Table of Contents

Estimated reading time: 8 minutes

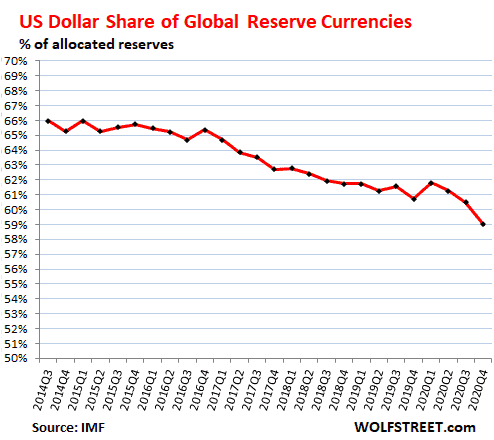

US Dollar Share of Global Reserve Currencies Drops to 25 Year Low

The USA’s financial response to COVID19 has raised concerns over the greenback’s prospects, as emerging economies such as China and Russia continue to diversify their holdings out of the global reserve currency.

As a result, the global share of US-dollar-denominated exchange reserves dropped to 59.0% in the fourth quarter of 2020. This was the 5th straight year of falls and matched the 25-year low of 1995.

It’s not just China and Russia either. A great post by Lorimer Wilson highlights 10 reasons why the reign of the US dollar as the world reserve currency is likely coming to an end:

- China And Japan To Use Own Currencies In Bilateral Trade

- The BRICS Plan To Use Own Currencies When Trading With Each Other

- China and Russia Use Own Currencies In Bilateral Trade

- Use Of Chinese Currency Growing In Africa

- China and United Arab Emirates To Use Own Currencies In Bilateral Trade

- India To Use Gold To Buy Oil From Iran

- Saudi Arabia Likely to Abandon Use of Petrodollar in Dealings With China

- The United Nations Continues to Push For A New World Reserve Currency

- The IMF Has Been Pushing For A New World Reserve Currency

- Most Of The Rest Of The World Hates The United States

How Will the Global Monetary System Change Take Place?

So slowly but surely the US Dollar is losing its global dominance.

Here’s a really thought provoking question from a reader (thanks Richard!). It’s also on the topic of the end of the current monetary system…

“I have been reading your material with interest and note your suggestions, however I have been doing some other reading on the whole issue of currency failures and in particular, the fate of the US dollar.

There seems to be two main schools of thought, one steadfastly refuses to acknowledge (or understand), that the US cannot keep printing money forever in order to keep the home fires burning and maintain its favoured position in global affairs, and the other which openly suggests and acknowledges that China is just waiting in the wings so to speak.

For decades now, it has been apparent to me that it is not possible to keep blowing up the balloon, however with ever increasing levels of ingenuity (or perhaps more correctly, deception and chicanery), the power brokers and money manipulators have managed to keep the wheels on the wagon for what now seems like an impossibly long time.

However I believe that the day of reckoning is steadily approaching and may now be in sight for the US and their monetary shenanigans (although we cannot exclude their dancing partners in this whole exercise, who have all supported and benefited from the US initiative), so the question in my mind is this:

You have suggested that if the US currency fails and there is a massive devaluation of the US dollar, then most nations will follow suit, to attempt to maintain some parity or stability in their systems – do I have that correct?

So, if the Chinese step up and suggest (demand more likely), in the face of a US currency failure, that the Yuan replace the USD in global transactions (the Yuan has already been accepted as a “reserve currency” – although what faith should be put in that designation is a moot point, however the Chinese are also talking about having a gold backing for their currency, so whilst that won’t please the money-masseurs, it may/should engender more faith in their proposals), won’t other nations adopt a “wait and see” position rather than just follow the US lemmings over the cliff?

Sure there may be a period of “adjustment”, but if the Yuan is gold-backed and installed as the global trading currency, then won’t that mean that other nations can adjust their exchange rates to the Yuan and not some devastated US dollar?

What’s your take on this please?”

Our Thoughts on the Global Monetary System Change

A clarification first. Where you say:

“You have suggested that if the US currency fails and there is a massive devaluation of the US dollar, then most nations will follow suit, to attempt to maintain some parity or stability in their systems – do I have that correct?”

Rather what we mean is that while some people think the US Dollar collapsing would mean other currencies would be worth more, our thought is that the US dollar may actually be the last currency to fall. But that all fiat currencies will be losing value. Just as they have done for many years.

See this article for more detail: What Would Happen to the NZ Dollar When the US Dollar Collapses?

It won’t necessarily be a devaluation overnight just by the USA. Then other countries, as you say, choosing to follow or not.

