Prices and Charts

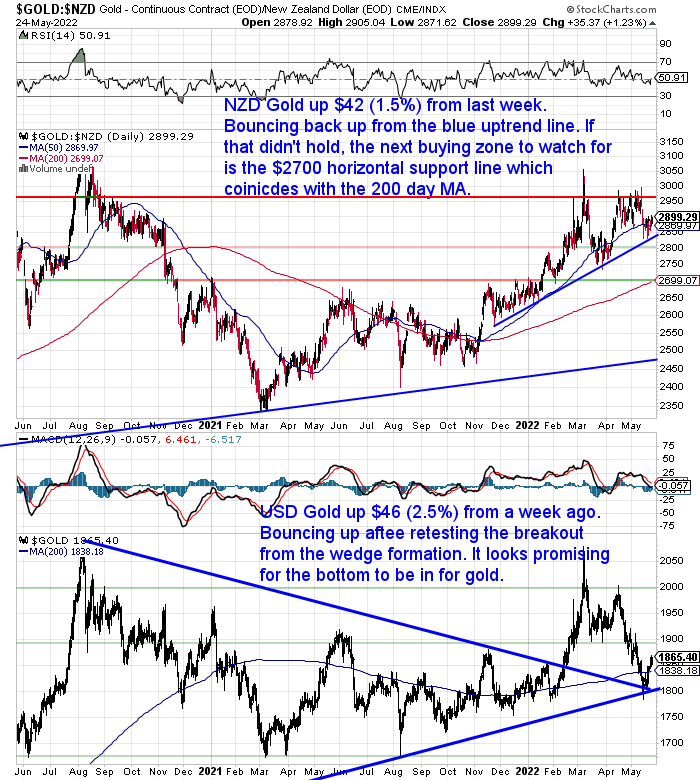

NZD Gold Yet Again Bouncing Up From Uptrend Line

Gold in New Zealand dollars is up $42 or 1.5% from a week ago. It has once again bounced back up from the rising blue trendline. That line has proven to be strong support all this year. So on that basis any further dip down to that level should be a good buying opportunity.

If for any reason that trendline didn’t hold, then there is very strong support at $2700. Where the 200 day moving average (MA) and horizontal support line coincide.

In USD gold looks likely to have bottomed out around $1800. It has bounced strongly off that level.

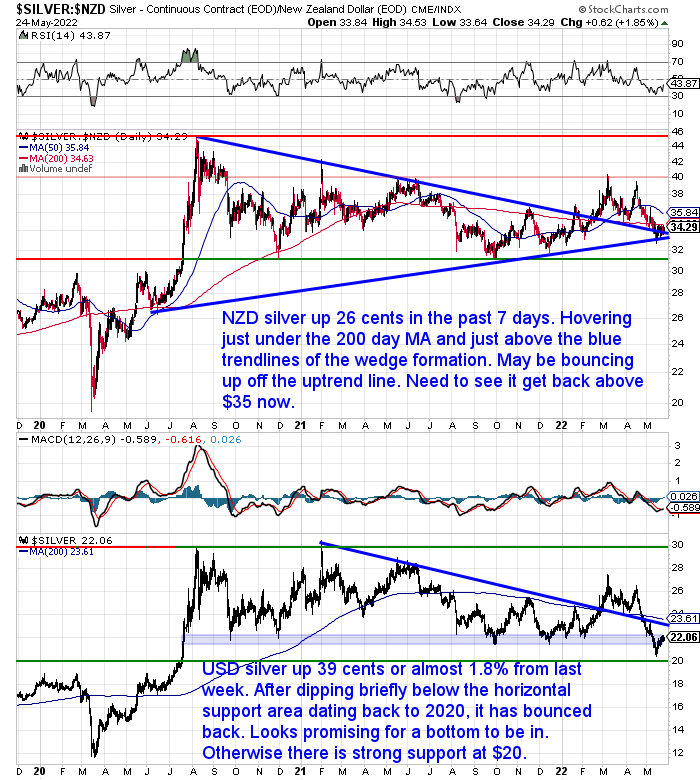

Silver Also Holding Above Trendlines

Silver in New Zealand dollars continues to hover just under the 200 day moving average. So far it has held above the blue trendlines of the wedge formation. We need to see it get back above the $35 mark now.

The stronger Kiwi dollar has continued to hold local silver prices back. This could continue to be the case in the short term as the NZ Dollar still has room to bounce back further yet (see chart further down).

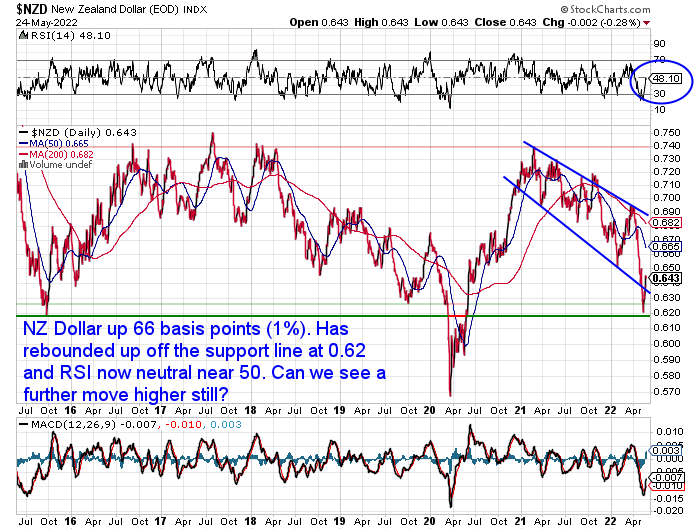

Kiwi Dollar Rebound Continues

The New Zealand dollar was up 66 basis points or around 1% this week. As noted above, it could still run higher yet. The RSI sits in neutral territory around 50 and the Kiwi is still well below the 50 day moving average which sits at 0.6650.

