|

Gold Survival Gold Article Updates

Oct 8, 2014

This week:

- Gold triple bottom?

- So is the bottom in for silver finally?

- France vs Monaco vs UAE

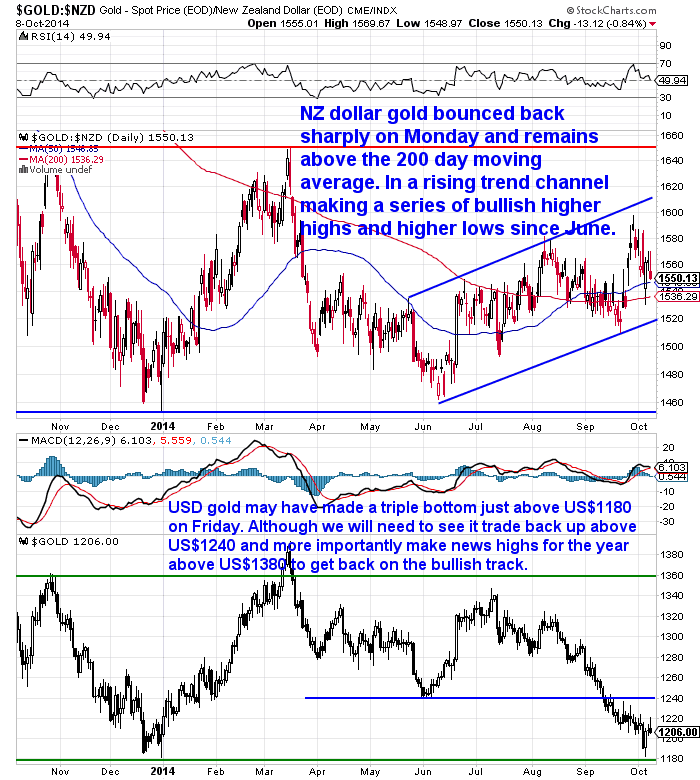

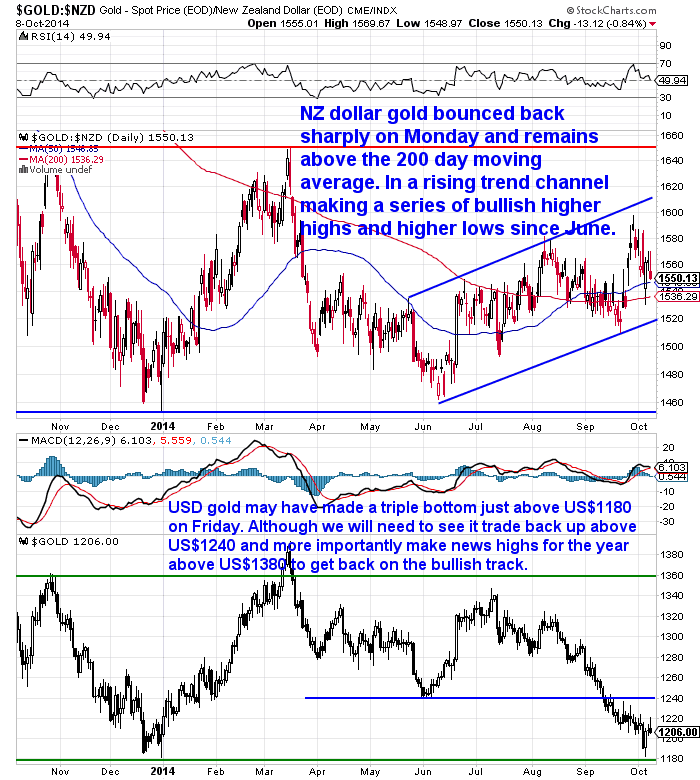

There has been action aplenty this week in precious metals markets. As can be seen in our charts below this week.

Friday’s – as ever – dodgy US jobs data saw gold and silver take a towelling. The lowest unemployment number since the financial crisis was a good excuse to take the metals lower. Of course this data excluded those “discouraged workers” no longer looking for jobs and no one notices the record low US employment participation rate. But while the masses go on believing in central bank omnipotence we can see the share markets continue rising for a while yet perhaps.

This was borne out even more this morning with the release of the US Fed minutes seeing share markets surge higher but also gold and silver did too. In a nutshell the Fed dialled back slightly on the talk of interest rate rises and seems the markets liked this.

See: US markets cheer Federal Reserve minutes

But as already mentioned gold and silver have some ground to make up.

