Market Nearly 7-to-1 Last Year), global inflation rates have been trending slightly higher of late.

The NBR reported that NZ inflation expectations have ticked up a bit of late as well.

“New Zealand inflation expectations for the next two years have increased, a Reserve Bank survey shows, probably adding to the view that the central bank may lift its projected track for interest rates in Thursday’s monetary policy statement.

Expectations for inflation one year out rose to 1.56 percent compared to 1.29 percent in the Reserve Bank’s last survey three months ago. The two-year ahead figure rose to 1.92 percent from 1.68 percent.”

Although the RBNZ doesn’t appear to have taken much notice of this so far, as they have not changed their projections.

So what if these inflation rates globally and here in New Zealand really pick up and surprise everyone? Maybe we don’t just see a nice steady tick higher to the supposed central bank “sweet spot” of 1-3% inflation? (i.e. the inflation rate where the central bankers enemy deflation is not a risk, but where most people don’t notice the value of their money slowly but steadily heading lower year after year).

What if inflation rates went even higher? How well prepared would most be if as a result interest rates also headed quite a lot higher?

We’d hazard a guess to say not too prepared at all.

Over in Aussie they are already seeing increases in calls to financial helplines. The Australian Financial Review reports:

“The Reserve Bank of Australia frequently seeks feedback on the health of the economy. It might want to call the debt counsellors soon.

Homeowners, consumers and property investors around Australia are making more calls to financial helplines as three warning signs back up the spike in demand: mortgage arrears are creeping up, lenders’ bad debt provisions have increased and personal insolvencies are near an all-time high.

“It’s steadily out of control — I don’t know of too many financial counselling services where demand doesn’t exceed supply,” said Fiona Guthrie, chief executive officer of Financial Counselling Australia, who says the biggest increase in calls is from people suffering mortgage stress. “There are more people who have got mortgages that they can’t afford to pay.”

Australia’s households are among the world’s most-indebted after bingeing on more than $1 trillion of mortgages amid a housing boom that’s fizzled out in parts of the country, but still roaring in Sydney and Melbourne.”

This is without any significant increases in interest rates either.

Mish Shedlock notes that:

“Australians’ private debt has soared to 187 per cent of their income. Debt is up from about 70 per cent in the early 1990s.

The jobless rate rose for the second straight month in December to 5.8 per cent, and underemployment, the number of workers wanting more hours, is near an all-time high. Wage growth is the lowest on record.

Australia has one of the world’s biggest property bubbles. In some sections of the country, prices are already under severe price pressure. The entire country will soon face that problem, at least in my opinion.”

The New Zealand economy seems to be doing better than Aussie. Australia might well soon slip into their first recession in something like 100 quarters of ongoing growth.

But rising inflation and interest rates would have a serious impact here too. Particularly if house price growth slowed.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare? For just $290 you can have 4 weeks emergency food supply.

For just $290 you can have 4 weeks emergency food supply.

—–

Why Gold is Not “Just Another Commodity”

While it’s nice to see some reporting on gold in the media here in NZ. Like elsewhere in the world we still see a negative angle to gold creep in mostly.

A report on December quarter world gold demand on interest.co.nz didn’t consider all the facts.

When commenting on Indian demonetisation the comment is made:

“India’s shock demonetisation policy brought the market to a virtual standstill. An initial rush for gold following the policy announcement came to a swift halt in the ensuing cash crunch. This is exactly the sort of regulatory shock you might have thought would raise demand for gold, but in fact the opposite happened. It is an event that has undermined a key reason why investors thought they should buy and hold gold.

…The reaction of gold demand in India, and international prices, to their demonetisation policy is perhaps the most interesting and surprising event of 2016. And one that will worry gold bugs because it shows gold is not ‘money’ in a crisis; it is just another commodity.”

However gold, and Indian gold purchasers, did react as you’d expect. Initially there were long lines of buyers and they were reportedly paying almost twice the spot price.

The reason the gold buying dried up was not because gold is suddenly no longer money. It was because money was no longer money! Or put another way with large swathes of cash no longer legal tender, the amount of cash that existed in the Indian economy was dramatically cut overnight.

“It was only on November 8 from 8 pm when people wanted to buy bulk quantity of gold, so that they could give all whatever they could (black money) and invest in gold. The jewellery showrooms were open till 11.30 pm. After that day, everything went completely down; there is no sales as people still do not have enough money in hand to spend,” mentions Deepak Tulsiani, co-founder, Dwarkadas Chandumal Jewellers.”

On top of this gold dealers were also being audited and checked to see if they were collecting gold buyers details. Given so much of the Indian economy runs on cash this likely scared many buyers away. One report stated:

“Buying gold from jewellers in cash without providing a permanent account number (PAN), backdated bills for high-value purchases and money launderers accepting old Rs 500 and Rs 1,000 currency notes for a hefty commission were reported. On November 10, the I-T department conducted raids in Delhi, Mumbai and other major Indian cities amid these reports on select jewellers and dealers.

