The US Federal Reserve Rate hike in December looks to have had a similar effect to the first rate hike in December 2015. With gold falling initially but then surprising most and rising. Stewart Thomson comments on this and also on why silver may be lagging gold currently and not moving much higher…

Gold: The Rate Hike Rally Continues

Graceland Updates

By Stewart Thomson

1. The last two bear markets in US stocks were deflation-oriented.

2. The next one is likely to be inflation-themed, and could feature the US dollar and gold soaring higher at the same time.

3. Please see below now. Chinese producer price inflation is suddenly growing at the fastest pace in five years, and it will soon be exported to America.

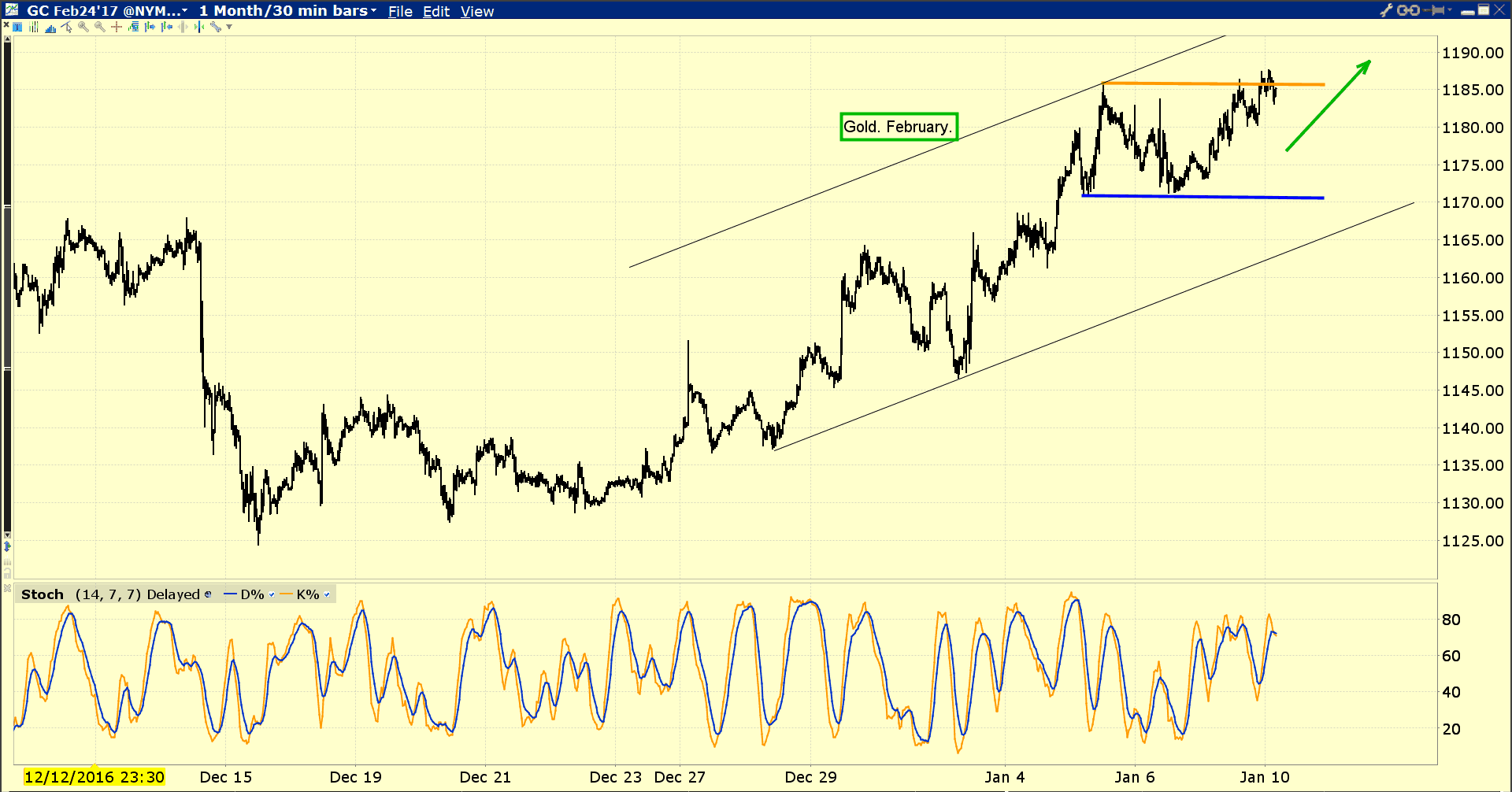

4. Please see below now. Double-click to enlarge.

5. Gold has been rallying since mid December. It may be poised to breakout to the upside from the $1170 – $1185 trading range and rise to $1200.