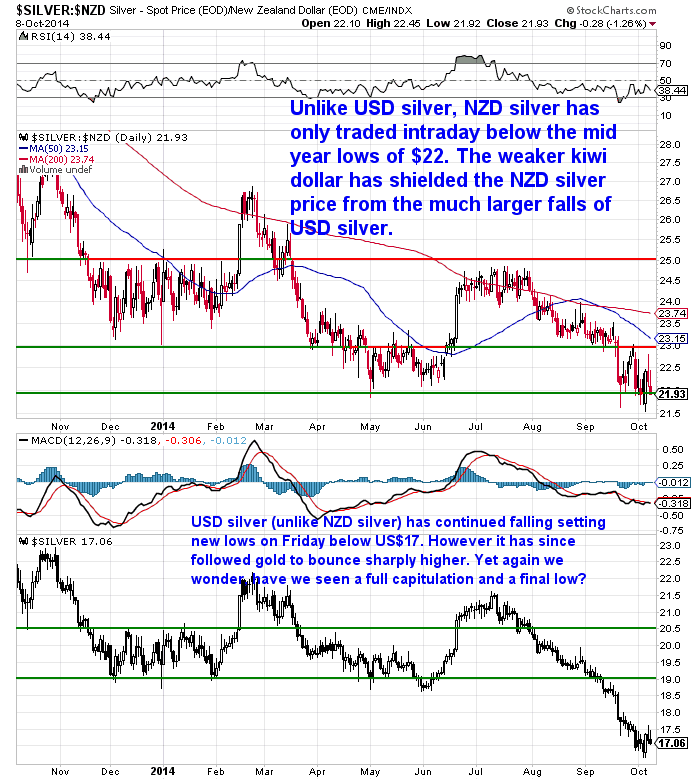

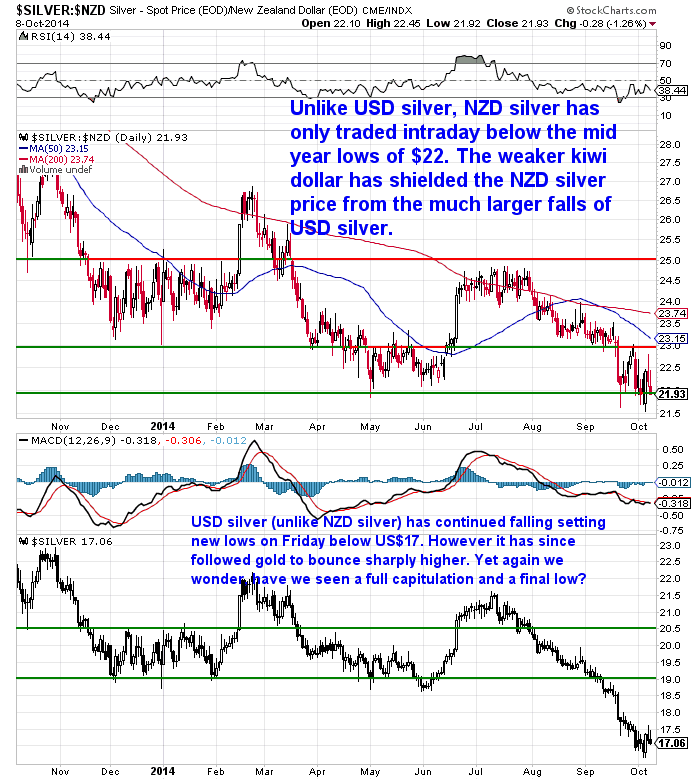

With silver in US dollars falling to new lows below US$17 on Friday US time and gold dipping down to retest the previous lows of $1180.

The good news is that so far anyway, this support level has held up. In fact as we type gold is back above US$1220 today. So if we can see a sustained rise here, we may have seen a triple bottom in USD gold at $1180ish. From what we’d read there were large positions betting against gold at US$1180 so this is a short covering rally until we can see gold move a decent chunk higher.

It’s a different story in gold in NZ dollars though.

The chart shows NZD gold in a rising trend channel, making a series of higher highs and higher lows since June. Currently sitting almost $100 per ounce above the June lows in fact.

Here are the numbers since last week.

Gold in US dollars was $1215.85. Up $6.47 since then to $1222.32 or 0.53%.

