It’s interesting to read outsiders perspectives of what’s happening in New Zealand. The land of the long white cloud got a mention over recent months on various websites.

The comments didn’t really fit under a particular heading. So we’ve just lumped them together here under the title “New Zealand in the News Around the World”. As they are all from non New Zealand websites. And “For All the Wrong Reasons”, well, because they are.

Governments Try to Stem the Tide on Housing Inflation

First up on wolfstreet.com they discuss how real estate firms in Canada, Australia, New Zealand, and other countries have been promoting their homes to investors in China. Setting up units in China and partnering with Chinese real estate portals, such as Juwai.com.

And how doing expos and conferences in China to lure investors has “worked like a charm”.

They look at how various government have responded to this including New Zealand’s. But that these policies are all in the “trial and error” stage.

Doug Casey Does Not Have High Opinions on the Ardern/Peters Government

While interviewed on the current crisis in Argentina, Doug Casey of Casey Research recently talked about how he thinks New Zealand is going downhill rapidly:

“Justin: So, are you still optimistic about Argentina? I ask because you recently told me that Argentina was one of the only countries in the world headed in the right direction. Do you still think that, given what’s happened recently?

Doug: Yes. They’re absolutely moving in the right direction. But, like I said, they’re doing one smart thing followed by one stupid thing. Two steps forward, one step back. But that’s better than doing one stupid thing after another. The previous government, under Cristina Kirchner, did something unbelievably stupid every single week—nothing intelligent, ever. If she’d been re-elected, Argentina would have moved in the direction of Venezuela, or at least Bolivia.

But let me say this. The average voter, anywhere in the world, has no philosophical bearing whatsoever. Look at New Zealand. By the mid-1980s, the country had become the shallow end of the gene pool. Anybody with any sense and enough money to buy a ticket to Sydney, London, or LA was getting out.

Then, Roger Douglas, a reformed socialist, started deregulating the economy, cutting taxes, and privatizing. The place boomed. It became an extremely prosperous country in the ’90s, ’00s, and early teens. Everybody started doing well. The currency got strong, it doubled against the US dollar. Real estate prices tripled and quadrupled.

But what did the stupid Kiwi voters do after 30 years of good times? They elect a 37-year-old female, who’s a hardcore communist. Now New Zealand’s going downhill rapidly.

And as corrupted as the average Argentine voter has become over the last 70 years, I don’t know if they can handle four years of a good thing. That may be too much to bear. So, they might elect someone even worse than Cristina after Macri. It’s unpredictable.

But we really shouldn’t be worried about what happens with Argentina. Instead, we should be worried about what comes after Trump. Because the chances are excellent that we’ll be deep in stage two of The Greater Depression by then. Perhaps we’ll also be in something resembling World War III. The next president of the United States is likely to be extremely dangerous.

It might be a bit harsh to say New Zealand is “going downhill rapidly“. But as we wrote yesterday some hard numbers are pointing to a definite slowing. See: NZX50 Near Highs But This Indicator Says the NZ Economy is Slowing Sharply

NZ Was Spared in the Last Crisis, But Could Be At the Forefront of the Next One

A recent Wall Street Journal article poses an interesting theory (hat tip to Money Morning NZ for highlighting this one). That being:

“Countries hard-hit by the financial crisis have spent much of the decade since trying to fix their banks. Countries that escaped unscathed have done the exact opposite, going on a borrowing binge that makes them prime candidates to be victims of any credit squeeze resulting from rising U.S. interest rates.”

The author identifies 5 such countries and New Zealand is among them:

- Australia

- Canada

- Sweden

- Norway

- New Zealand

Ian Harnett, chief investment strategist at Absolute Strategy Research in London, says that Norway and New Zealand were:

“Helped by a mix of commodities and exports to China they avoided the worst of the credit crunch in 2008-09, but still benefited from the low global rates that followed. “The result was they got the wrong price of capital,”…

“….Lots of lending, even into a rapidly rising housing market, doesn’t mean disaster is inevitable. If loans are used productively they can boost economic growth and be easily repaid, while a strong economy can cope with bad loans. But rising private debt in general and mortgage debt in particular is one of the most reliable indicators of trouble ahead, because it makes a country more vulnerable to economic or financial shocks.

