This Week:

- Gold Price Forecast 2016/2017: Gold Bull Market Still Intact, But…

- Why This Gold Correction is Normal

- Dangers of Central Banks Going Mainstream?

- Former Goldman Insider Says Price of Gold Could Double

- Janet, Government, And The Woodshed

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1758.83 | – $21.44 | – 1.20% |

| USD Gold | $1270.05 | + $14.45 | + 1.15% |

| NZD Silver | $24.51 | – $0.32 | – 1.28% |

| USD Silver | $17.70 | + $0.19 | + 1.08% |

| NZD/USD | 0.7221 | + 0.0168 | + 2.38% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1689 |

| Buying Back 1kg NZ Silver 999 Purity | $749 |

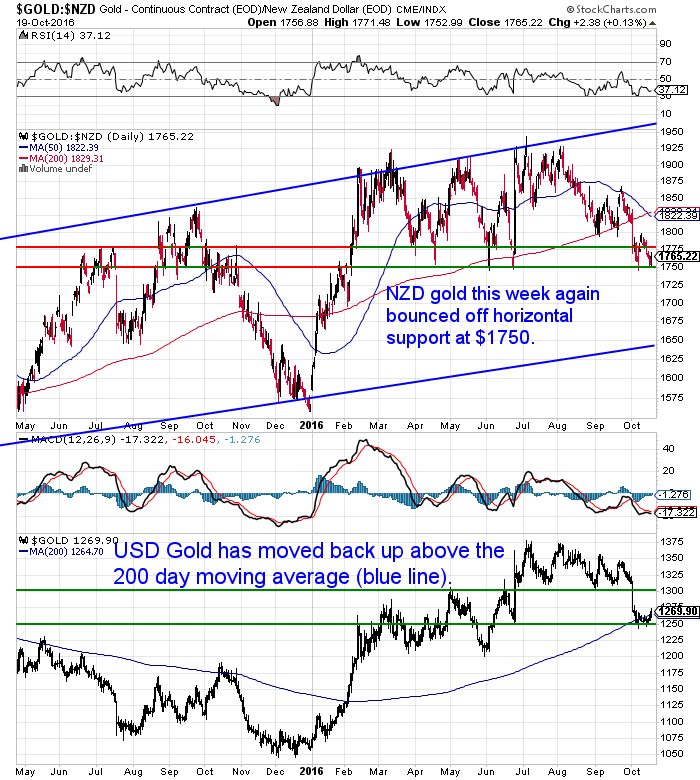

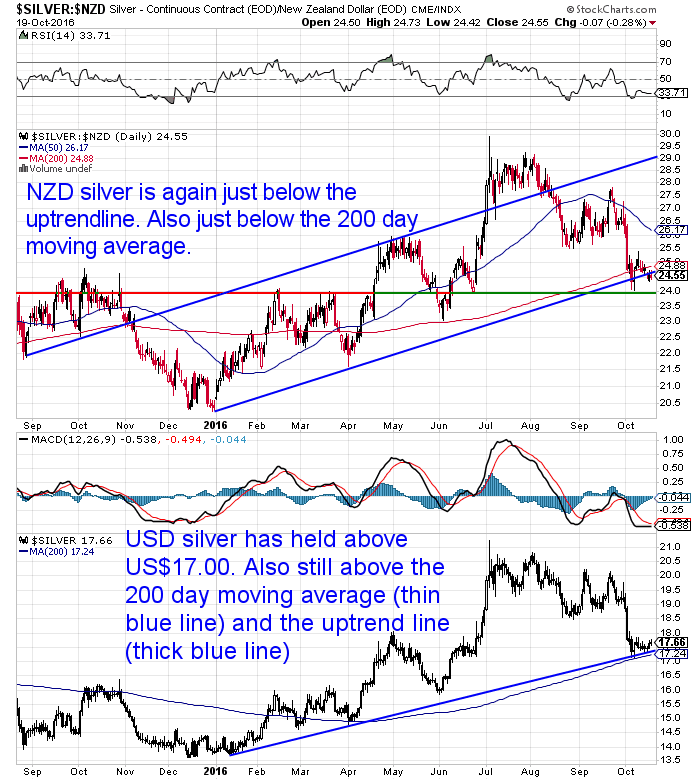

The Kiwi dollar has been key again this week. But in an about face, it has rallied over 2% higher from the very oversold level of a week ago.

This in turn has sent the low prices of gold and silver lower even while the US dollar prices have rallied.

