Two Specials Today

Any quantity of local gold at spot plus 2.5% plus insurance and delivery

or

1oz NZ Mint Gold Kiwi coins at spot plus 2.75%.

Minimum purchase 10 coins

Delivered and fully insured for $18,270

Reply to this email or phone David on 0800 888 465

This Week:

- Expanded: Wages from Ancient Greece and NZ Housing Both Say Silver Undervalued by a Factor of 20

- Is Silver a Better Value than Gold Right Now?

- Is Demand For Physical Gold Really Collapsing? Our Take…

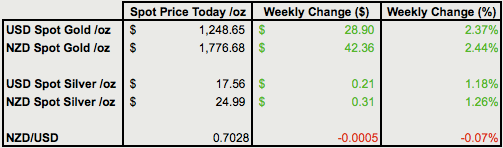

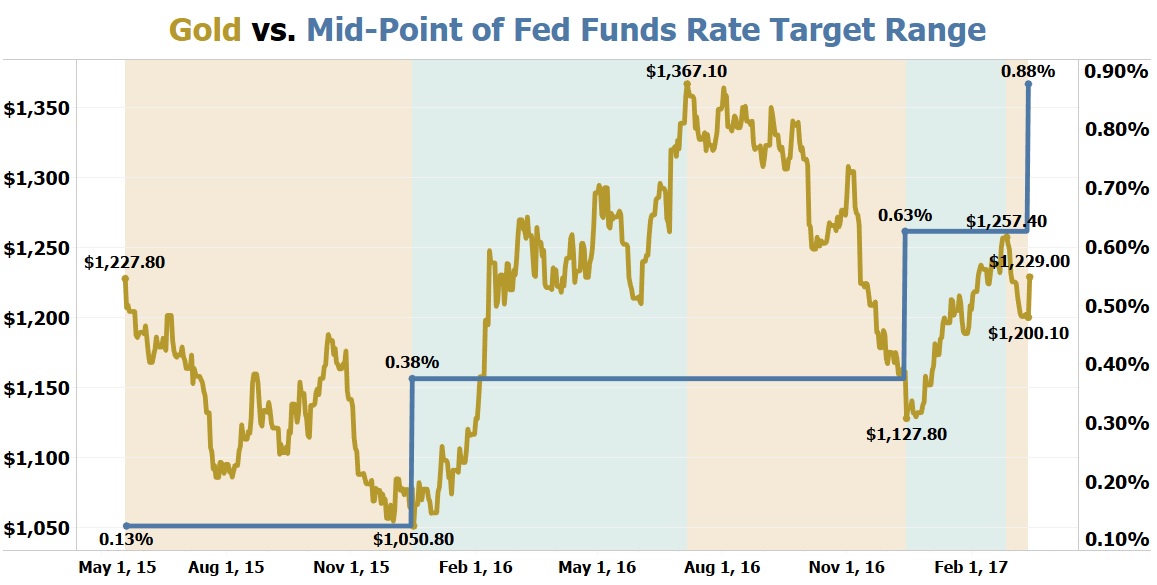

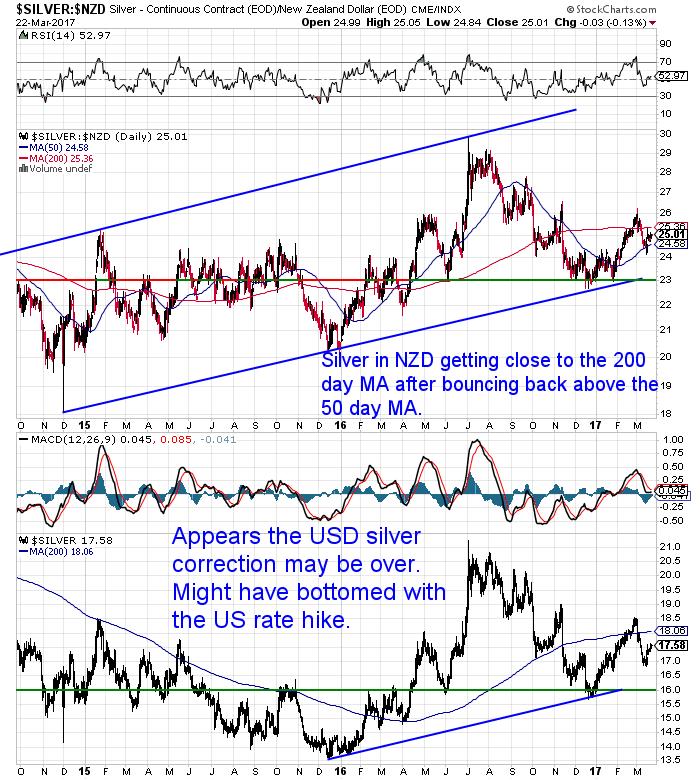

Prices and Charts

|

Looking to sell your gold and silver? Visit this page for more information |

|

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1702 |

| Buying Back 1kg NZ Silver 999 Purity | $761 |

Just a Brief Pullback

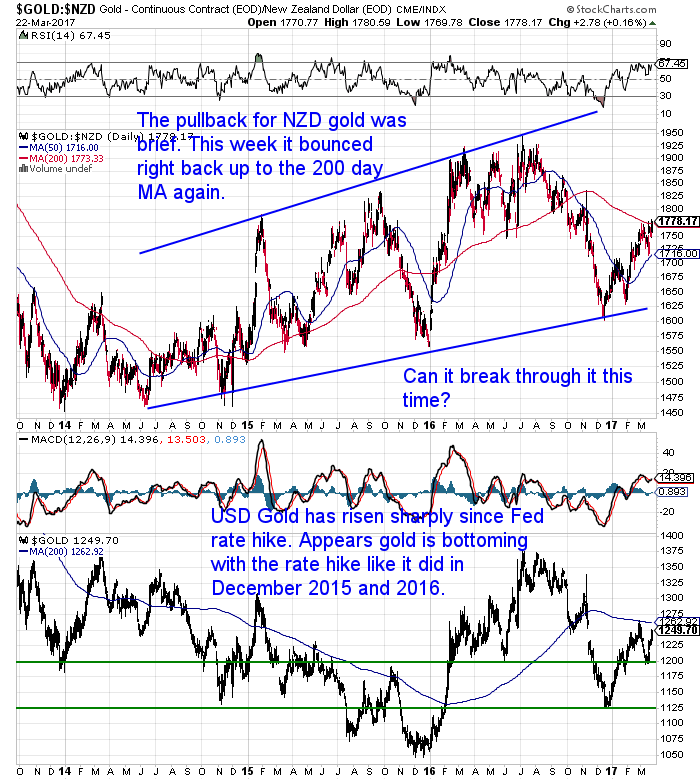

Gold Continuing Trend of Rallying After Fed Rate Hikes

Gold is continuing its trend of selling off leading up to widely expected Federal Reserve Rate Hikes, only to rally big immediately afterwards. During the 60-day periods prior to the December 2015 and December 2016 Fed Rate Hikes of 25 basis points, gold sold off by 8.9% and 7.3%, respectively. During the 20-day period leading up to yesterday’s Fed Rate Hike of 25 basis points, gold sold off once again by 4%.

After the December 2015 Fed Rate Hike, gold rallied by 30% within the next 7 months.

After the December 2016 Fed Rate Hike, gold rallied by 11.5% within the next 2 1/2 months. Already since yesterday’s Fed Rate Hike, gold has rallied $26.40 to settle today at $1,226.50 per oz!

The largest gainers after each recent Fed Rate Hike have been Gold/Silver Mining Stocks!

After the December 2015 Fed Rate Hike, the HUI Gold Miner Index rallied by 182.1% within the next 7 months. After the December 2016 Fed Rate Hike, the HUI Gold Miner Index rallied by 35.5% within the next 2 1/2 months. Yesterday, immediately following the latest Fed Rate Hike, the HUI Gold Miner Index soared 7.8% – one of its biggest up days in history! This is only the beginning with much larger gains to come in the weeks ahead for gold/silver mining stocks!

Wages from Ancient Greece and NZ Housing Both Say Silver Undervalued by a Factor of 20

Is Silver a Better Value than Gold Right Now?

The Conundrum of Gold Demand Versus Gold Price

“This information about gold flows is critical to understanding what will happen next to the price of gold. The reason is that the price of gold is largely determined in “paper gold” markets, such as Comex gold futures and gold ETFs. These paper gold contracts represent 100 times (or more) the amount of physical gold available to settle those contracts.

