This Week:

- Thoughts from Jim Rickards “Goldfinger” Industry Contact

- Brexit and Gold

- Can the Shanghai Gold Benchmark Price Change the Gold Market?

- Russia and the Irresistible Power of Gold – But What About Silver?

- Treasury Secretary Warns About Mortgage Debt and Risk to NZ Banks and the Wider Economy

LIMITED QUANTITY GOLD SPECIALS

***** 3 x 1oz Gold Kiwis coins 9999 purity are $1835 each 3 x 1oz Gold Kiwis coins 9999 purity are $1835 each

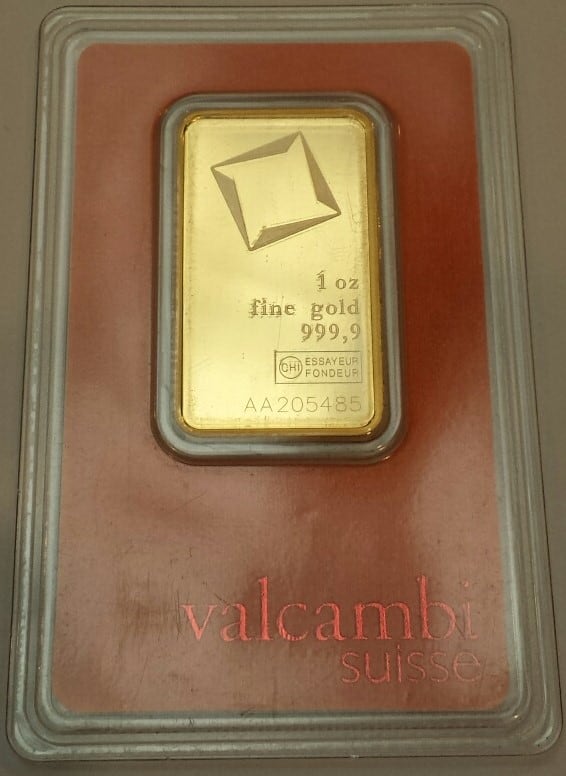

1 x 1oz Valcambi PAMP 9999 purity gold bar $1835

Ph 0800 888 465 and speak to David or reply to this email.