NZD gold has yet again dipped down to $1750 before bouncing higher. That makes it the 5th time since April! So we are still in the $1750 – $1775 range.

The lower half of the chart is gold in USD. It has just snuck up above the important 200 day moving average (MA) again.

Silver in NZ dollars is just below the uptrend line and 200 day MA. However this is perhaps not a major concern yet as NZD silver did dip below the 200 day MA in late March for a couple of weeks before resuming its ascent.

While silver in US Dollars is just above both the uptrend and 200 day MA lines.

Why This Gold Correction is Normal

Jeff Clark at goldsilver.com gave some good advice if you’re worried about a recent purchase that may have been at higher levels than we are right now:

- “Focus on the big picture.

- When the gold price declines in a bull market, history shows it’s almost always higher three months later. The only time this didn’t happen in the 2001-2011 period was during the 2008 financial crisis—but even then the price ended up more than doubling within two years. In the 1976 to 1980 mania, gold was always higher three months later.

- In other words, daily and even monthly fluctuations are nothing to fret over. Viewed on a long-term basis, corrections are nothing more than one step down before the next two steps up. This fact reminds us to keep the big picture in mind.”

However fractal analyst Hubert Moolman (from whom we published a report on silver a few weeks ago: Silver Price Forecast: Higher Silver Prices For Many Years To Come), has noted in a post just out today that gold is close to an important juncture:

- Gold Price Forecast 2016/2017: Gold Bull Market Still Intact, But…

- “The gold bull market is still very much intact. In fact, it appears that the all-time high could be taken out real soon.

- However, on the chart there is an obstacle that the gold price has to overcome. Another failure at this obstacle, and we could have a bigger drop than the one of a few weeks ago.

- Below, is a chart of the gold price (from tradingview.com):

- The top line is that obstacle that has to be overcome. Another failure at that line, and we could see price drop even more than it did two weeks ago, even to the $1000-level or below. However, although such a drop is possible, it appears very unlikely at this point.

- Furthermore, there would be clear indicators in the market (in particular, the stock market) that such a move is about to happen.

- On the flip side, a breakout at that obstacle line, and we could see the greatest gold rally of all time. This is mainly because other factors would create a panic that would make gold and silver more sought after than any good in this world.

- In other words, the significant breakout of gold (at the obstacle line above), could occur around the same time as other significant collapses in the stock market and the bond market. Collapses don’t come bigger than a bond market collapse or stock market collapse (in that order), so expect an extreme panic when these happen.

- A breakout at the line, shown above, would be similar to the 1978/1979 breakout, before gold exploded to a high of $850. However, in 1979, it did not align properly with a debt-collapse as well as a stock market collapse. This time it could very well align perfectly to deliver a fatal blow to the international monetary system.”

- Source.

He’s not the only one we’ve read lately that is getting cautious on both the long term bond markets and the stock markets. But picking a top is notoriously difficult to do.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

Presentation – Gold & Silver: Wealth Insurance with Upside

We mentioned it fairly late in last weeks email as it had only just been posted. But we’ve had some great feedback from a webinar we did last week. So thought it worthwhile mentioning again.

Just bear in mind it was done for an audience of forex traders. Therefore it has a bit of chart and technical analysis focus. But hopefully we got across the points clearly enough so even if you don’t have much knowledge of charting you’ll still find some benefit.

The most interest seemed to be surrounding these 4 alternative measures of gold and silver “value” we discussed:

- Gold / Dow Ratio: 18000/1300 = just under 14 ounces

- Gold / Housing Ratio: $500,000/$1750 = 285 ounces

- Silver / Housing Ratio: $500,000/$25 = 20,000 ounces

- Gold/Silver Ratio: $1260/$17.60 = 72 ounces

So if you haven’t done so we’d recommend checking that out this week. Click through and check out what else got covered at the very least…

Gold & Silver: Wealth Insurance with Upside.

Dangers of Central Banks Going Mainstream?

Is it just us or have you also seen more more mainstream banker types warning about the dangers that central banks have created?

Firstly Stephen Roach, the former chairman of Morgan Stanley Asia and the firm’s chief economist but now a senior fellow at Yale recently said:

- “While financial markets love any form of monetary accommodation, there can be no mistaking its dark side. Asset prices are being manipulated across the board – stocks and bonds, long- and short-duration assets, as well as currencies. As a result, savers are being punished, the cost of capital is repressed, and reckless risk taking is being encouraged in an income-constrained climate. This is especially treacherous terrain for economies desperately in need of productivity-enhancing investment. And it is not dissimilar to the environment of asset-based excess that incubated the 2008-2009 global financial crisis.

