This Week:

- Where Are We in the Psychology of the Silver Market Cycle?

- Is Gold Losing Its Shine to Bitcoin?

- Danger: Nations and Central Planners Developing Cryptocurrencies

- What is the Hyperledger?

Prices and Charts

Ready for a Bottom. Close to a Bounce?

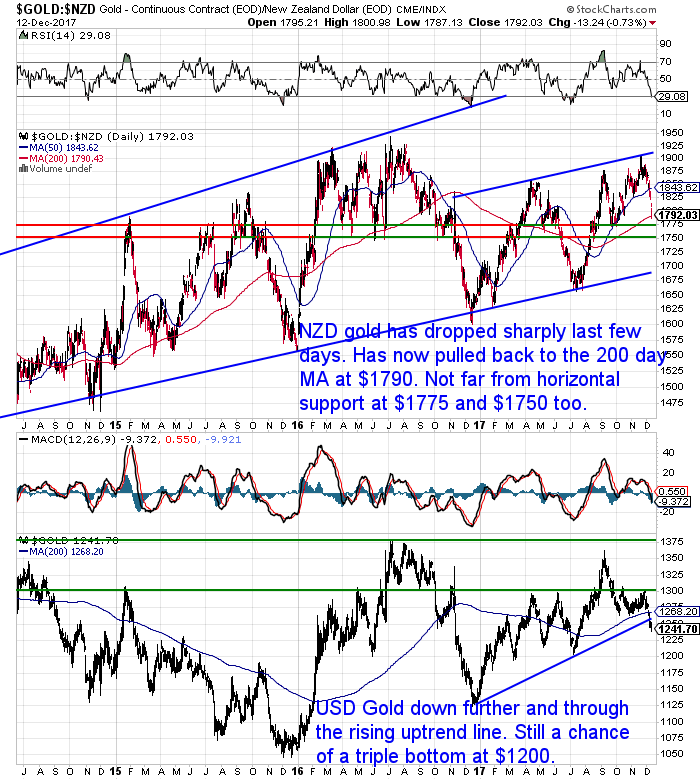

Both metals have fallen further this week.

Gold in NZ Dollars is today sitting right on the 200 day moving average line at around $1790. It is also not far from the horizontal support lines at $1770 and $1775.

On top of this the overbought oversold RSI indicator is now in oversold territory below 30.

So if this is not the bottom then it likely isn’t too far off.

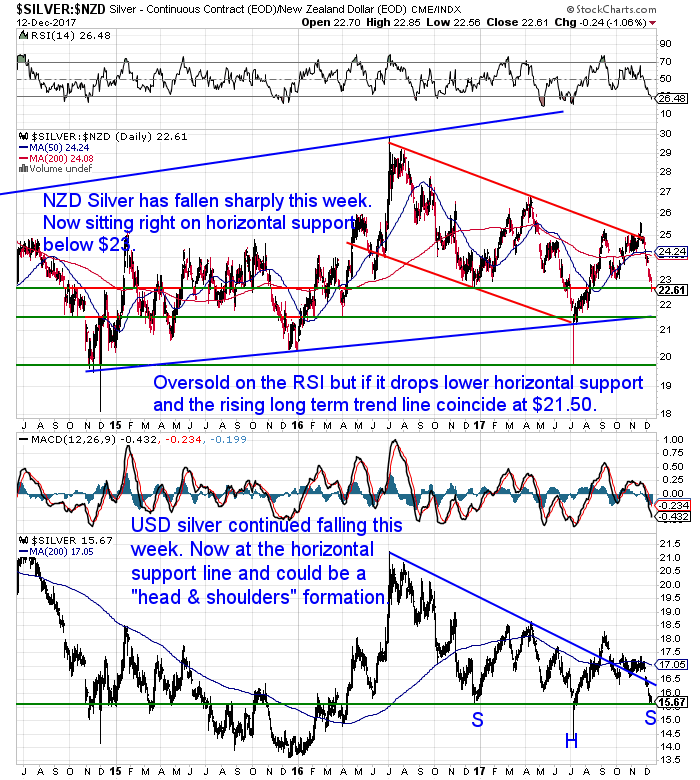

Silver fell even more sharply than gold this week – down over 3%. As a result it is even further into oversold territory than gold at 26 on the RSI. NZD silver is right on the horizontal support line at about $22.70. It may be trying to form an inverse head and shoulders pattern here.

But if silver were to fall any lower then we have the rising blue trendline and the next level of horizontal support coinciding at $21.50.

