- How to Buy Gold and Silver with Bitcoin

- Why Gold Could Go “Hyperbolic” in This New Bull Market For Gold

- Incrementum Board: Don’t Underestimate the Effects of Quantitative Tightening

- Gold To Silver Ratio Above 80: History Says Buy Silver

- “Rules-Based” Monetary Proposals Won’t Create Stable Money

Prices and Charts

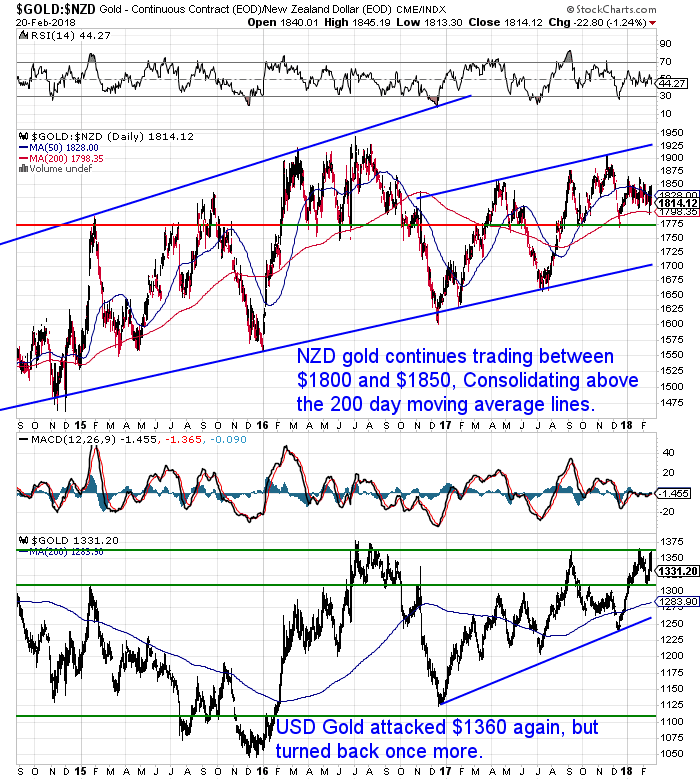

NZD Gold Trading in a Tight Range So Far This Year

NZD Gold continues trading between $1800 and $1850 as it has done so far for most of this year. The consolidation above the 200 day moving average line continued this past week.

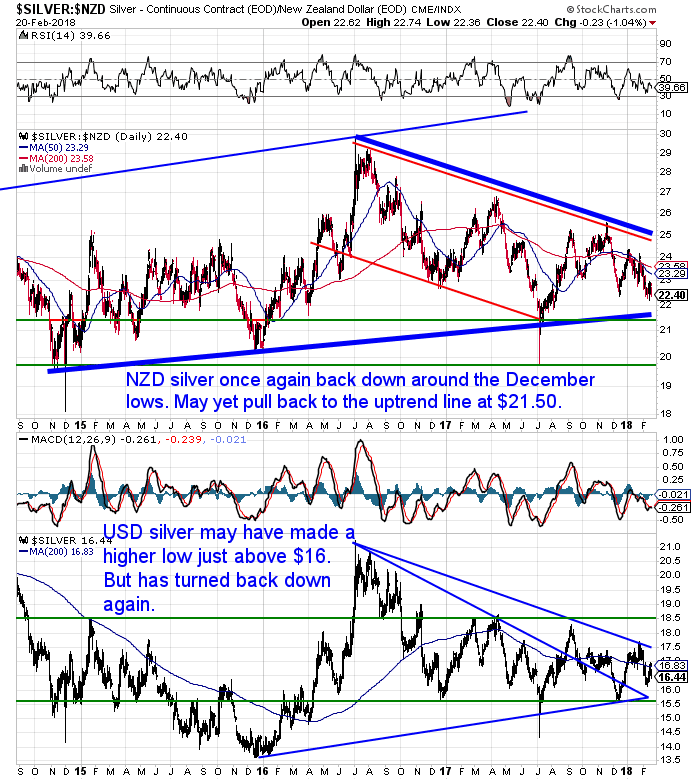

NZD Silver fell about 1.50% last week. It is again around the lows from December. Silver is now not too far from the long term uptrend around $21.50. It would not be a massive surprise if silver dipped to that level. Although that is not far from here. Silver is getting more and more compressed between the 2 thick blue lines of this wedge formation and so is nearing a breakout.

The Kiwi while up just under 1% for the week, once again failed to close above the overhead resistance line at 0.74 and looks to be heading a bit lower again now. Perhaps back towards the 0.72 level.

Unsure About Any Terms We Use When Discussing the Charts?

Remember to check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

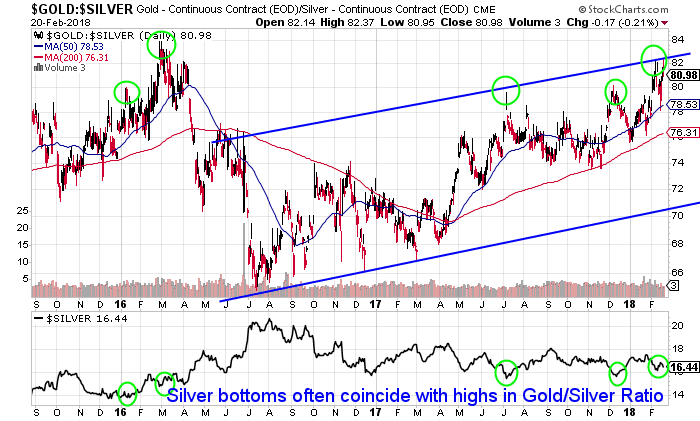

Gold To Silver Ratio Above 80: History Says Buy Silver

We’ve added the gold to silver ratio chart again this week. The ratio dipped lower during the week. But is now back above the key 80 level today.

