|

Gold Survival Gold Article Updates:

Dec. 11, 2014

This Week:

- Gold Shorting Exhaustion

- The Mother of All Bank Runs

- NZ Dollar hits two and a half year low

- NZ Govt surplus looks even shakier

- Interest rates were kept on hold this morning by the RBNZ

Prices and Charts

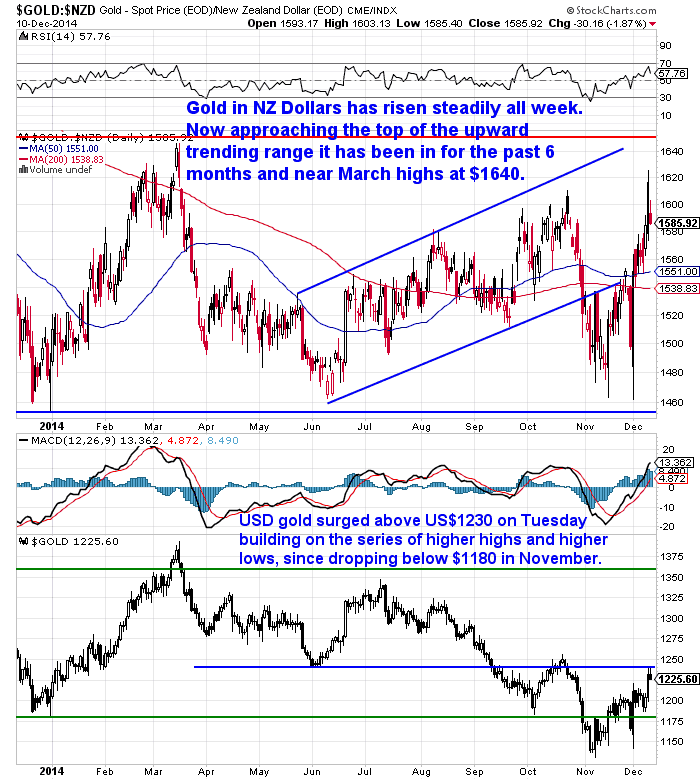

Gold in US dollars is up $17.72 or 1.46% to $1227.22 from a week ago.

While gold in New Zealand dollars has risen $14.93 or 0.95% to $1575.98. You can see if the chart below that yesterday was the highest price since March of this year. We may well see a pull back with the NZ dollar getting oversold and gold getting overbought from here. But those March highs might not be far off from getting bettered.

Silver in US dollars is up 71 cents or a hefty 4.3% to $17.10.

While in New Zealand dollars silver is up 81 cents to $21.96 or in percentage terms up 3.8% from last week. It is once again above the NZ$22 mark. Given that it was previously “support” we would have expected this to be tougher to break through than it was. We are also back above the 50 day moving average (blue line) for the first time since August.

So gold and silver have certainly reversed course sharply.

The negative gold lease rates (GOFO) that we discussed last week have reversed and gone back into positive territory.

And it seems we may have reached “Gold Shorting Exhaustion” according to Adam Hamilton of Zeal LLC.

He explains that the bottom line is that gold’s recent support breakdown was driven by extreme shorting by futures speculators. That short selling recently peaked at the second-highest levels of speculator shorts since 1999, if not ever. But instead of selling aggressively after the Swiss gold referendum failed, speculators instead scrambled to buy to cover, despite the perfect downside catalyst.

That almost certainly means the recent extreme futures shorting is exhausted. All traders with enough nerve to make leveraged downside bets on gold near major multi-year lows did it, and now they have to buy to cover. We are talking about hundreds of tonnes of gold here. Extreme shorts are always bullish, because they soon must be covered, and the action in the past week or so seems to indicate that overdue buying has already begun. Source.

The Mother Of All Bank Runs!

Last week we shared parts of a blog from Australian Fund Managers of Baker Steel entitled “A Golden Bank Run”.

We read another similarly titled piece by Bill Holter of Miles Franklin Precious Metals this week. Although this one looked at what Central Banks are up to as opposed to what is going on in the futures market with the bullion banks.

