Gold vs Bitcoin. Is one better than the other? Should you drop your gold in favour of cryptocurrencies?

Table of Contents

- Bitcoin vs Gold During the Corona-Virus Panic

- DropGold

- Drop Gold and Buy Bitcoin?

- Drop Gold and The Myths We’re Told

- Gold vs Bitcoin Point 1: Bitcoin, Far From Being Weightless or Virtual, is in Actuality Physically Heavier than Gold

- Gold vs Bitcoin Point 2: Bitcoin Occupies More Volumetric Space Than Gold

- Gold vs Bitcoin Point 3: Gold is, thus, More Value Dense than Bitcoin

- Gold vs Bitcoin Point 4: Bitcoin Needs Gold to Exist, Gold doesn’t need Bitcoin to Exist

- Gold vs Bitcoin – Gold is the Better Money – Bitcoin and Cryptocurrencies are a Speculation

- Gold vs Bitcoin and Cryptocurrencies – You Don’t Have to Choose

Bitcoin vs Gold During the Corona-Virus Panic

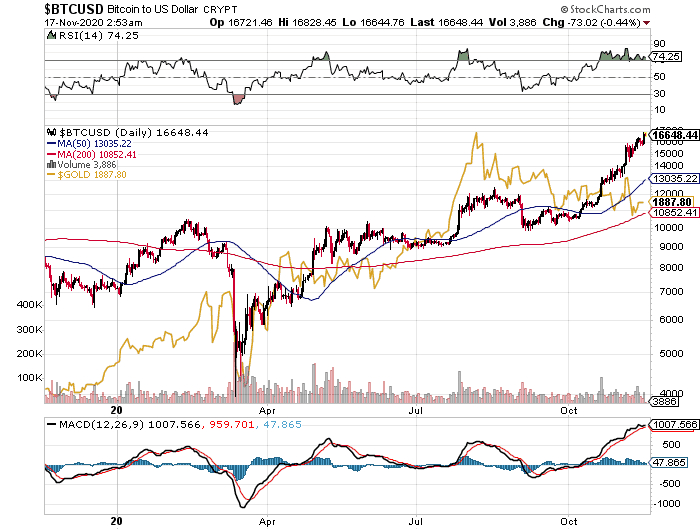

The chart below shows Bitcoin took a serious tumble in March in the early stages of the Corona-panic. Falling over 50%. Gold also fell initially but by less than 15%. So Bitcoin’s fall was much larger than gold. Gold also bounced back much quicker than Bitcoin.

However, Bitcoin and cryptocurrencies have seen a definite resurgence in recent months. Especially since October, Bitcoin has really been moving higher, a little like it did some years ago. Bitcoin is now above US$16,000. Not a huge distance from the all time high from late 2017 of just under US$20,000.

Chart of Bitcoin Vs Gold During 2020 and the Coronavirus

Bitcoin and gold have a number of similarities. After all Bitcoin was in fact modelled on gold. So this comparison of one to another is very common and not surprising.

DropGold

A good example of this pitting gold against Bitcoin is a campaign by one cryptocurrency proponent – Grayscale Investments – to “DropGold”.

The campaign aimed to publicise the benefits of cryptocurrency versus gold. Then to encourage gold holders – in particular holders of the GLD exchange traded fund (ETF) – to sell their gold and instead invest in the Grayscale Investments cryptocurrency ETF.

Drop Gold and Buy Bitcoin?

The DropGold campaign is nicely summarised as:

Drop Gold Because…

● Gold is an analog metal

● Gold is heavy

● Gold is weighing down your portfolio

● Gold is archaic

● Gold has no utility

Buy Bitcoin Because…

● Bitcoin is digital and virtual

● Bitcoin is weightless

● Bitcoin is the future

● Bitcoin is borderless

● Bitcoin has utility

Roy Sebag – of GoldMoney – has an excellent rebuttal of the “drop gold” campaign. He dismantles the argument to drop gold altogether in a very lengthy but well reasoned essay.

Interestingly Sebag’s background before GoldMoney was founder of Bitgold. But he is also involved in cryptocurrency mining and owns multiple cryptocurrency patents. So he has been heavily involved in cryptocurrencies for many years too.

In short, he’s not just a “gold bug”.

