We recently reported that in 2019 just about every asset class went up – including gold and silver. That is possibly evidence that we are in or entering Austrian economist Ludwig von Mises “crack-up boom”.

Below Darryl Schoon discusses the goings on in the US Repo market and what he believes was the cause of the Repo market troubles in 2019.

He outlines why the US central bank is trapped. How they will be forced to continue to provide massive amounts of liquidity to avoid a collapse in the markets. You’ll also see what his trading strategy is for 2020.

It’s an interesting read. The difficulty as always is in timing. Who knows how long the central banks of the world can keep things rising? But he shows how to prepare yourself for when the day comes. The video included also has an interesting tale about futurist Buckminster Fuller…

The Crack-Up Boom and Gold & Silver

Monetary edema: a monetary phenomenon occurring in late-stage capitalist economies when repeated attempts to restore economic growth causes excess money to be trapped in financial markets; asset prices then rise to record levels in a crack-up boom (per Ludwig von Mises), which ends with a “flight into real values [gold and silver] and the whole monetary system founders.”

As aggregate levels of debt exponentially expand in capitalism’s endgame, markets become increasingly destabilized and central bankers become the primary participant in markets they once regulated.

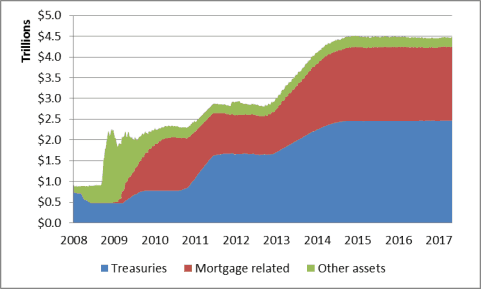

Prior to the 2008 financial crisis, central banks used interest rates to keep monetary growth and economic expansion in relative balance. The 2008 collapse, however, was so severe, the Fed was forced to purchase hundreds of billions of dollars of illiquid subprime mortgage-backed securities (below, colored red) from banks then on the verge of insolvency.

After 2008, the Fed has provided historic amounts of liquidity (over $4 trillion) to financial markets through quantitative easing and zero-rate policy i.e. QE and ZIRP. This was necessary to replace rapidly disappearing liquidity in financial markets caused by powerful deflationary forces unleashed by the collapse of the massive subprime property bubble.

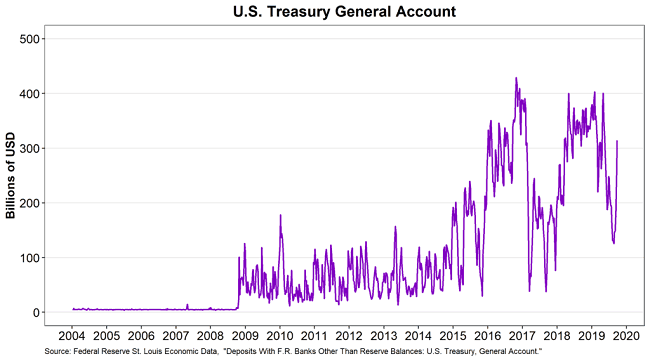

Prior to the 2008 crisis, the cash balance in the US Treasury General Account (TGA) was $5 trillion. After the crisis, however, the Treasury General Account rose to over $400 trillion, due to a corresponding imbalance in bank reserves on deposit at the Fed.

Source, David Beckwith, Seeking Alpha, December 30, 2019

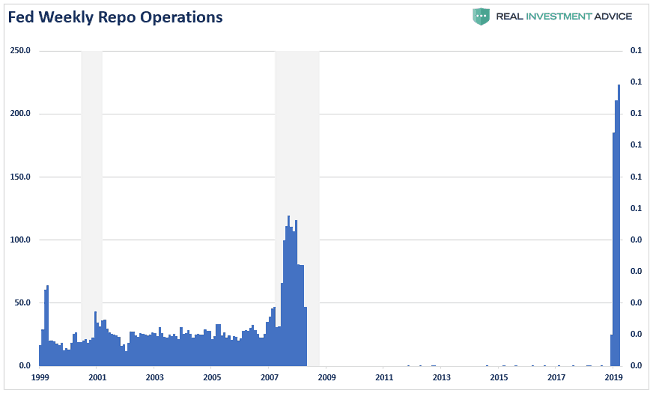

After 2008, the Fed used QE and ZIRP to quickly replace the trillions of dollars disappearing from the economy; but, in September 2019, a crisis in the overnight repo market forced the Fed after an absence of twelve years, i.e. 2007-2019, to intervene in the repo market again.

Fed Repo Interventions

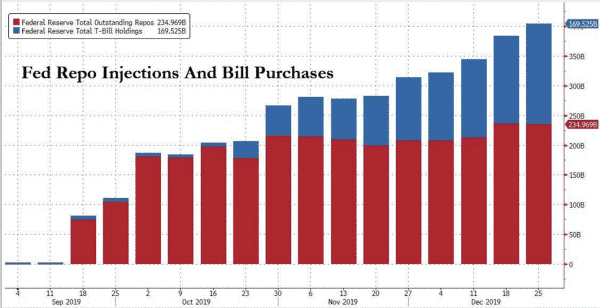

Since its intervention on September 17, 2019, the Fed has been forced to provide an ever-increasing flow of liquidity—to date, over a quarter trillion dollars—to the repo markets.

September – December 2019 Fed Repo Injections and Bill Purchases

The quarter-trillion dollars however, won’t be enough. The Fed, has badly underestimated how much and how quickly liquidity is now disappearing.

