This Week:

- NZD Gold at Almost 6 Year High

- Should I Buy Legal Tender (Face Value) Gold and Silver Coins?

- What Percentage of Gold and Silver Should Be in My Portfolio?

- Why the Ultra-Wealthy Love New Zealand So Much

Limited Stock & Subscriber Only Deals

1oz Perth Mint Gold Kangaroo Coins (Year 2000)

1oz coins at $2017 (Pick Up)

20 available – Same price as local gold bars

Each comes in plastic capsule

Not on website – Subscriber only deal – Phone or email David for quote

100oz Perth Mint Silver Bars

100oz bars at $2,508 Picked up

Around 60 available – These are a similar price to local silver bars

Great Subscriber Only Deal – Not on the website – Phone or email David for quote

10 x 1oz Pre-owned (Scruffy) Canadian Gold Maple Coins

10 x 1oz coins at $20,170

Delivered and fully insured

These Maple Leafs are no longer BU (Brilliant Uncirculated). They are classified as “scruffy” due to heavy contact marks, hairlines, minor scratches/scuffs, and indentations. They may also have been improperly cleaned or polished All of these problems arise from mishandling of the coins. But as a result you can buy them for the same price as a local gold bar.

Not on website – Subscriber only deal – Phone or email David for quote

500 x 1oz Silver Austrian Philharmonic Coins

500 x 1oz coins = $13,760

Most popular European produced silver coin.

Subscriber only deal – Not on website – Phone or email David for quote

Price Delivered and Fully Insured

500 x 1oz Silver 2018 Britannia Coins

500 x 1oz coins = $13,940

Not on website – Phone or email David for quote

Only 3000 coins available

Price Delivered and Fully Insured

Perth Mint 1 kg Silver Koala Coins

15 x 1 kg coins = $13,105

Get these 1kg minted coins for a similar price to PAMP silver cast bars.

Each 1kg coin ships in a protective plastic capsule.

Only 3 sets of 15kg available.

Price Delivered and Fully Insured

Call David on 0800 888 465 to learn more about these deals or just reply to this email, or click through to see more about them on the website.

Prices and Charts

NZD Gold at Almost 6 Year High

Biggest unreported news for the week in New Zealand?

NZD Gold this week hit its highest price since March 2013 – so close enough to a 6 year high!

But there were no articles about gold in the Herald as far as we’ve noticed. So this bodes well for the price heading higher we’d say. Bull markets like to run with the fewest people on board.

Why nothing in the media? Because gold in US Dollars has not risen to the same degree. And the USD gold price is what the media takes note of.

But in many currencies gold is now at all time highs. And not just currencies like the Venezuelan Bolivar either! The Australian Dollar gold price is currently at an all time record high.

The NZD gold price is close to overbought. So while it may run a bit higher yet, we should expect a pull back before too long. Maybe initially just back to what might now become the horizontal support line at about $1930.

But there is now a lot of blue sky above us. Refer back to what we wrote 2 weeks ago for where the price might go from here: NZ Dollar Gold Breakout About to Happen?

It’s not always the case, but so far what we wrote there about gold has been about right.

Same for silver.

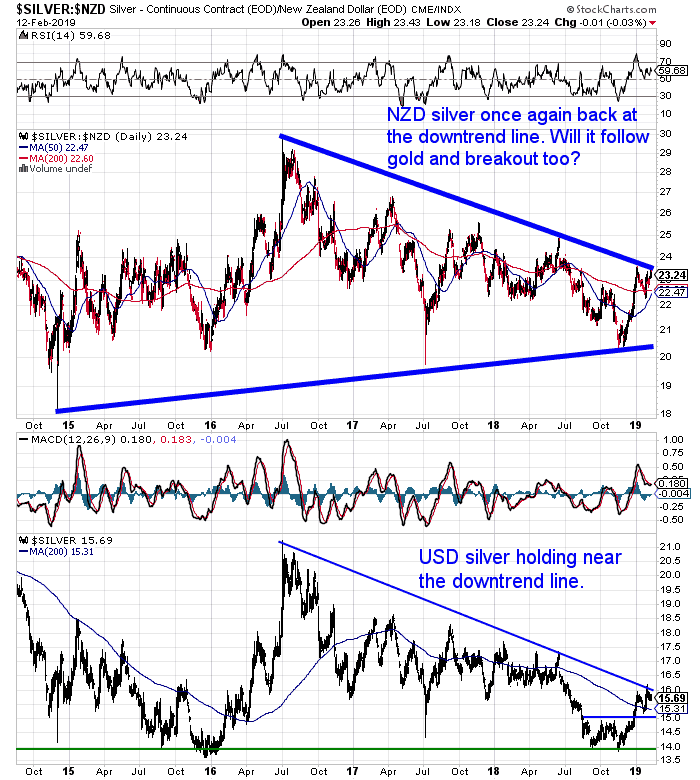

So far NZD silver has not quite broken out. But after a relatively brief pullback, silver is again testing the multiyear downtrend line. If the gold breakout continues, we’d say a silver breakout is not too far away either.