Sebag’s argument is worth reading in full. But here is our attempt to summarise it for those short on time:

Drop Gold and The Myths We’re Told

A Naturalist Exposition of Gold’s Manifest Superiority to Bitcoin as Money

By Roy Sebag – Refer Here for Full Original Essay

Sebag argues that:

“At the end of the day, Bitcoin is nothing more than a poorly conceived monetary system which taxes metabolic energy rather than preserving it—a system that simply tries to mimic what nature has already perfected and made self-evident.

If the world’s Gold miners stopped mining tomorrow, nobody that owns Gold would care. One gram of Gold would remain one gram of Gold. The Bitcoin story is different. Any owner of Bitcoin only owns what the latest version of the ledger says they own. That version exists based on the continued operation of massive computational servers somewhere out there requiring society to constantly divert its metabolic energy to maintain the apparent utility of the service.”

Gold vs Bitcoin Point 1: Bitcoin, Far From Being Weightless or Virtual, is in Actuality Physically Heavier than Gold

Sebag argues that the infrastructure required to keep the Bitcoin network operating means that Bitcoin is not “weightless”. Without this infrastructure and power usages Bitcoin could not exist:

“When one uses Bitcoin to store value or to affect a transaction, that act of human agency is virtual rather than physical. To use the DropGold’s campaign language: it is “borderless,” “digital,” and “weightless”.

As we will now see, these statements amount to sleights of hand which are demonstrably false. When I use my smartphone to create a Bitcoin wallet, transfer some coins in, and send them to a friend who’s using a smartphone halfway across the world, this activity may appear to be virtual to myself and my friend. The problem is that behind the virtual act, what is, in actuality, enabling all of this to take place is massive amounts of physical infrastructure in the natural world, comprised of computational hardware, energy transformers, physical space, and human computer engineers. That this infrastructure is not directly tethered to my act of communicating a transaction using the internet changes nothing.”

Sebag then mathematically calculates the weight of this infrastructure:

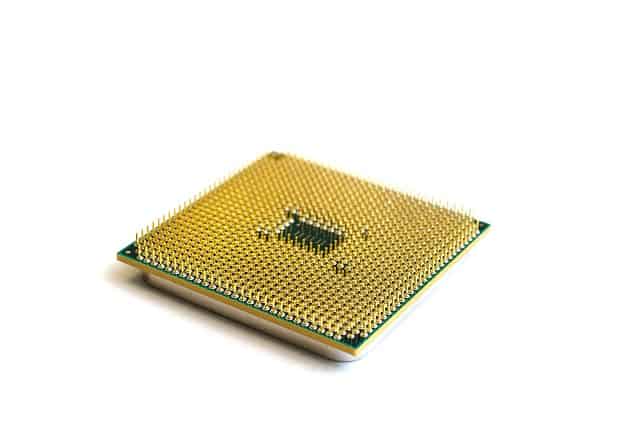

“…we are able to estimate the corresponding physical weight of mining chips and energy transformers existentially required for every 1 unit of Bitcoin in the ledger.

By dividing the combined weight of 29,995,871 kilograms of hardware necessary to support the current hash rate of 52,640,000 terahashes per second by the 17,700,000 Bitcoins in existence at the time of writing, we arrive at a ratio that mandates at least 1.69 kilograms of physical hardware residing somewhere in the world for every 1 unit of Bitcoin owned by someone residing in some other place in the world.”

Gold vs Bitcoin Point 2: Bitcoin Occupies More Volumetric Space Than Gold

Sebag next determines the volumetric space required to house the 3,899,284 Bitcoin mining chips, 2,145 transformers, racks and computing hardware associated with the 17,700,700 Bitcoins in existence at the current 52,640,000 terahashes per second network difficulty:

…Bitcoin requires physical infrastructure that, if condensed into one physical location, would require a building which was at least 2 meters high and 109,568 meters wide. As we can see, to merely house the physical infrastructure, which gives life to Bitcoin beyond the lines of code anyone could replicate manually, requires, at minimum, 15 million cubic feet or 437,327 cubic meters of volumetric space. Make no mistake about it, somewhere there are countless physical buildings housing all of this equipment. These buildings must be maintained through time if Bitcoin is to be sustained into the future, and their number will only grow if our current supply of Bitcoin is to ever increase.”

He then compares this to gold. Using the best estimate we have available of 171,000 tonnes:

“With this weight of Gold, we are able to estimate Gold’s volumetric space. One of Gold’s key advantages over Bitcoin, here, is that it can be cubed by simply dividing the total weight by its specific gravity of 19,300 kilograms per meter cubed.