So we look to be in an excellent buying zone for physical silver. With not too much further downside likely and major support levels close by.

The NZ Dollar has been rising this week. It is now not too far from the November highs. But with it sitting on the 50 day moving average line and at the top of the Bollinger bands, the Kiwi may struggle to get too much higher in the short term.

If we see the Kiwi weaker from here, that could also help local gold and silver prices find a bottom.

Unsure About Any Terms We Use When Discussing the Charts?

Remember to check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Where Are We in the Psychology of the Silver Market Cycle?

This weeks feature article looks at the phases of investor psychology in market cycles. Then compares these phases to the silver market cycle over the past 8 years or so, to see where the silver market is currently. Therefore helping to indicate where silver is going from here and aiding with deciding when to buy silver.

It’s probably not a huge surprise to tell you our guess is silver is not far past the phase of Depression and maybe barely into Disbelief. See what comes next…

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Cryptocurrencies the Opposite Phase to Silver?

One thing for sure is that Cryptocurrencies and especially bitcoin are not in the phase of Depression or Disbelief.

There’s plenty of people saying they are in a bubble. Some of whom have been proponents of cryptocurrencies. Others who have been critics.

But bubbles often don’t pop when there’s a lot of people calling for it to happen. Although they do all eventually pop. If you read the feature article above, a guess could be that bitcoin is in the belief phase perhaps?

In something so new it will be difficult to tell until after the fact.

We’ve got a few articles this week with different perspectives on cryptos. So check them out below.

Your Questions Wanted

Finally Remember, if you’ve got specific question, be sure to send it in to be in the running for a 1oz silver coin.

Merry Christmas to You. Gold and Silver Prices at Lows For the Holidays.

We saw written recently, that the gift of gold is peace of mind in uncertain times.

So if you want to give the gift of gold (or silver) for the holidays, or you’ve been looking to buy gold or silver yourself, then prices are looking like bottoming out, if not right now in the next week or so.

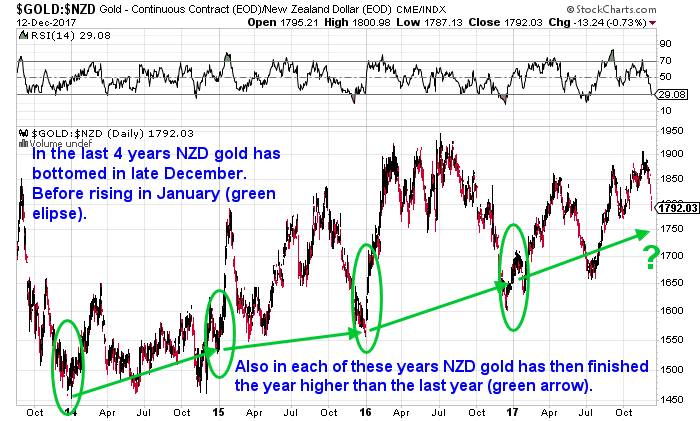

As we alluded to last week this has happened regularly in the past 8 years.

Let’s look in more detail at what happened the last 4 years for gold in NZ Dollars. Each time December began poorly, but by the time New Years Day rolled around things started to look up.

Then in each of the past 4 years, by the end of January in the following year, gold was up between 2.9 and 16.4%. Here’s the specific numbers:

–– On December 3, 2013 gold finished the day at $1496 per ounce. The low for the month came on the 31st at $1453, but by January 30, 2014, it traded at $1533 – up 5.5% from the December low.

–– On December 1, 2014 gold finished the day at $1551 per ounce. The low for the month came on the 31st at $1533, but by January 30, 2015, it traded at $1784 – up 16.4% from the December low.

–– On December 1, 2015 gold finished the day at $1606 per ounce. The low for the month came on the 30th at $1558, but by January 28, 2016, it traded at $1733 – up 16.4% from the December low.

–– On December 1, 2016 gold finished the day at $1655 per ounce. The low for the month came on the 15th at $1601, but by January 30, 2017, it traded at $1647 – up 2.9% from the December low.

The chart below gives a visual representation of this trend. It also shows that each year NZD gold finished the year higher than it ended the last year.

So the lesson imparted is to buy in December and enjoy the holidays. January is the start to a wholly new year.

On top of low spot prices, there are also low premiums above spot price on a number of gold and silver products currently. So buying now you get the best of both worlds.

Call David to discuss any of today’s deals on 0800 888 465. Or just reply to this email.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|

Pingback: Are You Ready For The Next Rally? - Gold Survival Guide