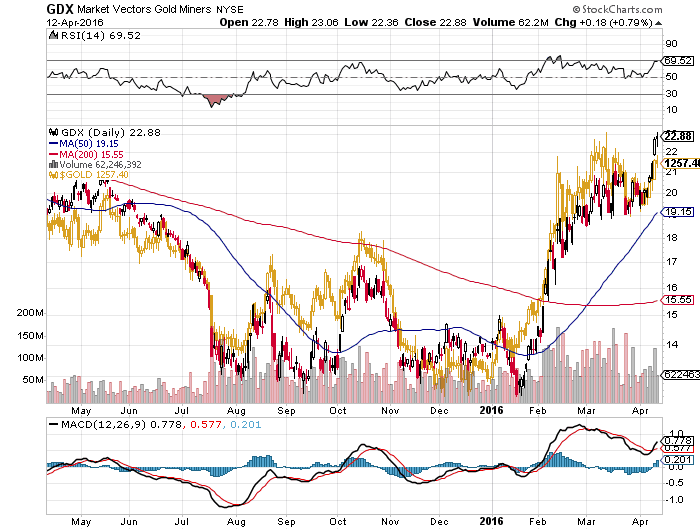

Gold and silver have bounced back higher the past couple of days, but are still not back to recent highs yet.

However mining stocks have actually hit new 52 week highs. Something that has not been noticed by too many.

See the chart below of gold (gold) versus the GDX gold mining index (black/red).

It seems like this may be early days yet in a return to a precious metals bull market. Read on for some hints on how to find those mining shares with massive upside potential…

How to Find Small Gold Stocks That Can Go up 1,000%

By Justin Spittler

Editor’s Note: If you’ve been following our work, you know we’ve been “pounding the table” on gold. In short, Casey Research founder Doug Casey believes gold is entering a mania that could lead to gains of 5x, 10x, 20x, or more in gold stocks in the coming years.

Today, in place of our regular daily market commentary, we’re sharing an educational essay from our gold stock guru Louis James. In it, he explains how to identify gold stocks with upside of 10x or more.

If you want maximum returns on gold and are willing to take the necessary risks, the junior gold space is the place to focus.

A junior resource company is simply a very small resource company. Most are exploration companies, looking to discover a rich deposit of oil, gold, freshwater, etc. The term also covers small producers: companies that have already discovered a resource and are extracting it or tapping into it, but are still small.

Juniors often have market valuations of less than $10 million for the whole company. Most have no net income and no meaningful asset value.

When the market is way down, some juniors trade for less than cash in the bank. That means that the total price of the company’s shares is less than the company’s cash on hand.

Mainstream investors dismiss juniors as “penny stocks.” They think they’re too volatile to touch.

To a degree, that’s true. Some juniors do trade for pennies. And all of them, even the ones that trade for several dollars a share, are extremely volatile.

Doug Casey calls them “the most volatile stocks on earth.” He’s not joking, nor exaggerating.

But this is a good thing—if you know how to make volatility your friend.

We’ll get to that in a moment. First, let me explain…

Why Invest in Juniors?

Imagine a typical exploration junior. It has no income. It has no measurable assets. Even the cash it has in the bank isn’t really an asset; it’s an obligation. The junior will use that cash to dig holes in the ground, hoping to make a big discovery.

Now, what is this company worth?

The answer can only be zero.

But what happens if it hits pay dirt? The stock will soar, of course.

At this stage, it’s impossible to put an accurate value on a mineral discovery…

How big is it?

How deep does it go?

How stable is the rock?

How hard will it be to get metal out of the ore?

No one can answer these questions from just one drill hole. Any market valuation at this point would overvalue the discovery.

However, if the discovery does have economic value, that value will be greater than zero. Any value is infinitely greater than zero—so the change in value is enormous and share prices leap.

That’s why we speculate on juniors. They have the potential to “go vertical” like nothing else…

Going Vertical

The junior sector is 10-bagger hunting ground. A 10-bagger is a stock that goes up 1,000%, or more. It sounds mythical, but they are real. We’ve bagged quite a few over the years.

This is why some see buying juniors as just gambling. In a way, it’s not a bad idea to think of the junior resource sector as a giant casino. It puts you on guard. And it prepares you for the losses you’ll suffer on your way to big wins.

There is, however, a huge difference between gambling and rational speculation. A gamble is essentially a game of chance. Sure, professional gamblers learn how to play the other players. But unless they cheat, the heart of the gamble remains random chance. You toss the dice. You win or lose.

A rational speculator does everything possible to stack the odds in his or her favor. This is not cheating. It’s research. It’s experience. It’s looking at trends. It’s looking at investments that should benefit from those trends, and picking the best.

All speculators take risks. But rational speculators use their intelligence and energy to minimize those risks.

Gambling is a game of chance. Speculation is an investment strategy that depends upon observation and intelligent planning. Chance can enhance or hinder it, but it doesn’t define it.

That’s why we’re here: to watch carefully, strategize, and hunt for 10-baggers.

Where Can You Find the Best Juniors?

The best hunting ground for 10-baggers is the Toronto Stock Exchange and its venture division, the TSX-V.

London’s alternative market, the AIM, and the Australian Stock Exchange, the ASX, are also friendly to junior resource companies. Some juniors list in the countries where they operate, such as Peru. The lion’s share, however, goes to Toronto.

The chart below shows the number of mining juniors listed in Canada and other countries.

Many successful juniors do seek U.S. listings. But the requirements are too steep for most juniors, even on the lower rungs of the NYSE. By the time a successful exploration company gets a U.S. listing, it’s no longer quite so junior.

Editor’s Note: Watch for part two of this essay in Monday’s Dispatch, where Louis will share key strategies for buying and selling gold stocks…

With gold already up 17% this year (and gold miners up 56%), NOW is the time to take a position in gold stocks. Because we don’t expect this extraordinary opportunity to last, we’re running a special $500-off deal for our gold stock research.

When you sign up, you’ll get instant access to Louis’s new report, 9 Essential Gold Stocks to Buy Right Now. He wrote this report for one simple reason. There are around 3,000 small gold stocks trading today. On average, they’ll likely rise 200% or more in a gold bull market. But the very best gold stocks have the potential to rise 10x, 20x, or even 30x. Click here to begin your risk-free trial.

Pingback: Our Key Advice on Buying Gold Stocks - Gold Survival Guide

Pingback: 5 Reasons to Buy Silver Right Now - Gold Survival Guide - Gold Survival Guide