|

Gold Survival Gold Article Updates:

May 21, 2014

This Week:

- London Silver Price Fix to End & What it Means

- Housing shortage in Auckland not backed up by rising rents

- Reader Question on Gold & Silver Manipulation

A number of articles on the site this week that are worth checking out. Scroll down to see the full list and intros to each of them including thoughts on the end of the London Silver Price Fix, Platinum and Palladium, and the new book by French economist Thomas Piketty, Capital in the Twenty-First Century.

Prices and Charts

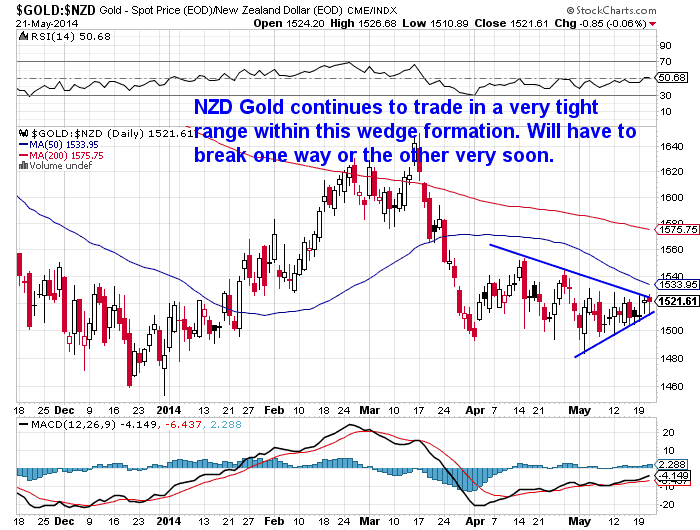

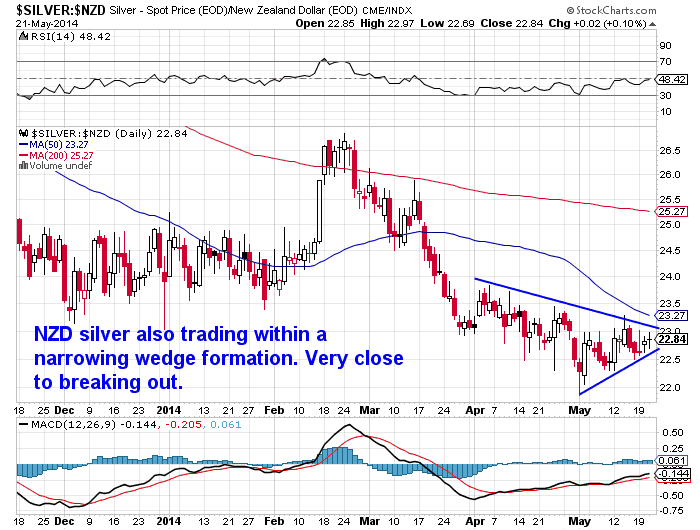

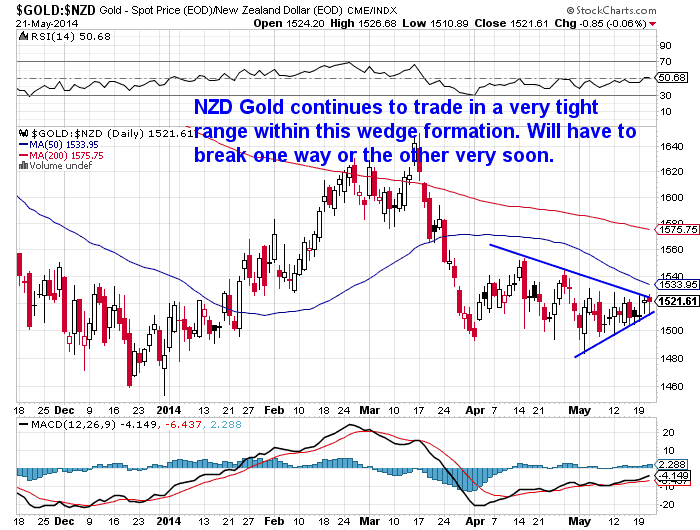

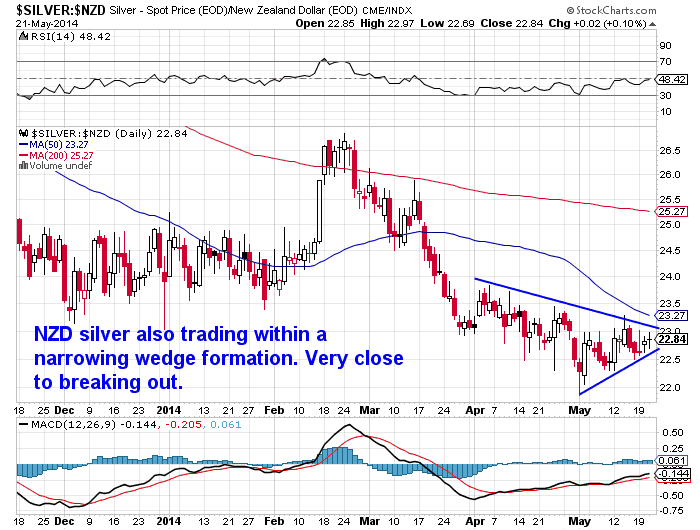

Last week we mentioned it was groundhog day in precious metals land, with very little volatility and tight trading ranges. This has continued over the last week.

NZ dollar gold is basically unchanged from a week ago, having fallen just 42 cents to be at NZ$1510 per oz today. While silver in NZ dollars is down just 19 cents or 0.82% to NZ$ 22.71 per oz.

The below charts clearly show how narrow the range has been of late. We can see that both metals are trading in a narrowing wedge formation. So very soon they will have to break out of this pattern and move one way or the other.

Who knows which way? On the one hand, there doesn’t seem to be much impetus for them to go higher but conversely every sell off has found solid support of late. For gold in US dollars it’s around the $1280 level. Or in NZ dollar terms around the NZ$1500 mark.

So the next week or 2 could prove interesting.

Housing shortage in Auckland not backed up by rising rents

A very interesting article we read this week was by Mark Whithers on the Empower Education site. An accountant specialising in property investment, Whithers looks at the Labour Parties proposed Capital Gains Tax. But we found his most interesting statement one that we agree with even if few others seem to.

