|

Gold Survival Gold Article Updates

Nov. 20, 2014

This Week:

- “Paper Gold” and Its Effect on the Gold Price

- Gold bounces back above $1200 – will it jump higher?

- Dairy Prices Drop Again

- Close to Maximum Pessimism?

Housekeeping

First up if for any reason our weekly email doesn’t make it to your inbox, we always publish them every Thursday evening onto the website as well. So you can look under the menu “Articles and Videos / Weekly Newsletter Archive” to find them or just click the big gold “Latest Weekly Newsletter button” on the homepage. See below:

And please drop us an email or use the contact form on the website if you suddenly stop receiving them (assuming you still want to keep receiving them that is!) and we’ll do all we can to get you receiving them again.

Prices and Charts

There’s been significant price volatility this week again. With a massive jump higher for gold and silver on Friday night. Then overnight the price plunged before rebounding. According to Zerohedge likely because of a leaked Poll result on the Swiss Gold referendum and then some surprisingly frank comments by the Russian Central Bank on their gold purchases.

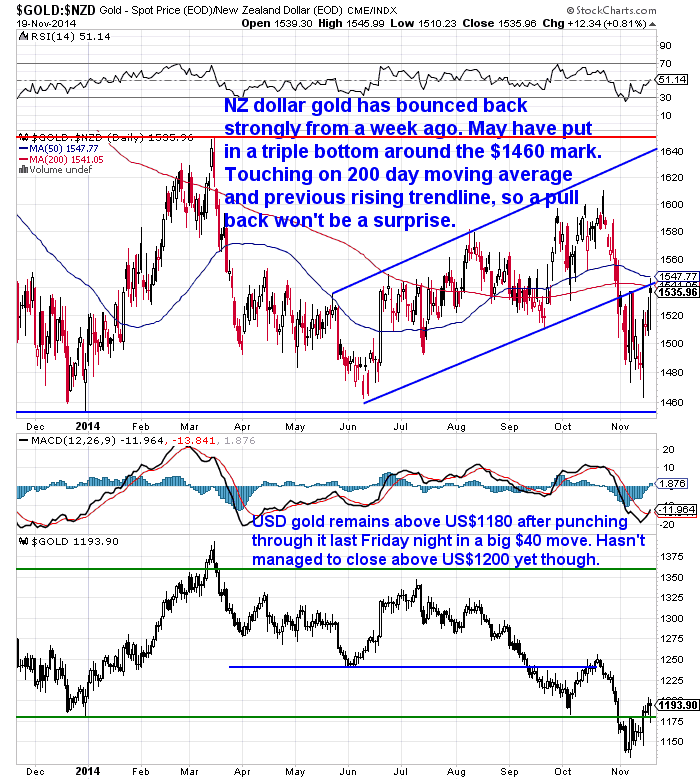

The upshot of all this is that gold in US dollars is up US$22.50 to US$1182.15 or in percentage terms up 1.9% from a week ago.

With the NZ dollar weakening slightly, local gold is up NZ$32.46 to NZ$1507.46 or in percentage terms up 2.2% from last week. You can see in the chart below that it dipped down to around the previous 2 lows of around $1460 before bouncing higher. Now sitting right on the 200 day moving average and also the bottom of the previous rising trendline, so a pullback from here will not be a surprise.

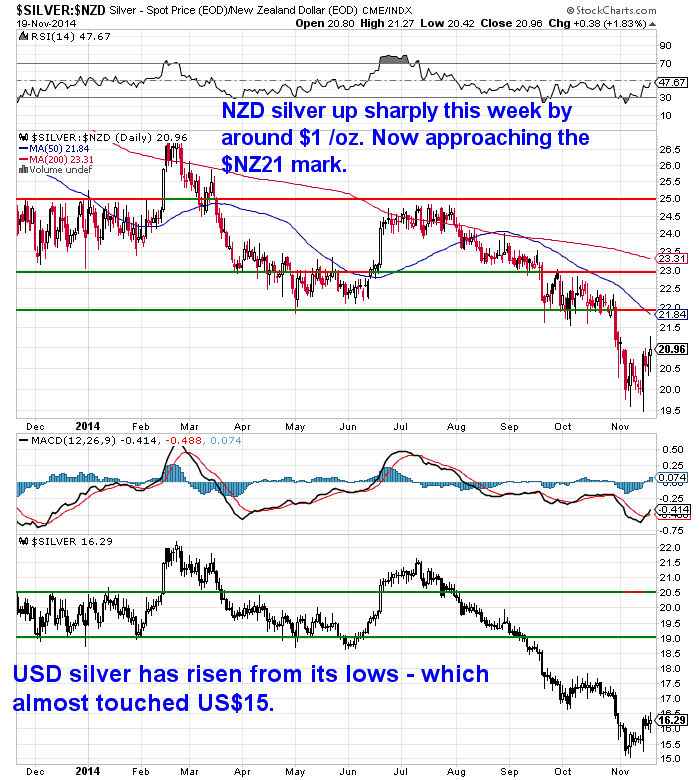

Turning to silver, in US dollars it is up 49 cents to $16.16 or in percentage terms up 3.1%

While in NZ dollars it is up 67 cents or 3.3% to $20.61.

