The excellent Ronnie Stoeferle and his partner at the asset management company Incrementum AG, Mark Valek, released their 2017 In Gold we Trust report on 1 June. As always there is a wealth of information contained in an easy to digest format.

The “In Gold we Trust” report is considered the “gold standard of gold research”. Last year’s report was downloaded more than 1.5 million times.

Just some of what is covered in the 2017 report includes:

• High expectations of Trump’s growth policy dampened the gold price increase in 2016 – Still up 8.5% in 2016 and 10.2% since Jan. 2017

• The further development of the normalization of monetary policy in the US is the litmus test for the US economy and it is decisive for how the gold price will develop

• If the normalization of monetary policy doesn’t succeed, gold will take on momentum

• Further US dollar weakness and higher commodity strength are likely to lead to higher inflation and stagflation

• Bitcoin: Digital gold or fool’s gold?

• Exclusive Interview with Dr. Judy Shelton – Economic advisory to Donald Trump about a possible remonetisation of gold

• 5 Reasons why the gold bull market will continue

The report comes in a condensed or expanded version.

These can be downloaded from the following links:

In Gold we Trust – Extended version (169 pages) – English

In Gold we Trust – Compact version (29 pages) – English

Further information about the report and the authors can be found at www.ingoldwetrust.report.

Read on for a Summary of Some of the Key Areas

In 12 chapters and on close to 160 pages, the authors analyze a wide range of factors influencing the gold price. This year’s report also includes an exclusive interview that Dr. Judy Shelton, who is an economic advisor of Donald Trump. Since Stöferle and Valek do not regard gold as a commodity, but instead as a monetary metal, its price in their view is highly dependent on the state of the global financial and monetary system. The authors consider the system to be fragile, i.e. because of over-indebtedness which is a result of the monetary policy interventions in recent years.

“Although financial markets seem to be all right at the moment, we consider the current situation to be a ‘uneasy calm’,” says Stöferle. The prices in many asset classes are at their highest levels and the volatility of equities is on a record low. Since the global crisis, the American economy has experienced its third-longest economic expansion after World War II, the fact that the FED has begun to normalize its monetary policy is interpreted by market participants as a confirmation that the US economy would be really recovering. China, whose economic situation has been a major concern in recent years, has not created stir for a while. And even in Europe there is some prospect for recovery. In short: The symptoms of past crisis seem to disappear.

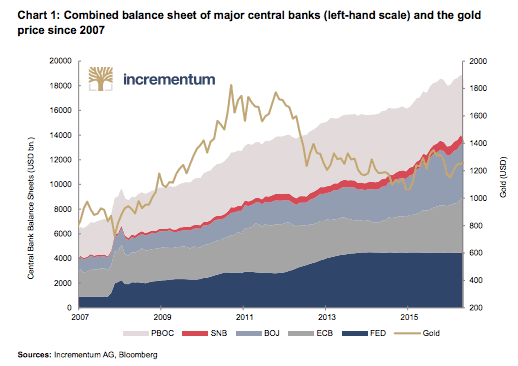

The positive sentiment in the markets also results from the global monetary tailwind. “Solely in the first quarter of 2017, the largest central banks created nearly 1,000 billion US dollars of new central bank money out of nothing, with which they bought financial assets,” says Valek. To illustrate this: With this amount of money (and at the current price level), each of the world’s 7.5 billion citizens could be bought one ducat (1/10 ounce) of gold.

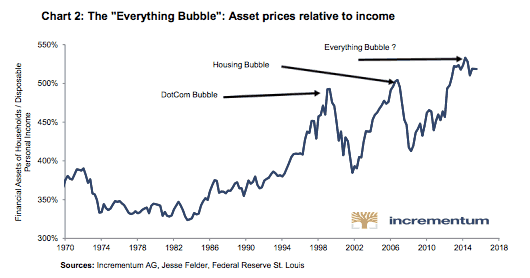

The extreme reflationary measures since the global financial crisis have boosted asset prices. As far as the economy of the world’s reserve currency, i.e. the USA, is concerned, it can be suspected that for the third time within two decades it is in the midst of an illusionary bubble caused by monetary inflation.

The two fund managers are skeptical towards the narrative of the recovery of the US economy, hence they don’t share the markets’s optimism regarding the effectiveness of Trump’s economic policy measures. 5 Reasons why the gold bull market will continue:

1. The next US recession inevitably approaches – only the precise timing is open to question. It is not only certain that another recession will come, it is just as certain how central banks will respond to it: by switching back to (or intensifying) expansionary monetary policy, by implementing rate cuts, renewed rounds of quantitative easing, and quite possibly some form of “helicopter money” program.