Whithers states [emphasis added is ours]:

—–

“More latterly, property investors have also enjoyed rises in property values and strengthening rents whilst interest rates have remained low for longer than many expected. Many property investors have been able to retire debt through these times by maintaining the same level of mortgage payments they had when interest rates were high and have accordingly further improved their positions and their profitability by reducing their debt.

While many property investors have felt sympathy for first home buyers, they have none-the-less benefited from the Reserve Bank’s new LVR restrictions on lending that have turned prospective first home buyers back into renters who will now remain tenants for longer.

Throughout all this, the politicians have continued to argue about the causes of property price increase, who is to blame, and whether in fact the problem is real or just perceived. Some are even still arguing about whether property price increase is a problem at all!

Claims that prices have risen because of a lack of supply in housing stock have the ring of truth. But then, property prices have risen far faster and far further than rents. If there was a true shortage of housing supply you would expect to see rents and house prices rising in some degree of alignment.

My view is that low interest rates and low deposit lending have been the primary reasons for rising house prices and that the rate of house price increase will diminish as interest rates rise through the year ahead and the LVR restrictions kick in.“

—–

Now who knows whether interest rates will continue to rise throughout the year to the degree most expect. We have our doubts. But we thought it interesting to see a property investor not really agreeing with the housing shortage argument.

Whithers argument about rents not rising in tandem with prices was actually shown graphically by a chart, in an article last year by Alistair Helm, the former CEO of Realestate . co . nz.

