Following the 2009 financial crisis, the term derivatives has been firmly embedded in todays lexicon.

With the failure of Bear Stearns in 2008, and subsequent bailout of multiple other too big too fail banks, the term “derivative” was popping up everywhere. Then in 2012 we had JP Morgan’s $7 billion trading loss on credit derivatives in the news.

In 2019 there was still plenty of discussion over Deutsche Banks derivative portfolio and the risks this places on the global financial system. With good reason too. Here’s a great summary from Wall Street on Parade:

The black hole surrounding derivatives is just as dark today as it was in 2008 – and just as dangerous. The Financial Crisis Inquiry Commission had this to say about the crash: “the existence of millions of derivatives contracts of all types between systemically important financial institutions—unseen and unknown in this unregulated market—added to uncertainty and escalated panic, helping to precipitate government assistance to those institutions.” There is not one Federal or state regulator today who could tell you which counterparty has the most concentrated risk to derivatives. Nor is there one Wall Street bank who has clarity on this issue — because the majority of the over-the-counter derivative contracts are secret contracts between one party and another.

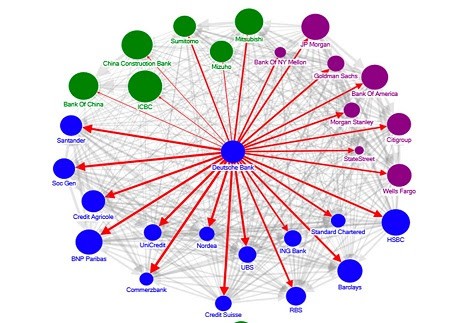

We know that Deutsche Bank’s derivative tentacles extend into most of the major Wall Street banks. According to a 2016 report from the International Monetary Fund (IMF), Deutsche Bank is heavily interconnected financially to JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America as well as other mega banks in Europe. The IMF concluded that Deutsche Bank posed a greater threat to global financial stability than any other bank as a result of these interconnections – and that was when its market capitalization was tens of billions of dollars larger than it is today.

Until these mega banks are broken up, until the Fed is replaced by a competent and serious regulator of bank holding companies, and until derivatives are restricted to those that trade on a transparent exchange, the next epic financial crash is just one counterparty blowup away.

Source.

Source: IMF – Banks are all interconnected. So there is a risk of contagion. In 2016, the IMF considered Deutsche bank the ‘most important net contributor to systemic risks in the global banking system.’ Because it is linked with a so many international institutions in the financial system.

Scary stuff. But have you ever stopped to think what exactly derivatives are, how do they work, and what risks do they bring?

Today we’ll try to unearth why Warren Buffet termed them “financial weapons of mass destruction” and cover…

Table of contents

- What is a Derivative?

- The History and Origin of Derivatives

- Derivatives Morph: From Farmers Friend to Financial Weapons of Mass Destruction

- Interest Rate Swaps are the Dominant Derivative

- Why Do Interest Rate Derivatives Now Make Up So Much of the Total?

- Interest Rate Derivatives Could be the Source of Big Trouble

- 2022 Interest Rates Rises Causing Problems?

- What Do These Derivatives Mean for New Zealand?

- NZ Bank Derivatives Have Grown Too

- How to Protect Yourself from Derivative Risk?

What is a Derivative?

First up a definition may be a good place to start. From the lazy reseachers’s dictionary wikipedia:

Derivative: A derivative instrument is a contract between two parties that specifies conditions (especially the dates, resulting values of the underlying variables, and notional amounts) under which payments are to be made between the parties;

So they are financial instruments whose values depend on the value of other underlying financial instruments or objects. Instruments such as commodities, equities (shares), residential or commercial mortgages, bonds, interest rates, or exchange rates. They can take the form of futures, forwards, options and swaps.

The History and Origin of Derivatives

The history of derivatives dates back to the 1800’s. Where derivatives were used to hedge farmed commodities, given these are affected by so many variables and have an unknown eventual sale price.

So instead of Farmer Joe doing his planting, growing and harvesting. Then hoping he’d have a crop of a certain size that he could sell, for a certain price to make a profit. He was now able to – for a comparatively small fee – guarantee a fixed income at a specified date in the “future” for his crop. So began the Futures markets.

Giving some level of predictability to farming income was very beneficial. It enabled growth and advancement in many other sectors which eventually led to the industrial revolution.

So derivatives have their place as they have had many positive impacts on humanity since their invention.