2. Excessive global over-indebtedness is by now glaringly obvious. That not only applies to developed countries, but to many emerging markets as well. The easiest way out of the situation would be a significant devaluation of the US dollar (and of all other fiat currencies) against commodities, primarily against gold.

3. The De-dollarization has begun. We regard this process as an uncoordinated form of dollar devaluation. Its main symptom is a gradual reduction of the US dollar’s importance as a global reserve currency. If central banks want to hold a monetary asset that is liquid, stateless and above all requires no counterparty, it is not debt securities denominated in other fiat currencies, but gold that represents the only real alternative.

4. Occurrence of a “black or grey swan” event. Numerous potential financial shocks can be envisaged in the current environment. Regardless of whether such a shock is triggered by geopolitical tensions boiling over, or by negative economic developments – an appropriate allocation to gold will mitigate the negative performance of assets that typically generate large losses in the wake of such events.

5. Based on our analysis of market structure, sentiment and price patterns, our assessment is that the medium to long term technical picture looks promising. The Coppock curve has given a long term buy signal in late 2015, while sentiment data indicate that skepticism in the market remains quite pronounced. We expect only little upside momentum in the short term though, primarily based on seasonality, but also due to a number of signals from technical indicators that remain in bearish territory for the time being.

Whether one fully agrees with our critical assessment of the system is one thing; the question of whether one should hold an appropriate share of one’s liquid wealth in the form of a “golden insurance reserve” is a different kettle of fish entirely. In order to make up one’s mind regarding this point, it may be helpful to ask oneself a few simple questions, such as:

When will I not need any gold in my portfolio?

When…

• debt levels can be sustained or can be credibly reduced

• the threat of inflation is negligible

• real interest rates are high

• confidence in the monetary authority is (justifiably) strong

• the political environment is steady and predictable

• the geopolitical situation is stable

• governments deregulate markets, simplify tax regulations and respect civil liberties

Of course, the future is always uncertain, hence the authors present scenarios outlining potential future gold price developments. “From our perspective, the decisive factors for the gold price will be the momentum of GDP growth, as well as the further progress made in terms of the Fed’s monetary policy normalization effort”, says Mark Valek.

Scenario A: “Relatively strong real economic growth”

The proposed economic policy initiatives are implemented and take hold, the US economy begins to grow strongly (>3% p.a.) and price inflation remains in an acceptable range (<3%). Monetary policy normalization succeeds. The central bank’s “experiment” pays off.

The gold price should trade in a range from USD 700 to USD 1,000

Scenario B: “Muddling through continues”

Real US GDP growth and consumer price inflation remain in a range of 1-3% p.a. In this case we would not expect the gold price to enter into the second phase of the secular bull market we currently anticipate.

The gold price should remain in a range from USD 1,000 to USD 1,400 in this scenario.

Scenario C: “High inflationary growth”

Trump’s economic policy initiatives are put into place, a large infrastructure spending program is launched, US economic growth accelerates significantly (>3% p.a.), but so does the consumer price inflation rate (>3%). Monetary policy normalization succeeds only partially, as real interest rates remain very low or even negative, due to the elevated consumer price inflation rate.

In this scenario the gold price should trade in a range from around USD 1,400 to USD 2,300.

Scenario D: One of the four events listed in the table below occurs.

Recession, stagflation and/or significant weakness in the US dollar are pushing the gold price up noticeably. In the wake of another US recession and the cessation of the monetary policy normalization effort, significant changes to the global monetary order cannot be ruled out. A very large gold price rally has to be expected.

Gold prices between USD 1,800 up to USD 5,000 appear possible in this scenario.

Given the analyses presented in this year’s In Gold We Trust report, the authors assign the highest probability to the latter two scenarios.

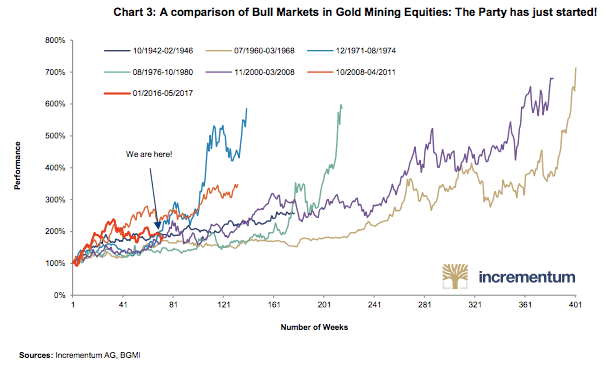

Valek and Stöferle continue to be bullish on mining stocks: “If the bull market in precious metals continues, the performance of mining stocks will be decidedly positive as well. Investors should continue to place their bets with conservatively managed companies in the sector, which rather than pursuing a “growth at any price” agenda are focused on delivering strong returns to shareholders.”, says Stöferle. From a valuation perspective, growth in free cash flows, gold reserves/resources per share, and earnings growth per share strike us as the most important metrics.