Holter talks about how we are witnessing a number of countries asking for their gold to be returned. These include Germany, the Netherlands and, most recently, Belgium. Along with French presidential candidate Marine Le Pen also bringing up the possibility of French gold being repatriated.

He goes on to discuss the ‘Belgian bulge’, and the ratio of Treasuries Belgium holds vs. physical gold holdings.

More recent news from the ECB dealt with classification of members’ gold reserves. Member states are being told to differentiate between allocated and unallocated gold, and to break down swap positions and receivables. Why change the reporting, and why now during the repatriations?

We haven’t seen this reported elsewhere and is quite a significant development in our view.

It’s important, because for 70 years the world has stored its gold at the New York Fed and never asked for it back. Other than Germany withdrawing 1,000 tons from the Bank of England in 2001, until now, Venezuela is the only country to ask for its gold back. The only way to describe what is happening is to call it a bank run.

So it will be interesting to watch the action from here. We seem to be witnessing the beginnings of a repeat of the 1960’s when Frances Charles De Gaulle kicked off a run on America’s gold that soon spread to multiple other nations and eventually led to Nixon severing the US dollars final link to Gold. Worth reading the full article if you get the time.

Source.

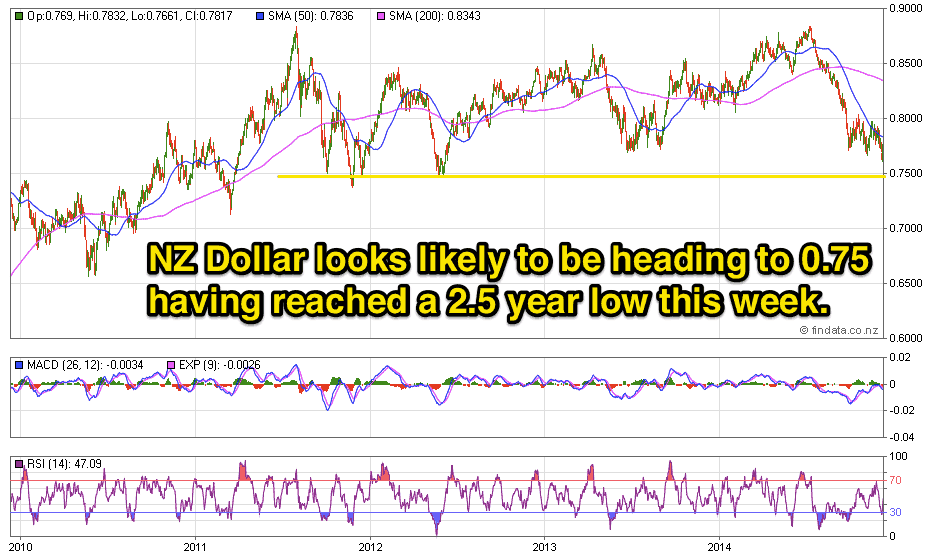

NZ Dollar hits two and a half year low

The Kiwi dollar hit a two and a half year low earlier this week possibly on the assumption that Fonterra would lower its milk payout forecast.

You can see in the chart below that the dollar dipped down into the 76 cent range. So there is a decent likelihood that it will move lower to the 75 cent mark now too. With a good chance of it going even lower too. Albeit likely that we get a bounce higher from here first.

This is the theme across the globe with most currencies weakening against the US dollar in recent months. Born out most strongly by the likes of the Russian Ruble which has hit all time highs in gold and the Japanese Yen which has made 18 month highs in gold.

The governments surplus is also looking shaky on the back of the likely lower Fonterra payout. This means less tax take for the government. Even with lamb, beef and forestry prices doing well these likely won’t make up for the plunge in dairy.

So this also could have a dampening effect on the NZ dollar over the next number of months.

Interest rates were kept on hold this morning by the RBNZ

The statement said:

—–

“The global economy continues to grow at a moderate pace, though recent data suggest a softening in major economies other than the United States. Inflation remains below target in most of the advanced economies due to spare capacity and declining commodity prices. Monetary policy is expected to remain very supportive for some time.”

