This Week:

- RBNZ Cuts Rates – ANZ increases Deposit Rates. Huh?

- Here’s Why the NZ Dollar is Still Rising

- Should We Just Not Worry About Inflation?

- Why NZ Doesn’t Need Anymore Inflation

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1855.68 | – $46.91 | – 2.46% |

| USD Gold | $1346.85 | – $11.60 | – 0.85% |

| NZD Silver | $27.85 | – $0.75 | – 2.62% |

| USD Silver | $20.22 | – $0.20 | – 0.97% |

| NZD/USD | 0.7258 | + 0.0118 | + 1.65% |

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1795 |

| Buying Back 1kg NZ Silver 999 Purity | $858 |

We’ve got half a dozen articles on the website this week so we will try and keep the newsletter brief so you can get to those all linked at the end as usual…

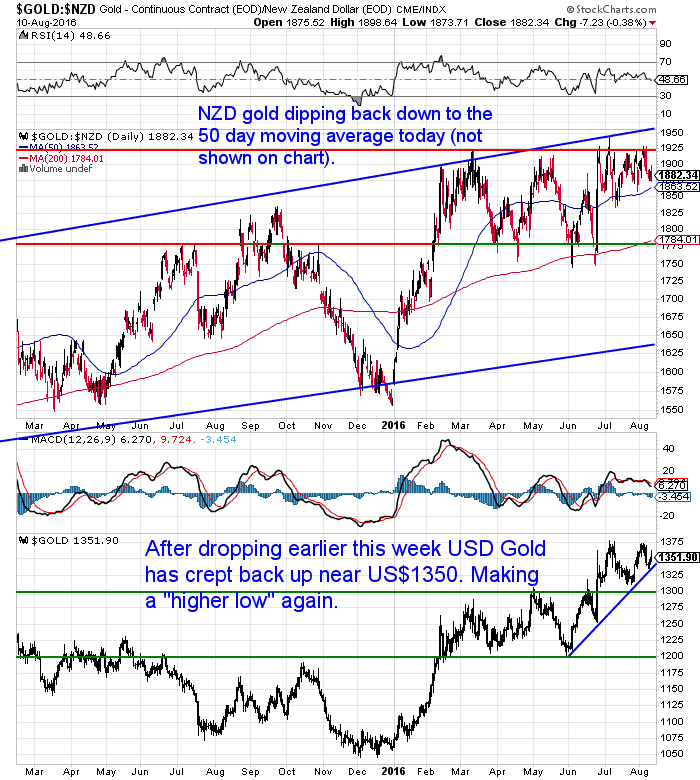

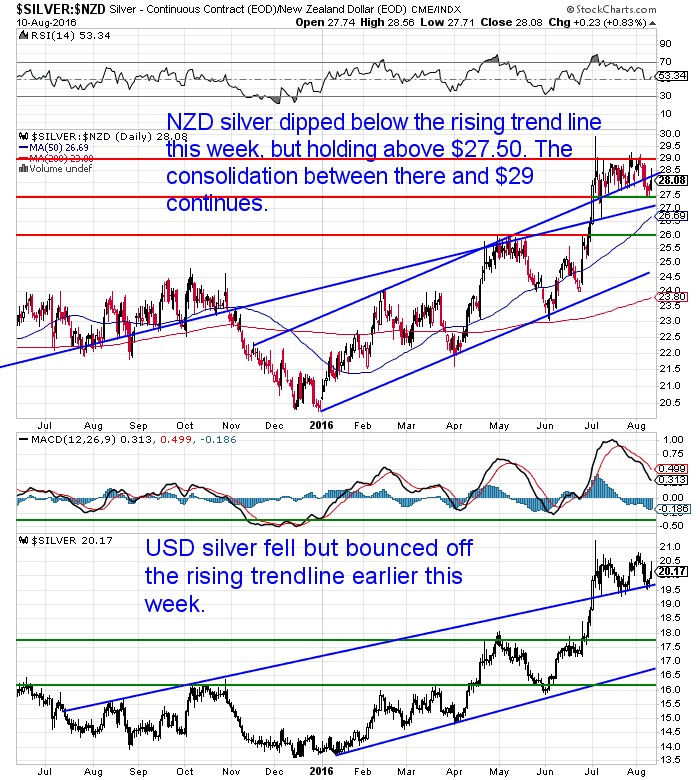

Both metals are down sharply on last week by around 2.5%.