Silver remains very cheap compared to gold. Above 80 we prefer to buy silver exclusively over gold.

Why?

Because history shows that from this level silver usually stages a large rally.

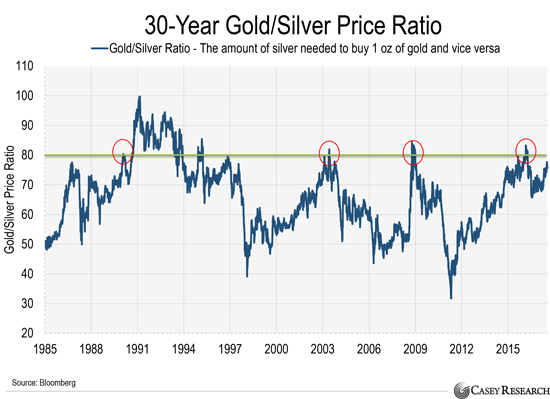

Last July at the Sprott Natural Resource Symposium in Vancouver, Keith Neumeyer, head of First Majestic Silver, spoke about this. He pointed out that the gold-silver ratio has only hit this level four times in the last three decades.

Each time it did, silver had a large rally.

“After hitting this level in 1990, it went on to surge 47%.

Thirteen years later, the ratio hit 80 again. This time, silver soared 224% over the following three years.

It happened for a third time in 2008. Silver went on to soar 371% over the following three years.

The ratio hit 80 for the fourth and most recent time back in February 2016.”

Source.

Silver rose around 25% after that. After a pull back last year the ratio is again back over 80. So history says silver is likely to surge higher when the ratio turns lower.

That likely makes now an excellent time to be buying silver.

We Now Accept Bitcoin To Buy Gold and Silver

In case you missed our email on Friday, we are now able to accept bitcoin in payment for gold and silver.

So if you’ve made some profits in cryptocurrency and want to divest some of those then check out the details below. With the Bitcoin price bouncing sharply over the last week, now might be a good time.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Incrementum Board: Don’t Underestimate the Effects of Quantitative Tightening

We finally got around to reading the Incrementum Advisory Board minutes this week. We often gain some insights from this.

A key point was not to underestimate the effects that the Fed reversing it’s quantitative easing program will have. Ronni Stoeferle commented that:

“Quantitative easing was positive for asset prices, why shouldn’t quantitative tightening be negative?”

Jim Rickards went on to say:

I would not underestimate the impact of quantitative tightening, I think it will affect asset prices, but with a lag. It is a very serious danger. It started at a slow tempo, but it ramps up every month. Remember what quantitative tightening is; you are destroying money. This has never happened before. This is a giant experiment, and there is no precedent. And it’s happening concurrently with rising interest rates. In my view the Fed is underestimating the tightening impact.

Heinz Blasnik:

Jim, I am on the same page as you when it comes to the Fed and tightening. And I think we will soon see the impacts of quantitative tightening increasing because there is a delay in the settlement of redeemed mortgage backed securities, i.e. the effects of quantitative tightening that has already taken place have yet to appear in the data. I think we will see this show up on the Fed’s balance sheet soon. Consider also that money supply growth declined dramatically even before QT started.

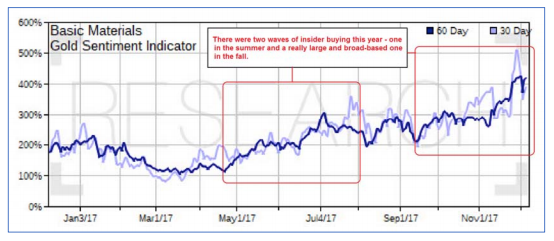

And just a final note on gold; from a technical perspective a breakout in gold will be quite significant because the recent consolidation in gold has been in such a wide range and has taken so long. In many ways the current situation is very reminiscent of what happened at the end of 2015. You have insiders at gold companies buying like crazy – we have rarely seen them buy that much, it doesn’t happen often in this sector. And the situation in the options market for gold stocks is precisely the same that I saw in late 2015 and in the first week of January 2016. Nobody is interested. Nobody is buying any calls and trading volume is very low. Consequently, I am quite bullish on gold at the moment, despite the dubious macro-fundamentals.

Insider Activity according to INK Research: Lately insider buying at gold companies has basically “gone off the charts” compared to historical standards.The spike in insider buying in the gold sector this fall (which went hand in hand with the decline in prices) was already the second one this year, but it attained extraordinary proportions.

Don’t forget to check out our other posts below.

If you think the insiders at gold companies might be worth following and buying some gold then get in touch. Or maybe given the gold silver ratio history outlined above you’d prefer silver?

Get in touch to discuss your options:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|

Pingback: Why Silver May Not Be “Off the Radar” For Much Longer - Gold Survival Guide