Hence our thinking that the Kiwi could run a bit higher yet and therefore hold back NZ dollar denominated gold and silver prices in the short term.

Late Update: RBNZ Raises OCR by 0.5% As Expected

Just as we go to hit send the RBNZ has announced a much expected 0.5% rate hike today. Although their hawkish tone seems to have given the NZ dollar a boost with it jumping about 70 basis points.

The RBNZ has flagged more aggressive rate increases ahead to tame inflation and it now sees its cash rate rising above 3% this year, nearing 4% in 2023.

Bloomberg reports:

“The central bank today projected inflation will slow to 3% in the second half of 2023 from a peak of 7% in the current quarter. Inflation is not seen returning to the 2% midpoint of the target band until 2025.

…The RBNZ projects annual average economic growth of 3.2% in the year through March 2023, then slowing to 1.3% in the following 12 months through March 2024. Previously it saw 2023-24 growth of 2.2%.”

Source

As you’ll see later on in the 2022 In Gold We Trust Report, stagflation, being high inflation and a no growth economy, is looking more and more likely.

The RBNZ reaction to high inflation is almost certain to cause a recession.

So we think the RBNZ, just like most central banks, will likely have to keep adjusting up their inflation projections and adjusting down their growth expectations.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – New Stock Finally Here

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Comparing NZ Money Supply, Government Inflation Statistics, Property Prices, and Gold Prices for the Last 22 Years

This week’s feature article compares a number of quite different measures to each other. Namely NZ money supply, government inflation statistics, property prices, and gold prices.

The comparison has allowed us to come up with a theory as to where the old adage of house prices doubling every 10 years comes from.

We think it’s likely a timely place to be comparing these measures to gold. Why?

Because they all seem to be at trend changes.

- Money supply – record highs due to covid response

- Inflation – turn up from record lows?

- Property – turning down from record highs?

Here’s what’s covered:

- NZ Money Supply and House Prices

- NZ House Prices Over the Past 2 Decades – How’s This for Spooky?

- How Does Money Supply Compare to the NZ Government Inflation (CPI) Calculations?

- How Do Property and Bank Deposits Compare to Gold in NZ Dollars?

- 4 Things We Can Learn From All These Inflation, Housing, Bank Deposit and Gold Numbers?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

In Gold We Trust Report 2022 Out Now: Stagflation 2.0

The always fantastic Incrementum In Gold We Trust Report has just been released.

We admit we have yet to have a serious look through the full report. But from what we’ve seen, stagflation looks to be the main focus this year for Ronnie and Mark at incrementum.

Here’s just a taste of what is covered:

- Definition and analysis of historical stagflation phases

- Structural reasons arguing for a long-term inflationary environment

- Parallels and differences from previous stagflationary phases

- The challenges that “Stagflation 2.0” poses for investors

- Which asset classes are likely to perform well in stagflation?

- After the Everything Bubble, is the Everything Crash now looming?

- Central banks: from pigeons to hawks and back again

- Updated gold price forecast

Here is a link to the compact version (they always cover so much ground that this version is still 26 pages long!).

In Gold We Trust 2022 Compact Version

Or you can also watch a 20 min presentation where Ronnie gives a good summary of the report here:

Here’s a short excerpt from the report that highlights two important points:

“While at least a small part of the population was able to enjoy rising asset values in times of disinflation, consumers as well as investors are finding life increasingly difficult in a time of in- creased inflation rates.

The omnipresent inflation means a notice- able reduction in the standard of living of the majority of people. When the real pie becomes smaller – whether in the form of higher prices, smaller package sizes, or thinner soups – this has far-reaching con- sequences for consumer behavior and investment activity. Distributional issues will be fought even harder socially, contributing to national and international tensions and further exacerbating the polarization that already exists. The return of the wolf [inflation] and all the calamities associated with it are increasing the pressure on monetary guardians to actually guard the purchasing power of the currency.

Monetary policymakers therefore have their backs to the wall. They are forced to at least pretend to face the wolf. However, tentative attempts to stem the tide of liquidity are beginning to expose problems that have been masked for years, if not decades, by emergency measures. Just as in 2018, when we warned of the inevitable consequences of the attempted turning of the monetary tides, we are now issuing another explicit warning. In addition to wolfish inflation, a bearish recession now looms.”

So the takeaways are;

- Investors will find it very difficult in inflationary times

- The central bankers response to inflation is likely to cause a serious recession

The report argues that gold is likely to perform very well in this future that Ronnie and Mark see coming.

Make sure you are prepared for such a scenario.

If you agree and want to get some or add to your stash, then please get in touch…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: RBNZ Will Start Reducing their $54 Billion Stockpile of Govt Bonds in July. But Should They Do More? - Gold Survival Guide