1 x 1oz Valcambi PAMP 9999 purity gold bar $1835

Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

|

Spot Price Today / oz |

Weekly Change ($) |

Weekly Change (%) |

| NZD Gold |

$1763.50 |

– $64.48 |

– 3.52% |

| USD Gold |

$1264.25 |

– $27.95 |

– 2.16% |

| NZD Silver |

$24.07 |

– $0.77 |

– 3.10% |

| USD Silver |

$17.26 |

– $0.30 |

– 1.70% |

| NZD/USD |

0.7169 |

+0.01 |

+ 1.41% |

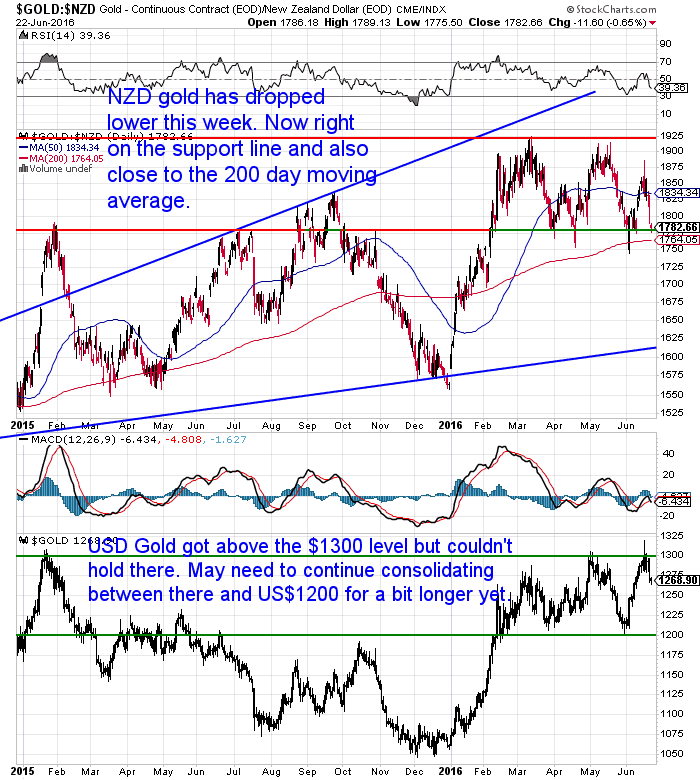

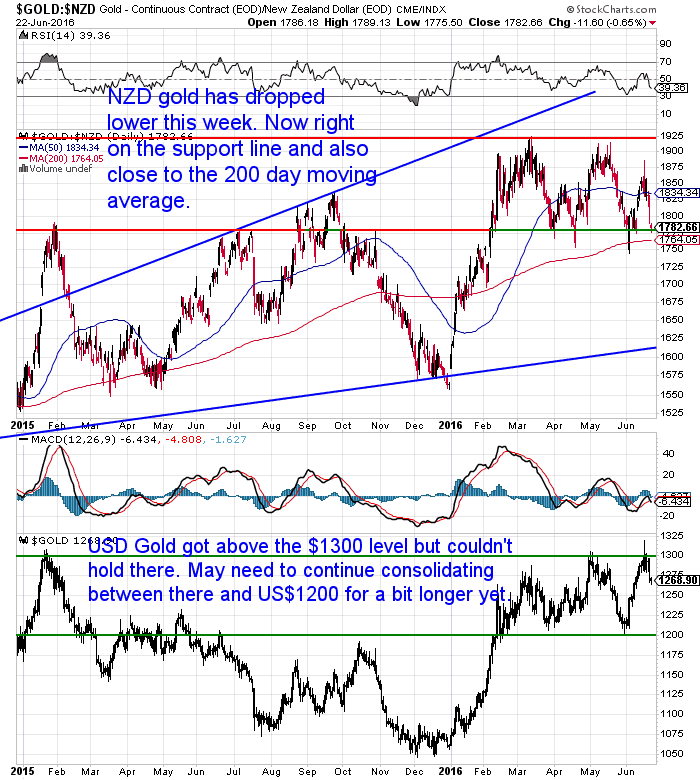

After nudging above US$1300 last week gold didn’t manage to stay there and has headed lower this week.

The New Zealand dollar has continued to strengthen (see chart further down) and so as a result local gold prices have dropped quite sharply over the past few days. They are now sitting right on the 200 day moving average and just above lows from earlier in June.

