Last week the Reserve Bank of New Zealand (RBNZ) raised the Official Cash Rate yet again by another 50 basis points. Today we look at interest rates and gold. Specifically answering the question: If interest rates rise, what happens to gold prices? This post covers:

Table of Contents

- A Common Misconception About Gold and Rising Interest Rates

- Rising Interest Rates in the 1970’s and the Effect on Gold

- Why Does Gold Rise When Interest Rates Rise?

- What Happened to the Gold Price the Last Time the Federal Reserve Hiked Interest Rates?

- How has Gold Performed Since the RBNZ Began Rising Interest Rates in October 2021?

- What Might the Future Hold for Interest Rates and Gold?

Estimated reading time: 7 minutes

A Common Misconception About Gold and Rising Interest Rates

Last October the New Zealand central bank raised the OCR by 0.25% to 0.50%. This was the 1st of 7 interest rate increases after the RBNZ initially raised rates back in October 2021 for the first time in 7 years. Common wisdom says that gold should fall when interest rates rise. You will see that sentiment in headlines like this from Reuters last week: Gold slides after Powell doubles down on tight monetary policy

Gold fell over 1% on Friday after Federal Reserve Chair Jerome Powell in his speech at Jackson Hole said the U.S. economy needed a tight monetary policy until inflation was under control.

Where they also stated:

“Gold is considered a hedge against economic risks, but rising interest rates dent the appeal of the non-yielding asset.”

But how does this common wisdom stack up with reality?

What Really Happens to Gold When the Fed Raises Rates?

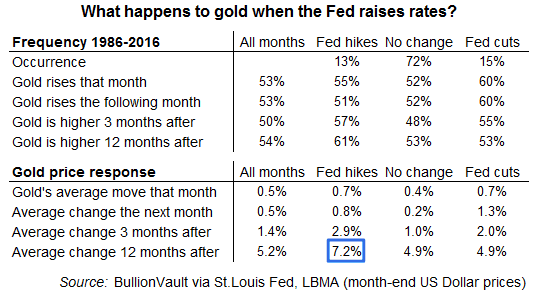

Bullionvault crunched the numbers from 1986 to 2016. Looking at each time the Federal Reserve changed interest rates and how this affected gold:

- that month,

- the following month,

- 3 months later and,

- 12 months later.

30 years of numbers don’t lie. When the Fed hikes rates, gold is more likely to go up than down, across all 4 time periods. Of particular note was that 12 months after the Fed hikes interest rates, the average change in the gold price is +7.2%. That certainly confounds “common wisdom”!

Rising Interest Rates in the 1970’s and the Effect on Gold

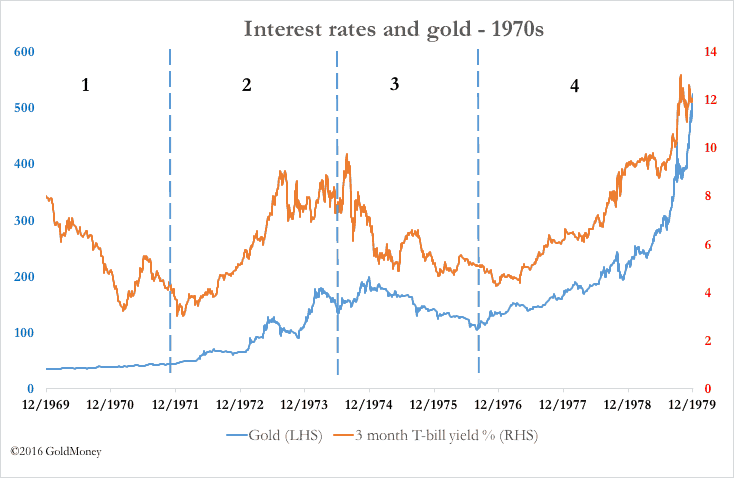

Now let’s look back at the 1970’s. In particular, the latter half of that decade when interest rates were steadily rising. The below chart clearly shows gold (blue line) rising with interest rates (orange line), from 1976 to the end of the decade.

Why Does Gold Rise When Interest Rates Rise?

Gold has a what is known as a “cost of carry”. This simply means that because gold pays no interest, there is a cost to hold gold. There is also the opportunity cost of lost potential interest an investor could earn if their money was put to use elsewhere. That’s why the above common misconception arises, that gold falls when interest rates rise. However the rate of inflation also needs to be taken into account. This is known as the real interest rate.