Perhaps a more likely is scenario is that put forth by the likes of Jim Rickards. Where a new international monetary arrangement is reached. Just like at Bretton Woods post World War II.

Rickards: Chinese Don’t Want the Global Reserve Currency

Rickards makes the argument that the Chinese do not want to have the global reserve currency. As the very nature of this means they would have to run a trade deficit, just as the US has done for many years. This would be required in order to produce enough currency to satisfy the rest of the world. This is what is called “Triffin’s Dilemma”. Rickards argues the Chinese are aware of this and so do not want a global reserve currency. But merely want a “seat at the table” and to play a large role in whatever the new international monetary landscape looks like.

(This article explains the dilemma quite well: The Triffin Dilemma)

Richards argues that the International Monetary Fund’s (IMF) Special Drawing Rights (SDR) will be what is rolled out in the next crisis. Because central banks will not be able afford to bail out their countries next time around. His theory is that the use of the IMF’s SDR’s effectively disguises to the man in the street who actually caused the undoubted resulting inflation.

For more on this see: If the US Dollar or SDR Was Linked to Gold, How Would This Affect New Zealand?

Of course Rickards background shows he is also a definite insider. So we need to bear this in mind. (Here’s an argument to look cautiously at Rickards theories as well because of this.) However, we still think he shares a lot of very useful information.

Regardless of how it all plays out the system currently is inherently unbalanced and will eventually need rebalancing. This could still occur as you mention where “other nations can adjust their exchange rates to the Yuan and not some devastated US dollar”. But the key point is that all currencies would need to adjust. Why? Because of how much excess currency has been produced (and likely even more will be produced yet). So that adjustment would have to be down versus something. That something will likely be gold.

China’s Rise to the Top is Not Assured

Here’s an old article we shared a few years back. It has an interesting angle on how the decentralisation of everything could actually have a very negative effect for China.

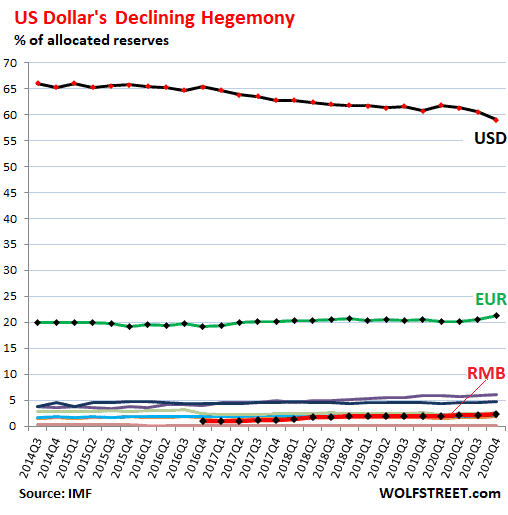

Another point to consider is that currently the Chinese Renminbi’s share of global reserves is only 2.25%.

As Wolf Richter points out, that is:

“…despite the magnitude and global influence of China’s economy, and despite the hype when the IMF elevated the renminbi to an official global reserve currency in October 2016 by including it in the basket of currencies that back the Special Drawing Rights (SDRs).

But the renminbi’s share has been creeping up ever so slowly. At the rate it has been gaining momentum over the past two years (+0.36 percentage points in two years), it would take the renminbi another 50 years or so to reach a share of 25%.

Clearly, other central banks are still leery of the renminbi and its implications, and are not eager to dump their dollars all at once in exchange for renminbi; easy does it.”

Source.

So perhaps China’s ascension to the top of the world is not a given either?

What to Do If the Answer Isn’t Clear?

Overall, we don’t have a definite theory we push as to how this all plays out. As we just don’t know. Nor do we like to follow any one persons theory. “Listen to all and follow none” is a creed worth following we reckon.

Our ideal remains for a monetary system that is decided on by free markets. As we describe here.

Not by men sitting round a table somewhere sharing cigars and deciding on how things should be. Then handing it down from on high to the rest of us.

But while a free market for money is our ideal it is perhaps not the most likely outcome.

So we become our own central bank with our own “reserves”. Then, regardless of how things play out we expect to maintain at least a portion of our wealth into the future. If you also think that is sensible then you can buy gold and silver here.

Editors note: This article was originally posted 1 September 2016. Fully updated 4 August 2021 including more China data

Pingback: SDR Bonds Sold in China - Will the Dollar Live to Die Another Day? - Gold Survival Guide

Pingback: Ronni Stoerferle: Gold Break Out and Recession Approaching? - Gold Survival Guide

Pingback: Silver Outperforming Gold Again - Gold Survival Guide

Pingback: Deja Vu - Precious Metals Smashed Lower... Again - Gold Survival Guide

Pingback: If/When the US Dollar Collapses, What Will Gold be Priced in?