…In April 2008…Federal Reserve staff…estimated that the level of reserves that would be needed “might be on the order of $35 billion…The assumption rose to $100 billion in 2016, $500 billion in 2017, and $600 billion in 2018. [January 2019] the FOMC judged about $1 trillion in reserves was abundant. I’d guess that their current estimate is about $1½ trillion [December 5, 2019]Bill Nelson, Bank Policy Institute Chief Economist, December 5, 2019

… I think [Fed chairman] Jay Powell is trapped. The Fed is trying to keep a bucket filled with holes full.

Danielle DiMartino Booth, CEO Quill Intelligence

THE FED IS TRAPPED – SO ARE WE

HEDGE FUNDS IN THE CRACK-UP BOOM

Most hedge funds are designed and sold on the premise that they will make a profit regardless of market conditions. Losses aren’t even a consideration – they are simply not supposed to happen.

www.investopedia.com

The hedge fund industry has suffered its first quarterly loss of 2019

Institutional Investor, October 17, 2019

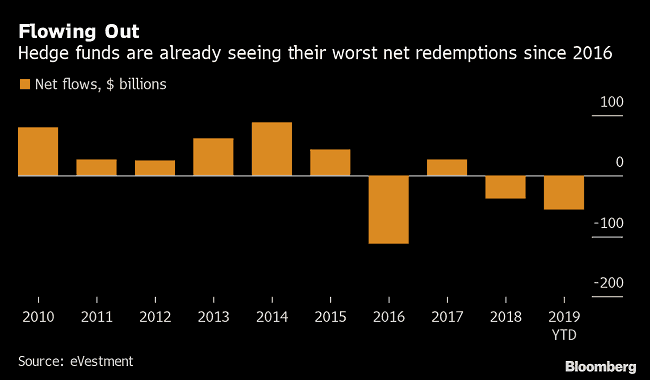

Investors have pulled $63 billion from hedge funds this year…The first two-thirds of 2019 have been rough for the hedge fund industry…The outflows are a continuation of the wave of redemptions that started back up in 2018 when investors pulled $37.18 billion out of the industry…

Hedge Funds Working to Limit Redemptions – Dozens of hedge funds have told investors they cannot get their money back right now as managers try to limit a wave of redemptions to safeguard all their clients’ investments—as well as their own futures…On Thursday, Knight Capital Group’s Deephaven Capital Management halted redemptions at two of its hedge funds. Recently, hedge fund Basso Capital told investors it was postponing redemptions. Hedge fund firm Ore Hill Partners imposed a gate in late August. Before that Drake Capital Management and Pardus Capital Management began restricting client’s departures and Ellington Capital Management stopped allowing investors to exit one of its portfolios last year.

Spooked by hedge funds’ worst-ever returns at a time the average fund has lost 20 % this year, pension funds and wealthy individuals alike are leaving hedge funds faster than ever before…Between July and September, investors pulled out a record $31 billion, which helped shrink the industry 11%…A lot of people are looking for liquidity which is causing people to redeem investments

Reuters, October 2019

On January 16th, in their article, New York Fed Considering Becoming Sugar Daddy to Hedge Funds as their Distress Grows, Russ and Pam Martens wrote:

On June 3 the $4.7 billion Woodford Equity Income Fund in the UK froze withdrawals by investors. The fund was slated to open for withdrawals in December but the UK regulator… announced in October that the fund will not reopen and will be liquidated instead.

On December 4, the UK based M&G Property Portfolio announced it would suspend deals, stating that it could not meet redemptions due to difficulty in selling commercial property. Investors had pulled an estimated $1.2 billion from the fund in the first 10 months of last year.

Just yesterday, the Korean hedge fund manager, Lime Asset Management announced that it was suspending withdrawals from its various hedge funds that would impact $1.7 billion in assets. The hedge fund manager had reported earlier last year that it was halting withdrawals on $700 million of funds. The problem at Lime is also reported to be illiquid assets.

Supporting the idea that a spike in hedge funds withdrawals is partly responsible for the Fed restoring its cash feeding to Wall Street, the Financial Times reported on October 1st that the CFO of a ‘top-10 US bank’ told it:

“We have plenty of liquidity. We are just choosing not to lend it out overnight to hedge funds.”

UNLESS THE FEP BAILS OUT TODAY’S OVER-LEVERAGED HEDGE FUNDS

THE BANKERS’ HOUSE OF CARDS WILL COLLAPSE

SOONER THAN LATER

2020 CRACK-UP BOOM TRADING STRATEGY

ASSET CLASS

Stocks

Bonds

Commodities

Real estate

Gold

Silver

CURRENT STATUS

crack-up boom prices

crack-up boom prices

crack-up boom prices

crack-up boom prices

price suppressed

price suppressed

STRATEGY

short

short

short

short

long

long

My youtube video, 2020: Bucky’s Predictions can be viewed at https://tinyurl.com/vdsdh7y . It’s going to get worse before it gets better.

On April 4th & 5th, Sandeep Jaitly, David Morgan, Peter Von Coppenolle, Martin Hinkling, and I will be speaking on Money: Rock, Scissors, Paperat The School of Mines at Imperial College in London. see http://drschoon.com/events/

These are interesting times. Join us in London.

Buy gold, buy silver, have faith

Darryl Robert Schoon

www.drschoon.com

Pingback: ILLIQUIDITY & GOLD AND SILVER IN THE END GAME - Gold Survival Guide

Pingback: Bill Bonner: Get Ready for the ‘Crack-Up Boom’ - Gold Survival Guide

Pingback: Should We Be Worried About the CoronaVirus? - Gold Survival Guide

Pingback: Will This Coming Decade Resemble the 1970’s? - Gold Survival Guide