This Week:

- 1930’s Gold Sovereign Transaction Shows Gold Undervalued Today

- Ronni Stoeferle: Retail Bullion Demand is Collapsing – What About in New Zealand?

- Biggest Bitcoin News No One Is Talking About

- Insure Your Wealth Against the Fake Valuations!

Would you like some assistance with timing your entry into and your eventual exit from gold and silver? Then you may want to

meet our “secret” investment advisor. You can learn more about who he is… And how you could benefit from his uncanny ability to enter and exit not just the precious metals markets but many other markets too, at just the right time.

So go here to learn more now.

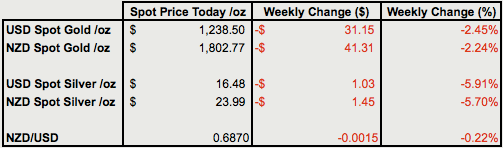

Prices and Charts

Silver Plunges

A decent correction has finally arrived this week

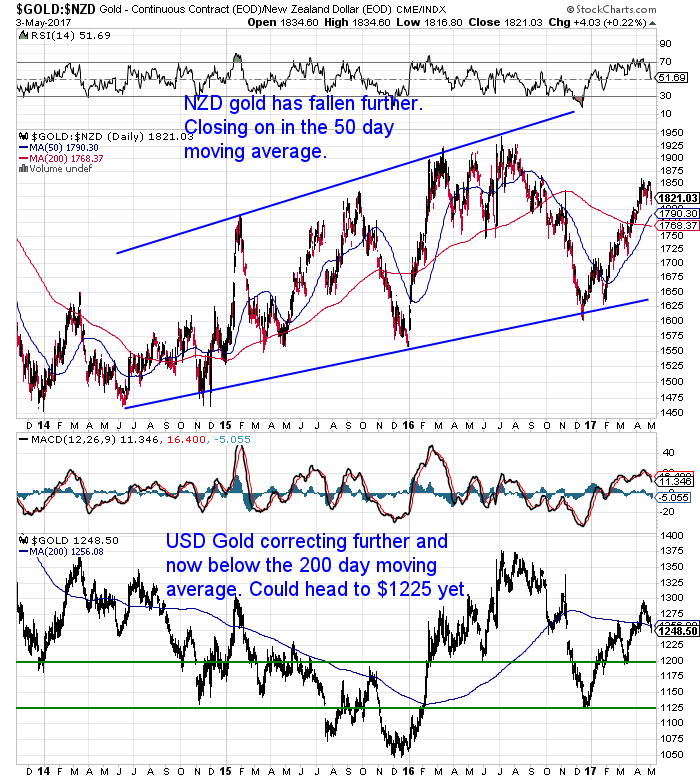

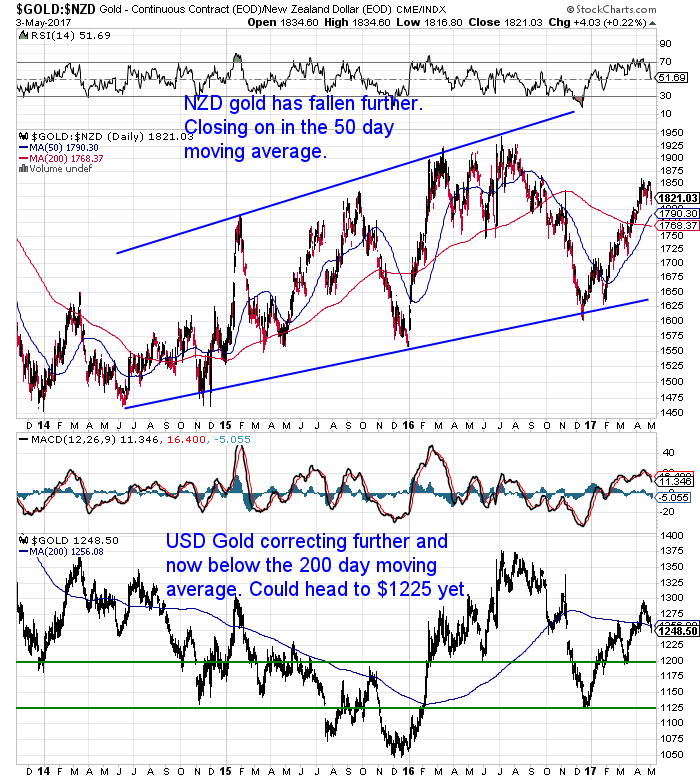

Gold in NZ Dollars is down over 2% from a week ago. A further drop wouldn’t be a surprise for gold as it has risen so sharply this year. Perhaps look for it to touch the 50 day moving average (MA) at $1790 yet?