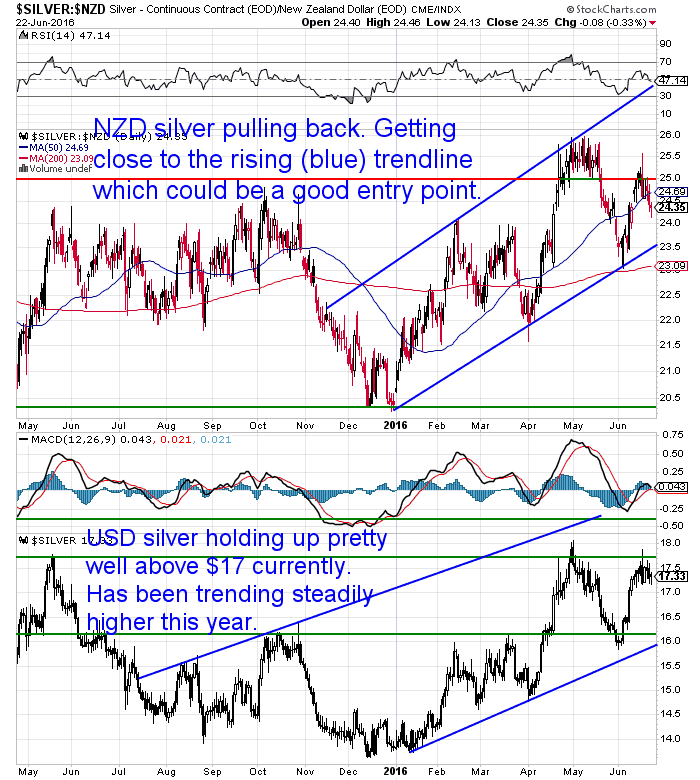

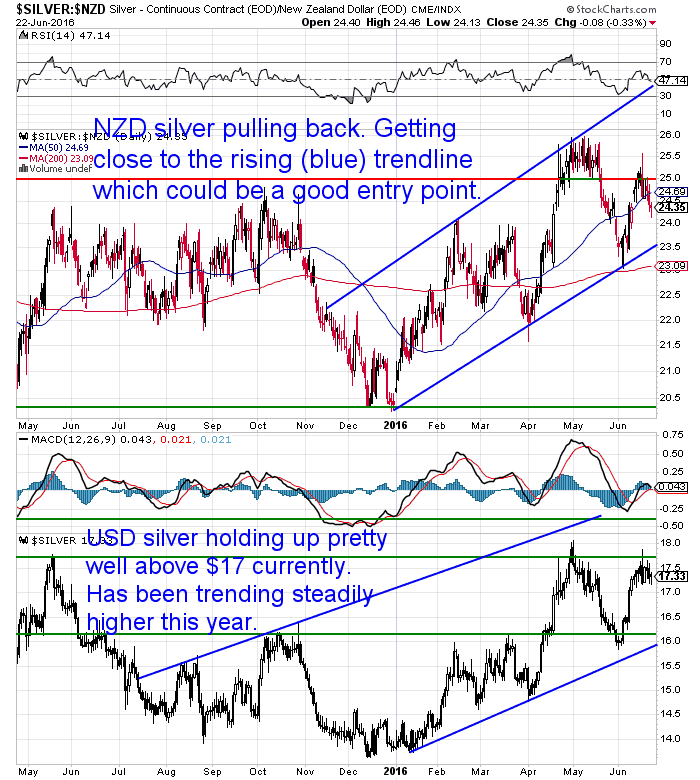

Silver has held up comparatively better than gold. In NZ dollar terms it is still above the 200 day moving average. Also above the rising blue trend line from the start of 2016.

As noted already the Kiwi Dollar has continued rising. It remains quite overbought and is looking a bit over extended, but continues its steady creep higher.