Looking at the charts though shows we are still in the same sideways trading pattern we have been for over a month.

Gold in NZ dollars remains stuck in the range between the 50 day moving average and $1925. It has been making “higher lows” all month but thus far hasn’t managed to get above that elusive $1925 level.

Silver had a sharp fall and dipped below one of the rising trend lines. But continues to consolidate between $27.50 and $29.00. Holding up remarkably well.

The NZ Dollar was the big mover today. With the RBNZ “only” cutting interest rates by 0.25% this seemed to surprise many who were expecting a 0.50% cut. As a result the Dollar jumped sharply back up to 0.73 following the announcement.

RBNZ Cuts Rates – ANZ Increases Deposit Rates. Huh?

To our mind there was more interesting news than the rate cut itself.

ANZ announced they would only be passing on one fifth of this cut to their mortgage holders. A 0.05% cut. But they would then be increasing deposit rates by up to 0.3%.

Their rationale for this was that it would help customers grow their savings:

- “On the deposits side, we have five times as many customers as those with home loans. Lifting term deposit rates will help customers grow their savings,” Hisco said.

- “We are sending a strong signal today to New Zealanders that at a time of record low interest rates, it is more responsible to pay down home loans and save, than borrow more. New Zealanders need to consider changing their financial strategies.”

- Source.

How altruistic of them! But we have serious doubts that a desire to help their customers is is the real reason.

Perhaps a more likely reason is one we saw mentioned earlier this week, when this same situation occurred in Australia.

- “…after the RBA’s rate cut: the same day, the banks announced that they would, as expected, cut their mortgage rates and some other loan rates, but would also raise their term deposit rates for savers– and by a whole whopping lot.

- Why would banks raise their deposit rates as the central bank cuts its rates? In other words, why would banks raise their cost of funds (deposit rates) while lowering their revenues (lending rates), thus crushing their spreads – and thus their profit margins? Among the big four banks, the movements were nearly panicky:

- CBA will raise its one-year term deposit rate by 0.55 percentage points to 3% and its two-year and three-year deposit rates by 0.50 percentage points to 3.1% and 3.2% respectively, effective August 19.

- NAB will raise its eight-month term deposit rate by 0.85 percentage points to 2.9%!

- ANZ will raise its one-year advanced notice term deposit rate by 0.60 percentage points to 3% and its two-year advanced notice term deposit rate by 0.75 percentage points to 3.2%.

- Westpac will raise its one-year term deposit rates by 0.55 percentage points to 3%, its two-year deposit rate by 0.45 percentage points to 3.1%, and three-year deposit rate by 0.55 percentage points to 3.2%.

- These are a mega increases of deposit rates!

- …That these banks jacked up their deposit rates, even as the RBA cut its rates, is a sign that they might be encountering trouble with wholesale funding. Their exposure to the Australian housing bubble and to a slowdown in China has been well known for a while, and we’ve written about it for over a year. Banks around the globe are now possibly getting nervous, or even a little spooked, and might be reluctant to lend to Australian banks, which would make wholesale funding harder to find, and more expensive.

- And so the Australian banks want to entice depositors to lend them money. These term deposits would provide stable funding that cannot be withdrawn easily. But they come at a much greater cost. And that banks would be desperate enough to do that is a sign of possibly serious funding issues. If push comes to shove, efforts to bail them out will be made. But it remains uncertain how to bail out four banks whose assets are 220% of the country’s GDP.”

- Source.

We have read about the increased cost of wholesale offshore funding recently. Even in the face of falling interest rates. Along with the rising cost of credit default swaps (insurance against default) in Australia and NZ

So perhaps this could be a reason for the move by ANZ here as well? Maybe the cost of offshore funding has risen for the ANZ too?

We’ve reported before that the level of NZ banks wholesale offshore funding has fallen compared to 2008. But from memory this figure is still just under 30%. And given our ongoing current account deficit where as a nation we spend more than we produce, it simply cannot disappear, as we require funds from offshore to keep the merry-go-round turning.

(Note: This article also looks at other possible reasons (none good) why the Aussie banks raised deposit rates after the recent RBA rate cut. Worth a look. Australia’s WTF Moment)

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Should We Just Not Worry About Inflation?

There is more talk here lately that the central bank monetary policy is broken, but what should we do about it?

Our answer remains a simple one. Get rid of central banks altogether and then we won’t need “monetary policy”.

But that is not likely any time soon so what is?

