Last week the US Central Bank again raised interest rates. This is in response to the US economy being so strong. Will gold rise after the latest Fed rate hike and surprise everyone again?

Gold and Previous Fed Rate Hikes

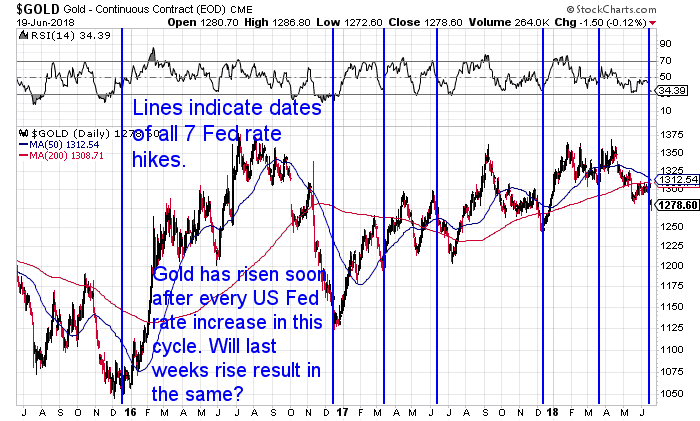

The chart below shows that gold has risen straight after each of previous US Fed rate rises, apart from once. And even then gold bottomed and rose within a month of the Fed rate hike.

So Will Gold Rise Again After the Latest Fed Rate Hike?

They say “past performance is no guarantee of future results”, but history can be a good guide.

Gold has dropped sharply just after the latest Fed rate rise was announced. We’d say odds favour it moving back higher again before too long.

When volatility is so low and everyone is so bored with gold (and silver), there is likely very few sellers left.

When there’s no sellers left that’s when prices will rise.

Read more: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

Gold Can Do Okay Even in the Good Times

The chart above shows that gold has been steadily rising since 2016, even while the US and global economy has been doing pretty well.

More evidence from the Donald that “everything is awesome” came last week when Trump tweeted:

“Stock Market up almost 40% since the Election, with 7 Trillion Dollars of U.S. value built throughout the economy. Lowest unemployment rate in many decades, with Black & Hispanic unemployment lowest in History, and Female unemployment lowest in 21 years. Highest confidence ever!”

And he’s right.

According to the number things could hardly get any better in the US.

But usually when things can’t get any better… is when they get worse!

Perhaps it is wise to prepare for the eventuality?

But Are the Bad Times On Their Way?

Particularly when the US Central Bank continues to raise interest rates. This is justified by the above rosy numbers saying that businesses and average Joes and Joannes need less support from the Fed.

The trouble is the whole planet has now gotten used to near-zero rates.

So “taking the punch bowl away” isn’t likely to end to well for all these borrowers. And if 2008 was any proof, perhaps it won’t end well for the lenders either?

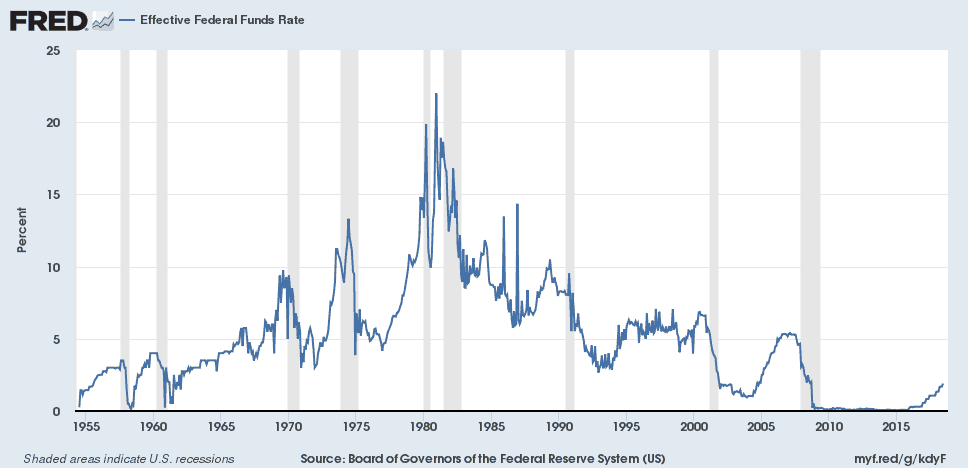

The US Feds own numbers show that the US central Bank doesn’t pause its rate hike cycle until just before the US economy takes a turn for the worse. The grey shaded areas are recessions. You can see the rate rises don’t stop until just before each of them.

Then the Fed slashes interest rates again to try and stave off a recession. Usually too little too late.

So even while “everything is awesome” gold has still been doing okay.

But odds are that when the recession hits gold will do better than many other assets. That is the reason to buy gold and silver. As financial insurance. Because as we said already usually when things can’t get any better… is when they get worse!

Perhaps it is wise to prepare for the eventuality?

How far off is the next recession? Read more: The Yield Curve Recession Predictor: Impact on Gold?

Pingback: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold? - Gold Survival Guide