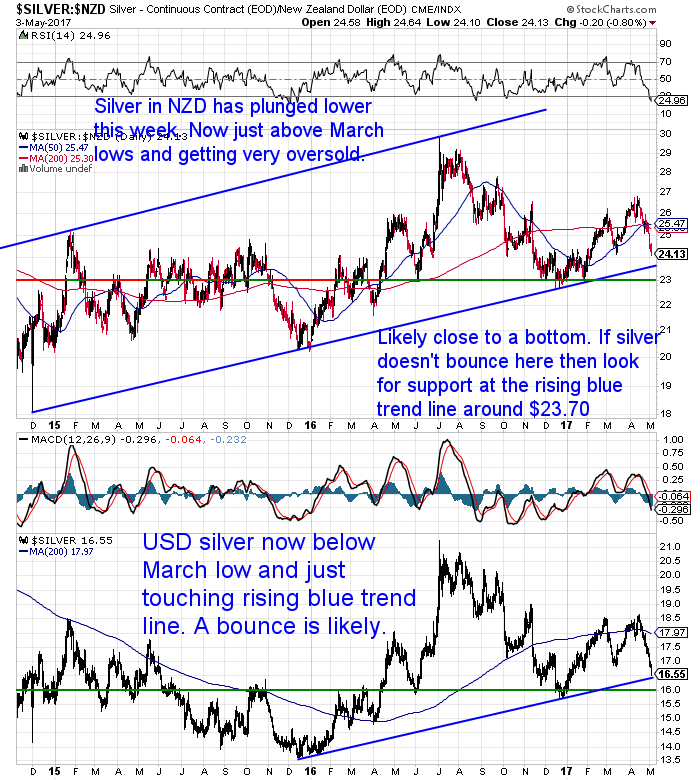

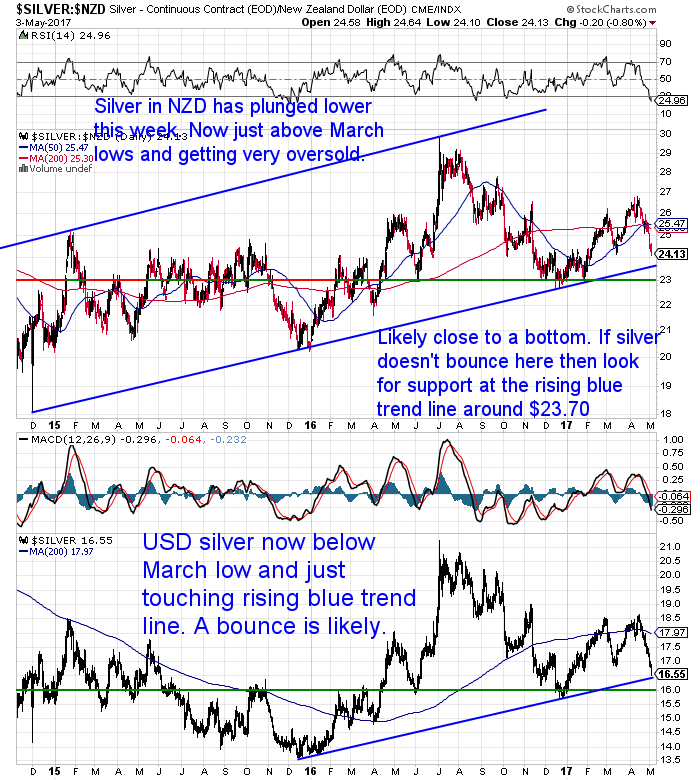

Silver really plunged lower. Down over 5% the past 7 days. But unlike gold silver is very oversold now and also close to the March lows in NZ dollar terms.