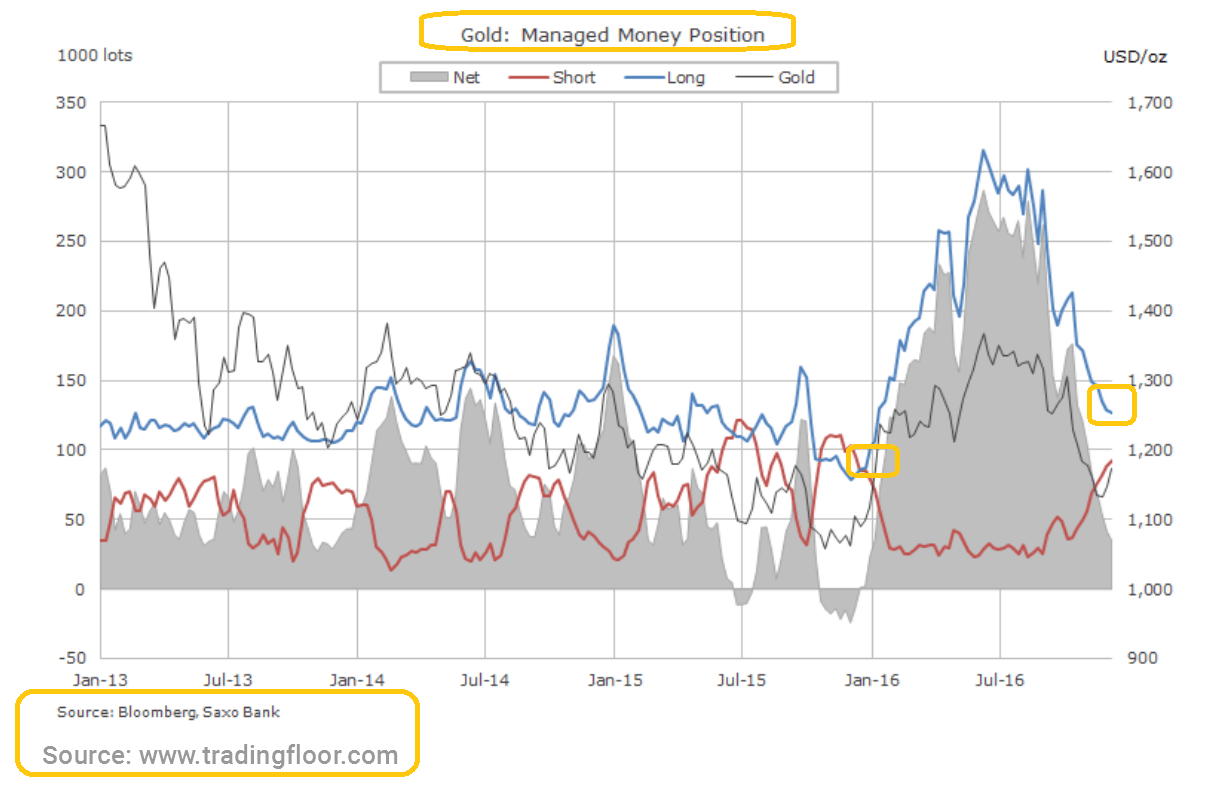

6. Please see below now. Hedge funds are holding a lot of short positions in gold on the COMEX.

7. That’s quite positive for the price, because most of these funds use a tremendous amount of leverage. That means they have a hard time holding onto their positions when they get margin calls.

8. It appears that many of these funds have added to their short positions into the current gold price rally, and that means a lot of their holdings are at or close to the margin call threshold.

9. Regardless, it’s important that gold investors focus where the price is now, rather than just on where it might be going in the future.

10. Here’s why: Just like plants in a garden, gold stocks and bullion need to be “planted and pruned”.

11. Gold has rallied about $60 from the $1125 area lows, and investors need to trim holdings into this strength.

12. For all practical wealth building intents and purposes, it’s not that important whether gold rises or falls from here, but it’s very important to trim more positions if it continues to rise, and be a buyer if it declines.