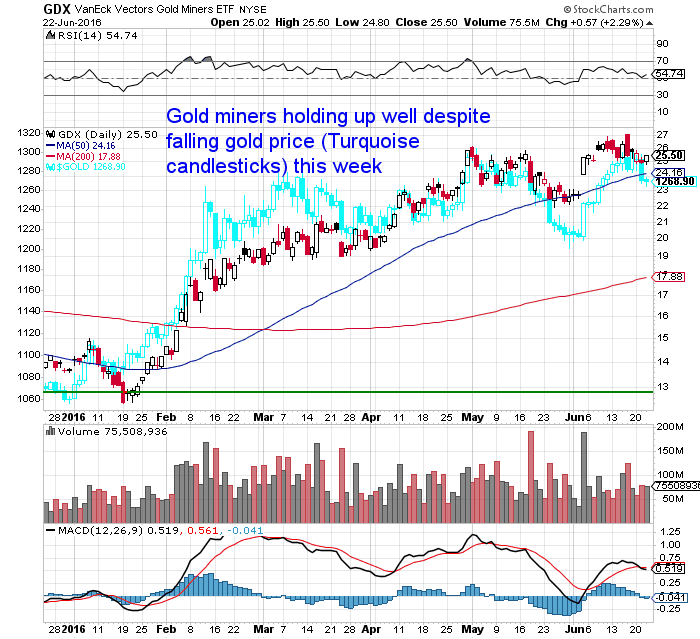

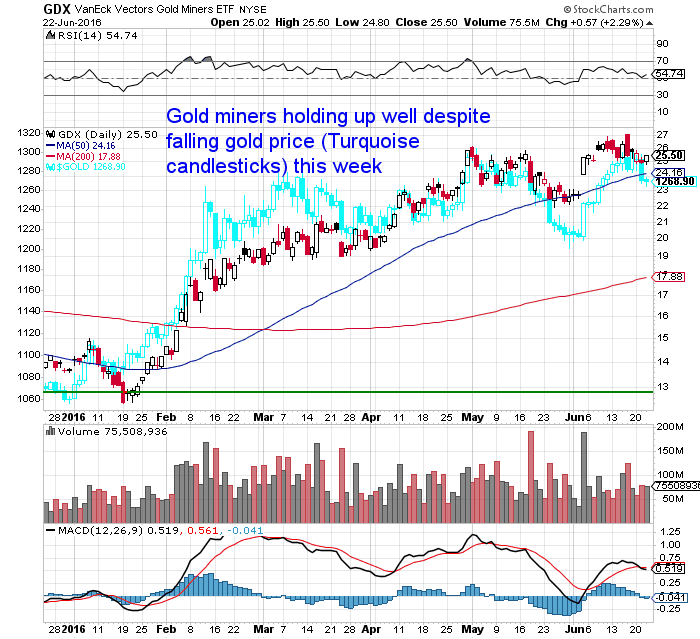

The behaviour of the gold mining stocks has been interesting the past few days. Unlike gold they have made new highs in the past week or so. Plus since then they haven’t actually fallen very much. You can see that clearly in the chart below of the GDX mining index in Red/black versus gold in turquoise.

Could be a positive sign.

Brexit and Gold

The major talk remains the Brexit vote

tomorrow. Given that the expectation is now that it will be a remain vote – at least based upon the bookies anyway – the consensus seems to be that this will cause gold to tumble.

If the “remains” do win odds are gold might take a dip, but the pull back in gold over the past few days could be pricing this in already.

All this looking for reasons for gold to rise and fall is probably over complicating things anyway.

We’d say gold will do what it will do, regardless of the Brexit voting outcome. It had already started rising before the announcement of the referendum earlier this year.

It had probably fallen too far for too long and was simply due to head back up again. We’d say the odds favour gold (and silver) continuing to do so for some time yet. Albeit with plenty of falls along the way.

We just read a brief piece by Jim Rickards outlining why the bookmakers odds favouring a remain vote at 75% might be significantly higher than reality.

Who knows? But the establishment have certainly done all they can to convince the British public that the sky will indeed fall if they vote to leave. We’d say it ends up remain as the scare tactics will probably work.

Or as Chrissy noted on our

Facebook page:

“Those who Vote., Decide Nothing – Those that Count the Vote.., Decide Everything !’ – Joseph Stalin”

Thoughts from Jim Rickards “Goldfinger” Industry Contact

Speaking of Jim Rickards. We’ve got a featured article this week that looks at some comments from Rickards’ gold industry contact he playfully calls “Goldfinger”.

This was all done to sell subscriptions to Rickards gold stock picking newsletter, so plenty of hype of course. But nonetheless “Goldfinger” made one interesting point about what the Chinese have been doing recently – which may surprise many people.

Then Rickards looks at how this might be about to change.

Thoughts from Jim Rickards “Goldfinger” Industry Contact

Can the Shanghai Gold Benchmark Price Change the Gold Market?

On the topic of China, we’ve been keeping an eye on the new Shanghai Gold Benchmark lately.

Jiao Jinpu, Chairman of the Shanghai Gold Exchange reported in the latest World Gold Council Investor Magazine that in its first month, the Shanghai Gold Benchmark Price’s trading volume was 105.91 tonnes of gold kilo bars. This corresponded to a turnover of CNY27.94 billion, and an average daily trading volume of 4.81 tonnes. A total of 102.10 tonnes of gold were physically settled, addressing the market’s need for physical gold.

Michael Kosares over on 24H Gold notes that this means that over 96% of the volume on the SGE is settled in physical metal. Pretty much the complete opposite of what takes place in the main Western exchanges.

“Jiao goes on to discuss how the Shanghai benchmark influences derivative contracts within China. Gold contracts – including leases, derivative contracts of various kinds, and commercial banks savings and accumulation plans – are based on the benchmark price which in turn is based on physical settlement. The physical price arrived at on the SGE transfers directly to derivative contracts. In China, in other words, the dog (physical gold) wags the tail (derivative gold).

On several occasions since the SGE benchmark started, Chinese investors and traders drove the price to higher levels that carried over to London and New York as the day progressed. (I should note that Chinese traders can also drive the price lower.) As the first major market to open in any given 24-hour period, China is positioned strategically in the daily cross-global flow of gold trading. Trends there, as a result, can have a strong influence on trading the rest of the day and in the London and New York markets.

Since all settlements are in physical metal, demand in China is for the real thing. Sellers will need to have a line on real metal in order to settle their side of the contract, not a paper promise. Already we have had reports of London bullion traders having to buy metal in Switzerland – the reverse of the prior relationship when London was the major seller to Swiss refiners. That might very well be the extended influence of the new Shanghai benchmark.”

