Prices and Charts

Gold Heading Higher Again This Week

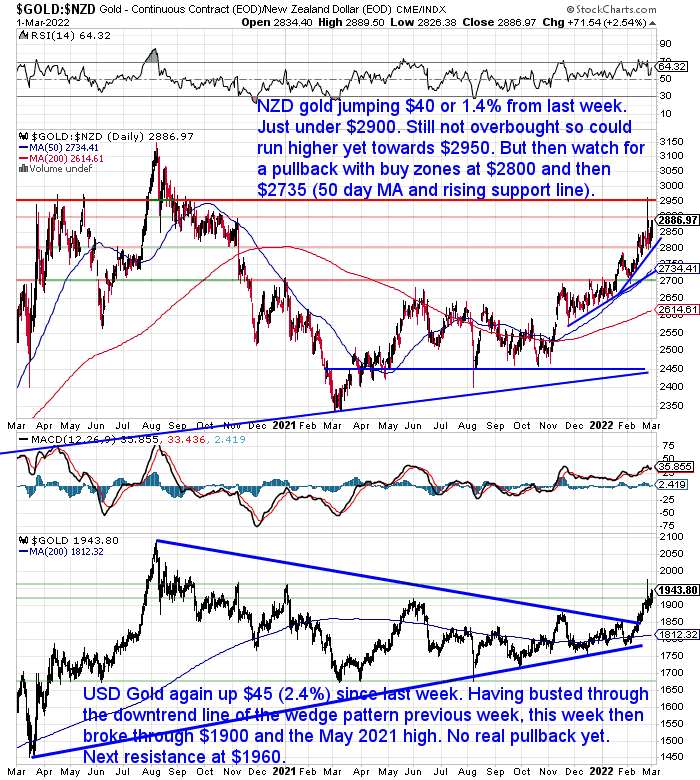

Precious metals have been quite volatile since the Russian invasion last week. But so far the overall trend remains up. Gold in NZ dollars is up $40 or 1.4% from 7 days ago. Today it is sitting a little under $2900. It is not yet overbought so we could see gold run higher yet. Maybe towards $2950. Then perhaps a correction from there? As always hard to predict. Especially with all that is going on in the world at the moment. But if we see a pullback, then a couple of buy zones to watch for would be at $2800 and below that the 50 day moving average and rising trendline at $2735.

All time highs are not a huge amount higher, so it wouldn’t be a surprise to see them taken out later this year.

Silver Surges by 5% – Breakout

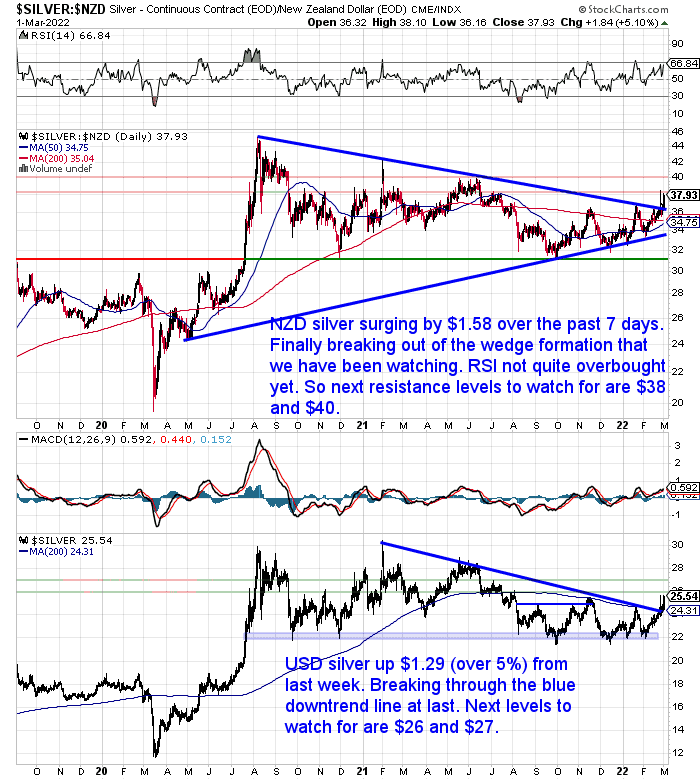

Silver vaulted even higher than gold, up 5% in USD or 4% in NZD terms. After nudging up against the downtrend line, this week it finally broke through it. NZD silver is now sitting just below $38. The RSI indicator is still just under overbought (overbought is 70). So we could see silver head higher yet. $38 and $40 are the next major resistance levels to watch for. But expect a pullback before too long. This just could be from even higher levels yet.

