Prices and Charts

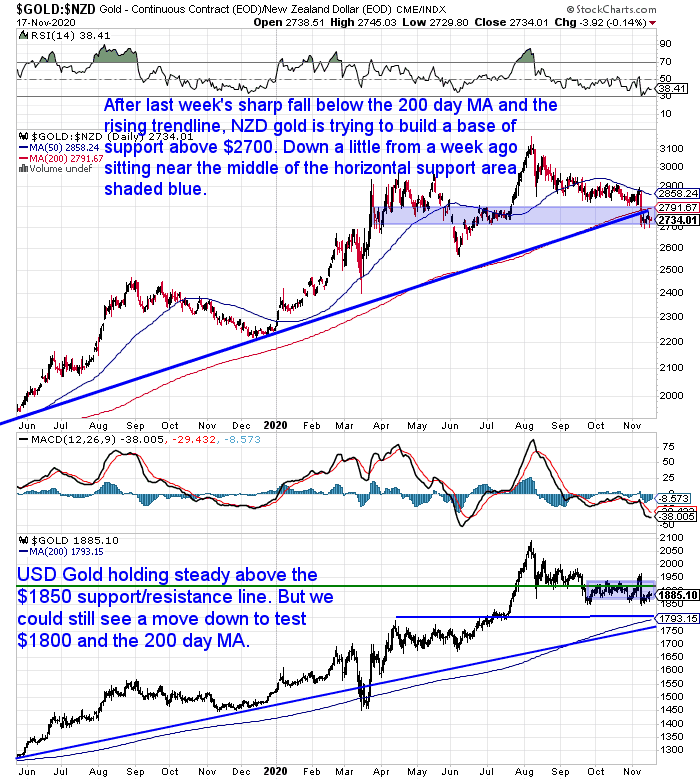

NZD Gold Bottoming Out Above $2700?

Gold in New Zealand Dollars is down a little lower from a week ago, chiefly because of the strengthening NZ Dollar.

After last week’s sharp fall below the 200 day moving average (MA) and the uptrend line, NZD gold looks to be trying to build a base of support above $2700. We need to see it get back above the 200 day moving average now.

While in US Dollars, gold continues in the sideways trading range above $1850 that it has been in since September.

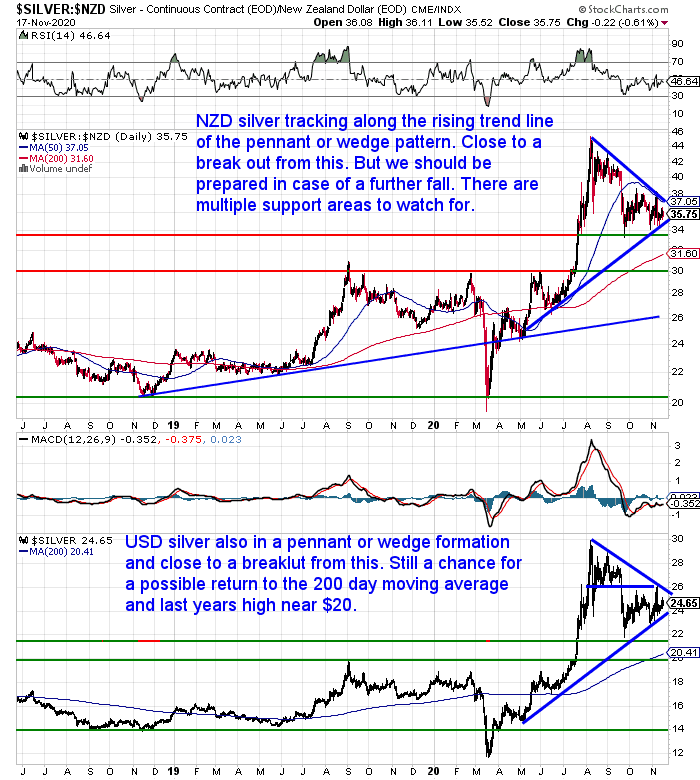

NZD Silver Holding Steady

Silver in New Zealand Dollars is pretty much unchanged from a week ago. It continues to track along the rising trendline of the pennant or wedge formation. Silver is now close to a break out from this pattern in both NZD and USD terms. The technical indicators are evenly balanced in terms of which way they might head from here. With a neutral RSI and NZD silver sitting midway between the 50 and 200 day moving averages, it could go either way.

Consider buying a series of tranches to get a good overall position.

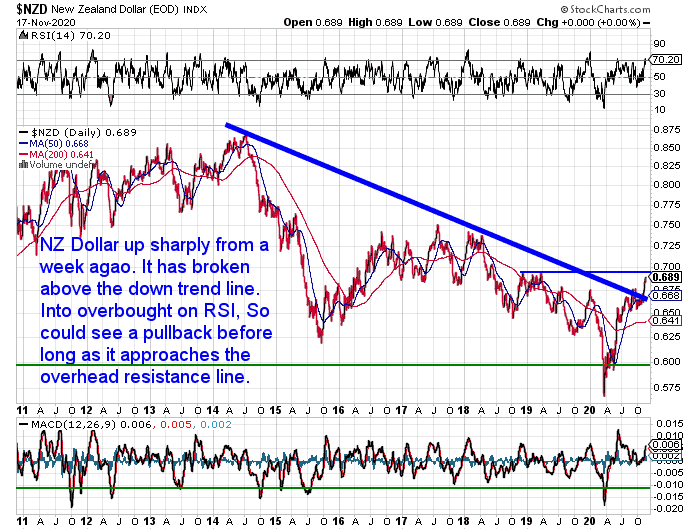

NZ Dollar Strength Continues

The New Zealand Dollar continued its rise this past week. Moving from the low 0.68’s to be at 0.6877 as we type. The Kiwi has broken above the downtrend line. It is now approaching the overhead horizontal resistance line near 0.70. But the NZD is also into overbought territory above 70 on the RSI so we could see pullback before too long.

