Here’s 3 Positive Factors That Point to Higher Prices Ahead for Gold

Overnight Thursday last week (New Zealand time), both gold and silver fell sharply lower. Silver broke below US$19 and gold went as low as US$1270. Some would argue these moves mean both gold and silver will head lower given, these numbers are held as important technical support levels. However, there was an important point to also note…

1. Both metals then bounced very sharply and closed the day higher

A very positive sign. Gold rose sharply back to US$1292 and has since managed to get back above $1300.

While silver rose back up regaining all of what it had lost and then some, to get back above US$19.70 where it still remains now.

It was not surprising that both precious metals fell on Thursday, as together with Friday it was options expiry and futures expiry in the futures markets on these days. A time that often means temporary weakness in the prices of both metals and mining shares.

2. Safe Haven Buying or Lack of Sellers?

Talk over the weekend was that rising tensions in the Ukraine are what caused gold to rise. However there might be another reason.

Namely that there are not many traders prepared to sell or short at this point.

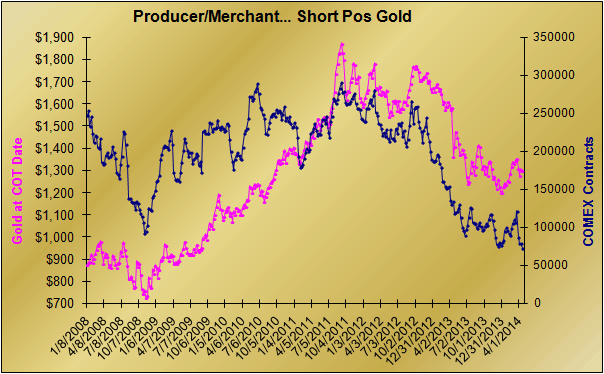

We covered this topic in our weekly email on April 3rd, looking at how gold Producers/Merchants had gotten out of a large number of shorts they had on gold as it fell towards US$1300.

“You should note that these Producers/Merchants include the largest bullion dealers, refiners, manufacturers, fabricators, jewelry makers and the bullion trading banks they end up trading through on the New York and London bourses. In short, PM’s include much of the “gold trade” who use futures to hedge. And the Producer/Merchants are nearly always net short because they are primarily using futures to hedge.

So the Producers/Merchants are the actual users of the metal, who are using futures contracts to hedge their physical metal purchases. Simply put, if the price falls they have some protection against physical purchases they have made at higher levels.”

Since then they have reduced their short positions even further. As of April 15th the Producer/Merchant gross short position has fallen to an 8 year low. Gene Arensburg reports:

“The current Producer Merchant short position – just their collective gross shorts by themselves – is the lowest (smallest) number of PM short contracts in DCOT [disaggregated commitments of traders] history, with data back to 2006. In other words, with gold near $1300 the Producer Merchants (the big traders of physical gold bullion, the bullion dealers, the refiners, the producers, the jewelers, the manufacturers, and the bullion trading banks they end up trading through on the COMEX) are currently holding the smallest number of pure short contracts in our records. We believe that is the very same thing as saying that – for whatever reason – the gold trade is not, repeat not motivated to hedge (or protect against a falling price). That means to us that the industry is looking more for higher gold prices, not lower prices.

Chart showing just the Producer Merchant [PM] short contracts. As of April 15 the lowest PM short position in DCOT history. Source CFTC for COT, Cash Market for gold, GGR.”

On top of this the “Swap Dealers” which includes the likes of Goldman Sachs, who have still recently been calling for $1050 gold, haven’t been “walking their talk”. Instead reducing their shorts quite dramatically, with their net position falling by 26,582 contracts. So the eight largest traders between them have a “level book” meaning they are not short or long.

The upshot of all this is as we said earlier, is that there aren’t too many traders in the futures markets who are prepared to bet on lower gold prices around the $1300 mark. This was backed up by the spike down but sharp reversal back up on Thursday night.

So it’s got us wondering if perhaps gold might not go a lot lower from here. And we may have seen a “higher low” formed around the US$1270-80 area.

3. The Performance of Mining Shares is a Positive

Another potentially bullish factor is the behaviour of the mining shares in recent days.

In our newsletter last week we made note of the fact that both gold and silver miners had performed better than the metals themselves in the past few days. While gold and silver prices had been stagnant the prices of the respective mining indexes had actually risen a few percent.

Take a look at comparison charts of mining shares versus precious metals.

The first chart is of the gold miners index GDX (blue) versus the Gold ETF GLD (green) – a proxy for the gold price, over the past 6 months.

You can see GDX led gold lower in November falling twice as far in percentage terms.

Now in just the past week GDX has risen much more strongly than GLD has.