NZ Dollar Up Just Under 1%

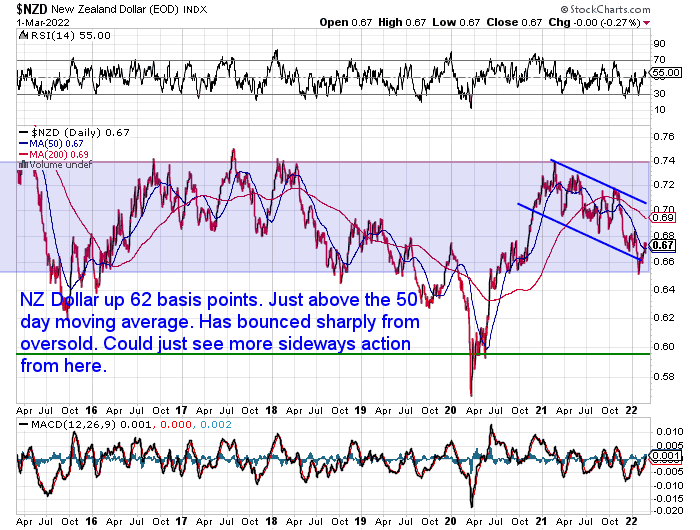

The Kiwi dollar is up just under 1% or 62 basis points. But as already stated, this did not put too much of a dent in local gold and silver prices.

The Kiwi could head a bit higher yet. But with all that is going on in the world, it is likely we will just see continuing sideways action in the longer term

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Presentation: Is Gold & Silver the Way Out of Hyperinflation?

This week’s feature post is a video presentation we did a couple of weeks ago.

In this presentation we look at the potential for hyperinflation and how according to one definition the odds of this happening aren’t as crazy as most of us in countries such as New Zealand might think.

Here’s what’s also covered in the presentation:

- The difference between the currency printing of 2008 and during Covid19

- 3 Reasons to buy gold and silver

- Keeping What You’ve Got

- Real interest rates are negative

- Upside Potential

- 5 Indicators or measures of the upside potential in gold and silver

Plus you’ll also learn:

- Why buy physical gold and silver?

- What types of gold and silver to buy?

- 4 tips when buying gold and silver.

- Where to store physical precious metals?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Even the Mainstream is Now Finally Wondering is Inflation Here to Stay?

Economists might not have been expecting it to last, (do you recall the “transitory” phrase from the middle of last year?), but higher prices shouldn’t come as a big surprise to our readers. As we have been warning of this since early 2021. Here’s just some of what we’ve written in the topic on inflation this past year.

Feb 2021: Inflation in 2021 and Beyond: What’s Different to 2009?

May 2021: Could a Record High NZ Crown Settlement Account Boost Inflation in NZ?

June 2021: Why Even if Inflation is “Transient” It Won’t Be. Huh?

June 2021: Copper to Gold Ratio: What Can it Tell Us About Inflation?

But lately we have seen more articles on the topic of inflation creeping into the mainstream media. Here’s just 2 we spotted today.

Opinion –Dileepa Fonseka: So far 2022 is proving to be the mirror image of 2020 for New Zealand: everyone’s getting Covid, there is no lockdown, and a recession with a side of stagflation is looming too.

Read more

Opinion – David Hargreaves: David Hargreaves assesses the return of the old enemy – inflation expectations

Read more

We’d say stagflation is looking very likely. That is a recession or very sluggish growth combined with high inflation rates.

A Sad Day for NZ

As we sign off it is a sad but perhaps not very surprising day to see what is going on in Wellington. Regardless of your views it seems the police have created more destruction and incited more violence in a few hours than all the protesters combined did in 21 days.

It further demonstrates the hypocrisy of those in charge, when we have a foreign affairs minister in an address for the U.N., calling for “diplomacy, negotiation and de-escalation” as war breaks out on the other side of the world. While at home we see a complete absence of these traits from the government in which she is a part!

As some have rightly pointed out, government representatives have in the past actively engaged with the mongrel mob and even the Taliban! But average Kiwi’s with real grievances are mocked and ignored.

But we are not surprised. We remain firmly a-political here. No other parties have really been any better, having sided with the government in avoiding to talk with any protest representatives. Don’t expect this or any government to “save us”.

For the average person, times are likely to get tougher in the future too. Why?

Because as we point out in the presentation in this week’s feature post, even if all the Covid restrictions are lifted tomorrow, we then have to face the effects of these government and central bank measures. As mentioned already, one of those becoming more and more apparent is rising prices of everyday goods.

Ongoing inflation will be most felt by the poor and middle class on fixed incomes. Having been told it was “transitory”, it is likely most people won’t be prepared if (or we think more likely when) inflation becomes entrenched. It will likely be blamed on “foreigners”. It will depend where in the world you are as to which foreigners will be to blame! But it’s looking likely inflation will be worldwide, so then it seems everyone will be to blame! Make sure when this happens you point out that it is every government and central bank that is to blame.

So make sure you have sufficient insurance to protect yourself and your family from the loss of purchasing power your currency units are likely to experience in the future.

So get in touch if you’d like a quote.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Inflation - Hot and Going to Get Hotter Regardless of War in Ukraine - Gold Survival Guide