- Moreover, frothy asset markets in an era of extreme monetary accommodation take the pressure off fiscal authorities to act. Failing to heed one of the most powerful (yes, Keynesian) lessons of the 1930s – that fiscal policy is the only way out of a liquidity trap – could be the greatest tragedy of all. Central bankers desperately want the public to believe that they know what they are doing. Nothing could be further from the truth.”

Then we had the Chairman of UBS bank, also warning about the dangers central banks have created:

- UBS’ Weber warns on danger of ‘massive interventions’ from central banks

- Axel Weber, UBS chairman and a former policymaker at the European Central Bank (ECB), has warned today’s incumbents that monetary intervention is causing international spillovers and major disturbances in global markets.

- “They (central banks) have taken on massive interventions in the market, you could almost say that central banks are now the central counterparties in many markets. They are the ultimate buyer,” Weber told CNBC on the sidelines of the annual meetings of the International Fund and the World Bank in Washington D.C.

- Weber, who was president of the German Bundesbank between 2004 and 2011 and was also a member of the ECB’s Governing Council, referenced the housing bubble leading up to the 2008 financial crash and said central banks had strayed from their core mandate.

- “Investors have been driven into investments where they have very little capability for dealing with what is on their plate and I think that is a sure reminder of where we were in a different asset class in 2007,” he said.

- “So I think the central bankers need to be very careful that they do not continue to produce disturbances in the markets, which they acknowledge – it’s a known side effect – but the perception that the underlying impact of monetary policy outweighs the potential side effect in my view is starting to be wrong,” he added.

- Since the global financial crash of 2008, central bank policy has focused on buying up bonds in large quantities and cutting interest rates to record lows. The Federal Reserve has since looked to unwind its own policy which focused on the Treasury market and the yield curve, but the Bank of Japan and the ECB’s large-scale bond-buying programs continue.

- “I don’t think a single trader can tell you what the appropriate price of an asset he buys is, if you take out all this central bank intervention,” Weber warned, adding that it often meant investors were making bad choices with where to put their money.

- Source.

This theme was summed up nicely this week in an article by former Federal Reserve of Dallas analyst Danielle DiMartino Booth. So yet another former insider pointing out the trouble sbrewing. Hat tip to John Mauldin’s “Outside the box”:

- “If anything, the power of the kings and queens running the world’s central banks has become even more concentrated. In a reversal of economic fortunes, today’s economy is in desperate need of higher rather than lower interest rates, of a normalization of policy to put a floor under the bloodletting in pensions, insurance companies and among retirees worldwide.

- And yet, the powers that be insist they know that better than the unwashed and uneducated masses that suffer at the hands of their misguided policies. Of course the benefits of negative interest rates outweigh the costs. And whose business is it anyway if central bankers impinge on the ability of capital to determine the value of a given entity?…

- That brings us to the parallel between then and now, to the conflagrations smoldering under the surface of the world economy that have a similar source of kindling as the World War era. That is, debt, a huge overabundance of debt. The latest figures out there suggest that global debt now eclipses $200 trillion, or about three times the global economy.

- And unlike in the late ’90s, when Indonesia, Thailand, and South Korea jacked up their debt loads and then Russia’s default forced Al, Bob, & Larry to ride to the rescue, today “the debt is simply everywhere, at least to the extent we can see and measure it. Corporate and sovereign debt, of both the developed world and emerging market varieties, are at record levels. China’s debts certainly add to that record but who really knows to what extent? It’s the ultimate black box of leverage on Planet Earth.”

- Read on to see why Danielle doesn’t think “a perverted gentlemen’s agreement” among central bankers, politicians, and investors will stave off a quadrillion-dollar reckoning.

- Source.

The likes of Martin Armstrong among others have argued that when the masses lose faith in central banks and government that is when the system becomes unhinged. We doubt we’re there yet but we do seem to be stutter-stepping our way ever closer to that day.

The trick is to be prepared in advance with your metallic insurance. Better years early than a day late.

Get in touch if you have any questions about the buying process. David is happy to answer them.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

Former Goldman Insider Says Price of Gold Could Double

Forget The Fed…Here’s the Key Interest Rate You Need to Be Watching

Janet, Government, And The Woodshed

Why is NZ’s Bank Bail-in Scheme “Most Ruthless” in the World?

Why Gold Stocks Perform Better Than Gold

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9amClick here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |