Gold Survival Gold Article Updates:

June 26, 2013

This Week:

- What to Make of the Bernanke Announcement?

- Big Trouble in Not So Little China?

- Global Co-ordinated Central Bank Action?

In what is becoming all too common in recent months both gold and silver are down again from last week. This followed the Bernanke announcement timelining a tapering of their bond buying, along with a (suspiciously timed to coincide with the Fed announcement) 25% increase in margin requirements by the CME Group for gold futures traders.

We have more on the Bernanke announcement further on below but first a look at how exactly this has impacted prices for precious metals here in NZ.

Gold is down to NZ$1649 from last week’s price of $1715 per ounce.

Silver was hit even harder, today trading at NZ$25.34, down almost $2 per ounce on last week where it was NZ$27.20. Silver looks to be closing in on the next level of support around NZ$24.50.

This is in the range we outlined might be coming in this article a few weeks back: Have We Seen the Bottom for Silver in NZD? and updated in this one: NZ Dollar Gold and Silver: Update After the Fall

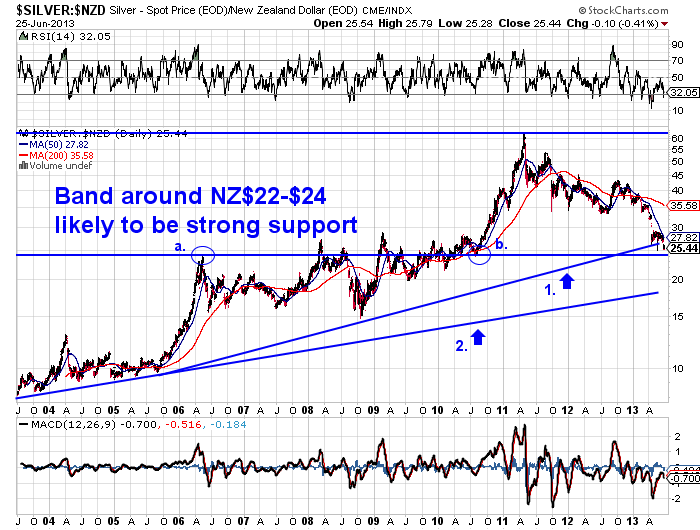

We are now experiencing the further downside we suspected was still to come in these previous articles. You might want to read or reread those to get an idea as to where support levels may be from here. But to save you some time here is an updated long term NZ dollar silver chart showing we are getting close to the next band of support at around NZ$22-24.

Unlike silver, gold in NZD is still a little way above the lows of April due to the weakness in the kiwi dollar, although we think the odds are this NZ$1600 level may yet be tested again (see top chart).

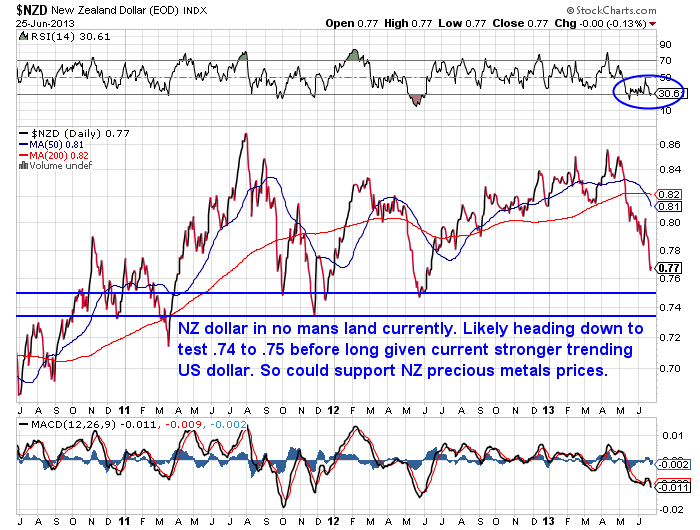

Speaking of the NZ dollar, today it is at .7735 versus .7982 last week prior to the Bernanke announcement. You can see in the chart below the kiwi is in no mans land at the moment and given the “risk off” sentiment it’s likely it will test the .74 to .75 region before too long.

So even if gold and silver fall further from here in US dollar terms it’s likely the kiwi dollar will weaken too and therefore offer some downside protection for NZ buyers of gold and silver around these levels.

What to Make of the Bernanke Announcement?

We along with many others were off with our call last week that the Bernank would try and retreat slightly from the tapering remarks he’d made previously. Instead he outlined a timetable for it to happen (albeit with many provisos) and you know the rest. Everything fell on the fear of the Fed no longer back stopping the bond market.

Of course on reading more closely what Bernanke actually said he has left himself and whoever comes after him massive wiggle room to back pedal and even print more. And given how rose tinted the Feds projections are we still have our doubts they will follow through. Some of the best stuff we have written on the topic since then was from Grant Williams in his latest Things That Make You go Hmmm entitled Call My Bluff.

Williams also features a short but interesting piece by Paul Brodsky of QBAMCO titled “That Pesky Marketplace — A Political Fable” which hazards a guess at just what Bernanke might be up to. Definitely worth a read – you may need to give up your email address to get Things That Make You go Hmmm but it’s worth it (see link above).

We could write more about what we think the Fed is up to here, but this morning we just posted a great article by Darryl Schoon that actually covers much of what we would say and he references a couple of other people like Alistair Macloed whose recent comments we would also take heed of. So if you only have time to read one of this weeks articles this is the one we would go to first. THE FED’S FORKED TONGUE

We could write more about what we think the Fed is up to here, but this morning we just posted a great article by Darryl Schoon that actually covers much of what we would say and he references a couple of other people like Alistair Macloed whose recent comments we would also take heed of. So if you only have time to read one of this weeks articles this is the one we would go to first. THE FED’S FORKED TONGUE

We also have to a couple articles from Casey Research looking at where we are currently in the gold market and what to do to prepare.

We also have to a couple articles from Casey Research looking at where we are currently in the gold market and what to do to prepare.

What Are Reasonable Gold Market Expectations?

And the final example looks at the junior mining sector in comparison to 1999 and takes the pulse to see if it’s as bad as back then.

These last 3 articles all link to a webinar that was live last night featuring the likes of Eric Sprott and Doug Casey – Gold: Dead Cat or Raging Bull?. We started watching this morning but have only gotten 5 minutes in so can’t give you an opinion on it yet, but given the difficult times for gold and silver at the moment there is certain to be some useful discussion in there somewhere.

Big Trouble in Not So Little China?

We commented a couple of weeks ago on how Australia is looking decidedly weak. Some of the data coming out of China recently is not offering a great deal of positivity for Australia either. You may have heard how in recent days the interbank lending rate in China spiked up to 14% compared to the usual low single digits. Interestingly, instead of it’s usual firehose of liquidity, the Peoples Bank of China’s initial response to the banks was along the lines of “You guys sort it out amongst yourselves”.

Although in recent hours they have backtracked on that and said “that it will intervene to adjust market liquidity if necessary, following the nation’s worst cash crunch in a decade.” Source.

The Chinese central planners are effectively trying to gently let the air out of China’s shadow banking system which Fitch says is now close to 69% of Chinese GDP at close to $6 trillion! Thats quite a bit of air to let out gently!

Here’s an article from Dan Amoss that explains just how this shadow banking system works and the trouble China faces because of it. China’s Growth Story Ends With a Whimper

So there could be trouble ahead for Australia and by extension us here too.

It perhaps seems a bit obvious that we just get steadily rising interest rates from here that many are now predicting. Seems more likely that there is still some event to come that will cause a (final?) rush back into US treasuries and a further falling of interest rates. Perhaps China will be that (not so) black swan?

Global Co-ordinated Central Bank Action?

The timing of this getting tough by the PBoC is interesting, coming hot on the heels of the Feds tapering talk. Especially when you read the Bank for International Settlements (BIS) latest report which states:

——

‘Central banks cannot do more without compounding the risks they have already created…How can they avoid making the economy too dependent on monetary stimulus? When is the right time for them to pull back … how can they avoid sparking a sharp rise in bond yields? It is time for monetary policy to begin answering these questions.’

——

See more in this article “Central banks told to head for exit”

So perhaps a co-ordinated “toughening up” by central banks is underway?

As the Daily Bell puts it:

“There is no avoiding what the Bank for International Settlements has just demanded. The top men at that august institution are demanding a global depression…

…Having watched central banking create a global crisis no less extreme than the Great Depression, they now seek to exacerbate it.

And just to make sure that no one misunderstands what is going on, they have apparently coordinated the Chinese tightening with Ben Bernanke’s statement about a “taper” of current stimulus.

And why does the BIS call for a global depression? We’ll leave that up for you to decide, dear reader. But what’s going on today reminds us of our suspicions that the Great Depression was similarly manipulated and for similar reasons.

Chaos is ever a tool of globalism.”

Also recall the BIS is where the “Bail In” or depositor “haircut” model to handle bank failures originated. As we mentioned back in April a 2010 BIS document is referenced at the very end of a RBNZ paper from 2011 on the Open Bank Resolution(OBR).

So the Daily Bells intimation that this global central bank withdrawal is a planned and co-ordinated event does not seem that far fetched.

First convince everyone Central Banks will forever print and also bail out any banks that run into trouble. Then change the rules so that now the depositors will pay for any bank failures. Then dial back the central bank support and when the house of cards topples, those in the know finally suck up all the wealth that evaporates?

If you want to remove some of your wealth from this house of cards then you know where to find us.

Late Update: As we hit send gold and silver prices have actually dropped down a bit on the numbers we have published above. Gold in NZ Dollars is now at $1626, closing in on the lows of April. Silver is down to NZ$24.77 per ounce.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Another Contrarian Silver Indicator |

2013-06-20 00:53:24-04 Gold Survival Gold Article Updates: This Week: Waiting on the Bernank Another Contrarian Silver Indicator How About the Gold/Silver Ratio? It’s been a pretty uneventful week in the precious metals world. The kiwi dollar is pretty well unchanged from last week at .7982 this morning. Gold in NZ dollar terms is at $1715.32 […] 2013-06-20 00:53:24-04 Gold Survival Gold Article Updates: This Week: Waiting on the Bernank Another Contrarian Silver Indicator How About the Gold/Silver Ratio? It’s been a pretty uneventful week in the precious metals world. The kiwi dollar is pretty well unchanged from last week at .7982 this morning. Gold in NZ dollar terms is at $1715.32 […] |

| What Lies Ahead for Gold? |

2013-06-20 23:16:41-04We were a bit slow to post this article yesterday, but it has proven to be quite prescient with gold and silver along with just about everything else dropping overnight. Anyway, it outlines what some of the headwinds for gold may be, but also gives some hope that the fundamental reasons for owning gold have […] 2013-06-20 23:16:41-04We were a bit slow to post this article yesterday, but it has proven to be quite prescient with gold and silver along with just about everything else dropping overnight. Anyway, it outlines what some of the headwinds for gold may be, but also gives some hope that the fundamental reasons for owning gold have […] |

| What Are Reasonable Gold Market Expectations? |

2013-06-23 22:09:50-04With gold and silver falling again, this article outlines how full capitulation may now be underway. It offers a couple of hints about how to handle this situation… What Are Reasonable Gold Market Expectations? By Jeff Clark, Senior Precious Metals Analyst The historical record shows that those who get washed out during big corrections miss […] 2013-06-23 22:09:50-04With gold and silver falling again, this article outlines how full capitulation may now be underway. It offers a couple of hints about how to handle this situation… What Are Reasonable Gold Market Expectations? By Jeff Clark, Senior Precious Metals Analyst The historical record shows that those who get washed out during big corrections miss […] |

| Nuclear Winter? Not Yet! |

2013-06-24 19:28:49-04Here’s an interesting couple of charts that look at private placements in junior mining companies as an indicator as to how good or bad the financing market is for mining companies is in comparison to the late 1990′s when it was terrible. Quite a different way of looking at whether we are in a “nuclear […] 2013-06-24 19:28:49-04Here’s an interesting couple of charts that look at private placements in junior mining companies as an indicator as to how good or bad the financing market is for mining companies is in comparison to the late 1990′s when it was terrible. Quite a different way of looking at whether we are in a “nuclear […] |

| THE FED’S FORKED TONGUE |

2013-06-25 18:52:36-04This is a must read piece as it does a great job of summarizing much of what we have read since the Bernanke speech last week caused just about everything to fall (apart from interest rates). It gives a good insight into what the Feds game may actually be with the announcement, along with what we can […] 2013-06-25 18:52:36-04This is a must read piece as it does a great job of summarizing much of what we have read since the Bernanke speech last week caused just about everything to fall (apart from interest rates). It gives a good insight into what the Feds game may actually be with the announcement, along with what we can […] |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1649.26/ oz | US $1275.70/ oz |

| Spot Silver | |

| NZ $25.34/ ozNZ $814.66/ kg | US $19.16 / ozUS $630.14/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

$15150 (delivered and insured)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

If they keep printing, they’ll lose control and the fiat financial system will collapse. OTOH, if they stop printing, they’ll lose control and the fiat financial system will collapse.

Of course, the real value of gold, as Fekete describes it, is the ultimate extinguisher of debt. So while all eyes are on the printing presses, and trying to predict what will happen next, the global “tower of debt” continues to grow taller and shakier without any end in sight… Until it collapses, and then everyone will act surprised.

Metals are getting clobbered by margin-calls, and people have to scramble – selling good assets to cover bad bets. That’s before we don our tin-foil-hats and talk about other reasons for a shake-out in gold.

Buy the dips. Buy on the way down, and “dollar cost average” as the price drops. Only fools try to predict bottoms (or tops) but one thing is certain: The days of fiat are numbered.

Thanks Atom, Yes as you say Feketes Tower of Debt is still growing everyday. Meanwhile the mainstream line is things are improving so many will be surprised when it turns to be not quite so rosy.

Such an informative article! Thank you so much for sharing this post. Though, it has been an issue that gold has been dropping for the past several months and I also have some readings about it. I do not know when it will bounce back to normal but, I do hope that in time it will.