This week an excellent question. Partly about inflation and partly about gold versus a collectible car.

Question:

“Serious question related to future inflation. Let’s say you have a collectible car from the 1968 era currently has seen massive inflation over 10 years. Today would you hold or convert to PM?

I’m confused and foggy on what will happen in nz will collectibles increase or decrease in fiat terms or will it depend on a multitude of drivers? We have seen inflation accelerating in very recent weeks in terms of food already what will be next.

Any way what I’m really asking is, if you got a car worth 100k should I sell now? and get shinny stuff.

Not after advice I’m after an honest professional opinion.”

This is a really good question. The likely answer is not a straightforward yes or no. It also likely depends on personal circumstances and preferences. But we’ll have a crack at outlining what to take into consideration.

Is Inflation Coming? If So, What Kind?

Firstly you might want to consider how likely is the inflation our reader sees coming?

Last week we wrote about inflation and what kind of inflation may be coming as a result of all the currency printing central banks have undertaken recently. See: Is Inflation Coming? If So, What Kind?

That post looks at inflation, deflation, stagflation and the velocity of money. Plus we take a stab at what we might see in the future.

Inflation, Deflation or Stagflation – How Might Each Affect Collectible Car Prices?

Now back to our reader’s question on how inflation might affect the price of a collectible car versus gold…

Collectible Car vs Gold in Inflation

If we get straight out inflation then a vintage car is likely to rise steadily in price too.

Our reader points out that the last 10 years has seen a 1968 vintage rise massively in price.

Most asset prices have gone up over that time frame. Housing. Share markets etc. All driven by the easy money policies of central banks pretty much the world over.

We haven’t seen a massive rise in price in everyday consumer goods. Instead this excess currency has gone into assets and driven up their prices.

But in a slowing economy, there’s no guarantee that this will continue.

Collectible Car vs Gold in Deflation

if we get a serious bout of deflation then most prices will fall. We’d expect gold to hold up pretty well too if history is any guide. So in this environment our money would be on gold over a vintage car.

Collectible Car vs Gold in Stagflation

How about if we get more of a 1970’s type stagflation, where the economy is sluggish and unemployment is higher, but prices still rise?

This seems to be the inflation that a number of the opinions we discussed last week see as most likely.

Then it’s likely collectibles could rise too. In the 1970’s most assets went up in price. Real estate etc. However gold and silver actually rose more than most other assets in dollar terms.

In such an environment you might well be able to buy your car back down the track using less ounces of gold. So you’d have a car plus some ounces of gold left over.

Gold Bull Market: Greed vs Fear

The rise of gold to the high in 2011 was more of a “greed” driven price rise. Our guess is we are now entering the next phase of this precious metals bull market. This is where the monetary characteristics of gold and silver will come to the fore. As a result we will see a “fear” driven rise in price in this next phase.

That is people moving out of other assets – as they are worried about how they will perform and are looking for a safe store of value. Versus buying gold simply because the price has gone up. Which may have been more what caused the run up in gold in 2011.

Non-Monetary Benefits of a Collectible Car (and Gold)

However, there are also the psychological benefits of owning your vintage car to consider. Perhaps you use it in the weekend occasionally and get enjoyment from that? Of course many people get a psychological benefit from holding physical gold and silver in their hands too!

So that is hard to quantify. It simply comes down to individual preference.

Other Assets Held

Another individual consideration is what other assets a person has? If someone holds few other investments then this may have a greater bearing on the decision to sell a collectible and buy gold. Whereas if someone already held a meaningful amount of gold, then maybe there wouldn’t be so much of a reason to sell the collectible car?

How has the Collectible Car Performed Compared to Gold Over the Last 2 Decades?

The vintage car market is a broad market. Our reader doesn’t mention the specifics of how much his car has risen in price over the past decade. But he could compare what he knows in terms of price history for his vehicle model, with how gold has done since 2000.

Gold was priced at NZ$551 on the 1st Jan 2000. Today it sits at NZ$3085. A rise of 5.6 times or 460%. How has the dollar price of a particular vintage car performed over that period? Has it risen more than 5.6 times?

Gold may well have better than many people would think over the past 2 decades.

Of course past history is no guarantee of the future and all that. But given gold is in a bull market, the past might help provide a guide nonetheless.

Final Thoughts On Gold vs a Collectible Car

We guess a good way to look at this is, if I had a $100,000 today would I buy a vintage car or $100,000 worth of gold bullion?

For us it would be gold, but then we don’t know too much about buying vintage cars either!

However there are also many uncertainties about where things are heading in the coming number of years. Personally we think gold and silver is a safer bet than most other assets for the coming years. So with any spare cash we have, we’d rather hold gold (and silver) than just about anything else.

If you don’t have a vintage car or any other collectibles you can still ask yourself this same question when looking at buying any other investment currently.

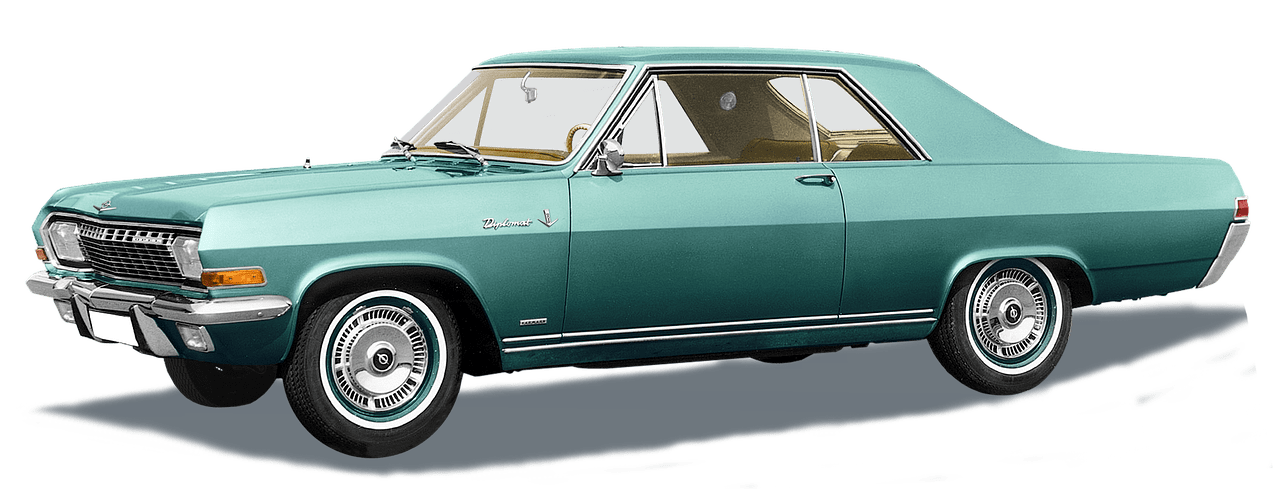

We think precious metals are likely to hold their value better than most. So we feel most comfortable just buying them and forgetting about them for the next few years. Then maybe down the line we’ll be able to swap some gold for that 1968 Dodge Charger!

Pingback: The Precious Metals Correction Finally Arrives! Gold and Silver Down Sharply - Gold Survival Guide