Source.

“The chart clearly shows that whilst property prices have increased by over 45% since the start of 2009 rents are up just 15% and the past 18 months have barely seen any change.

If Auckland really had a housing crisis then rents would be increasing – it’s the same economics of supply and demand.”

So both these pieces seem to support our argument made 18 months ago in: Housing Un-affordability: It’s Not Supply, It’s the Debt Stupid!

In this article we stated that “Our theory remains that it is the oversupply of money and credit that is the problem more so than the undersupply of land and housing.”

The above chart would seem to back that up. Of course if rates remain low, then prices could continue to rise still, but it would seem these rises are of a more speculative nature than the structural one (housing shortage) that we hear mentioned about in the media so much. So if anything happens to alter this flow of cheap money, such as a marked slowdown in China, significantly rising interest rates, or some other external shock, then this equation could change quite rapidly.

Buying a Safe to Store Your Gold and Silver

We’re just putting the finishing touches on our article on buying a safe to store gold and silver that we mentioned a few weeks back. So with any luck keep an eye out for that next week.

Reader Question on Gold & Silver Manipulation

We had a question from a reader this week asking for our thoughts on manipulation after last weeks newsletter. Where he took some of our commentary to mean we didn’t give much weight to the manipulation argument. The question was:

—–

Hi Gentlemen,

I’ve heard some pretty strong arguments from folks like David Morgan, Peter Schiff, Greg Hunter and others from the alternative media that the prices of gold and silver have been manipulated by the Fed, or the US Government, or other groups. One would have to agree that it is not typical for demand to rise and the price to fall – nor is it common for a huge amount of orders for paper gold to be placed all at once at an odd hour for trading.

Many commentators suggest that this is being done because the metals are indicators of public confidence in the future. When confidence is low, there is a ‘flight to safety’ and thus, by keeping prices artificially low the public is given the impression that confidence in the economy and the future is high.

I take it from your report that you don’t put much stock in these explanations – do you really think the behaviour of these markets is normal? (I’m not complaining of course, I hope to buy more gold and silver while the prices are low)

DH

—–

And here was our reply:

—–

Hi DH,

Thanks very much for taking the time to email.

On the contrary actually, we wouldn’t disagree with any of what you have stated.

This seems very likely to us and the folks at GATA have put together much evidence over the years that makes it much more than just a conspiracy theory. Here’s the presentation that Chris Powell of GATA gave last year here in NZ and in Australia: Chris Powell in Auckland on Gold Price Suppression

Here’s a couple of articles we’ve written and featured on manipulation in the past few years:

Gold Manipulation – Is It For Real?

Precious Metals Market Manipulation

With the price likely having been forced much lower as you say by very unusual large sell orders that no “for profit” seller would make all at once, and now having stayed low for quite some time, it seems to us it has had the suppression / manipulation / intervention desired effect. That is confidence in “the system” is on the rise and interest in gold and silver has certainly fallen. We have seen this first hand in the past 5 months with much lower sales here in NZ. That might not have been the case in the east but reports from the likes of the Perth Mint and our contacts in the US retail bullion market back up what we are observing here.

So lower prices seem to have lead to lower prices.

However we do seem to be getting close to where there are not too many sellers left. So perhaps the bottom is not too far off (if not already here).

We still comment on charts and what sentiment is like and what the price is doing, as even if (though) it is manipulated there are still also real people involved in buying and selling so these other factors likely also impact price. So hope that clears up our position.

Thanks again for your question. Let us know if you have any others.

Regards

Glenn.

—–

As we told DH there doesn’t seem to be too many sellers at current prices to force them too much lower. Although there aren’t many buyers around from what we’re seeing either. But if you’d like to go against the grain and take a position in gold or silver then get in touch.

