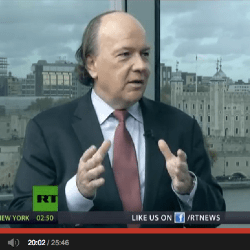

Jim Rickards is worth listening to. Given he is somewhat of an “insider”, we get an inclination as to where things are heading in terms of the global monetary system.

While the Jim Rickards interview starts at 12:27, it is worth listening to the first half of the program where Stacey and Max discuss the “melt up” in ultra expensive artwork by ultra high net worth individuals. More evidence that a select few get first use of the cheap money on offer we’d say.

In the interview Rickards and Keiser discuss:

- How if the Fed was a hedge fund (which it sort of is) and marked it to market it would be insolvent.

- How the Fed is getting closer to the point where they won’t be able to pay “dividends” to the US treasury without becoming insolvent. which will make the US budget deficit worse.

- How you can’t have a recovery when inflation outstrips wage growth

- How Central Bank announcements are like computer Vapourware – you make an announcement with no substance to it.

- How we are just guinea pigs in Central Bankers experiments as it is nonsense that they can talk about where employment will be in 2 years.

- What is really going on when the Bank of England says the housing market is supporting the “recovery”.

- How Central Bankers are trying to recreate the lending and spending debt and consumption model when there is nothing to support it except money printing.

- How the art market going up is really the dollar going down.

- How the old money protects their wealth with a 1/3 gold, a 1/3 land and a 1/3 fine art.

- Why this isn’t trickling down into the gold market.

- Why China’s leaders probably aren’t “dopes”.

- What we can expect from Janet Yellen and why she has more resemblance to Miley Cyrus than Lady Gaga!

- How the Fed has already tapered twice and why this means Yellen won’t want to again.

- And “straws in the wind” such as how a new alliance between Saudi Arabia, Egypt, Israel and Russia would not favour the dollar.

Pingback: More Weakness Ahead for Gold and Silver? | Gold Prices | Gold Investing Guide