Not at all surprising, as the miners are regarded as a leveraged play on gold so they usually rise more than gold itself, but fall more as well.

However what is of note is that the mining stocks began rising last week a few days before gold did (see the far right of the chart).

The next chart is of the Silver Miners Index SIL (blue) versus the Silver ETF SLV (green) – proxy for the silver price. A telling point is that the price of silver is back almost to its lows of the end of December, down around 15% from 6 months ago (see the green circles in the chart). Whereas the silver miners index is down around 8% from 6 months ago, while at its lows in December it was down 22% from 6 months prior.

So the silver miners are up quite a bit from their December lows.

Why is this significant?

Well, it points to silver stock investors believing that the price of silver is likely to be higher than it is currently. They seem to expect miners will make more money after all costs than the current price of silver would suggest.

With silver futures, open interest is at the highest level seen since 2008.

Open interest means “The total number of options and/or futures contracts that are not closed or delivered on a particular day.” http://www.investopedia.com/terms/o/openinterest.asp

Read more: Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide

So at close to a record high (green line in the above chart), this means there is a lot of betting on silver right now. That is, silver is due to move fairly sharply in one direct or the other. Which way will it be?

As always only time will tell, but for gold in particular we are leaning towards a higher low being in at the US$1270-80 level.

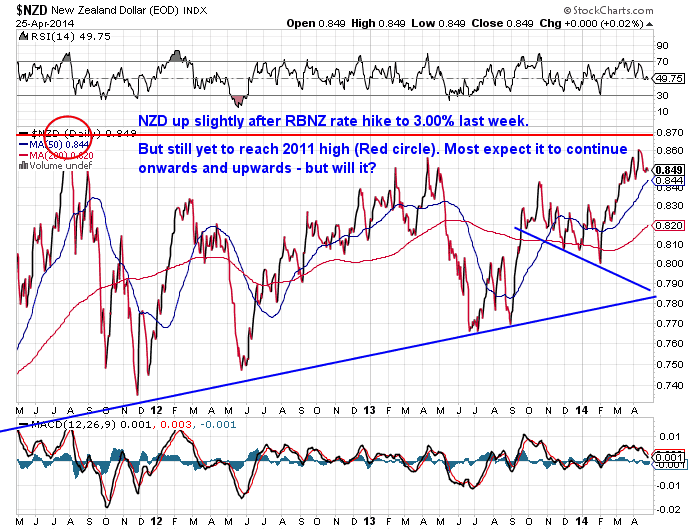

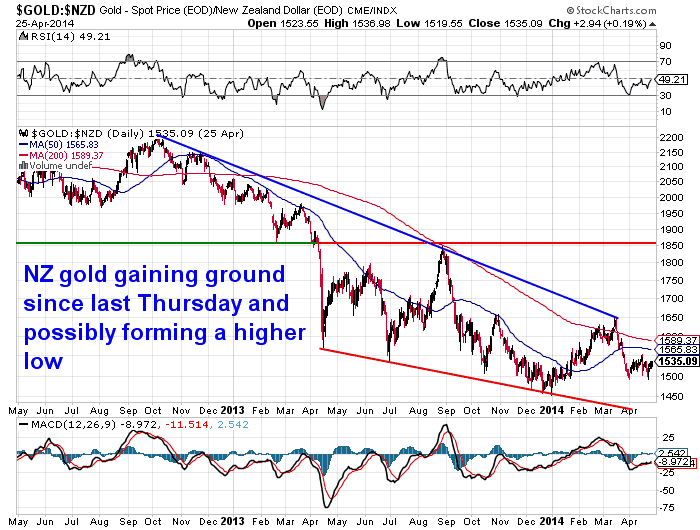

Also given the NZ dollar has so far not managed to breach the 2011 highs, we also wonder whether we might be somewhat close to a high in the exchange rate.

See this article for more on why the dollar could be close to topping out:

Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand?

So this could make now a very opportune time for buyers of gold and silver in New Zealand dollars with it looking like it might have formed a higher low around the NZ$1500 mark.

Another subjective indicator for precious metals bottoming out here…

Is that we remain very quiet in terms of volume of precious metals transactions currently. And from what we hear it is much the same for others in the precious metals industry in New Zealand. Also we’ve heard from precious metals retailers in the USA that it has been very slow there too.

Unfortunately most people are not too good at buying when the price is low in any sector. In gold and silver too, the average westerner is much more likely to chase the price higher, rather than buying a,t or close to, multi year lows. So the odds favour the next bull run higher in precious metals coming with the fewest people on board, meaning the bottom will come with little fanfare and most won’t notice.

If you’d like to go against the grain and establish or add to your financial insurance at these cheap levels, then get head to our order page to request a quote:

Request a Quote for Gold or Silver