Source.

100 tonnes might not be enough to change the way gold and silver is priced overnight.

But this will be interesting to track.

Especially if the demand from the likes of the western ETF’s like GLD continues and demand increases in China (see the Jim Rickard’s Goldfinger article above for more on that topic).

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

Russia and the Irresistible Power of Gold – But What About Silver?

Dan Popescu this week posted a good summary of Russia’s likely position with respect to gold:

“The percentage of gold in Russia’s reserves dropped to a low of 2.2% in 2005, but today it is back at the 1999 level of 15%. In 2005 President Putin told the Bank of Russia to buy gold. He told the central bank not to “shy away” from the metal. “After all, they (international reserves) are called gold and currency reserves for a reason,” Putin said.

Putin told journalists at the St. Petersburg Economic Forum 2014 “For us [Russia and China] it is important to deposit those [gold and currency reserves] in a rational and secure way… and we [China and Russia] together need to think of how to do that keeping in mind the uneasy situation in the global economy.” This sentence made Popescu wonder if there isn’t a coordinated strategy by Russia and China to use gold in their war on the “exorbitant privilege” of the “hegemon.”

The Soviet Union viewed gold as a strategic metal and a matter of national security, and Putin does too. He may have the same objective as China of accumulating around 9,000 tonnes of gold as soon as possible, which is more than the US (8,133.5 tonnes) and less than the Eurozone (10,788.8 tonnes). China has mentioned a target of 8,500 tonnes.

Russia’s strategy of diversifying away from the dollar in 2007-8 is paying off. The recent call by Kenneth Rogoff, former chief economist of the IMF and Professor of Economics and Public Policy at Harvard, for emerging countries to sell US Treasuries and buy gold confirms and reinforces Putin’s bet on gold. With 15% gold in international reserves, Russia is far beyond the 10% Rogoff recommends. For Russia, gold has become not only a strategic asset but also a weapon in the new cold war with the US.”

Source.

Coincidentally we also spotted an article from Hugo Salinas Price which we reposted this week. It was actually a presentation he gave in Russia at the invitation of the Russian Deputy Prime Minister. But not on gold.

Rather on the very positive impacts it could have if Russia were to implement a 1/2 ounce “Silver Ruble”. This is similar to Price’s argument for a silver Libertad in Mexico. But he goes into quite some detail on the global impacts such a move by Russia would have.

The Silver Ruble Coin for Russia

Treasury Secretary Warns About Mortgage Debt and Risk to Banks and the Wider Economy

Last week we noted the increase in

articles in the mainstream pointing out the size of the debt in New Zealand.

This week government bean counter Treasury Secretary Gabriel Makhlouf added his comments to the mix:

“When New Zealand’s housing debt is around $215.9 billion, a 26.6% increase

in five years, nobody should be surprised the Treasury is concerned,” he said in a speech to the Committee for Auckland Group Summit.

Housing debt was far and away the largest component of this country’s $246 billion of household debt, which has increased by 26.2%

in five years, he said.

“By the beginning of 2016, the level of household debt to disposable income had risen to 163%,” he said.

“That is higher than in the lead up to the Global Financial Crisis and is likely to go higher still, with the Reserve Bank expecting credit growth to continue to outpace income growth.”

He warned that the historically high debt to income ratios in Auckland, where it now takes nine times the average household income to buy an average house, meant households were increasingly vulnerable.

“A drop in income or a rise in interest rates might see some struggling to meet their mortgage payments,” he said.

He was also concerned about the risks this posed to our banks.

“Housing represents around 60% of bank balance sheets,” he said.

“In the event of downturn, the high levels of debt across the banking sector and significant levels of indebtedness of individual households could have knock on effects that might cause serious losses of confidence and financial disruption.

“In short, inflated Auckland house prices are a risk to New Zealand’s financial stability and the economy more generally.”

Source.

So perhaps a good idea to make sure your own debt levels aren’t too high.

Pay down some debt if you can.

No real surprises there for most of us.