The actions by the tax-man seem to have put pressure on domestic gold prices. Since rising to above Rs 31,700 per 10 grams on November 9, gold rate has dropped to less than Rs 29,500 in most major markets across the country.”

So it wasn’t that gold is suddenly “just another commodity”. On the contrary holders of gold in India before the demonetisation have had gold perform just the role it should. They have had another source of savings with which to purchase everyday goods or to swap for the new notes, given the old notes were longer legal tender.

Try as they might we doubt the Indian government can stop the innate desire to own physical gold that Indians have. And also the need to protect themselves from many many years of terrible government.

What Causes Gold Prices to Rise?

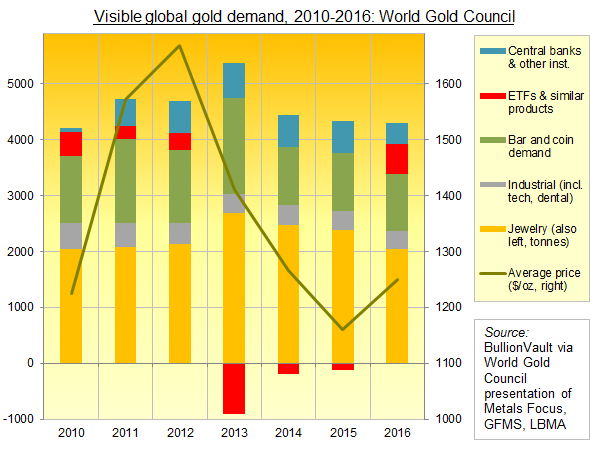

The stalling gold demand in 2016 reported above would be expected to dampen gold prices. And yet demand and price don’t seem to be that closely related when it comes to gold.

Adrian Ash of Bullionvault writes:

Central banks as a whole clipped their net gold demand to a 6-year low in 2016…fully one-third below the previous half-decade’s average.

Industry then? Nope. Technological and dental demand for gold fillings fell 3% last year in total on the World Gold Council’s first estimate…retreating to what must mark some kind of record-low at less than 7.5% of total global end-use.

So if it’s not jewellery, not coins, not small bars, not central banks, and not industrial users…that just leaves bigger investors, trading in and out with money which would otherwise go into stocks, bonds, commercial real estate and the rest.

This money shows most clearly on both GFMS and the WGC’s data through the size of exchange-traded ETF products.

See where gold prices drop? See what ETF trust funds were doing?

Now see those years when gold prices rose? See how ETF investors behaved?

This goes beyond just ETF products, however, such as the SPDR Gold Trust (NYSEArca:GLD). Because the bigger, deeper and smarter pool of big-money investing in gold comes of course in the physical wholesale market…

…the market of large, 400-ounce London Good Delivery bars…stored securely in specialist vaults…

…So to repeat, yet again: It is who buys or sells…not simply how much…which counts for gold prices. And it’s the largest investors…trading the largest, lowest-cost wholesale bars…who count most of all.

“Ah, but what about China?!” you might cry.

After all, the world’s No.2 economy leads the world in gold mining output…gold consumer demand…central-bank accumulation…and gold bullion imports.

To date, all these world-leading statistics have failed to move gold prices higher or lower. It remained Western funds and wealth managers who drove the market.

But this might…just might…be set to change. We’ll get to find out in 2017 perhaps.

Because China’s own wealth management industry might now be shifting some cash into gold…”

Coincidentally Jim Rickards also discussed this discrepancy between the paper market pricing and physical gold demand this week:

Players on the physical side are price takers, not price makers. This has been true for years, but now the tables may be turning. I’ve received firsthand reports of shortages of physical gold from refiners. Vault operators have told me physical gold holders are taking gold out of banks and putting it into private vaults, where it is no longer available to prop up the paper market.

Now even the miners are saying they’re running out of gold. Due to the price decline since 2011, new mines are not opening, output from existing mines is declining, old mines are being shut in and reserves are being reduced (see below for more).

We’re heading for a crackup where physical shortages will cause delivery failures and ignite panic-buying of physical gold that even the paper market can’t contain.

Gold has been moving from banks such as Deutsche Bank to private vaults not owned by banks. But the paper market is doing physical buyers a favor by keeping the price artificially low, making the entry point attractive. The super-elites see a crisis coming and they’re getting ready.

What about you?

I’m always amazed at how the power elite publicly disparages gold and urges you not to buy it. Meanwhile, they’re buying it themselves and putting in in safe nonbank storage. When it comes to the rich, my advice is to watch what they do, not what they say.

A gold price super-spike is coming. The time to get your gold is now.”

Then Rickards gold stock picker Byron King comments:

Right now, almost all of China’s retail, investor-driven demand for gold is met by the Shanghai Gold Exchange. Established in 2002, the Shanghai Gold Exchange is wholly owned by the Chinese government. In recent years, the organization has become the largest facility in the world for bullion sales and trading.