In contradistinction, one cannot cube Bitcoin, and my work above was extremely conservative in estimating the associated space and support structures required to power the Bitcoin network. The result is that all of the Gold in the world, 171,000 tonnes, would fit neatly within a soccer pitch, a cube of approximately 8,860 cubic meters in volumetric space, which, due to gold’s densely packed atoms would only measure just 20.7 meters on each side.

…All told, we arrive at the insight that at the time of writing: all the Bitcoin-associated physical infrastructure already requires roughly 49 times more volumetric space and than all the Gold in the world would occupy.

…the length of the Bitcoin cube is 109,568 metres or 5,293 times the length of the gold cube. Therefore, Bitcoin occupies more volumetric space than Gold.”

Gold vs Bitcoin Point 3: Gold is, thus, More Value Dense than Bitcoin

Next he argues that Gold is actually more value dense than Bitcoin:

“Let us begin by representing the 29,995,871 kilograms of associated Bitcoin infrastructure equivalent in the 437,327 m^3 cube we discussed in the previous section. This same cube of 29,995,871 kilograms of Gold would fit neatly in a 1,520 m^3 cube. We now have two physical cubes, both representing the same embodiment of metabolic energy (weight), but the Gold cube, as we can see, is far more efficient at storing this energy. Due to Gold’s specific gravity, the Bitcoin cube requires 287 times more volumetric space to represent the same physical weight.

Not only does Bitcoin require much larger space to represent the same weight, he also points out that:

“The Bitcoin cube requires a sustained amount of metabolic energy expenditure in order to perpetuate into the future, while the 1,520 m^3 cube of Gold does not.

…It is surely disappointing to discover that, even when using the cheapest and most energy dense of fuels (coal), we can see that billions of kilograms of additional volume of fuel must be extracted, transported, stored, converted to electrical energy, and distributed to the Bitcoin cube of hardware each year. This helps us visualize that this tax on the network is very much real, certainly not virtual, and certainly not weightless. Unfortunately, it introduces another important insight: there is an inherent decay through time for the Bitcoin, or in options parlance: “theta bleed.”

This decay or “bleed” introduces serious questions about Bitcoins ability to sustainably serve as money in the future.

Gold vs Bitcoin Point 4: Bitcoin Needs Gold to Exist, Gold doesn’t need Bitcoin to Exist

Finally he makes the point that bitcoin actually needs gold to exist:

“Thus far, we have established that once the metabolic energy has been expended to mine Gold from the earth, its natural properties guarantee that no further metabolic energy will ever need to be expended in order to maintain Gold’s constant, physical state. By contrast, we have seen how Bitcoin, once “mined,” requires the constant expenditure of metabolic energy in order to continue to exist through time.

Beyond this basic difference, unfortunately for Bitcoin, there is yet another fundamental difference between these monies: whereas Gold does not need Bitcoin in order to exist, Bitcoin cannot exist without Gold. The very computer chips used to “mine” Bitcoin must conduct electromagnetic energy at 300,000 km/s–the speed of light–if they are to be effective. The only material conductor in existence which is capable of handling that capacity is Gold. Therefore, in order for Bitcoin to be “mined” at all, Gold is an inherent prerequisite.”

Gold vs Bitcoin – Gold is the Better Money – Bitcoin and Cryptocurrencies are a Speculation

Sebag makes a very good argument as to why gold is the better form of money compared to Bitcoin. He concludes:

It is my final hope that the Bitcoin community will embrace this research and a shared understanding that the Gold and cryptocurrency communities should be working together rather than against each other as we march towards the inevitable demise of the fiat currency system.

Ultimately, what this paper reminds us of is that there is nothing new under the sun. There is no better designer, no better architect, and no better measure of toil and motivator of merit than a product of the first order laws of nature. Human abstractions can try to build a better mousetrap, but these are merely paradigms that fail when correctly pierced by sound meditation and analysis of our natural world.

So Does That Mean We Should Just Ignore Bitcoin and Cryptocurrencies?

As a company who sells gold and silver you might think our answer would be yes.

However we believe you don’t have to choose one over the other.

Related: How to Buy Gold and Silver with Bitcoin

Why Gold and Cryptocurrencies are Two Separate Asset Classes

We see gold and cryptocurrencies as two very separate assets classes. Albeit asset classes that do share some similarities.