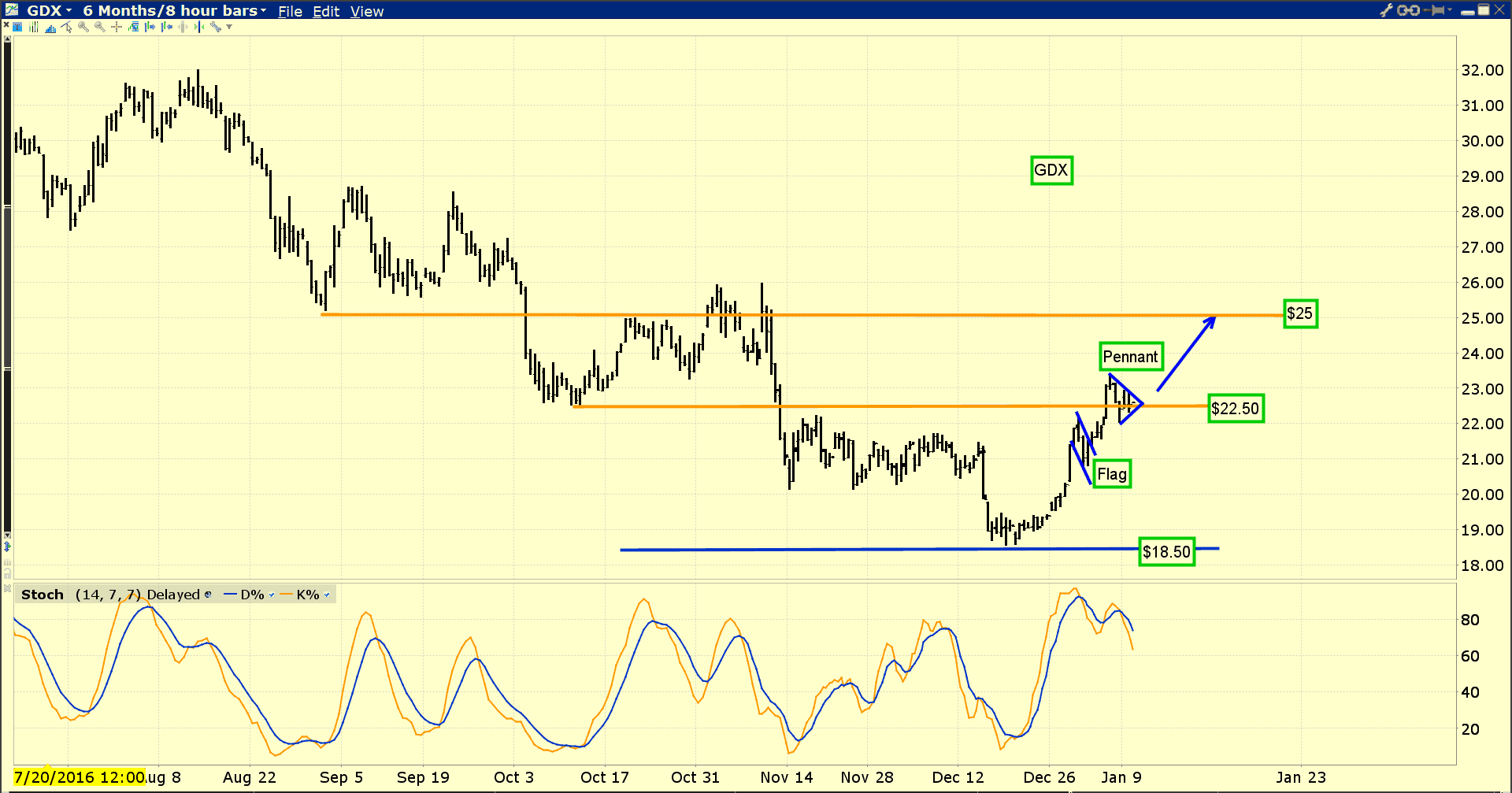

13. Please see below now. Double-click to enlarge. GDX bulls and bears are battling in the $22.50 resistance zone.

14. Gold bugs should cheer that GDX rises out of the pennant formation and rises to the next resistance zone at $25, but investors should sell lightly into that rally if it happens.

15. Note the 14,7,7 Stochastics oscillator at the bottom of that 8 hour bars chart. It’s suggesting that the pennant could fail, and GDX could may not make it to $25 on this rally.

16. The bottom line: Gold stock enthusiasts should be sellers here in the $22.50 area, sellers of more in the $25 area, and eager buyers in the $20 and $18 price zones!

17. I get a lot of emails about the gold demand situation in India. There’s no question that Indian government policies have had a negative effect on gold demand there in 2016. What happens in 2017 will likely be determined in the February budget.

18. If the import duty is reduced, Indians will be more willing to buy gold in the cashless manner being promoted by the government.

19. Regardless, the big picture for gold in 2017 is likely to centre more on events in America than India. The movement of money out of the US central bank and into bank accounts is underway, and rate hikes will accelerate it.

20. Money velocity is poised to reverse, perhaps by mid 2017, and at the same time the bull market in US stocks is very long in the tooth.

21. Gold rallied nicely after the Fed’s first rate hike in 2015, and it’s rallying nicely again after the second rate hike.

