Is This What’s in Store for New Zealand Down the Road?

How’s this for perverse? Could anything as crazy as negative interest rates on mortgages come to New Zealand?

Homeowners in Denmark are “about to get negative interest rates on their loans for all maturities through to five years, representing multiple all-time lows for borrowing costs.”

“At the biggest mortgage bank in the world’s largest covered-bond market, a banker took a few steps away from his desk this week to make sure his eyes weren’t deceiving him.

As mortgage-bond refinancing auctions came to a close in Denmark, it was clear that homeowners in the country were about to get negative interest rates on their loans for all maturities through to five years, representing multiple all-time lows for borrowing costs.

“During this week’s auctions, there were three times when I had to stand back a little from the screen and raise my eyebrows somewhat,” said Jeppe Borre, who analyzes the mortgage-bond market from a unit of the Nykredit group that dominates Denmark’s $450 billion home-loan industry.

For one-year adjustable-rate mortgage bonds, Nykredit’s refinancing auctions resulted in a negative rate of 0.23%. The three-year rate was minus 0.28%, while the five-year rate was minus 0.04%.”

Source.

Why Do These Mortgages Have Negative Interest Rates?

Why are Danes getting paid to have a mortgage?

Because the mortgage rates are influenced by government bond rates. And in Denmark these have been negative since 2012. Where their central bank has lowered interest rates “in an effort to defend the krone’s peg to the euro”.

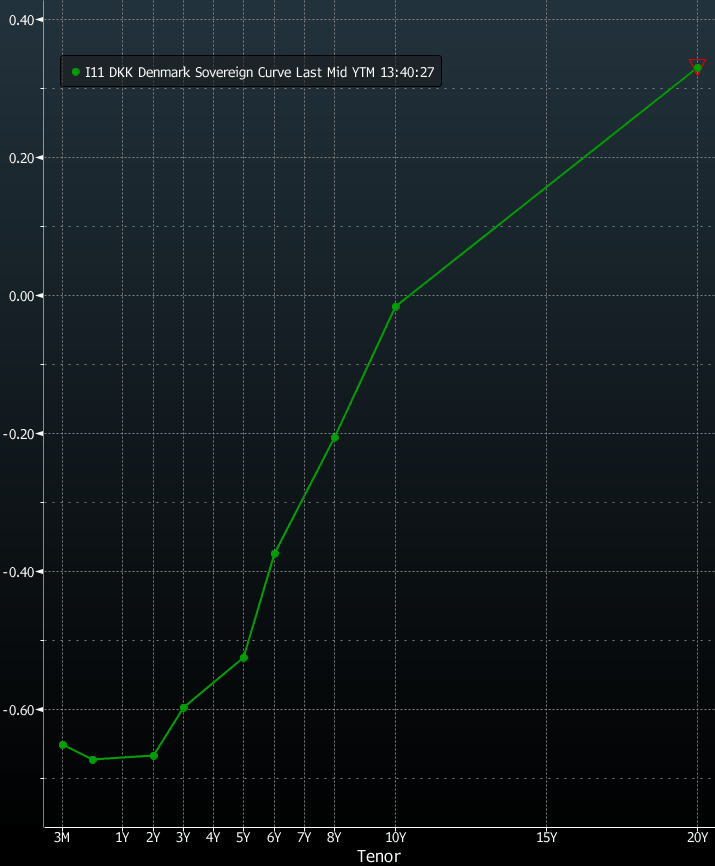

Now government bond rates are negative right the way out to 10 years! That is, people are paying the Danish government to borrow money off them!

Denmark’s Government Bond Yield Curve

And now banks are paying Danes to borrow money from them too. (Albeit there are fees on top of the negative interest rates. So they may not quite be “getting paid” to borrow yet).

Why Are Wealthy Savers Prepared to Pay Governments to Borrow From Them?

Nick Hubble at the Daily Reckoning reckons the likely answer is that the wealthy are scared of bank failures.

You see governments fail much less often than banks do.

The wealthy care most about return of their money rather than return on their money.

So wealthy savers prefer to pay the government a little to get their money back a few years into the future. Rather than earn a smidgen of interest but face the risk of a bank failure.

Therefore these negative interest rates may well be an indicator of trouble to come in banks. Hubble points out that if you ask a financial historian when a particular past financial crisis really kicked off, they’ll likely point to a bank failure:

Creditanstalt and the Great Depression. Lehman Brothers and the GFC.

So, which bank will ignite the next financial crisis?

There are a lot of contenders around right now.

China just experienced its first modern bank failure. Baoshang Bank was taken over by regulators and emergency funding from the central bank is on the way too.

How will the communist authorities handle the situation?

In Italy, bank shares plunged around 30% this month. Italian banks own a lot of government bonds, so if the Italian government defaults, the banks will go down too.