Look at house price to income ratios. In 2007 the housing bubbles of Ireland and Spain led the world on this measure, according to OECD data. Now Canada, Australia and Sweden, along with New Zealand and Norway, are well ahead of other developed countries—and close to the Irish and Spanish 2007 levels.

Sweden, Australia and Canada have a multiplying factor if trouble hits: Banks are financing themselves abroad, often on a fairly short-term basis. This exposes them to any tightening of global funding conditions; both after Lehman and in the 2011-12 eurozone panic troubles were exacerbated by a shortage of dollars outside the U.S.

Foreign financing creates a dilemma for central banks when a disaster hits. If they cut rates to help domestic borrowers, the currency will weaken and banks will pay more for foreign funding. But if they raise rates to support the currency, domestic borrowers are more likely to default on the banks.”

The full article is worth a read. See: To Spot the Next Financial Crisis, Look Who Was Spared by the Last One

(Note: If that link requires you to login to the WSJ, just google the title “To Spot the Next Financial Crisis, Look Who Was Spared by the Last One” and that should let you access it without a subscription.)

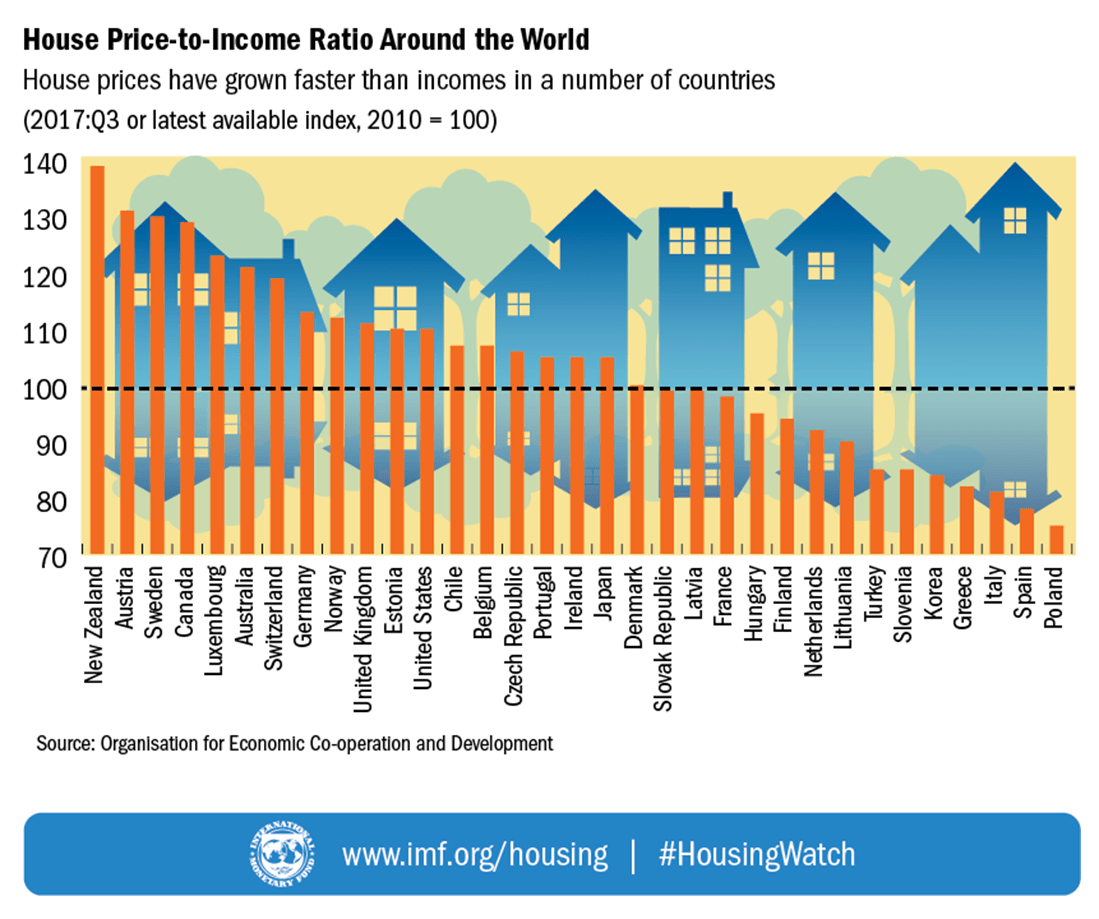

IMF: New Zealand Has the Worst House Price to Income Ratio in the OECD

According to the IMF New Zealand has the worst house price to income ratio in the OECD:

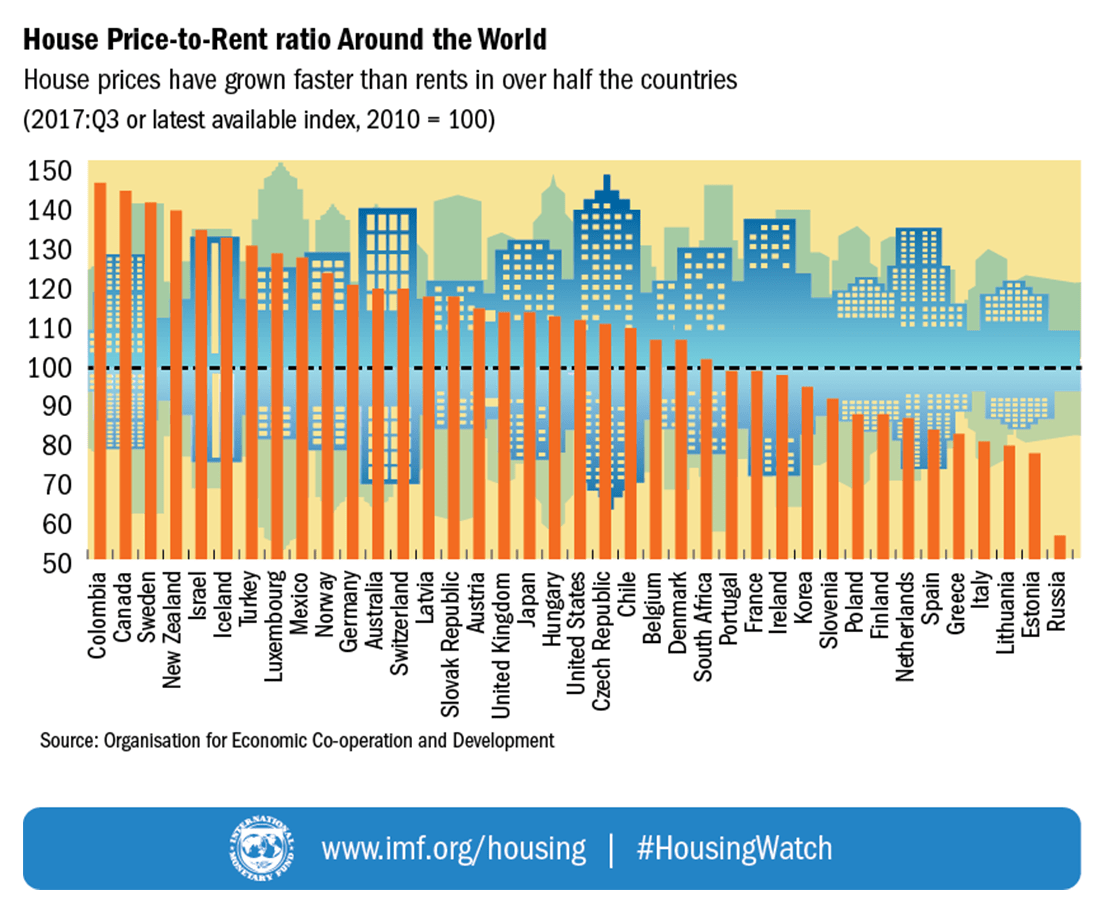

But rents are also out of whack with house prices. NZ comes in at number 4 on that list:

Source: http://www.imf.org/external/research/housing/

As the Wall Street Journal points out all 5 countries rank highly on house price to income measures. They also all feature highly in the rents to house prices list.

So eventually either rents rise further or house prices fall. Or maybe a bit of both.

Rents are already crazy high and very unaffordable for large swaths of the population here in New Zealand. They could well edge higher, but the odds of them closing the gap and catching up fully with house prices seems slim. Especially with inflation accelerating at its fastest pace in seven years, cutting further into the average Joe’s disposable income.

So New Zealand certainly appears vulnerable.

Are you prepared just in case this author is right?

Counterweight your real estate exposure by buying precious metals.

Read more: A House Price Crash Caused By the New NZ Government Policies?

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide

Pingback: NZ Dollar Falls - Why has the NZ Dollar Weakened and Where to Now? - Gold Survival Guide