Stewart Thomson explains why it may be good news out of Asia and improving economic growth, that drives gold higher from here. Rather than the western “fear trade” of recent years.

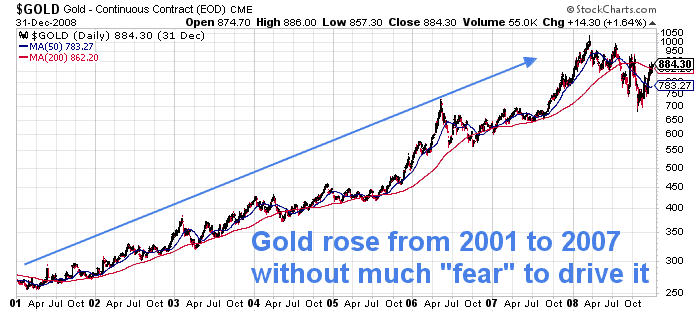

This may seem unlikely at first glance. But look back at a chart of gold from 2001 and you’ll see the price rose for the next 6 or 7 years without any major worries of economic collapse dominating the headlines…

Gold And The Big Four: Slam Dunk

By Stewart Thomson

Gracelandupdates.com

The synergistic relationship between gold and economic growth is quite healthy, and poised to become even more healthy in 2018 – 2019.

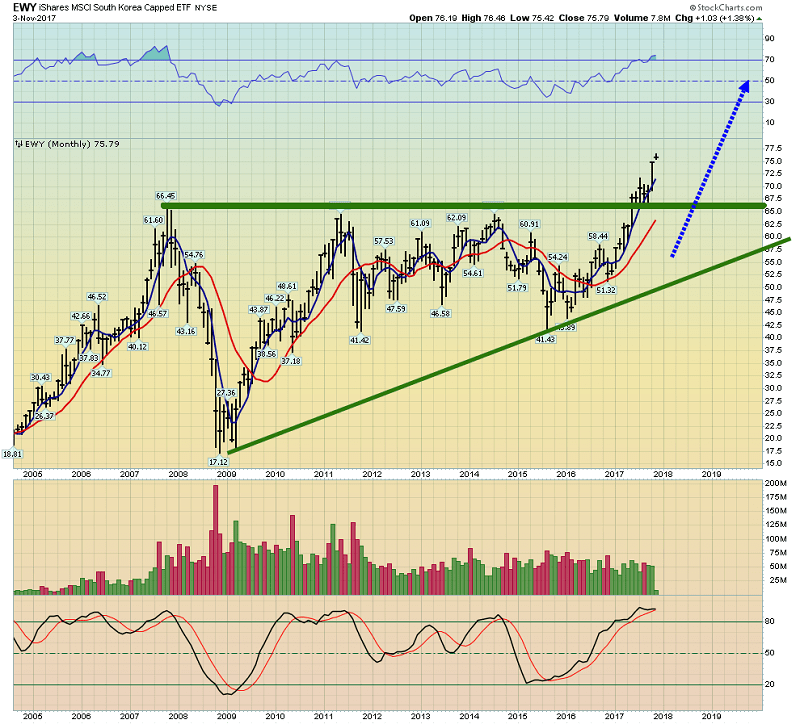

This is the fabulous South Korean stock market ETF chart.

Big name Western money managers are finally racing to move money into Asian markets, and this is great news for both gold and global stock markets.

For several years I’ve recommended that the gold community slightly reduce (but not drop) their focus on gold’s Western world fear trade and increase their focus on the Eastern stock markets and the love trade for gold.

South Korea’s stock market sports 50% earnings growth and a P/E ratio of just 10! Japan’s market is also red hot, and so are the markets of China and India.

US markets have risen strongly, but with anemic economic growth and nosebleed valuations. Growth is vastly stronger in Asia, but without European and US money manager participation, Asian stock markets have previously languished.

This situation has changed dramatically in 2017, and 2018 should see an acceleration of this new trend.

The bottom line: American markets are hot but overvalued. Asian markets are red hot but not overvalued.

I own ETFs (and some individual stocks) in the “Big Four” Asian markets; India, China, Japan, and Korea. I urge all Western gold bugs to “get with the (good) times”. The fear trade for gold will never disappear, but it’s a new era, and this new era is dominated by Asia.

