This week:

– New Zealand doing okay so far

– Kiyosaki: “Sell Aussie”

– Europe Yawwwwn

– Fed Presidents invest in inflation hedges

– A quick look at gold in NZ dollars

– This weeks article and video

Sorry we’re late getting this out today. We had a small flood to contend with caused by an overloaded washing machine! While cursing our bad luck we then did stop to consider the poor devils in Queensland contending with real floods and then realised we weren’t too badly off in the end and should take a few deep breaths and chill.

New Zealand doing okay so far

This also got us thinking that in the global monetary crisis New Zealand hasn’t fared too badly either – so far anyway. We also wondered if that’s why film maker James Cameron is intending to move to our fair country?

Local headlines were more along the lines of the fact that the farm in the Wairarapa he’s got permission to purchase is not too far from Weta Workshop in Wellington, where Avatar 2 is being made etc.

But the other angle is that he is escaping from the USA like a good many wealthy individuals as reported here:

Read Between the Lines: Hollywood Mogul Buys 2,600 Acres of Farmland; Moving to New Zealand

So perhaps we can take his move as a vote of faith in little ole NZ?

Kiyosaki: “Sell Aussie”

However the counter to this was a short post we read by Robert Kiyosaki in the past week. It wasn’t directed at NZ as such but rather Australia, however being our largest trading partner the maxim is that where Aussie goes we follow. Anyhow, Kiyosaki’s post was headlined “Sell Aussie” and was discussing a recent seminar he attended and how a couple of charts caught his eye (you need to sign up to read it but it’s free)…

“The two indexes [Baltic Dry Index and the Harpex Index] measure ocean freight, indicators of world trade, and the world economy. They caught my eye because my education is in ocean transportation. I learned to be a merchant-ship’s officer at the U.S. Merchant Marine Academy.

Both indexes are important because the Baltic Dry Index measures raw material transported by sea, and the Harpex Index reflects finished products shipped in containers. Both indexes look like a black-diamond ski slope. If they don’t change direction and head back uphill, depression is imminent.

I’m concerned for Australia because the Aussies ship in bulk which is measured by the Baltic Dry Index. Countries such as South Korea, Japan, India, and China ship refined manufactured products via containers which is measured by the Harpex Index. If this trend continues, Australia, India, and South Korea will follow the rest of the world into the recession—a double dip. This is not good for anyone. If I were in Australia today, I would use their strong dollar to buy gold and silver.”

I did read a slightly contrary article this week too on the Baltic Dry Index (BDI) (I can’t recall where it was now unfortunately). But from memory the author was saying that the low price of shipping was also a function of over supply of shipping.

Basically too many ships were ordered at the height of the good times a couple years back and these continue to come on line now. Meaning more ships chasing the same or lesser amount of goods to ship, therefore lower prices.

However they also said that even a rise in the number of ships did not account for the massive fall in the BDI over the past month.

Anyhow, if Kiyosaki is correct it doesn’t bode well for us here either, given our interconnectedness with Australia. With our high kiwi dollar at present, his parting advice could be easily applied to us too.

Europe Yawwwwn

We haven’t got much to say on this subject still except more printing still seems likely to us one way or another. You can find plenty of reports that they are nearing a solution with Greece (again!). But the counter is that Greece could well be planing to exit the Euro. We’ll just wait and see because no “solution” will be a real solution.

Fed Presidents invest in inflation hedges

Following on from last week, where we commented that it seems likely the Fed will be looking to create more inflation we came across this article for further proof. New York Fed President William Dudley held $1.45 million in Inflation Protected Treasuries (TIPs).

“William Dudley, the New York Fed president who famously pooh, poohed the possibility of significant price inflation, actually owned Treasury securities that protect investors against price inflation. In March of last year, Dudley played down the threat of price inflation to an audience enraged about increasing food prices, by telling the audience that not all prices were going up, and that they should look at the prices of iPads.”

The old adage of actions speak louder than words comes to mind!

And then even more interesting was this report 2 days later that another Federal Reserve president, Richard Fisher, held $1 million of gold.

And there’s meant to be no concern of inflation rising according to the Fed? As the first article says “Watch what they do, not what they say”.

So if the guys effectively controlling interest rates worldwide, are holding gold and inflation hedges, it makes sense to us to have some too.

This weeks article and video

Links to this weeks articles are at the end of this email as always.

We’ve got a detailed analysis of the Feds statement last week, plus an interesting video on the historical purchasing power of silver with some inspiration from cinema.

Gold in NZ dollars

As always we say to keep an eye on the gold price in NZ dollars not the US price commonly quoted. So how’s it doing so far this year?

Well, the high kiwi exchange rate is keeping a lid on gold in NZ dollars at the moment. Looking at the chart below we can see that today’s price of $2063 is hovering right around the 200 day moving average (the red line in the chart). As we’ve written many times before historically this has proven a decent time to buy.

So if you’d like to follow the actions of the Fed Presidents and heed Kiyosaki’s advice and buy some gold and silver then as always there are 3 ways to buy.

1. Email: orders@goldsurvivalguide.co.nz

2. Ph: 0800 888 GOLD ( 0800 888 465 )

3. Online order form and full product list

Have a golden week.

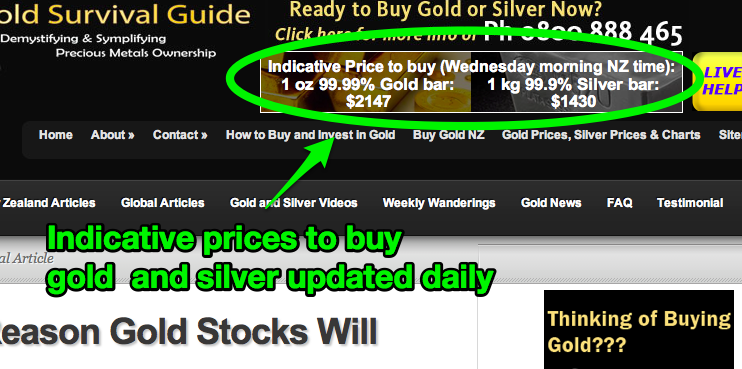

Glenn (and David). Founders Gold Survival GuideP.S. A reminder we’ve now got indicative pricing on the top banner on the website, (see image below) so you can check in at any time to get an idea of what an ounce of gold or a kilo of silver is going for.

This weeks articles/videos:

2012-02-07 20:38:50-05

Last week following the Federal Reserve announcement we commented that we thought the Fed would like to see more inflation. In this article from the always thorough Bud Conrad, we get a number of other insights into the likely meanings behind and results to come from the announcement. Bud comments on: – The reactions of gold, […] read more…

The Historical Case for $960 Silver

2012-02-07 21:58:56-05

We’re not sure that there is much point in making price predictions for gold and silver. It’s likely to be a “moving target” if central banks continue to create more “currency units” ad infinitum, so what ever price one extrapolates for today might be irrelevant in the future. However we found this video interesting in […] read more…

Pingback: Chart of the week: Gold in NZ dollars ready to break out? | Gold Prices | Gold Investing Guide

Pingback: Kiwi Dollar Takes a Dive and Helps Out Precious Metals | Gold Prices | Gold Investing Guide

Pingback: Rich Dad Poor Dad Author Robert Kiyosaki Warns Australia of ‘Biggest Crash in History’: Should You Listen? - Gold Survival Guide