Real Interest Rates and Gold

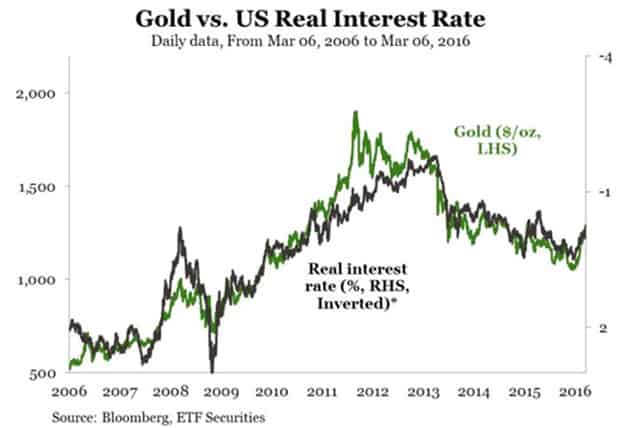

So if the inflation rate is higher than the prevailing interest rate, then the real interest rate is negative. This was the situation in the 1970’s when gold rose even when interest rates were high. Because Inflation was even higher. Looking at more recent history, gold also peaked in 2012, about the time real interest rates were at their lowest. (See the chart below. The right hand scale has the real interest rate inverted, so when the blue line is falling real interest rates are rising.) Then real interest rates rose from 2012 to 2015 while gold also fell. Since then real rates have turned up and so has gold. (Note: the chart below only runs to 2016).

So overall we can see a very close correlation between real interest rates and gold.

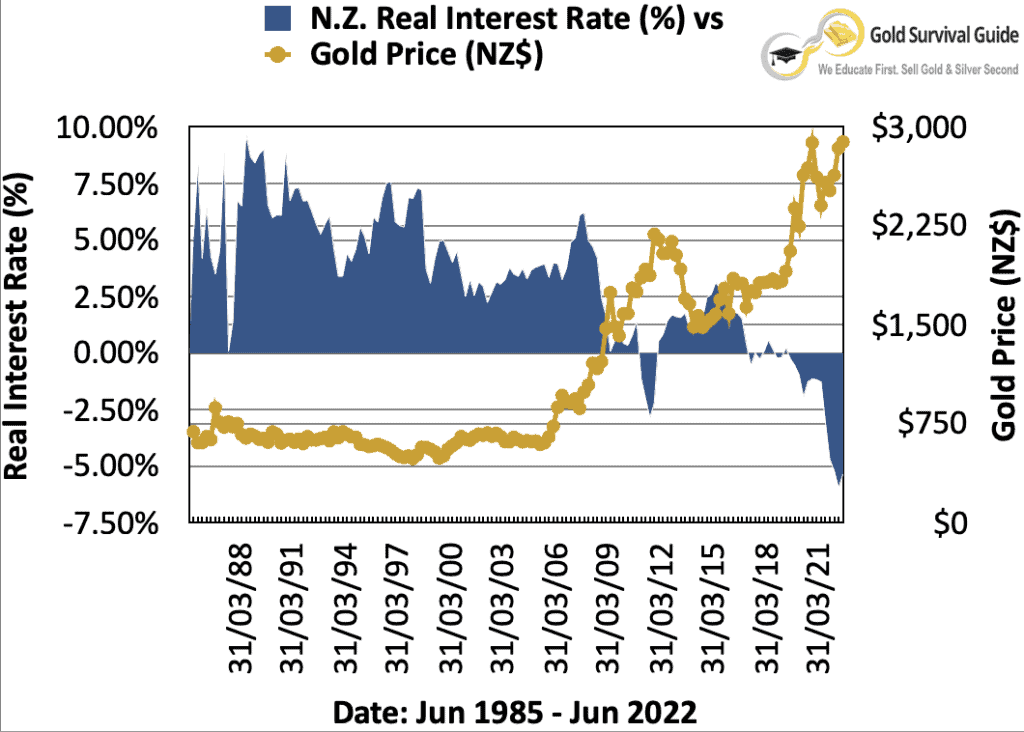

The below chart of our own making may be easier to follow. As the real rate of interest is not inverted. It clearly shows that gold in New Zealand Dollars moves higher when real interest rates turn lower.

For more detail on real interest rates and gold see: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

What Happened to the Gold Price the Last Time the Federal Reserve Hiked Interest Rates?