Derivatives Morph: From Farmers Friend to Financial Weapons of Mass Destruction

However in the 2 centuries that have passed since then, derivatives have morphed into something resembling a financial casino. A casino where a few major players actually control 92% of the industries derivatives.

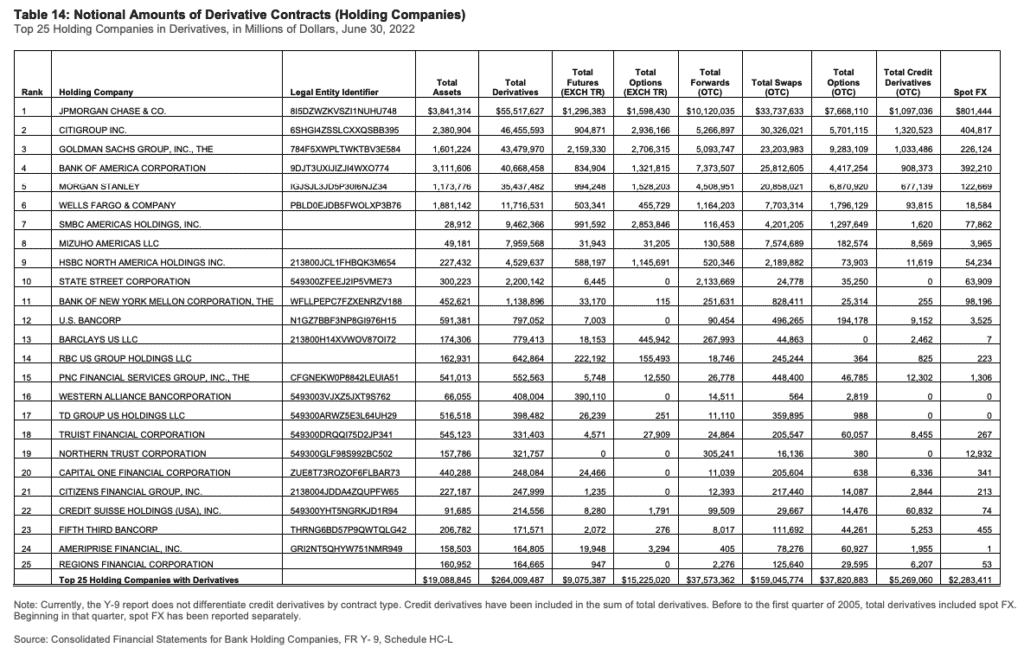

As at 30 June 2022, 7 main banks whose names will not surprise you, hold $243 trillion of the $264 trillion held by the top 25 US companies: J.P. Morgan Chase & Co, Citigroup, Goldman Sachs, Bank of America, Morgan Stanley, Wells Fargo and SMBC Americas Holdings, INC).

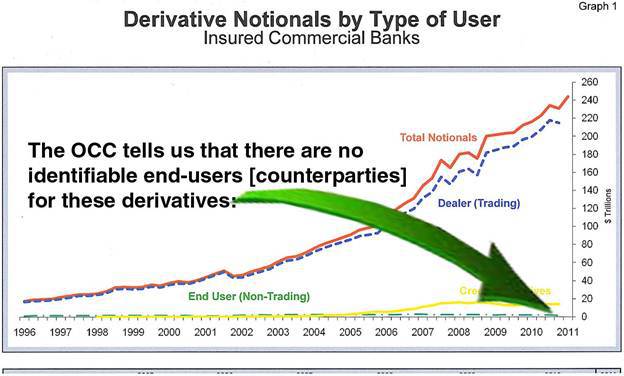

The chart below shows how small a percentage of derivatives are held by actual end users (green line) looking to hedge themselves. Versus merely traded by the likes of the above 7 banks (blue line).

(For a graphical representation of the freakish size of these banks derivative books see this great infographic: Demonocracy.info – Derivatives: The Unregulated Global Casino for Banks)

Rob Kirby gives a detailed overview of the full history of derivatives if you want all the holes filled in here.

Interest Rate Swaps are the Dominant Derivative

Apart from the massive change in traders versus end users that can be seen in the chart, the other major change in the past 20 or so years was the advent of the “interest rate swap”.

It’s widely discussed that credit derivatives (i.e. derivatives of loans/mortgages) were the cause of the 2008 financial crisis. Interestingly, it is actually interest rate swaps with a notional value of $475 Trillion that make up almost 80% of the total derivative pool of $598 Trillion (as reported by the Bank of International Settlements year for the ending 2021 (BIS) https://stats.bis.org/statx/srs/table/d5.1?f=pdf).