So we could continue to see the NZD gold and silver prices underperform compared to the commonly quoted USD precious metals prices. But in the long run all currencies are losing value against gold.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

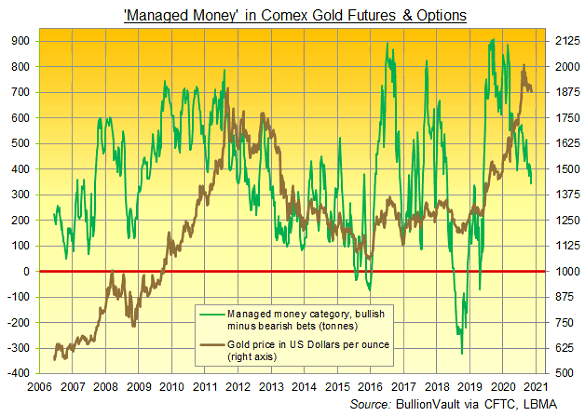

Gold ‘Set for a Break-Out’ with Comex Bullish Bets at 18-Month Low

We stated above that gold and silver are both evenly poised in terms of whether they might head higher or lower.

A Bullionvault report this morning highlighted the positioning of futures traders in gold.

Gold Trading ‘Set for a Break-Out’ with Comex Bullish Bets at 18-Month Low as Covid ‘Explosion’ Offsets Vaccine Hopes

“Latest data from US regulator the CFTC meantime show that bearish betting against gold prices by money managers trading Comex futures and options was barely changed from a week earlier last Tuesday – the day after Pfizer’s vaccine PR knocked $100 off spot prices.

But with bearish speculation still near its strongest since June 2019, bullish betting among hedge funds and other money managers fell for the 3rd week running, dropping 6.2% – the fastest pace since mid-September – to reach the smallest since May 2019.

…Together, that left last Tuesday’s net long position in Comex gold derivatives equal to a notional 345 tonnes of bullion among Managed Money traders, the smallest in 18 months and below its 15-year average of 379 tonnes.

These numbers show that the correction in gold is doing just what it needs to. That is, reducing the interest in gold which in fact sets gold up for its next move higher.

Gold may need to dip a little lower first, but it’s likely the next leg up is not that far away.

Gold vs Digital Currencies – Which Should You Choose?

Low and negative interest rates around the world have been sending most asset classes higher once again. Stock markets, real estate prices, and bond prices have all been rising. Recently we have seen digital currencies also surging higher. Now closing in on all time highs.

With gold still in correction mode there are renewed calls to drop gold for digital currencies instead. So which should you choose? This week’s feature article tackles this question…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold Can Benefit From Both a Crisis or a Boom – But With a Lag

Nick Hubble writing in the Daily Reckoning Australia, looked at why gold may be lagging other investment classes right now:

Gold, either way

“The interesting thing about gold is that it can benefit from both a crisis and a boom if that boom is inflationary.

The irony being that the gold price tumbles at the onset of both these scenarios.

At the beginning of a crisis, the gold price falls alongside everything else. Why? It is a long story involving the investment banks involved in the gold market and their other positions.

But, as the government and central bank responses to the crisis begin, and as investors seek safe havens, the gold price tends to outperform in a crisis thereafter. Including the COVID-19 shock and 2008.

This is an easy market mispricing you can take advantage of in a crisis. Buy the dip.

This week, the gold price got smacked despite the narrative being a sudden recovery under a vaccine. This seems unfair at first. If gold takes a hit during the onset of a crisis, surely it should go up at the onset of a sudden recovery from a pandemic?

But no, that’s not how it works.

If a global boom is on, safe haven gold looks like the wrong bet. And so the gold price fell on the pandemic news. Dramatically so.

However, and this is the key to gold’s medium-term future, it seems to me that interest rates will lag behind the global boom, if we do get one coming out of this pandemic. There is simply too much debt to raise rates on, as just described.

This in turn means that monetary policy will be one step behind inflation. And that’s the most important influence on the gold price there is. Inflation ahead of interest rates makes gold go up.

As I see it, the recent gold slump is a buy either way. One way you can get ahead of the market and profit from it being wrong too.”

So, if the covid-panic gets worse, gold should do well. But, if we get a recovery, rates will stay lower than they really should be. As a result we’ll see inflation higher than interest rates. Or what is known as a “negative real interest rate”. (For more on this see: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand? [Mid Year 2020 Update]).

So gold will do well too.

Seems a solid argument to us.

Let us know if you’re ready to buy and have any questions…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Sharp Fall - But a Sharper Bounce Back - is the Bottom Now in for Gold & Silver? - Gold Survival Guide