This article is not dissimilar to many overseas we’ve read in recent months where the theory is that we should just not worry about inflation:

- “So, I think we do need to be bold and say that for now we aren’t going to worry about inflation. But, of course there needs to be agreement with the Government that this is what would be done.”

- “Inflation targeting is dead. But what to replace it with? For now, targeting growth would seem the answer. But how best to do that?”

- Source.

Odds are this “growth targeting” is what eventually leads to “helicopter money”. That is debt being monetised to fund infrastructure spending. Or rather money printing that the government spends rather than it being dished out to commercial banks.

Another article hints that perhaps this might be the government answer too:

- “The only quick-fix that I can see would be for the government to abolish inflation targeting and unleash a tidal wave of inflation to shrink household debt. While that may rescue those who have borrowed beyond their means, it would come at a massive cost. The economic fallout of such a policy would be disastrous, to put it mildly, and would punish households that have chosen not to ride the exuberance of the property market. Let’s hope it never comes to that.”

The author a senior lecturer in economics at the University of Auckland also points out that:

- “Rock-bottom mortgage rates make it tempting to borrow huge sums of cash from the bank. But households should consider much more than the current level of interest rates when making that decision. Low interest rates are not manna from heaven – they are a consequence of the economic climate and tell us something about where the economy is headed. Take heed of all the information before taking the plunge.”

- Source.

Take heed indeed.

Why NZ Doesn’t Need Anymore Inflation

Speaking of inflation, the below linked article does well in explaining how inaccurate the measures of inflation in NZ are anyway. And why we probably don’t really need any more of it than we have already. An opinion that is in the distinct minority amongst financial commentators.

Fergus Hodgson: Country does not need more inflation

Here’s a thought that just popped into our head tying all this together.

With the ANZ raising deposit rates and their head “encouraging” people to save money in the bank.

Maybe people will?

Then maybe the central planners do away with “inflation targeting”, change to “growth targeting” and then finally unleash the inflation. So the good little people will be trying to save only to then see their savings rapidly eroded?

Here’s Why the NZ Dollar is Still Rising

Here’s why the New Zealand Dollar is still rising even after a 0.25 interest rate cut by the central bank today. The Daily Reckoning reports:

- “Gold is set to benefit from a “perfect storm” of dwindling investment alternatives and greater investor risk, according to the August report of the World Gold Council (WGC).

- It says central banks are increasingly pulling out all the stops to stimulate growth, which has driven yields on government bonds to absurdly low levels. Fewer than 40% of government bonds around the world available to average investors have a positive yield, and only 17% yield more than 1%.”

New Zealand government bonds are included in that 17% that “yield more than 1%”.

So despite the Reserve Bank’s best efforts the dollar remains up. They will continue to try and talk it down, but there is a lot of money across the planet searching for anything resembling a yield. It will continue to find it’s way down here most likely.

But in a world where only 40% of government bonds are positive, this money will also flow into gold. Because while gold doesn’t yield anything, zero is much better than negative! More and more people are slowly realising this.

But we have a long way to go yet. The below chart of world asset values shows gold is still extremely under-owned at less than 0.5% of financial assets.

Eventually many more will move into gold and silver. It would be a good idea to get yours before they do.

Silver Coins For Emergencies

If you’d like to follow Jim Rickards advice from last week and grab some silver coins to stash away just in case, we still have a couple of options.

There are still around 2500 silver fern coins available at lower than normal pricing of spot + 15%. Refer to the start of this email

Or Royal Canadian Mint 1oz silver maples. There is free shipping on boxes of 500 x 1oz Canadian 9999 purity Silver Maples delivered to your door via UPS, fully insured until you sign for them.Price today is $16,310.

Delivery in approx 7-10 business days.

Lastly, don’t forget to check out all the articles posted on the site this week linked below.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