22. Investors have nothing to fear from rate hikes, and it is those hikes that will incentivize banks to move more money out of the Fed and into the fractional reserve banking system.

23. Bank loans made at the end of the business cycle tend to be much more inflationary than loans made in the early stages. I expect 2017 will see more bank loan growth against the background of higher nominal rates and lower real (nominal minus inflation) rates. This is very positive for precious metals.

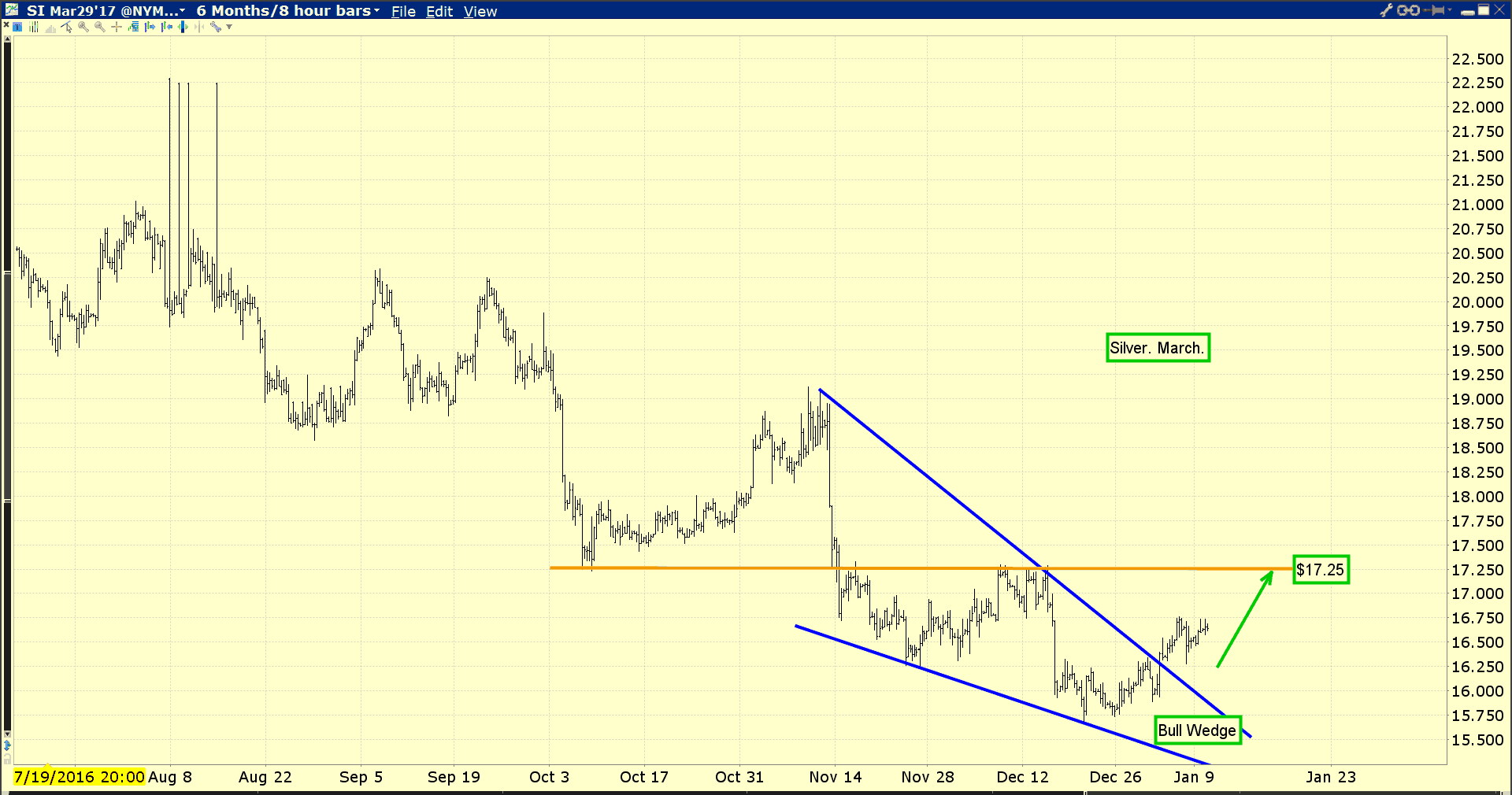

24. Please see below now. Double-click to enlarge. Silver price enthusiasts may be a bit disappointed with the price action during this rally, but it’s important to remember that silver typically lags gold at the start of a major move, and leads it in the later stages. By the end of 2017, as inflation fears begin to take hold, silver should be leading gold by a significant margin!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?