With regards to the NZ dollar, so far what we guessed in the gold breakout post from 2 weeks ago is also playing out. While there has been a sharp plunge in the Kiwi, it remains in the sideways range between 0.67 and 0.70 it has been in since November.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

Should I Buy Legal Tender (Face Value) Gold and Silver Coins?

With this weeks specials on 1oz Perth Mint Gold Kangaroo Coins (Year 2000) and Pre-owned (Scruffy) Canadian Gold Maple Coins, the answer to the above question is a resounding “Yes!”.

You can have these coins for the same price as local gold bars, so they are a great deal while stocks last.

But if you want to know more about these types of legal tender coins then be sure to check this post out too…

What Percentage of Gold and Silver Should Be in My Portfolio?

A question from a reader this week (probably a very common question too), made us realise we’d never directly answered it.

That being just how much gold and silver should you own? Or more specifically what percentage of precious metals should you have in your portfolio?

This is a very personal decision and not a one size fits all.

You’ll learn about the 9 factors you should consider in deciding how much gold is enough.

Plus there are some studies that have been done that will help you determine what percentage is right for you.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Avoiding a Big Loss and Why the Ultra-Wealthy Love New Zealand So Much

Dan Denning of The Bill Bonner Letter, says the most important thing for investors is to avoid a really big loss. In line with our feature article for the week they also have a recommendation for a much lower percentage in shares than most financial advisors would say…

“Your key challenge now – especially if you’re at or near retirement age – is to avoid the big loss.

Am I talking about a 95% one-day loss in the S&P 500 or the Dow? Of course not. The indexes won’t fall that far… in a day. But history shows that a typical bear market at the end of a huge credit boom – and we’ve just had the biggest boom ever – can take the indexes down 70% to 80%.

It’s why Dan and Bill have been urging their readers to stick to a very conservative allocation to stocks. Here’s Dan again…

Unless you’re happy taking big risks, Bill and I recommend keeping no more than one-quarter of your wealth in stocks. Then split the rest between cash… real estate… and precious metals.

That’s a much smaller exposure to the stock market than most mainstream financial advisors recommend. But they use long time-horizons and historic returns of about 8% a year to justify a larger exposure to stocks.

But you don’t have 100 years to make money on your stocks. You may not even have 30. That means taking a much more cautious approach.

Ultimately, how much of your wealth is in stocks versus other investments is up to you.

But as legendary financier J.P. Morgan put it, if a lot of your wealth is tied up in stocks, consider “selling down to the sleeping point.”

That was Morgan’s advice to a friend who complained that his stock holdings were keeping him awake at night.

Dan is exploring other ways you can protect yourself in the next crisis…

As we mentioned at the end of yesterday’s Cut, he’s down in New Zealand right now to see whether it’s a suitable location for a crisis “bolt-hole.”

As he put it in a private email to the Legacy Research team…

New Zealand has become popular with the ultra-wealthy as a billionaire bolt-hole in the case of an “event.” I’m talking civil unrest, a natural disaster, an electromagnetic pulse blast that takes down the power grid, a pandemic, or an old-fashioned financial system crisis.

The world’s ultra-wealthy are already making plans to comfortably ride out any such disruption from the comfort of a bunker somewhere down under.

Presumably with plenty of chilled Sauvignon Blanc on hand and New Zealand’s excellent butter, honey, and lamb products.

Some questions Dan will be trying to answer for Legacy readers while he’s in New Zealand…

Is it practical to move there? How would you do it? Or are you better off looking for a bolt-hole somewhere in the U.S.?”

Source.

We reported on this very subject a few years ago over on our sister site Emergency Food NZ:

So it looks like New Zealand is still seen as a safe jurisdiction for Americans. But of note is that the wealthy are continuing to plan for things to get a bit worse.

Even if you don’t have the wealth accrued to invest in a “bolt-hole” overseas, you can still make sure you have your wealth insurance in place. With the help of this week’s feature article you can determine what percentage of gold you need to balance out your other assets and investments.

Then simply get in touch for a quote.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

New Stock Just Arrived – Learn More….

—–

|

Pingback: NZ "Bolthole" Escapes, Financial Volcanic Eruption and Bonds vs Gold - Gold Survival Guide