So we’d guess that silver is due to bounce higher from here. Of if it doesn’t then look for support to come in at around $23.70 where the rising blue trend line is. Could it go even lower? Never say never.

But overall this looks like a really good buying zone to be adding physical silver to your existing hoard. Or to be starting one if you don’t have any.

Silver has been rising for the past 2 years and now is a chance to buy with it again close to the rising trend line. Something that may only happen once or twice a year.

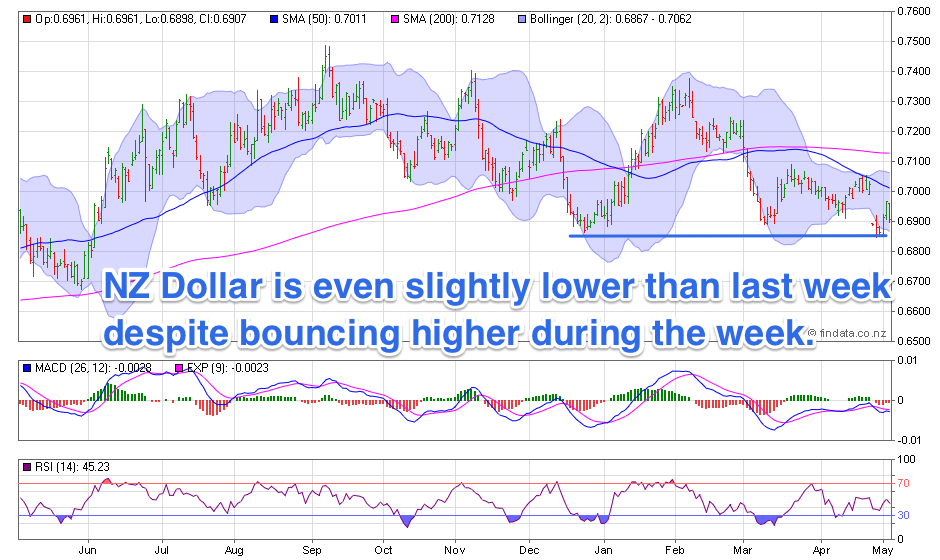

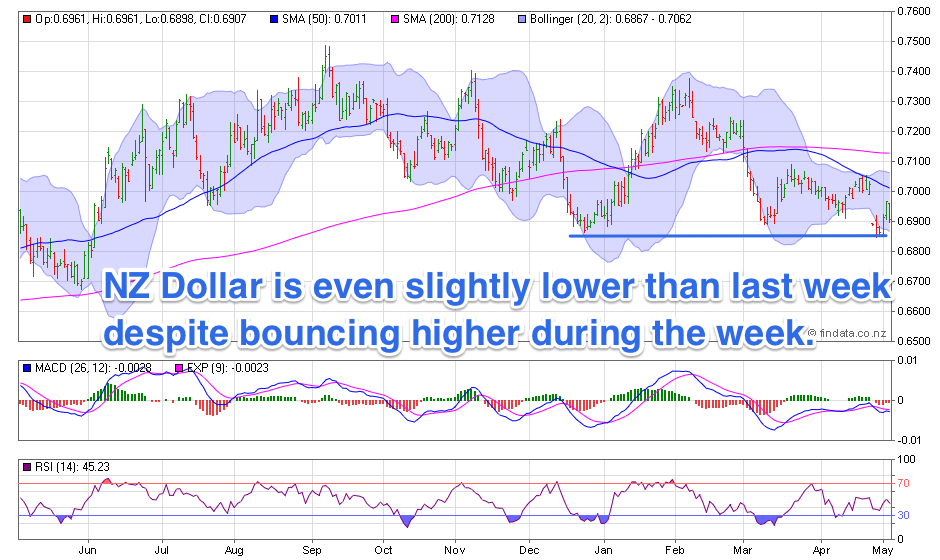

The Kiwi Dollar dipped lower then bounced sharply higher during the week. But has now moved back down even below the low of a week ago. But does look to have support at around .6850.