As long as paper gold contracts are rolled over or settled for paper money, then the system works fine. But, as soon as paper gold contract holders demand physical gold in settlement, they will be shocked to discover there’s not nearly enough physical gold to go around.

…As long as supply and demand for physical gold are in rough equilibrium, there is no catalyst for a sudden spike in gold prices, apart from the usual geopolitical flight to quality demand. But, as soon as demand begins to overwhelm supply, then it’s “game on” for significantly higher physical gold prices followed by the toppling of the inverted pyramid of paper gold contracts.”

“…In effect, Switzerland is a conduit for much of the gold in the world. Gold arrives in Switzerland as 400-ounce good delivery bars, doré bars (those are 80% pure ingots from gold miners), and “scrap” (that’s the term for jewelry and other recycled gold objects).

This gold is then melted down and refined mostly into 99.99% pure 1-kilo gold bars. These 1-kilo “four nines” quality bars are the new global standard and are the ones most favored by the Chinese.

By examining Swiss imports and exports, we can see where the supply and demand for physical gold is coming from and how close to balance (or imbalance) that supply and demand is. This information can help us to forecast the coming super-spike in gold prices. Switzerland does not produce its own gold.

The “big five” destinations are China, Hong Kong, India, the U.K. and the United States. Those five destinations account for 91% of total Swiss gold exports.

Hong Kong demand is mostly for re-export to China. This is revealed through separate Hong Kong import/export figures, which are also considered reliable by international standards. Using Hong Kong as a conduit for Chinese gold is just one more way China tries to hide its true activities in the physical gold market.

Bear in mind that China is the largest gold producer in the world. There is an additional 450 tons per year of indigenous mining output available to satisfy China’s voracious demand for official gold, held by its central bank and sovereign wealth funds.

And China has been a major destination for Swiss gold.

In December 2016 Switzerland exported an astonishing 158 tonnes of gold bullion directly to China. That’s a 168 % increase over the previous December.

In total, Switzerland exported 442 tonnes to China last year, up 53 % from 2015.

Heavy Chinese buying means there’s less physical gold to meet investor demand going forward. That means the price of gold is likely to go up because that’s the market’s solution to excess demand.”

Is Demand For Physical Gold Really Collapsing? Our Take…

This Weeks Articles: |

|||

|

|||

|

|||

|

|||

|

|||

|

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.