Look again at the chart above and you can see the small amount that credit derivatives make up. The yellow line represents credit derivatives versus the total notional derivatives in red. (Note: the chart only goes up until 2011. But the proportion between these different types of derivatives has stayed reasonably consistent since then).

Why Do Interest Rate Derivatives Now Make Up So Much of the Total?

Because as Rob Kirby states, it is these interest rate swaps which allow the US Fed/Treasury to control or manipulate the ”price of money”, that is the long term US treasury interest rate.

In times gone by Bond Vigilantes (no they didn’t take the politicians into the street and hang them by their necks!) would sell government bonds. Therefore driving interest rates up when governments were overspending.

Effectively the vigilantes would be saying to governments, “We don’t trust your ability to repay so we are selling your bonds and therefore you have to pay a higher rate to attract another buyer of your debt.”

This no longer occurs as demonstrated by Bill Gross’s PIMCO Bond Fund selling out of its massive stake of US treasuries in March 2011. The treasury interest rate then promptly plummeted, just the opposite of what you’d expect.

To be honest the process through which the US Exchange Stabilisation (Fund ESF) manipulates the treasury interest rates is pretty complicated.

I’m not sure we can summarise and make it any simpler than Rob Kirby’s article (which we have gained much insight from). So below is an extract from that: (Otherwise just stick with “they create the demand out of thin air” and you won’t be too far from wrong!):

“++The ESF participates in these trades taking “NAKED INTEREST RATE RISK” – meaning they do not provide their counterparties with the requisite amount of bonds to hedge their trades – thus forcing them into the “free market” to purchase them. This generates UNBELIEVABLE “stealth” settlement demand for U.S. Government securities. This is how/why U.S. Government bonds and hence the Dollar can be made to appear “bid-unlimited” – even when economic fundamentals are SCREAMING otherwise. The amount of demand for cash government bonds that can be conjured out-of-thin-air in the derivative interest rate swap complex, which might be best described as “high-frequency-trade” on steroids – measured in hundreds of Trillions in notional – literally OVERWHELMS the cash bond settlement process. This means bond yields are set arbitrarily – in accordance with Fed / Treasury policy – NOT IN FREE MARKETS. This also explains why there are no identifiable end-users for the dizzying growth in interest rate derivatives [swaps] – the trade is all attributable to the Treasury’s ‘invisible’ ESF – an institution that is not publicly accountable to ANYONE or ANYTHING. This is why other nations can and do have, from time to time, failed bond auctions while America never has and NEVER WILL BE ALLOWED TO. This is all done in stealth to facilitate and give an air of legitimacy to the U.S. Treasury’s ZIRP [zero interest rate policy].”

Source.

So this is how they managed to keep interest rates fixed close to zero in the US in the aftermath of the financial crisis and through until this past year.

Interest Rate Derivatives Could be the Source of Big Trouble

Back in December 2011, the BIS data showed that $184 trillion of interest rate derivatives were in Euros. While only $161 trillion were in US dollars.

In the years since the value of US denominated interest rates derivatives has grown to $169 Trillion. While in Euro’s these have dipped to $114 Trillion.

So factor in that most banks borrow short but have large loan books at fixed rates for long periods. Therefore a big rise in interest rates could trigger claims on these interest rate derivatives. (Hat tip to Alf Field for this point).

Alf Field (who we enjoyed listening to at the 2011 Gold Symposium in Sydney) pointed out back in 2012:

Crikey!“If just 10% of the interest rate derivatives in Euro’s produce losses, the world’s banking system would be looking down the barrel of a loss of $22 trillion. That is enough to bankrupt the entire world’s banking system, something that the politicians of the world could not tolerate. What would a bail out of $22 trillion do to financial markets? What would it do to the gold price? If it is not interest rates, there are $64 trillion of foreign exchange derivatives and a “mere” $32 trillion of credit default swaps outstanding that could produce “black swan” surprises.”

2022 Interest Rates Rises Causing Problems?

Perhaps with the increase in interest rates over the past year we are starting to see some problems with these interest rate derivatives?

Here’s some recent news items following recent issues in the U.K. Pension markets:

“Basically pension plans appear to have been caught in doom-loop of margin calls on interest rate derivatives that forced them into dumping longer-maturity UK gilts, and spurred the Bank of England into intervening today.” https://t.co/YSvVPEvsI7

— Pedro da Costa (@pdacosta) September 28, 2022

Did the extreme moves in rates and Fx just light this fuse? https://t.co/4bh5FL131A

— Lawrence Lepard, “fix the money, fix the world” (@LawrenceLepard) September 29, 2022

It seems the UK and by extension the global financial system was under severe pressure due to pension funds’ interest rate derivatives collapsing in value after the UK Budget…

“Pension funds are globally on the verge of collapse due to rising interest rates and insolvency risk. In order to create cash flow, the pension funds have created interest rate swaps. But as bond rates surged these swaps collapsed in value, requiring either liquidation or margin injection.