Stewart Thomson echoes our thoughts on silver being in an excellent accumulation zone in this article:

1930’s Gold Sovereign Transaction Shows Gold Undervalued Today

This demonstrated how very undervalued silver is currently by looking at what labourers were paid in silver in ancient Greece, and also the value of New Zealand houses when measured in silver. The resulting numbers were eerily similar.

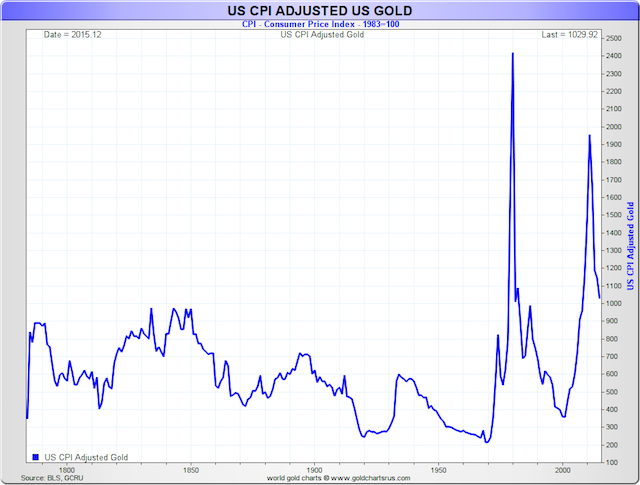

Here’s another historical comparison this time looking at gold.

In the early 1930s the settlement between King Ibn Saud of Saudi Arabia and a consortium of oil companies on rights to that country’s vast oil riches, involved payment of 35,000 British gold sovereigns – roughly one-quarter ounce gold coins.

We can compare this valuation from the 1930’s to today:

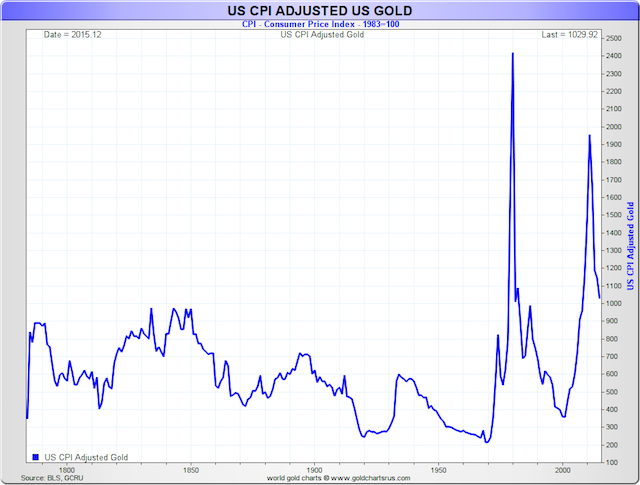

“At the time of Saudi Arabia’s oil concession, British sovereigns were valued at $8.24 each, or $288,365 for the 35,000 coin lot. The price of oil in 1933 was about 85¢ a barrel. A British sovereign, as a result, could buy 9.7 barrels of oil. Today those same sovereigns would bring a little less than $10.5 million at melt value ($298 each/$1265 per ounce gold price) and a barrel of oil is selling for about $52. Thus, today a British sovereign can buy a little less than six barrels of oil — a statistic that gives you an inkling of gold’s current under-valuation. For gold to buy the same amount of oil now that it did in 1933, the price would have to go to $2150 per ounce. It may be no coincidence, and it certainly reinforces the notion of gross undervaluation, that the inflation-adjusted price of gold in 1980, when gold traded at $850, would be in the vicinity of $2400 today. (Please see chart below courtesy of goldchartsrus.com)”

Source.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

<

Never worry about safe drinking water for yourself or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions and has time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

Ronni Stoeferle: Retail Bullion Demand is Collapsing – What About in New Zealand?