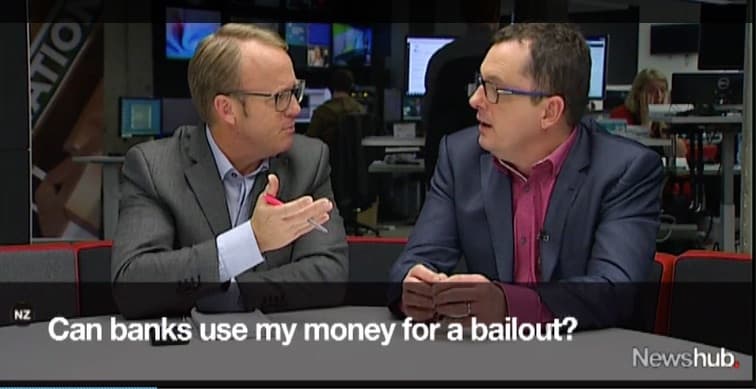

What may still be a surprise to some people is that in the event of banks taking a hit and potentially failing, as deposit holders we will be near the back of the queue in terms of getting our money out. We are merely unsecured creditors of the banks.

In plain terms there is

NO GOVERNMENT DEPOSIT GUARANTEE in New Zealand.

We’re written about this many times over the years, but still the majority of people are completely unaware. Here’s a few of them.

Bank Failures | Could they happen in NZ | The Reserve Bank thinks so

Bank Failures: Will New Zealand be Cyprussed?

RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

The Greens are again pushing for the implementation of a deposit guarantee scheme in New Zealand. That generated some discussion again this week. See

this article and short video.

It doesn’t seem that the government is too interested in implementing this though.

Especially when these same depositor “hair cut” schemes have now been implemented around the world in the likes of Canada, Australia, USA etc. Albeit to handle deposits above their insurance levels. (Often around $100,000 to $250,000 is the maximum coverage in these other nations).

But rather than rely on a government mandated insurance scheme, set up your own “deposit insurance”. Get some gold or silver and store it outside of the banking system and rest easy at night.

You know where to come to get some peace of mind.

Free delivery anywhere in New Zealand

The free delivery offer continues. Boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,390 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

|

2016-06-16 02:49:52-04

This Week: Negative Rates Are Taking Over the World… Are You Prepared? Speaking of Bond Guru’s… Could New Zealand interest rates end up negative eventually as well? Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1827.98 + $43.72 + 2.45% USD Gold $1292.20 + $29.30 + 2.32% […] |

|

|

|

|

2016-06-16 18:03:25-04

Gold continues to quietly move higher without attracting too much attention (well, other than from a few Billionaires anyway). See what what happened earlier this morning in the gold market and why what interest rates do this year might be be that significant as far as a bull market in gold goes… Why the Fed […] |

|

|

|

|

2016-06-16 21:01:18-04

Yesterday in a Daily Reckoning email we read an interesting summary of opinions from Jim Rickard’s gold industry contact. A man whom Rickards calls “Goldfinger”. Now this was a summary of part of a webinar event being used to sell a new gold stock newsletter service – likely a well timed release too given that […] |

|

|

|

|

2016-06-22 17:58:41-04

We’ve discussed negative interest rates a lot lately. We’ve also referenced the “War on Cash” many times too. This short interview transcript outlines why this is occurring, how it suddenly sped up early this year and what you can do about it. While the loss of cash and therefore financial privacy sounds troubling all is […] |

|

|

|

|

2016-06-22 18:38:07-04

Our preferred monetary system is one chosen “by the people”. We’ve discussed this numerous times such as here. But we highly doubt this will be voluntarily allowed by the powers that be. Not without some kind of collapse of the status quo. Hugo Salinas Price has an idea about how the current monetary system may […] |

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

| Today’s Spot Prices

Spot Gold |

| NZ $ 1763.50 / oz |

US $ 1264.25 / oz |

| Spot Silver |

| NZ $ 24.07 / oz

NZ $ 773.85 / kg |

US $ 17.26 / oz

US $ 554.77 / kg |

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

|

| Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

- To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

- To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

|

| The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Gold Survival Guide

PO Box 74437

Greenlane Auckland 1546

New Zealand

| Copyright © 2016 Gold Survival Guide.

All Rights Reserved. |

3 x 1oz Gold Kiwis coins 9999 purity are $1835 each

3 x 1oz Gold Kiwis coins 9999 purity are $1835 each

1 x 1oz Valcambi PAMP 9999 purity gold bar $1835

Ph 0800 888 465 and speak to David or reply to this email.