And thus the Bank of England had to support the UK pension funds and financial system to the extent of £65 billion to avoid default.

In the last couple of weeks we have seen a dismal situation in Switzerland. Swiss banks, through the Swiss National Bank (SNB) have received $11 billion ongoing support through currency swaps (a form of dollar loans) from the Fed.

No details have been revealed of the Swiss situation except that 17 banks are involved. It could also be international banks. But most certainly the ailing Credit Suisse is involved.

What is clear is that these UK and Swiss situations are just the tip of the iceberg.

The world is now on the verge of another Lehman moment which could erupt at any time.”

Source.

What Do These Derivatives Mean for New Zealand?

So how does all this affect little old New Zealand on the other side of the world? Well, bankrupting the entire world’s financial system doesn’t sound too good to us. Don’t think our geography will necessarily help us too much on that one.

But we may also have some derivatives of our own to worry about closer to home.

In early 2102 we stumbled across this report. Where an Australian economist, Associate Professor Dr Sue Newberry, said that New Zealand government accounts ignore “off-balance sheet exposures” amounting to more than $112 billion (emphasis added is ours).

“There has been a significant increase in the government’s activity in financial markets over the past decade, she said. However, the government’s accounts do not show that clearly.

“What happens if you do show the extent of exposures to derivatives is really quite massive,” she said.”

Derivatives are both an asset and a liability. Newberry said the way these are accounted for is by netting these off rather than showing the totals of each. However, the dangers of derivatives were revealed in the global financial crisis in that one side of a contract can collapse while the other side remains in force. “Netting off obscures that,” she said.

[She] said adopting “Generally Accepted Accounting Practice” standards is disguising the rapid growth in financial market activities and the extent of the government’s exposures.”

The point we’ve highlighted is a good one and one that seems to be ignored by the establishment. The massive size of the global derivative tower is often explained away by saying they “net” each other out.

Anyway back to New Zealand, a treasury spokesperson said in reply to Dr Newberry:

“Derivatives with the Debt Management Office (NZDMO) mainly consist of interest rate and cross currency swaps [hhhmmm sound familiar???] used to manage risks associated with either debt issuance or with fixed-income asset purchases. The office also executes derivatives with other parts of the Crown.

“NZDMO tends to manage risk associated with these trades by transacting with the private sector. The other Crown entities use the trades with NZDMO as hedges for their own risks,” it said. However, to get a complete picture of derivatives used would require talking to all entities involved.

Delegation to transact is subject to controls and managed by skilled professionals, Treasury said.

“These professionals act within transparent risk policies and parameters and are accountable for their efforts and must meet detailed reporting guidelines and frameworks.”

Not sure how much the fact they are “managed by skilled professionals” makes us feel better! $112 Billion seems pretty sizeable to us to be “off book”. Consider that NZ’s gross domestic product in 2012 was around $202 Billion, this off book derivative figure amounts to over half that figure!

We’re no forensic accountants but that number even if only half right seems scary to us. But then again probably every other country uses similar accounting methods, so what’s the big deal?!! Who knows exactly what these numbers mean, but that is the point with derivatives – no one really knows what their impact will be as this is all new territory.