While the stronger kiwi dollar this morning (up almost 1 cent to 0.7891) meant gold in NZ dollars was down $15.20 to $1549 or in % terms down 0.97%

Meanwhile silver in US dollars was is up 21 cents to $17.45 or up 1.21% from last weeks email.

Whereas silver in NZ dollars is down 7 cents to $22.11 or down 0.31%.

So is the bottom in for silver finally?

We wouldn’t want to call it. However buyers of gold and silver mining shares seem to think so with large rises of 7-10% in most miners this morning. The HUI gold bugs mining index is today back above the lows from December as a result. Now we’ll need to see some follow through too.

So this gives another opportunity for anyone wanting to silver, to buy right on the lows of June again.

Monster boxes of 500 canadian silver maples have proven popular – although no where close to as popular as they were in April 2013.

So this means the premiums above spot price have remained low. So not only a low spot price but a low premium for anyone buying today. As always just drop us an email or give us a call if you’d like a specific quote.

Your Window into the 2014 Casey Research Summit Opens Here

Another spectacular summit just concluded! But you can hear every word … when you order your Summit Audio Collection today. This year’s all-star faculty, with Alex Jones as the keynote speaker, debated the most controversial issues threatening your wealth, health and liberty. It’s a rare opportunity for you to learn how to survive and thrive in today’s crisis economy.

Listen, Learn and Profit!

A full 26 hours of digital recordings – every Summit presentation, panel discussion and workshop – in CD and MP3 formats.

News a Little Less “Rock Starish” in NZ

Each day we receive an email of NZ and international business news from ASB. Just the first few from scanning Tuesdays headlines showed that the tune has changed quite noticeably from only a few months ago here in NZ when all the news was of ever rising agricultural commodity prices. Instead we see:

Business confidence fades as reality fails to match economic hopes.

A more cautious tone in the Institute of Economic Research’s most recent quarterly survey of business opinion signals a slowdown in economic growth from a sprinter’s to a middle-distance runner’s sort of pace… Read more

Finance Minister Bill English is warning the tax take may come in below forecast in the current financial year, as figures released today confirm it was short by nearly $1 billion in the year to June 30 and English warned of the potential impact of slumping receipts from agricultural exports… Read more

This last article in particular is quite telling, showing that the tax income expected by the treasury is not coming to fruition. English actually comments that this may be more than a one off due to much lower than forecast dairy prices and therefore lower payouts to farmers. It could even threaten the much vaunted budget surplus.

Meanwhile headlines we saw on the BBC World News show a negative report downgrading global growth from the IMF has put a dent in Asian share markets.

France vs Monaco vs UAE

And in Europe – where we remain for alas just one one more day – continues to stagnate with very low inflation rates worrying the central bankers.

France has missed its EU target for debt to GDP and has just seen its public debt tick over $2 trillion for the first time. Given what we have learnt about the French system while staying with friends here, it is no surprise.

Their unemployment benefit is based upon your actual earnings not a low fixed rate. You can receive this for up to 2 years and so it is not uncommon for people to have a job for just long enough to be able to claim this for the allotted time, whereby they will again find work for a short period and rinse and repeat.

As far as healthcare goes, just about have everything seems to be paid for especially when it comes to children.

And from speaking to locals the equivalent of local councils and government departments seem very over-staffed compared to NZ.

That said most French seem pretty happy. I guess you would be if you were so well looked after!

They certainly have it sussed when it comes to the way they eat and the type of food they eat. As a result, seeing someone overweight on the streets is a very uncommon sight because of this.

However their day of reckoning will still have to come we would think.

The system in France is quite a contrast to that of Monaco which we visited briefly a few days ago.

To be honest we didn’t know too much about the history of Monaco before we visited. Save the common reports of it being a “tax haven”, the Grand Prix, and it being a popular spot with the rich.

Monaco seems to be a place where the “Benevolent Dictator” model appears to work. We guess so long as your dictator remains benevolent anyway.

From what we gathered most people living and working there seem pretty happy with the principality and his “serene highness” (where did they come up with that title?) Prince Albert. People we stayed with had met him and found him to be quite the entertainer apparently.

Anyway Monaco does show how zero income tax will attract capital and wealth. Surprisingly though you still get plenty of healthcare and schooling included as a resident.

However property to buy or rent is very expensive due to the tiny size of this country. A country that you can drive across in just minutes. Hence it remains the domain of the mega wealthy. Whereas for the average man it probably works out about the same when you pay for an expensive roof over your head.