This Weeks Articles:

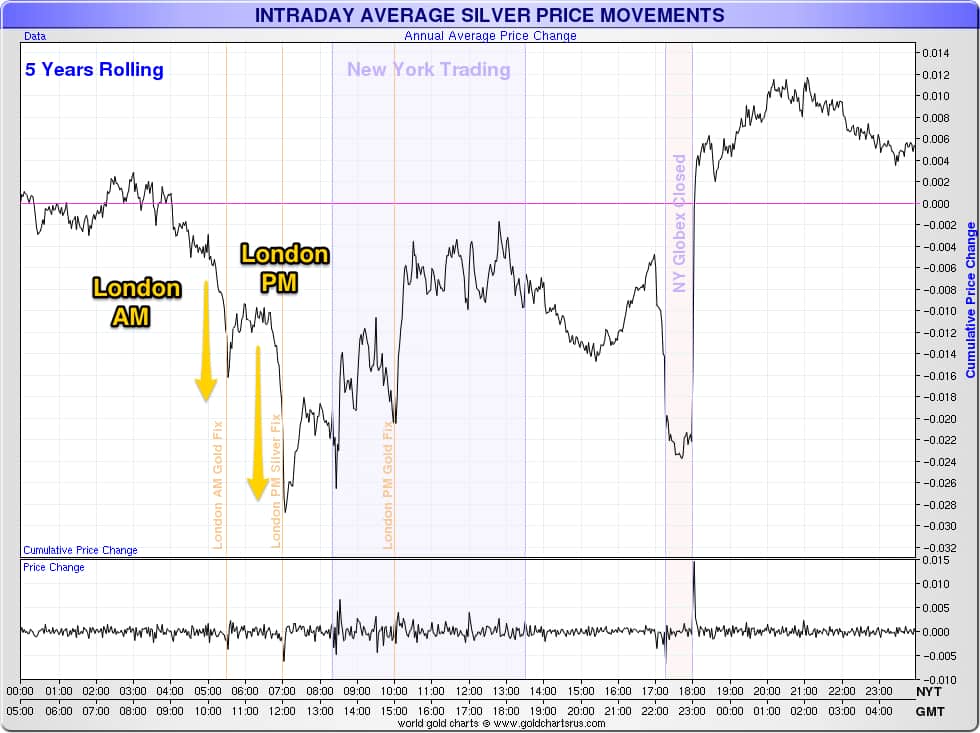

| Shocking News: London Silver Price Fix to End & What it Means |

2014-05-21 17:37:00-04 2014-05-21 17:37:00-04 |

Here’s JS Kim of SmartknowledgeU’s theory as to why the London Silver Price fix is being shut down as of this August. His view is in direct contrast to that expressed in the mainstream by a Reuters columnist yesterday.

Yellen’s Wand Is Running Low on Magic

2014-05-14 18:49:20-04 |

2014-05-21 18:10:47-04Odds are you’ve come across some reports in recent months of the new book Capital in the Twenty-First Century by French economist Thomas Piketty. With the inequality between the rich and poor a real talking point in the US, Europe and even here in NZ, the book has garnered some attention. But read on to see why most of what he states is just a rehash of past tried and failed ideas and theories.

2014-05-21 18:10:47-04Odds are you’ve come across some reports in recent months of the new book Capital in the Twenty-First Century by French economist Thomas Piketty. With the inequality between the rich and poor a real talking point in the US, Europe and even here in NZ, the book has garnered some attention. But read on to see why most of what he states is just a rehash of past tried and failed ideas and theories.

2014-05-21 18:29:23-04See 6 reasons why it looks like Platinum and Palladium may have entered the beginnings of a 10 year bull run higher.

2014-05-21 18:29:23-04See 6 reasons why it looks like Platinum and Palladium may have entered the beginnings of a 10 year bull run higher.

2014-05-21 17:37:00-04

2014-05-21 17:37:00-04 2014-05-14 18:49:20-04

2014-05-14 18:49:20-04