Michael J. Kosares at

USAGold commented this week that:

“…global demand for the physical metal [gold] has not only sustained itself in recent years, it has grown rapidly, and clearly at a rate that far exceeds the rate of growth in mine production. Just this past week, we have seen reports of renewed strong demand in China and India – two traditional powerhouses when it comes to physical ownership of the precious metals. Generally speaking, the East buys on price while the West buys on momentum, thus one might conclude that anecdotal evidence shows that the price has been “right” in recent months. This time around, as reported here previously, professional money managers have positioned themselves as buyers in concert with the East, something that happens only on occasion. The two together though are currently an imposing presence the global gold marketplace.”

But this increased demand from China (plus India lately) and professional money managers is in stark contrast to what is going on at a retail level in the bullion market in North America.

The very affable Ronni Stoeferle this week reported on the lack of demand in the retail market according to bullion dealers at a conference he spoke at recently.

So in this week’s feature article we look at what is going on in the retail bullion market here in New Zealand.

You’ll see how retail gold investors have been behaving quite differently to big money investors. You’ll also discover how this compares to what’s happening in the New Zealand bullion market. Plus what the current headwinds and tailwinds for gold are.

Insure Your Wealth Against the Fake Valuations!

“I think… that investors would do well to shift their focus more and more from the flakey intangible assets to the tangible assets such gold and silver, agricultural land and non contaminated fresh water. Next to that investing in the stock and bond markets is already for a long time not based on fundamentals. Everything is fake; the valuations of stocks, bonds and currencies are completely distorted by QEs, ZIRP and NIRP, actions of the Plunge Protection Team and the HFTs with their algos. So explain to me how an investor can invest on the basis of real fundamentals and is not taken for a ride as we are witnessing for example with the GDX and GDXJ. We live in a fake society whereby fake is ruling our reality! Anyway why buy insurance for your house, your car, and your life but not for your wealth? Why not put 10%-15% of your wealth in physical gold and silver and the gold and silver mining companies if you want to hedge your investments in your house and investments. If everything goes well all your assets will do well whilst if things turn sour gold and silver could give that nice leveraged hedge if you have the physical. When it happens people will wake up and realize that physical gold and silver are money the only real money the only reality and that everything with paper is just paper, worth hardly anything, fake!”

Source.

Silver in particular looks like being cheap

wealth insurance right at the moment. Get in touch if you have any queries or would like a quote.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles:

|

|

Thu, 4 May 2017 11:18 AM NZST

Stewart Thomson believes the current weakness in gold and silver is to be expected given that we are between US Federal Reserve rate hikes. Check out why he believes that gold and especially silver are currently in very good “accumulation zones” for buyers of both metals… Gold & Silver: Accumulators Buy Now May 2, […]

|

|

|

Wed, 3 May 2017 4:10 PM NZST

See how retail gold investors have been behaving quite differently to big money investors. Discover how this compares to what’s happening in the New Zealand bullion market. Plus what the current headwinds and tailwinds for gold are. It’s been awhile since we shared any thoughts from the excellent Ronni Stoeferle of Incrementum and the In […]

|

|

|

Wed, 3 May 2017 11:30 AM NZST

Here’s the second part looking at why the once in a lifetime chance to buy property has likely ended. If you missed Part One check that out first here. “The Great Post-WW2 Real Estate Bull Market Is Over”—Part II By Justin Spittler Justin’s note: Today, we’re sharing part two of Doug Casey and E.B. Tucker’s […]

|

|

|

Wed, 3 May 2017 11:25 AM NZST

House prices in Auckland seem to levelling out currently. That’s not to say they can’t go higher still but at some point a ceiling will be reached. This article looks at what is going on in North American real estate. Auckland doesn’t have Real Estate Expo’s with Rappers and Tony Robbins as headliners though. So […]

|

|

|

Tue, 2 May 2017 9:17 AM NZST

Have you perhaps been taking more interest in Bitcoin of late? We have seen it getting more widely mentioned and discussed over the last year or so. But this piece of news has had little mention outside of Bitcoin focussed websites. It could end up being pretty significant… The Biggest Bitcoin News No One Is […]

|

|

|

Fri, 28 Apr 2017 12:06 AM NZST

Silver Coins Deal 4000 x 1oz Perth Mint Silver Kangaroos 2015 BU (Brilliant Uncirculated). See here to learn more Gold Kiwi Special Today 1oz NZ Mint Gold Kiwi coins at spot plus 2.75%. Minimum purchase 10 coins Delivered and fully insured for $19,028 Reply to this email or phone David on 0800 888 465 This […]

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Note: For local gold and silver orders your funds are deposited into our suppliers bank account. We receive a finders fee direct from them. Pricing is as good or sometimes even better than if you went direct.