However it does get you thinking, if somewhere with a greater land mass were to follow a similar line what it could do for them?

Monaco has basically no unemployment and little crime care of a 6 to 1 ratio between residents and the police force and a network of surveillance cameras. We imagine the lack of unemployment is as much to do with the lack of local unemployment benefit as anything. And the lack of crime as much to do with a lack of unemployment.

Of course the Grimaldi’s did pinch the place off the original inhabitants by posing as Monks, so like most places across the planet Monaco was bourne out of conquest and invasion.

Interestingly in many ways United Arab Emirates is quite similar with no income tax.

However it is quite different in terms of freedom. Particularly if you are a woman there is oppression aplenty, not to mention pay scales based purely upon race. We’ll have more to report from there after a few days, including checking out the Gold Souks (markets).

In contrast Monaco is a very clean fantasyland of seeming freedom. And while there are places to eat where you won’t get much change out of 3-400 euros, there are still plenty of spots that are no more expensive than in France.

An interesting spot to visit anyway and one that shows if nation states must exist, the smaller they are in terms of geography and population the better they are likely to be.

This Weeks Articles:

RBNZ “Jawboning” or Intervening to Lower the Exchange Rate? |

2014-09-25 21:55:28-04Gold Survival Gold Article Updates: Sept. 25, 2014 This Week: Everything falling RBNZ “Jawboning” or Intervening to Lower the Exchange Rate? Kings, Popes, Taxes and Modern Day Serfs. RBNZ “Jawboning” or Intervening to Lower the Exchange Rate? It appears the RBNZ might again have intervened in the foreign currency markets. The NZ dollar has dropped […]

2014-09-25 21:55:28-04Gold Survival Gold Article Updates: Sept. 25, 2014 This Week: Everything falling RBNZ “Jawboning” or Intervening to Lower the Exchange Rate? Kings, Popes, Taxes and Modern Day Serfs. RBNZ “Jawboning” or Intervening to Lower the Exchange Rate? It appears the RBNZ might again have intervened in the foreign currency markets. The NZ dollar has dropped […] 2014-10-06 17:22:33-04In Part 2 of THE PRICE OF GOLD AND THE ART OF WAR (see here for Part 1), Darryl Schoon takes a close look at the shenanigans that went on in gold back in September 1999… THE PRICE OF GOLD AND THE ART OF WAR Part II If you wait by the river long enough, the bodies of your enemies […]

2014-10-06 17:22:33-04In Part 2 of THE PRICE OF GOLD AND THE ART OF WAR (see here for Part 1), Darryl Schoon takes a close look at the shenanigans that went on in gold back in September 1999… THE PRICE OF GOLD AND THE ART OF WAR Part II If you wait by the river long enough, the bodies of your enemies […] 2014-10-07 16:05:27-0410/17 Prof. A. Fekete: The real cause of unemployment This is the tenth video (5 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary – Episode 04/17 […]

2014-10-07 16:05:27-0410/17 Prof. A. Fekete: The real cause of unemployment This is the tenth video (5 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary – Episode 04/17 […] 2014-10-07 16:49:15-04Jim Rickards: Obama’s Abandoning the Saudis for Iran and Dooming the Petrodollar By Alex Daley, Chief Technology Investment Strategist I sat down with Jim Rickards, author of many best-selling economics and investing books, including his latest, titled The Death of Money. In this exclusive interview, Jim shares his view on the changes in US foreign […]

2014-10-07 16:49:15-04Jim Rickards: Obama’s Abandoning the Saudis for Iran and Dooming the Petrodollar By Alex Daley, Chief Technology Investment Strategist I sat down with Jim Rickards, author of many best-selling economics and investing books, including his latest, titled The Death of Money. In this exclusive interview, Jim shares his view on the changes in US foreign […] 2014-10-07 17:09:08-04War, Peace, and Financial Fireworks By Casey Research Politics has long been a driver of international markets and fickle financial systems alike. Everything is connected. Here are some voices from the just-concluded Casey Research Fall Summit talking about cause, effect, and war. James Rickards, senior managing director with Tangent Capital Partners and an audience favorite […]

2014-10-07 17:09:08-04War, Peace, and Financial Fireworks By Casey Research Politics has long been a driver of international markets and fickle financial systems alike. Everything is connected. Here are some voices from the just-concluded Casey Research Fall Summit talking about cause, effect, and war. James Rickards, senior managing director with Tangent Capital Partners and an audience favorite […]