Here’s a longer term view of silver in NZ dollars over the past 5 years:

And going back even further for 10 years showing we touched the very long term support line recently.

“Paper Gold” and Its Effect on the Gold Price

A must read article this week was the one we referred to last week from Casey Research’s chief economist Bud Conrad. We’ve had the pleasure of meeting Bud in the past, and it was actually at a dinner he was speaking at back in 2008 where the idea for Gold Survival Guide was first germinated. He does a great job of outlining just how the gold futures market is so concentrated in the hands of just 3 banks and how this opens up room for abuse.

He does hold out some hope though that this will not last forever. A point also made in a great overview article from the always balanced Lawrie Williams on mineweb this morning:

—–

Gold bounces back above $1200 – will it jump higher?

“Gold bounced back above $1 200 this morning in London, but before one can be sure that this is the start of the long-expected recovery there could yet be teeth in the bear. The big money playing the futures markets with paper gold can still exert ultimate control over where the price is headed short term and if it suits them there could yet be another sharp price drop to try and drive out any remaining weak gold holders.

But medium term it may be that options are becoming more and more limited for keeping the market depressed. Gold continues to flow from West to East with the big recovery in Indian demand coupled with continuing high levels of withdrawals from the Shanghai Gold Exchange as the key elements in this. Although whether Indian demand has recovered to overtake China’s over the past two quarters as World Gold Council figures might suggest, and which has been reported as fact by much of the media, given SGE withdrawal figures have been running at such high levels of late we think is not a true picture of the real situation, but in combination India and China are taking in gold at back to peak levels.

Demand is also seen as high in a number of other countries in Europe, the Middle East and elsewhere in Asia, while Russia and some of the old FSU countries are adding to their gold reserves thus taking even more metal off the markets. It is hard to see where all this volume of gold is coming from as it certainly substantially exceeds new global gold output.

Gold in backwardation too also suggests that supplies of physical metal in the West are becoming more and more limited and the logic of shorting gold may be about to disappear. There has been the suggestion that the recent fall in the gold price down to $1 140 has been a bear trap to catch the short traders out.”

Source.

—–

Dairy Prices Drop Again

On the home front the GlobalDairyTrade auction overnight again surprised the bank economists with the key Whole Milk Powder index falling 5.1%. We saw that ASB have yet again revised down their 2014/15 milk price forecast to $4.70 per kg of milk solids.

So more reasons why we could see interest rates remaining much flatter than most expect for a while longer yet.

Close to Maximum Pessimism?

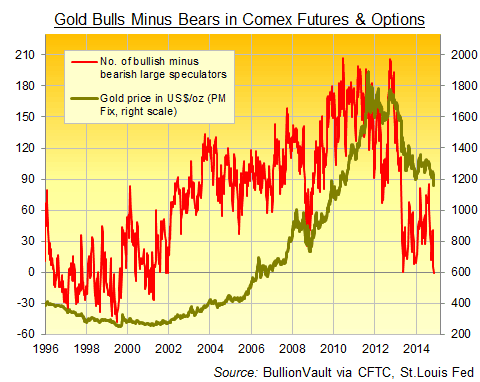

We get the feeling that negative gold sentiment reached a real crescendo last week just prior to the big pop higher on Friday night in US markets. We’ve seen an awful lot of “Gold is Finished” type articles of late. Plus many comments to “sell any rallies above US$1200”.

On top of this the number of bears in US gold contracts last week outnumbered the bulls for the first time since 2001 as can be seen in the chart below.

We pondered 2 weeks ago, “The odds favour further falls ahead now that the previous support at US$1180 was broken. However the counter to this is that it seems to be commonly expected that gold will now fall to somewhere in the vicinity of US$1050. So perhaps this expectation is getting somewhat all pervading?”

So this might have been the case with the sharp jump higher on Friday. Of course who knows exactly what might happen? We stick to the theory that it’s a good idea to purchase precious metals in stages and add to this on any big falls. There have been a few people following this of late. From our perspective the number of purchases remains low. However those buying are buying in decent sized chunks, maybe they will prove to be the “smart money” in the long run?

If you think they are then get in touch. We’re happy to have a chat if you’re new to the world of precious metals. Or for that matter if you’re an old hand. The great thing about what we do is that our customers are much nicer (and more interesting) to talk to than the general public! So we enjoy talking to you! |

Pingback: Reminder: There is no deposit insurance in NZ banks - Gold Prices | Gold Investing Guide