Bitcoin and Cryptocurrencies are a Speculative Investment

We view Bitcoin and cryptocurrencies as a form of investment. Or rather even as a speculation.

An investment is where you hope to make 10% and not lose your capital. A speculation is where you hope to make 1000% or more, but expect to lose 100% of your capital.

For example, you may choose to speculate with 10% of your investment portfolio.

Cryptocurrencies are a speculation. They have a very short track record to date. Albeit a speculation that could be a once in a lifetime opportunity for sizeable gains.

Gold is Financial Insurance (Wealth Protection with Upside)

Whereas gold is financial insurance. We may not expect gold to make 1000’s of percent returns. But thousands of years of history also say it won’t ever be worth zero.

(Note: Although history says gold does have the potential to gain over 1000%. See: How Do You Value Gold | What Price Could Gold Reach?)

Gold vs Bitcoin and Cryptocurrencies – You Don’t Have to Choose

So you don’t have to choose one over the other. It doesn’t have to be gold versus bitcoin. Rather it could be gold and bitcoin.

Hold a meaningful amount of gold for protection (with upside potential).

You can shop the range of gold and silver available to buy here.

(Just how much gold should you own? See: What Percentage of Gold and Silver Should Be in My Portfolio?)

Then speculate with a small portion of your other investable assets on cryptocurrencies.

Our Preferred Method of Investing in Cryptocurrencies

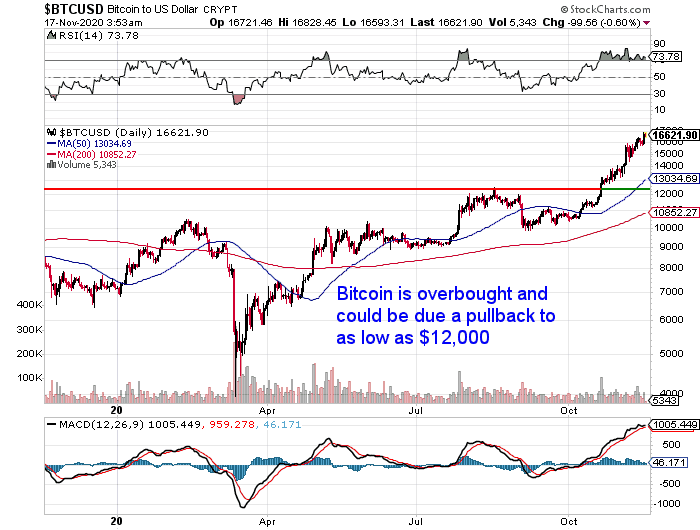

Bitcoin is into overbought territory right now. It could go a bit higher yet, but then a decent pullback could be in order. Perhaps a short sharp one down to as low as $12,000?

So right now could be a good time to set yourself up and be ready to buy some crypto assets.

To learn more about our preferred way to invest in cryptocurrencies see:

How to Invest in Bitcoin & Cryptocurrencies (Our preferred method is not only simpler and easier but cheaper too. With much lower fees than you’ll find on many cryptocurrency exchanges).

Editors Note: This post was first published 11 June 2019. Last updated 17 November 2020.

Pingback: Is it Time to Trade Your Gold in for Bitcoin? - Gold Survival Guide

Pingback: Is Gold Losing Its Shine to Bitcoin? - Gold Survival Guide

Pingback: The Darker Side of Bitcoin Technology and Gold’s Next Spike - Gold Survival Guide

Pingback: The Davos Plan For Your Cash and Bitcoin - Gold Survival Guide

Pingback: Gold Backed Cryptocurrency: Is This Why Central Banks Are Buying So Much Gold? - Gold Survival Guide

Pingback: The “Time Price” - Why Gold is Money and Will Continue to Be - Gold Survival Guide

Pingback: If/When the US Dollar Collapses, What Will Gold be Priced in?

Thank you for your informative article. It was just what I needed.

I have bought Bitcoin with the intention of selling next year when it peaks and transferring to gold.

My problem is that the Bitcoin supplier I used (BitPrime) while giving me good service was too small to handle the larger amount of money that I would need when converting back .

You have now shown me the way forward.

Hi Warren, Thanks for your comment. Yes this is a good method for those wanting to move out of BTC and into Physical gold. Just get back in touch when the time is right for you. Best of luck.