In Australia, an imploding housing bubble and a class action lawsuit threaten our own banks as well.

One of the biggest and most important banks in the world, Deutsche Bank, is turning into a slow-motion train wreck. Its shares, bonds and default insurance are at dangerous levels.

Source.

Interest Rates Are Also Falling Here in New Zealand

Interest rates have also been falling here in New Zealand. Following the RBNZ rate cut to a record low 1.5%, banks have been dropping floating home loan rates.

New Zealand is a long way from mortgages that pay you money. But still the trend looks to be down for interest rates.

Latest reports point to another interest rate cut to come yet:

RBNZ ‘nudged closer’ to another OCR cut

BNZ economists see the likelihood of another interest rate cut increased by the results of the latest ANZ Business Outlook Survey

The Reserve Bank will have been nudged “a smidgen closer” to lowering the Official Cash Rate further after May’s ANZ Survey of Business Opinion, according to BNZ’s head of research Stephen Toplis. In an Economy Watch publication, Toplis said the RBNZ has displayed a clear focus on the possibility that falling growth will alleviate capacity constraints in the economy and, in turn, ease pressure on the labour market and future inflation.

Source.

But as we wrote about last year, the New Zealand central bank has already floated the idea of negative interest rates as a possible response to the next financial crisis.

See: RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

New Zealand Interest Rate Swaps Hit New Lows

Here’s a report from a couple of weeks ago too:

“New Zealand interest rate swaps* were either at or close to record lows across the range on Wednesday in the light of global uncertainties and following on from the Reserve Bank’s Official Cash Rate cut last week. The rates have been pushed down this year by signs of a global economic slowdown and more recently the escalation of trade wars and the cutting by the RBNZ of the OCR from 1.75% to 1.5%.”

Source.

What is an Interest Rate Swap?

“*An interest rate swap is where two people, or parties, agree to exchange two different types of interest rate for a specified period of time. NZ interest rate swap rates are determined by the rates on NZ government bonds and the demand for paying or receiving the fixed rate. A gauge of the level of demand is the difference between the NZ government bond rate and the swap rate, known as the “swap spread”.

The major influences on the level of demand are corporate borrowers (who have floating rate borrowings), banks (who also want to match fixed rate mortgages against their floating rate borrowing) and issuers of fixed rate NZ$ bonds, who typically want to pay the fixed rate.”

Related: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

Negative Interest Rates in New Zealand – Not as Whacky as They Once Sounded

With the Official Cash Rate (OCR) at only 1.5%, (and another cut likely to come), negative interest rates in New Zealand don’t seem so wacky now.

Remember these cuts are coming when the New Zealand economy is far from in trouble. We think the odds of more than one further rate cut are far higher than any bank economist would have you think.

It is even starting to get some mention in mainstream media:

What happens if interest rates hit zero?

“The Reserve Bank cut the cash rate to a record low and is considering how to stimulate the economy if it ever had to cut it to zero percent. Bernard Hickey looks at the options, which include negative interest rates and creating money to buy assets.”

Source.

Now ANZ Bank Economists are Openly Discussing Negative Interest Rates

Now on 17 June, a report by ANZ Bank economists says there is a “very real” chance that New Zealand’s monetary policy will run out of conventional ammunition. The authors suggested the central bank look at a series of unconventional measures, including quantitative easing.

If unconventional monetary policy were to be necessary – something they say is not a given – they recommend reducing the official cash rate to negative 0.25 percent and “provide very strong forward guidance that rate hikes are a very distant prospect.”

Source.

Low and Negative Rates: Good for Mortgage Holders – Bad for Retirees

While very low or even negative rates are great for borrowers, they don’t look so rosy for retirees.

If you haven’t already, consider adding some gold (and silver) to your investment portfolio. With bank deposit rates so low there is little, if any, opportunity cost to holding gold and silver bullion instead.

Editors Note: This article was first published 4 June 2019. Updates 19 June 2019 to include: Now ANZ Bank Economists are Openly Discussing Negative Interest Rates

Pingback: NZD Gold Above $2000 - Should You Buy the Breakout? - Gold Survival Guide

Pingback: How Might the RBNZ Respond to the NZ Economy Weakening Further? - Gold Survival Guide

Pingback: Update on the War on Cash: Australia Moving to Cashless Society? + RBNZ on Digital Currency - Gold Survival Guide

Pingback: Update: RBNZ Bank Financial Strength Dashboard - How Helpful is it? - Gold Survival Guide

Pingback: Real Interest Rates in New Zealand | What Can They Tell Us About When to Buy Gold?

Pingback: Negative Interests Rates in NZ by November? - Gold Survival Guide

Pingback: What Would Negative Interest Rates Mean for New Zealand? - Gold Survival Guide