In their investment process, the focus is on developers and emerging producers. Based on the premise that the bull market in gold has resumed, the authors expect the gold-silver ratio to decline over the medium term. In this scenario pure play silver mining stocks should offer particularly interesting investment opportunities.

Valek concludes “The narrative of economic recovery is to a large extent an illusion. Together with the rally in asset prices, it created a positive atmosphere in the markets for several years, while gold was abandoned. Now, however, the tide seems to be turning.”

About the “In Gold we Trust”-Report:

Ronald-Peter Stoeferle has written the ‘In Gold we Trust’ study for 11 consecutive years. For 4 years it has been co-authored by his partner Mark Valek. It provides a “holistic“ assessment of the gold sector and the most important factors influencing it, including real interest rates, opportunity costs, debt, central bank policy etc.

The authors are proud that the following highly renowned companies are “Premium Partners” of the report: Philoro EDELMETALLE GmbH, Münze Österreich AG, Endeavour SilverCorp., Victoria Gold Corp., Bullion Capital Ltd., ÖGUSSA GmbH and Tocqueville Asset Management L.P.

Ronald-Peter Stöferle, CMT

Ronnie is partner of Incrementum AG and responsible for Research and Portfolio Management.

He studied Business Administration and Finance in the USA and at the Vienna University of Economics and Business Administration, and also gained work experience at the trading desk of a bank during his studies. Upon graduation he joined the Research department of Erste Group, where he published his first “In Gold We Trust” report in 2007. Over the years, the Gold Report has proceeded to become one of the benchmark publications on gold, money, and inflation.

Since 2013 he has held the position as reader at scholarium in Vienna, and he also speaks at Wiener Börse Akademie (i.e. the Vienna Stock Exchange Academy). In 2014, he co-authored the book “Austrian School for Investors” and in 2017 “Die Nullzinsfalle” (The Zero Interest Rate Trap). Moreover, he is an advisor for Tudor Gold Corp. (TUD), a significant explorer in British Columbia’s Golden Triangle.

Mark Valek, CAIA

Mark is partner of Incrementum AG and responsible for Portfolio Management and Research.

While working full time, Mark studied Business Administration at the Vienna University of Business Administration and has continuously worked in financial markets and asset management since 1999. Prior to the establishment of Incrementum AG, he was with Raiffeisen Capital Management for ten years, most recently as fund manager in the area of inflation protection and alternative investments. He gained entrepreneurial experience as co-founder of Philoro Edelmetalle GmbH.

Since 2013 he has held the position as reader at scholarium in Vienna, and he also speaks at Wiener Börse Akademie (i.e. the Vienna Stock Exchange Academy). In 2014, he co-authored the book “Austrian School for Investors” and in 2017 “Die Nullzinsfalle” (The Zero Interest Rate Trap).

Incrementum AG

Incrementum AG was founded in 2013. Independence and self-reliance are the cornerstones of our philosophy, which is why the four managing partners own 100% of the company.

Prior to setting up Incrementum, we all worked in the investment and finance industry for years in places like Frankfurt, Madrid, Toronto, Geneva, Zurich, and Vienna. We are very concerned about the economic developments in recent years especially with respect to the global rise in debt and extreme monetary measures taken by central banks.

We are reluctant to believe that the basis of today’s economy, i.e. the uncoveredcredit money system, is sustainable. This means that particularly when it comes to investments, acting parties should look beyond the horizon of the current monetary system. We want to re-think investment strategies and implement them in a way that is in line with today’s requirements. Our clients appreciate the unbiased illustration and communication of our publications. Our goal is to offer solid and innovative investment solutions that do justice to the opportunities and risks of today’s prevalent complex and fragile environment.

Contact:

Incrementum AG

Im alten Riet 102

9494 – Schaan/Liechtenstein

Email: Mark Valek: mjv@incrementum.li

Ronald-Peter Stoeferle: rps@incrementum.li

Pingback: In Gold We Trust Chartbook 2017 - 60 Slides for Gold Bulls - Gold Survival Guide