This gives some thoughts as to what you should have first before buying the likes of bitcoin or junior gold and silver mining shares. Plus how gold and commodities have reached extreme undervaluation levels…

Is it Time to Trade Your Gold in for Bitcoin?

From Justin Brill, Editor, Stansberry Digest: Originally posted at The Crux

Is bitcoin taking the place of gold?

If you’ve taken our advice to keep a portion of your savings in precious metals, you may be asking yourself that question.

After all, bitcoin is often referred to as “digital gold.” In fact, it was originally designed to possess many of the same “sound money” characteristics as physical gold…

It’s fungible, meaning one bitcoin is equivalent to any other. It’s divisible…

meaning one bitcoin can be divided into 100 million units (each unit is known as a “satoshi,” named for bitcoin’s pseudonymous creator, Satoshi Nakamoto). It’s portable and (relatively) convenient to transport. And it’s somewhat scarce…

Like gold, its total supply is limited (by computer code, rather than nature) and it can’t be created out of thin air by any government.

Yet, while bitcoin has soared – up 1,660% this year alone – gold and silver have barely budged by comparison. After rallying around 30% and as much as 50%, respectively, in 2016, they’re up about 4% each this year.

So should you consider moving your money out of precious metals and into bitcoin instead?

If you’ve been with us for long, you can probably guess the answer is a resounding “NO.”

You see, gold possesses another critical characteristic of sound money: It’s durable. Gold – as an element – doesn’t corrode, break down, or change over time. And gold – as money – has proven to be a reliable store of value and useful medium of exchange for more than 5,000 years.

Bitcoin has only existed since 2009 – less than 10 years. While bitcoin itself has never been successfully hacked or compromised, we can’t be certain technologies like artificial intelligence and quantum computing won’t eventually find a vulnerability.

Likewise, bitcoin is still far too volatile to qualify as either a store of value or a medium of exchange.

To be clear…

This doesn’t mean that bitcoin or another cryptocurrency won’t eventually clear this hurdle, too. It’s possible…

But it’s far too early to say. More important, even if cryptocurrencies fulfill their promise to revolutionize our economy, they’re unlikely to ever fully replace precious metals.

Our colleague Tama Churchouse – editor for our corporate affiliate Stansberry Churchouse Research, and one of the biggest “crypto” bulls we know – agrees. As he explained in a recent note to readers…

Gold is a physical, tangible, and real asset. You can pick it up and feel its satisfying weight in your hand. It can’t be altered. Gold is gold. Once I own it, that’s it. I don’t need to rely on a functioning Internet. I don’t need a computer. It’s pure, tangible value…

No matter how big bitcoin gets, it will never be gold. If you were to ask me which I think is more likely to be around a hundred years from now, it’s gold… every time.

Nothing has usurped it for millennia as a globally accepted medium of exchange or store of value, and I don’t think bitcoin will do so either.

Despite fears to the contrary, data suggest the crypto boom is having little effect on the gold market this year…

According to a recent note from Goldman Sachs analysts, “There is no evidence of a mass exodus from gold.”

In particular, they noted there has been “no discernible outflow of gold” from exchange-traded funds (“ETFs”). In fact, gold ETF holdings recently hit their highest levels since mid-2013. In other words, speculative money is flooding into cryptos, but gold is continuing to serve its traditional role as a “chaos hedge.”

As Goldman explained…

The composition of demand between bitcoin and gold is the key difference. Bitcoin is attracting more speculative inflows. The net effect is that bitcoin has demonstrated much higher volatility and lower liquidity/price discovery compared to gold…

While the lack of liquidity and increased volatility may keep bitcoin interesting, it is unlikely to convince investors looking for the kind of diversification and hedging benefits which gold has proven to possess over its long history.

Of course, that’s not the only reason we remain bullish on precious metals…

The historic extreme between stocks and commodities today suggests the entire resource sector could soar in the years ahead. As we explained in the June 7 Digest…

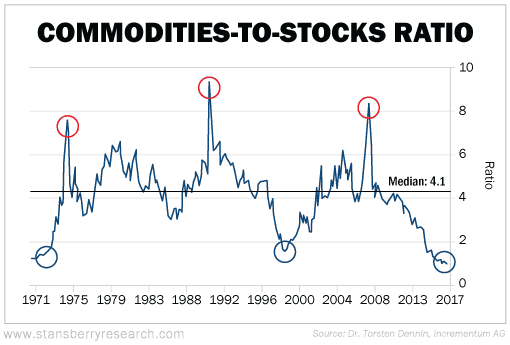

The chart shows the commodities-to-stocks ratio over the past 47 years. This ratio compares commodities – as tracked by the S&P GSCI Commodity Index – with the benchmark S&P 500…

As you can see, this ratio has now fallen to an extreme rarely seen over the past five decades…

In fact, it is now even lower than either of the previous two bottoms. Some of you may recall the first…

It was just before President Nixon took the U.S. dollar off the gold standard. Over the next several years, inflation shot higher…

commodities soared…

and stocks entered a brutal bear market.

The second bottom occurred just before the final run-up in the dot-com boom.

Again, over the next decade, commodities dramatically outperformed stocks. The broad GSCI Commodity Index rose nearly 300% from January 1999 through the end of 2007, while the S&P 500 gained less than 30%.

Today’s historic lows suggest “real” assets could once again be set to beat financial assets over the next several years. This could also be great news for gold in particular…

gold soared nearly 1,800% and 600%, respectively, following the last two lows.

History also paints an incredibly bullish picture for gold miners…

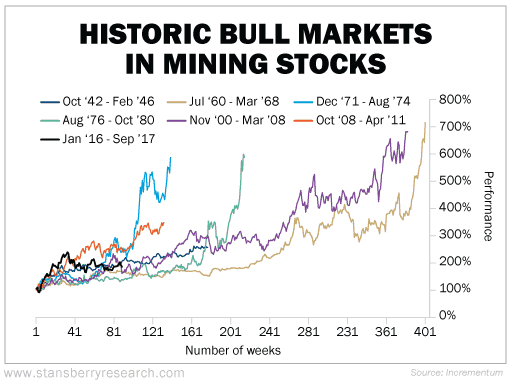

The following chart shows every bull market in gold stocks over the past 75 years.

As you can see, the current bull market – which began in January 2016 and has risen as much as 150% – barely registers…

To match even the weakest rally, gold stocks would have to double from here. Under the most bullish scenarios, hundreds-of-percent gains are possible. And given the unprecedented stimulus central banks have unleashed around the world, this bull market could easily surpass them all.

As always, the markets offer no guarantees…

But history suggests this bull market is far from over.

Our advice remains the same…

We continue to urge every reader to keep a small percentage of his wealth in physical gold and silver. We consider these positions to be a form of “disaster insurance” that you should buy and hold and hope you never need to use.

If you’re in a position to take on a little more risk, a small position in the highest-quality precious metals stocks might make sense. These stocks provide leverage to the price of gold…

And history suggests it’s a great time to buy. Only then – and only if you can afford to speculate – should you consider assets like junior gold and silver stocks or cryptocurrencies.

But make no mistake, these vehicles are not for the rent money. Junior miners are notoriously volatile. And cryptocurrencies make them look tame by comparison.

Don’t put a penny into them that you aren’t willing to lose.

Regards,

Justin Brill

Trying to decide when to buy gold or silver? Then check out When to Buy Gold or Silver: The Ultimate Guide

Related: Gold vs Bitcoin/Cryptocurrencies – Which One Should You Choose?