One recent estimate is that, in 2016, Shanghai Gold Exchange moved over 2,000 tonnes (or 64,000,000 ounces) of gold into Chinese investors’ hands. It’s a mix of new production gold, and imports of gold from western inventories. All this demand and sale, even though recent gold price premiums on the Shanghai Gold Exchange have been as high as 25% above the global-posted spot price.

This reflects the physical scarcity within Chinese gold trading channels. Presently, Shanghai Gold Exchange has over 10 million customers, and it’s just a beginning. As China continues to try to combat its economic, political and social issues, we must confront the idea that Shanghai Gold Exchange could become the source for explosive growth in customer numbers, and gold demand, in the years to come.

A collapse in China won’t be contained within China. A shortage of gold to meet demand in China will soon affect U.S. investors. So you must begin now to prepare now, and position yourself to profit from increasing demand for gold.”

Here in New Zealand there certainly doesn’t seem to be great demand for gold or silver currently. But unlike India or China, Kiwi’s like most westerners, seem to prefer to buy once the price has already risen.

We’d say now is a good time to be buying while the prices of both metals remain low. Odds favour them moving higher during the year again, so consider getting in before rather than after they do.

You can call, email or order online for a quote. See the details below along with all the articles posted on the website this week.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

This Weeks Articles:

A Global Money Printing CompetitionThu, 9 Feb 2017 9:52 AM NZST  Despite rising steadily since the start of the year, the sentiment towards gold and silver still seems not particularly positive. Despite the price looking like it bottomed out in December, rising but still being comparatively low to much of 2016, we are seeing very little buying of either metal currently. Below Stewart Thomson explains why […] Despite rising steadily since the start of the year, the sentiment towards gold and silver still seems not particularly positive. Despite the price looking like it bottomed out in December, rising but still being comparatively low to much of 2016, we are seeing very little buying of either metal currently. Below Stewart Thomson explains why […]

|

How You Could Have Beat the Market Nearly 7-to-1 Last YearTue, 7 Feb 2017 4:48 PM NZST  We’ve recently commented on the quiet rise in inflation rates here in New Zealand: Inflation Rates Edging Higher – Impact? See how this is happening globally and surprising people. Plus what the concern is in the future if the increases continue…. How You Could Have Beat the Market Nearly 7-to-1 Last Year By Justin Spittler […] We’ve recently commented on the quiet rise in inflation rates here in New Zealand: Inflation Rates Edging Higher – Impact? See how this is happening globally and surprising people. Plus what the concern is in the future if the increases continue…. How You Could Have Beat the Market Nearly 7-to-1 Last Year By Justin Spittler […]

|

When the Money Supply Dries UpTue, 7 Feb 2017 4:22 PM NZST  Countries fall from grace with remarkable speed. Here’s some historical examples to show just how quickly it can happen and why the USA will eventually lose its current advantage as sole global reserve currency… When the Money Supply Dries Up By Jeff Thomas In 1944, the US had been the primary supplier for arms for […] Countries fall from grace with remarkable speed. Here’s some historical examples to show just how quickly it can happen and why the USA will eventually lose its current advantage as sole global reserve currency… When the Money Supply Dries Up By Jeff Thomas In 1944, the US had been the primary supplier for arms for […]

|

This Important Chart Shows Why Gold Could Hit $6,000 by 2019Tue, 7 Feb 2017 4:01 PM NZST  Gold might be up overall quite a margin since the early 2000’s. However it’s important to get some perspective from previous moves higher to see where gold could head to yet… Weekend Edition: This Important Chart Shows Why Gold Could Hit $6,000 by 2019 By Justin Spittler Editor’s note: Today, we have another important essay […] Gold might be up overall quite a margin since the early 2000’s. However it’s important to get some perspective from previous moves higher to see where gold could head to yet… Weekend Edition: This Important Chart Shows Why Gold Could Hit $6,000 by 2019 By Justin Spittler Editor’s note: Today, we have another important essay […]

|

Support Building to Abolish NZ$100 NoteThu, 2 Feb 2017 4:03 PM NZST  This Week: Correction Over Already? A Model for Tracking Gold’s Short-Term Fundamental Fair Value Support Building to Abolish NZ$100 Note Other Plans to Attack Cash Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1664.03 + $12.05 + 0.72% USD Gold $1209.25 + $9.09 + 0.75% NZD Silver […] This Week: Correction Over Already? A Model for Tracking Gold’s Short-Term Fundamental Fair Value Support Building to Abolish NZ$100 Note Other Plans to Attack Cash Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1664.03 + $12.05 + 0.72% USD Gold $1209.25 + $9.09 + 0.75% NZD Silver […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9amClick here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2017 Gold Survival Guide. All Rights Reserved. |

Pingback: Infographic: Bullion Banking Mechanics - Gold Survival Guide