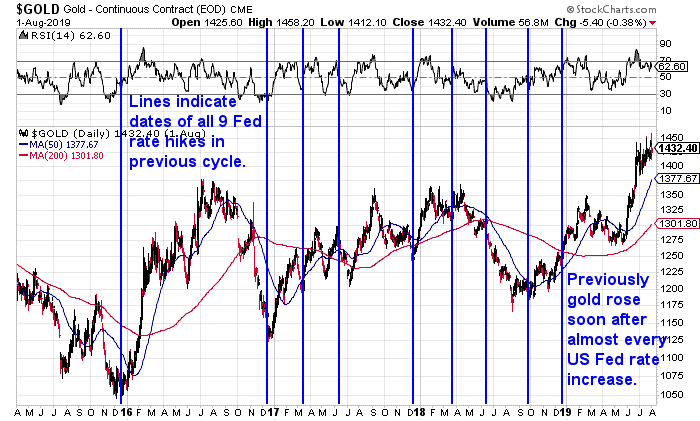

How did gold perform the last time we saw a rising interest rate cycle? Let’s look at the US Federal Reserve rate hikes back in 2015-2018.

In 7 of the 9 rate hikes, gold turned higher straight (or soon after) after the Fed announcement. The only times it didn’t was in March and June of 2018. But then gold bottomed out in August and rose steadily higher from there.

So gold clearly rose with those interest rate increases.

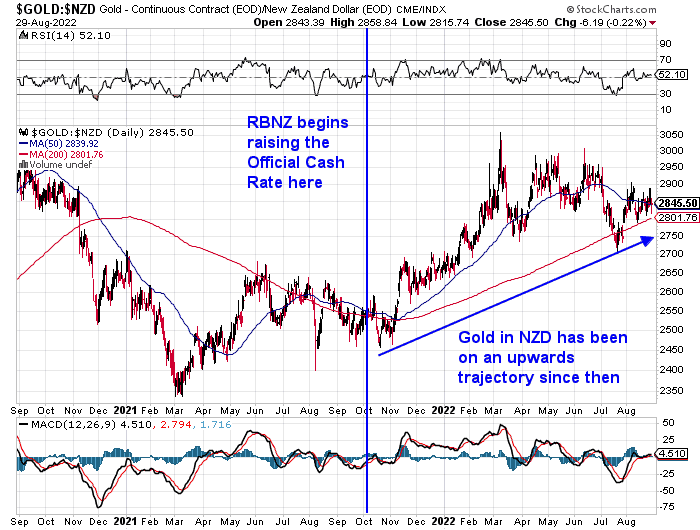

How has Gold Performed Since the RBNZ Began Rising Interest Rates in October 2021?

How about here in New Zealand? How has Gold in NZ Dollars performed since the RBNZ started raising the official cash rate in October 2021?

The below chart shows it has clearly been rising since then.

What Might the Future Hold for Interest Rates and Gold?

The consensus seems to be that there are a number of further interest rate increases to come. Both in the USA and here in New Zealand. US Federal Reserve head Jerome Powell’s speech last week was interpreted that the US central bank would be taking a hard line against inflation. An article in the Australian Financial Review compared him to Paul Volker from 1980:

The US central bank boss, who has invoked the memory of former Fed chairman Paul Volcker, might have little choice but to cause the economy to brake sharply.

Source.

However Volker raised interest rates until they were something like about 3% above the inflation rate. Can you see current central bankers raising interest rates well north of 8.5%?!! That would do more than cause the global economy to “brake sharply”!

So perhaps there are still many more interest rate increases to come. But it is unlikely they will rise high enough for the real (as in after inflation) interest rate to become strongly positive.

In fact our guess would be that if interest rates do continue to rise, so will inflation rates. The “transitory inflation” has certainly proven to be quite the opposite so far.

Despite their tough talk we have our doubts about whether central banks will be able to raise interest rates high enough to really tame inflation. That will mean real after inflation interest rates are likely to stay low to negative into the future. Perhaps they will get even more negative?

This is likely to be supportive for the gold price. In the medium term we will likely see a move back towards 2020’s high of NZ$3,150.

Be sure to have your position in gold before this next run higher begins. Buy gold or buy silver.

Or for help deciding what type of gold to buy see: PAMP Suisse Gold / Silver vs Local NZ Gold / Silver: Which should I buy?

You might also want to read: The Yield Curve Recession Predictor: Impact on Gold? >> or: Everything is Awesome! But Will Gold Rise After the Latest Fed Rate Hike? >>

Editors note: This article was originally published 28 March 2018. Last updated 30 August 2022.

Pingback: What to make of all this interest rate stuff?

Pingback: Fed Rate Hikes and Gold Prices - Interesting Research

Pingback: The Yield Curve Recession Predictor: Impact on Gold? - Gold Survival Guide

Pingback: 3 Gold Myths

Pingback: When Will You Know It's Time to Sell Gold?

Pingback: RBNZ Raises Rates and NZ Dollar Falls? - Gold Survival Guide

Pingback: Why Buy Gold? Here's 15 Reasons to Buy Gold Now

Pingback: Will NZ's Housing Market Be the World's 'Crash Test Dummy'? - Gold Survival Guide