This week:

– More Fed “Jaw Boning”

– Gold’s performance in NZD for first quarter 2012

– So how’s silver looking?

More Fed “Jaw Boning”

Overnight the release of Federal Reserve’s FOMC last meeting minutes talked down the chances of further monetary manipulations… From Bloomberg…

“The minutes of the meeting show decreased urgency to add monetary stimulus. At their January meeting, a few members said that current economic conditions “could warrant the initiation of additional securities purchases before long.” In last month’s meeting, no sentiment was expressed for additional easing without a deterioration in conditions.”

We find it surprising how much weight is given to these minutes. Seems to us the Fed just “jaw bones” depending on what is going on at any given moment. Has gold risen too much? Talk down the chances of more intervention. Growth and jobs announcements weak – talk intervention up. We don’t bother to pay too much attention to them in the long run.Nonetheless they do seem to have a short term impact on prices. The gold and silver prices did come back overnight possibly due to this announcement (but who really knows if that’s why?).However we think gold and silver are holding up surprisingly well considering there is plenty of negative sentiment towards them at the moment.

Gold in NZD first quarter 2012

In NZ dollars gold again dropped down briefly to $2002NZ overnight. But once again the $2000NZ “support” level held.

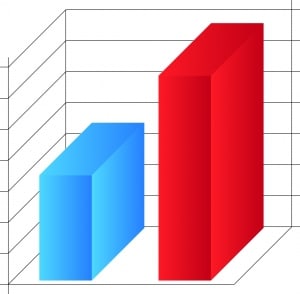

For the first quarter of 2012 gold in NZD dollars was up 1.6% on the back of plenty of negativity towards it. And even with the Jewellers strike in India which caused a massive drop in gold imports we didn’t see new lows in gold (over $1 billion a week was lost to the Indian gold market while the strike was on). So gold is looking surprisingly good we reckon.

Actually on the topic of India one of this week’s articles is an interesting interview with indian husband and wife jewellers Ashish and Rashmi for an on the ground look at the Indian gold market.

Also this week is an article from Professor Antal Fekete where he discusses the futility of the ruling establishments current policies.

And a topical video dispelling a number of the gold myths that get bandied about regularly.

So how’s silver looking?

Possibly even more surprising has been silvers behaviour lately. It is really off the radar of the media for now, but nonetheless it has held up remarkably well. Actually scratch that, it would be better to describe it as really flying for the first quarter of 2012 as in NZ dollars silver is “up” this quarter by 10.6%. And no ones really noticed. Annualised that would be over 40%! But outside of the precious metals world it’s not even being talked about. That’s how we like it though. A steady rise without any real attention on it.

Of course that’s not to say it will continue to rise this much for the rest of the year. But, for arguments sake it would only have to reach $50.75 (a rise of 42.4%) in order to match this first quarter’s performance for the entire year. Not an impossibility given that this price is still a way off last year’s high of $62.50NZ.

Our guess is that some of the positive economic sentiment is helping silver and hurting gold, due to silver’s greater industrial usage. And this is shown through in their relative performance so far this year.

That is, if in fact the global economy does pick up then silver will likely benefit from that more than gold. We have our doubts about a real improvement but it’s quite feasible that we limp along for a while yet.

Anyway this is why we like to have a bob each way. Own both physical gold and physical silver as insurance as they can behave and perform quite differently at times.

REMEMBER: Make sure you don’t pay too much attention to the US dollar price though. Recall that a fall in US dollar gold can be accompanied by a rise in the USD/NZD exchange rate, resulting in a much lessened impact on the NZ dollar gold and silver prices. This is just what happened overnight. Gold in US dollar terms was down 1.86% whereas in NZ dollars only down 1.10%.

The psychology of buying at lower prices

Our guess is these prices will look pretty cheap in the long run. We’re liking the fact that sentiment towards precious metals is not too crash hot at the moment. A quiet bull market is a sustainable bull market. And it means more chances to turn $$$ into bullion.

However we also have the advantage of our “Gold Survival Guide Reader Sentiment Indicator” which we mentioned a few weeks ago.

Things are quiet at the moment from an inquiry perspective and this is usually a good contrarian indicator for us that the price is not a bad one to be buying at.

It also shows how difficult it is psychologically to buy at lower prices, because the trouble is the mind is always thinking that “it could go lower yet, I better wait and see”. Sometimes it does but more often it doesn’t and instead you’re left sitting on the sideline. Picking the bottom is nigh on impossible.

So if you don’t want to be following the masses, now might be a good time to get some silver and particularly gold. That $2000 support level seems to be holding strong.

Give David a call, email, or livechat and he can get you a specific quote.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 )

3. or Online order form and full product list

Have a golden week!

Glenn (and David)

Founders

Gold Survival Guide

This weeks articles:

More on planning for Bank Failures in NZ

2012-03-29 05:54:12-04

This week: – Triple bottom might be in for NZD gold – Jim Sinclair first out the gate again – More bull from “The Bernank” – More on planning for Bank Failures in NZ Triple bottom might be in for NZD gold Last week we mentioned gold in NZ dollars might be looking to make […]

read more…

The Gold Problem Revisited

2012-03-29 21:57:38-04

First up a warning if you are somewhat new to the realm of gold. The following is a fairly advanced article by monetary scientist Antal Fekete and we have to admit we needed to read it a couple of times in a quiet place to digest it all! However wrapped up in this article are […]

read more…

Will India Stop Buying Gold?

2012-04-02 00:50:01-04

Of news lately has been that the Indian government has raised import duties on gold bars and coins into India. In fact a strike by Indian Jewellers just ended today after the government back tracked on also implementing a 1 percent levy on non-branded gold jewellery. The expectation would be that these further tariffs (they […]

read more…

Nine Gold Myths Everyone Needs to Understand to Survive this Global Economic Crisis

2012-04-03 01:34:06-04

There is certainly plenty of negative sentiment around about gold (and silver) at present. At the very least it seems many are sitting on the fence expecting it to fall further. The below video from J.S. Kim of SmartknowledgeU debunks a number of the myths that are trotted out every time gold reaches a new […]

read more…

The legal stuff – Disclaimer:

Pingback: Thumbs up for NZ from the IMF? | Gold Prices | Gold Investing Guide