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

- To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

- To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.

Stewart Thomson believes the current weakness in gold and silver is to be expected given that we are between US Federal Reserve rate hikes. Check out why he believes that gold and especially silver are currently in very good “accumulation zones” for buyers of both metals… Gold & Silver: Accumulators Buy Now May 2, […]

Stewart Thomson believes the current weakness in gold and silver is to be expected given that we are between US Federal Reserve rate hikes. Check out why he believes that gold and especially silver are currently in very good “accumulation zones” for buyers of both metals… Gold & Silver: Accumulators Buy Now May 2, […]

See how retail gold investors have been behaving quite differently to big money investors. Discover how this compares to what’s happening in the New Zealand bullion market. Plus what the current headwinds and tailwinds for gold are. It’s been awhile since we shared any thoughts from the excellent Ronni Stoeferle of Incrementum and the In […]

See how retail gold investors have been behaving quite differently to big money investors. Discover how this compares to what’s happening in the New Zealand bullion market. Plus what the current headwinds and tailwinds for gold are. It’s been awhile since we shared any thoughts from the excellent Ronni Stoeferle of Incrementum and the In […]

Here’s the second part looking at why the once in a lifetime chance to buy property has likely ended. If you missed Part One check that out first here. “The Great Post-WW2 Real Estate Bull Market Is Over”—Part II By Justin Spittler Justin’s note: Today, we’re sharing part two of Doug Casey and E.B. Tucker’s […]

Here’s the second part looking at why the once in a lifetime chance to buy property has likely ended. If you missed Part One check that out first here. “The Great Post-WW2 Real Estate Bull Market Is Over”—Part II By Justin Spittler Justin’s note: Today, we’re sharing part two of Doug Casey and E.B. Tucker’s […]

House prices in Auckland seem to levelling out currently. That’s not to say they can’t go higher still but at some point a ceiling will be reached. This article looks at what is going on in North American real estate. Auckland doesn’t have Real Estate Expo’s with Rappers and Tony Robbins as headliners though. So […]

House prices in Auckland seem to levelling out currently. That’s not to say they can’t go higher still but at some point a ceiling will be reached. This article looks at what is going on in North American real estate. Auckland doesn’t have Real Estate Expo’s with Rappers and Tony Robbins as headliners though. So […]

Have you perhaps been taking more interest in Bitcoin of late? We have seen it getting more widely mentioned and discussed over the last year or so. But this piece of news has had little mention outside of Bitcoin focussed websites. It could end up being pretty significant… The Biggest Bitcoin News No One Is […]

Have you perhaps been taking more interest in Bitcoin of late? We have seen it getting more widely mentioned and discussed over the last year or so. But this piece of news has had little mention outside of Bitcoin focussed websites. It could end up being pretty significant… The Biggest Bitcoin News No One Is […]

Silver Coins Deal 4000 x 1oz Perth Mint Silver Kangaroos 2015 BU (Brilliant Uncirculated). See here to learn more Gold Kiwi Special Today 1oz NZ Mint Gold Kiwi coins at spot plus 2.75%. Minimum purchase 10 coins Delivered and fully insured for $19,028 Reply to this email or phone David on 0800 888 465 This […]

Silver Coins Deal 4000 x 1oz Perth Mint Silver Kangaroos 2015 BU (Brilliant Uncirculated). See here to learn more Gold Kiwi Special Today 1oz NZ Mint Gold Kiwi coins at spot plus 2.75%. Minimum purchase 10 coins Delivered and fully insured for $19,028 Reply to this email or phone David on 0800 888 465 This […]