Investors should be very comfortable owning Asian stock markets and gold… at the same time. The bottom line: America isn’t out, but Asia is in!

When times are good (and they are now very good in Asia), Asians buy more gold. Exponentially more. Chinese demand reflects this fact. It’s rising again; demand is up almost 20% over 2016, and poised to rise even more strongly in 2018.

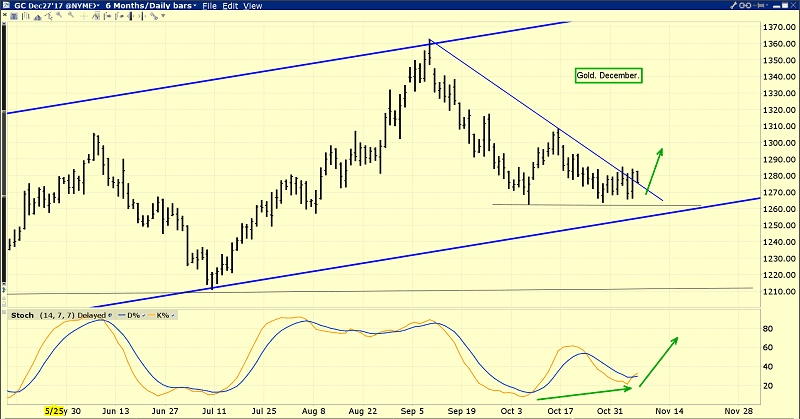

This is the daily gold chart.

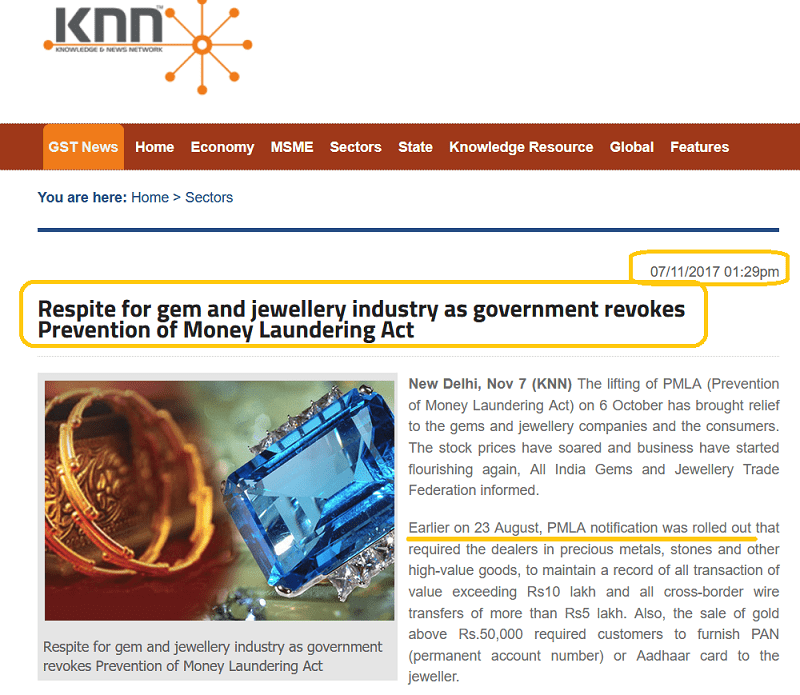

Technically, gold’s rally ended in early September because of significant resistance at $1362 (the demonetization night high).

Fundamentally, gold peaked then because of the Modi government’s August 23rd launch of the hideous PMLA program. That launch immediately sent Indian imports plunging towards the zero marker. When Indian gold imports sink, the price of gold sinks. It’s that simple.

The good news: The government has rescinded PMLA and imports are growing again. Wedding season is beginning and Chinese New Year buy season approaches. As a result, the price is showing firmness, and a gold price rally appears imminent.

I’ve predicted that Indian GDP growth should hit 10% by 2020. America’s could fall to 1% by then while US inflation starts surging and gold mine production shrinks noticeably. This is an epic win-win situation for gold.

Sentiment in the gold and hedge fund communities is now generally negative, as it always is when significant rallies begin.

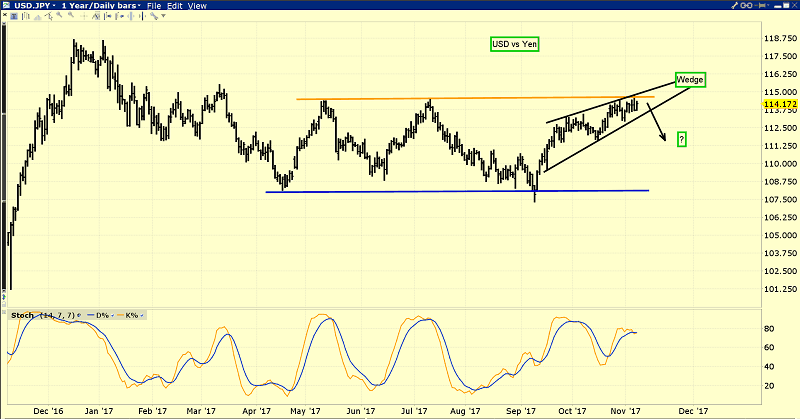

There’s a bear wedge in play on this dollar-yen chart now, which is more good news for all gold price enthusiasts. The commercial traders are also adding to their short positions in the dollar against both the yen and the Swiss franc.

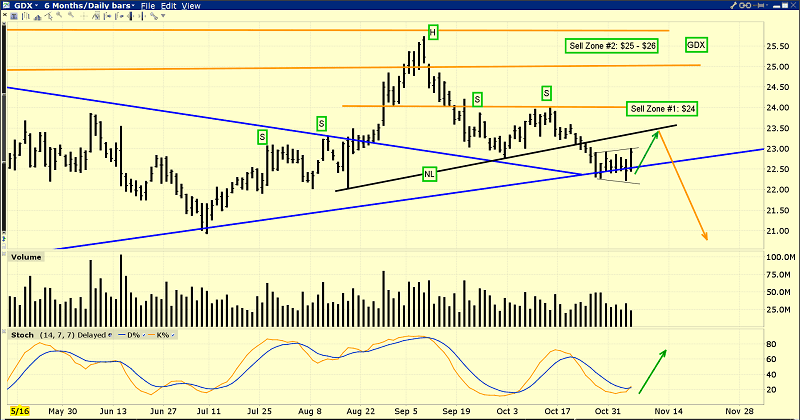

This is the GDX chart. There’s a modest head and shoulders top pattern in play, and that has a lot of old timer gold bugs nervous.

Unfortunately, these old timers may be too obsessed with the Western fear trade era of the past, and missing out on the Asian stock markets and gold price synergy that defines the new gold bull era.

Minor H&S top patterns like this one are irrelevant in the big picture, and this one may be getting technically voided anyways.

This is just what the gold bug doctor ordered, to spread some bull era cheer!

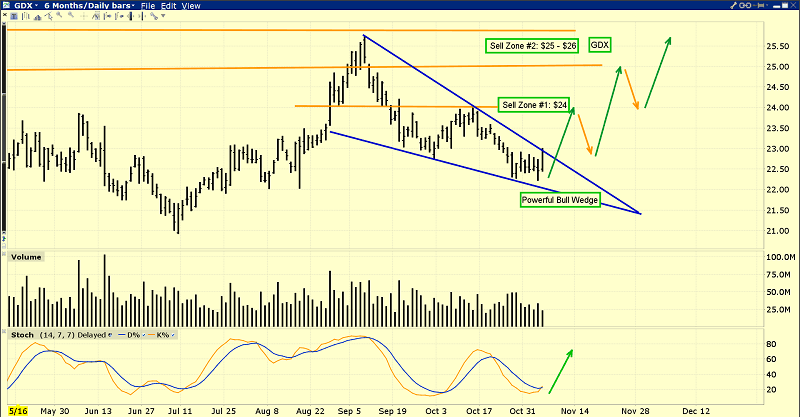

A fabulous bull wedge pattern is destroying the H&S top pattern, which makes sense given the great fundamental action taking place in India and China.

Owning the “Big Four” stock markets of India, China, Korea, and Japan while engorging on gold, silver, gold stocks (with some bitcoin for extra wealth building fun), is perhaps the greatest “no-brainer” investor play in the history of markets!

Related: Money Velocity: Historic Upturn Nears – Inflation Coming?

About Stewart Thomson

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form, giving clarity of each point and saving valuable reading time.