NZ Bank Derivatives Have Grown Too

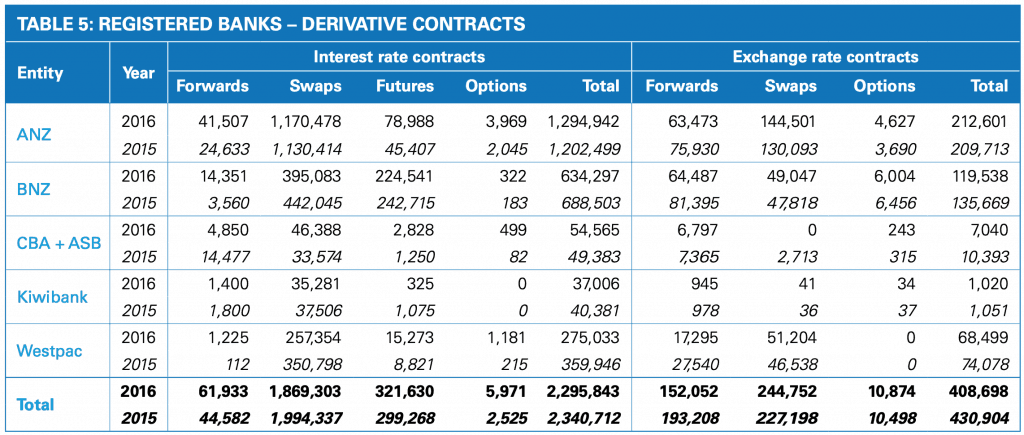

The derivatives held by New Zealand Banks, particularly interest rate derivatives, have grown significantly in recent years too:

“Derivatives contracts held by New Zealand’s major banks surged in value by 38.5% in the year to September 30, 2015.

A chart in KPMG’s annual Financial Institutions Performance Survey shows derivatives contracts held by the country’s big five banks rose by $770.3 billion, or 38.5%, to to $2.77 trillion. Interest rate contracts comprised the lion’s share, jumping 48% to $2.34 trillion.

At $1.2 trillion, ANZ holds just over half all the interest rate contracts with a big annual jump in interest rate swap contracts recorded year-on-year. ANZ also holds the biggest slice of the combined $430.9 billion of exchange rate contracts, although ANZ’s share dropped 6% to $209.713 billion.

All up, ANZ NZ had $1.4 trillion worth of derivatives held for trading as of September 30 last year, which was the end of the bank’s financial year.”

Source.

The most recent KPMG Financial Institutions Performance Survey doesn’t seem to contain any derivative positions data. The most recent we could find was from 2016 as shown below:

So bank derivative positions reduced ever so slightly in the year 2016 from 2015. But just as it is in the USA, the total size of derivatives held by New Zealand Banks is still huge in comparison to the New Zealand banking system itself. Total derivatives in 2016 were $2.71 Trillion, compared to total assets of $456 billion for the top 5 banks.

How to Protect Yourself from Derivative Risk?

As Rob Kirby commented in the article we referenced earlier, physical precious metals are “the achilles heel” of financial fraud. And if all the above isn’t reason enough to remove some paper money from within the manipulated financial system and exchange it for physical gold and silver we don’t know what is!

Because physical gold and silver are the only financial assets with no counter-party risk. Meaning you are not relying upon the solvency of someone else for your asset to maintain its value.

For 14 other reasons to buy gold see: Why Buy Gold? Here’s 14 Reasons to Buy Gold Now

If you’re looking to buy gold or silver bullion and you’d like to see what products are available, go here: Buy Gold or Silver Online Shop

You might also want to check out this post to help with selecting what gold or silver to buy: PAMP Suisse Gold / Silver vs Local NZ Gold / Silver: Which should I buy?

Pingback: Writer Satyajit Das on How New Zealand will Fare in the Crisis | Gold Prices | Gold Investing Guide

Thank-you for another informative article. This is slightly off topic, but in regards to banks, do you think it is necessary to change banks and deal only with a credit union ‘bank’ such as the Co-operative bank? Is it any safer than one of the main street banks? And could there be an opportunity for a bullion based bank such as the Free Lakota Bank? Cheers, John

http://www.freelakotabank.com

Pingback: Why Has the New Zealand Dollar Been Rising of Late? | Gold Prices | Gold Investing Guide

Pingback: QE3, Gold and Silver: How Will it Affect New Zealand Precious Metals Prices and the NZ Dollar? | Gold Prices | Gold Investing Guide

Pingback: Why NZ’s Interest Rates Could Stay Low For a While Yet | Gold Prices | Gold Investing Guide

Pingback: What to make of all this interest rate stuff? - Gold Prices | Gold Investing Guide

Pingback: Paper Gold vs Physical Gold - What Should You Buy? - Gold Survival Guide

Pingback: The Gold Correction is Underway - Gold Survival Guide

Pingback: New Zealand Bank Bail in Capital of the World - Gold Survival Guide

Pingback: Silver is the Star this Week - Gold Survival Guide

Pingback: The Inverse Oil Shock - The Opposite of the 1970’s and The Gold to Oil Ratio - Gold Survival Guide

Pingback: Silver Allocation of 4% to 6% Optimal In Investment Portfolio - Gold Survival Guide

Pingback: Interesting Graphic: Real House Prices Over 40 Years - Gold Survival Guide

Pingback: Bank Failures - could they happen in NZ? The Reserve Bank thinks so