—–

They went on to say they think things will eventually pick up…

—–

“With output projected to grow at or above capacity, CPI inflation is expected to approach the 2 percent midpoint of the Reserve Bank’s target range in the latter part of the forecast period. Some further increase in the OCR is expected to be required at a later stage. Further policy adjustments will depend on data emerging over the assessment period.”

—–

Bank economists are predicting the next rise in interest rates to be in December 2015.

So while rates are expected to stay low for the next year, we actually still think they could well stay low much longer than they all imagine.

Expect More Meddling to Come From the RBNZ

There has also been talk in the media of further “macro prudential” tools that might be implemented by the Reserve Bank. Central banker speak for more meddling to correct previous meddling.

They seem to think the RBNZ’s Loan to Value Ratio restrictions have worked so well that they might try something else now.

The argument is the Loan to Value ratio rule has locked out first home buyers, leaving the “evil” property investors to scoop up all properties for sale. So now the talk is the central planners may institute a rule targeting residential property investors.

So their theory is one distortion (extremely low interest rates) can be “cured” with another (Loan to Value ratio restrictions). This then causes another distortion (property mainly being bought by investors) so they’ll solve this with new restrictions on investors.

Of course what is really happening is that poor to middle income people are steadily being squeezed out. Their earnings have stalled while asset prices keep rising. Both these are symptoms of the central bankers meddling, but the central bankers conceit is that much like the modern “sickcare” industry, they continue to treat the symptoms without ever realising they are actually the cause of much of the “patients” troubles. And one “treatment” has side effects that require further “medication”.

Bill Bonner actually sums this up perfectly in his Diary of a Rogue Economist. And he could just as easily be talking about New Zealand:

—–

“The critic might have added that whether you call it Abenomics, Yellenomics or Draghinomics, [ or Wheelernomics? – GSG Editor.] the “nomics” are the same.

So is the monumental conceit behind them: Finance ministers and central bankers claim they know what is wrong with the economy… and what to do about it.

Because an economy is the aggregated choices of consumers, businesses and investors, what the authorities are really doing is undermining the desires and decisions of millions of people – rich and poor.

That they do so in the name of prosperity – which they can neither properly define nor measure – is comic as well as tragic.

But they keep at it… And everywhere, they get about the same results. From another Financial Times article:

Wages have flat-lined in the developed world as workers fail to benefit from the uneven global economic recovery.

Average real pay in developed economies rose 0.1% in 2012 and 0.2% last year, according to the International Labour Organisation’s biennial report on global wages. Workers in several rich economies, including Italy, Japan and Britain were earning less than in 2007.

Let’s see… The feds transfer trillions of dollars in unearned wealth to the rich. They try to drive up consumer prices for the middle and lower classes. Economic growth slows. Earnings stall. And debt levels shoot higher and higher.

We think we know how this story ends.”

—–

Earlier in the same article he also noted value investor James Montier comment that we are seeing a central bank “near bubble”:

—–

“This is the first central bank sponsored near-bubble,” says Montier.

He calls it a “near bubble.” We don’t know if he anticipates another bigger, huger, gigantesque double bubble full of trouble.

But we do.

That’s what we’ll have when we get to the climax of this story. But not right away. We’ll have to wait for another crisis to spook the Fed into a new round of reckless and asinine activity.

Then… hold on to your hats!”

—–

We’re inclined to agree with him. While there are quite a few warning of a crash coming in stock markets, our guess is that stocks (and housing too) can keep going up for a bit longer yet. We are yet to see the final rush back in of the average guy or gal in the street which won’t happen until sentiment is universally positive. Interesting that Bonner thinks we’ll see another crisis before even more “stimulus” is kicked into gear and then that will bring the real bubble. The aftermath of this is when gold and silver will likely come into their own.

So make sure you’ve got yours before the trouble arrives.

Free delivery anywhere in New Zealand and Australia

A box of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, with free delivery fully insured anywhere in NZ or Australia is $13,120 and delivery is now about 7-10 business days away.

|

Pingback: Ronald Sterferle: How much longer can gold price intervention go on? - Gold Prices | Gold Investing Guide