1 x 1oz Valcambi PAMP 9999 purity gold bar $1835

Ph 0800 888 465 and speak to David or reply to this email. Silver has held up comparatively better than gold. In NZ dollar terms it is still above the 200 day moving average. Also above the rising blue trend line from the start of 2016.

Silver has held up comparatively better than gold. In NZ dollar terms it is still above the 200 day moving average. Also above the rising blue trend line from the start of 2016.

As noted already the Kiwi Dollar has continued rising. It remains quite overbought and is looking a bit over extended, but continues its steady creep higher.

As noted already the Kiwi Dollar has continued rising. It remains quite overbought and is looking a bit over extended, but continues its steady creep higher.

The behaviour of the gold mining stocks has been interesting the past few days. Unlike gold they have made new highs in the past week or so. Plus since then they haven’t actually fallen very much. You can see that clearly in the chart below of the GDX mining index in Red/black versus gold in turquoise.

Could be a positive sign.

The behaviour of the gold mining stocks has been interesting the past few days. Unlike gold they have made new highs in the past week or so. Plus since then they haven’t actually fallen very much. You can see that clearly in the chart below of the GDX mining index in Red/black versus gold in turquoise.

Could be a positive sign.

This was all done to sell subscriptions to Rickards gold stock picking newsletter, so plenty of hype of course. But nonetheless “Goldfinger” made one interesting point about what the Chinese have been doing recently – which may surprise many people.

Then Rickards looks at how this might be about to change.

Thoughts from Jim Rickards “Goldfinger” Industry Contact

This was all done to sell subscriptions to Rickards gold stock picking newsletter, so plenty of hype of course. But nonetheless “Goldfinger” made one interesting point about what the Chinese have been doing recently – which may surprise many people.

Then Rickards looks at how this might be about to change.

Thoughts from Jim Rickards “Goldfinger” Industry Contact

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

Coincidentally we also spotted an article from Hugo Salinas Price which we reposted this week. It was actually a presentation he gave in Russia at the invitation of the Russian Deputy Prime Minister. But not on gold.

Rather on the very positive impacts it could have if Russia were to implement a 1/2 ounce “Silver Ruble”. This is similar to Price’s argument for a silver Libertad in Mexico. But he goes into quite some detail on the global impacts such a move by Russia would have.

The Silver Ruble Coin for Russia

Coincidentally we also spotted an article from Hugo Salinas Price which we reposted this week. It was actually a presentation he gave in Russia at the invitation of the Russian Deputy Prime Minister. But not on gold.

Rather on the very positive impacts it could have if Russia were to implement a 1/2 ounce “Silver Ruble”. This is similar to Price’s argument for a silver Libertad in Mexico. But he goes into quite some detail on the global impacts such a move by Russia would have.

The Silver Ruble Coin for Russia

The Greens are again pushing for the implementation of a deposit guarantee scheme in New Zealand. That generated some discussion again this week. See this article and short video.

The Greens are again pushing for the implementation of a deposit guarantee scheme in New Zealand. That generated some discussion again this week. See this article and short video.

It doesn’t seem that the government is too interested in implementing this though.

Especially when these same depositor “hair cut” schemes have now been implemented around the world in the likes of Canada, Australia, USA etc. Albeit to handle deposits above their insurance levels. (Often around $100,000 to $250,000 is the maximum coverage in these other nations).

But rather than rely on a government mandated insurance scheme, set up your own “deposit insurance”. Get some gold or silver and store it outside of the banking system and rest easy at night.

You know where to come to get some peace of mind.

Free delivery anywhere in New Zealand

The free delivery offer continues. Boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,390 and delivery is now about 7-10 business days.

It doesn’t seem that the government is too interested in implementing this though.

Especially when these same depositor “hair cut” schemes have now been implemented around the world in the likes of Canada, Australia, USA etc. Albeit to handle deposits above their insurance levels. (Often around $100,000 to $250,000 is the maximum coverage in these other nations).

But rather than rely on a government mandated insurance scheme, set up your own “deposit insurance”. Get some gold or silver and store it outside of the banking system and rest easy at night.

You know where to come to get some peace of mind.

Free delivery anywhere in New Zealand

The free delivery offer continues. Boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,390 and delivery is now about 7-10 business days.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.