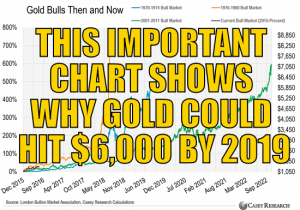

This Important Chart Shows Why Gold Could Hit $6,000 by 2019Thu, 11 Aug 2016 9:53 AM NZST  Check out this historical evidence that shows not only how much higher gold could go, but just as importantly how low it could fall and still not really matter in the long run… This Important Chart Shows Why Gold Could Hit $6,000 by 2019 By Justin Spittler Editor’s note: Today, in place of our usual […] Check out this historical evidence that shows not only how much higher gold could go, but just as importantly how low it could fall and still not really matter in the long run… This Important Chart Shows Why Gold Could Hit $6,000 by 2019 By Justin Spittler Editor’s note: Today, in place of our usual […]

|

Rickards: No, This Won’t Cause a Gold Shock (Something Else I’ve Just Exposed Will)Thu, 11 Aug 2016 9:44 AM NZST  In this piece Jim Rickards hints at what he thinks might cause a much higher run in gold without actually covering it specifically. Read on to the end and we’ll be back to fill you in… The market has the technical setup for the greatest gold shock in history. When it rocks markets, gold will […] In this piece Jim Rickards hints at what he thinks might cause a much higher run in gold without actually covering it specifically. Read on to the end and we’ll be back to fill you in… The market has the technical setup for the greatest gold shock in history. When it rocks markets, gold will […]

|

Gold Stocks Versus Bullion: Inflation 101Wed, 10 Aug 2016 1:17 PM NZST  For the second week running we have Stewart Thomson with his Graceland Updates pointing out why inflation may actually be the risk people should be concerned with… Graceland Updates By Stewart Thomson Gold price bulls and bears may all be getting a bit frustrated now, as gold refuses to follow their predicted paths, and […] For the second week running we have Stewart Thomson with his Graceland Updates pointing out why inflation may actually be the risk people should be concerned with… Graceland Updates By Stewart Thomson Gold price bulls and bears may all be getting a bit frustrated now, as gold refuses to follow their predicted paths, and […]

|

Why Doug Casey Thinks We Could See $5,000 GoldWed, 10 Aug 2016 12:38 PM NZST  The Bank of England – one of the world’s biggest central banks – just swung its “sledgehammer” in response to the volatility and shock caused by the recent Brexit vote. Learn about what else may yet happen in Britain and the impact this is having on gold… Why Doug Casey Thinks We Could See $5,000 […] The Bank of England – one of the world’s biggest central banks – just swung its “sledgehammer” in response to the volatility and shock caused by the recent Brexit vote. Learn about what else may yet happen in Britain and the impact this is having on gold… Why Doug Casey Thinks We Could See $5,000 […]

|

After 100%+ Gains, Is It Too Late to Buy Gold Stocks?Wed, 10 Aug 2016 12:01 PM NZST  Here’s a historical comparison that shows even after large gains there can still be much more to come in gold mining shares… After 100%+ Gains, Is It Too Late to Buy Gold Stocks? By Justin Spittler Editor’s note: Yesterday, we told you that there are huge money-making opportunities in the gold market that are staring […] Here’s a historical comparison that shows even after large gains there can still be much more to come in gold mining shares… After 100%+ Gains, Is It Too Late to Buy Gold Stocks? By Justin Spittler Editor’s note: Yesterday, we told you that there are huge money-making opportunities in the gold market that are staring […]

|

Don’t Buy Another Gold Stock Until You Read ThisMon, 8 Aug 2016 7:55 PM NZST  A seventh big name investor recently began singing the praises of gold. Read on to see why and how to follow his lead. Plus a chance to learn how to select gold stocks that may seriously outperform gold itself… Don’t Buy Another Gold Stock Until You Read This By Justin Spittler Today is a very special […] A seventh big name investor recently began singing the praises of gold. Read on to see why and how to follow his lead. Plus a chance to learn how to select gold stocks that may seriously outperform gold itself… Don’t Buy Another Gold Stock Until You Read This By Justin Spittler Today is a very special […]

|

Why silver may continue to rise against the oddsThu, 4 Aug 2016 6:36 PM NZST  This Week: Reader Sentiment: Contrarian Indicator Silver or Gold? Why Cutting Interest Rates Doesn’t Work Reader Theories on the ANZ Chief’s Housing Warning LATE UPDATE: Spot prices have dropped a little So Gold Kiwi’s are now $1964 Silver Ferns are now $1300 for 2 tubes of 20 Prices and Charts Spot Price Today / oz […] This Week: Reader Sentiment: Contrarian Indicator Silver or Gold? Why Cutting Interest Rates Doesn’t Work Reader Theories on the ANZ Chief’s Housing Warning LATE UPDATE: Spot prices have dropped a little So Gold Kiwi’s are now $1964 Silver Ferns are now $1300 for 2 tubes of 20 Prices and Charts Spot Price Today / oz […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

|