The New Zealand Dollar has been falling since the start of the year. But at the end of February it dropped sharply. This was likely due to the expectation that New Zealand would be more seriously impacted by the Coronavirus outbreak than markets had previously been expecting.

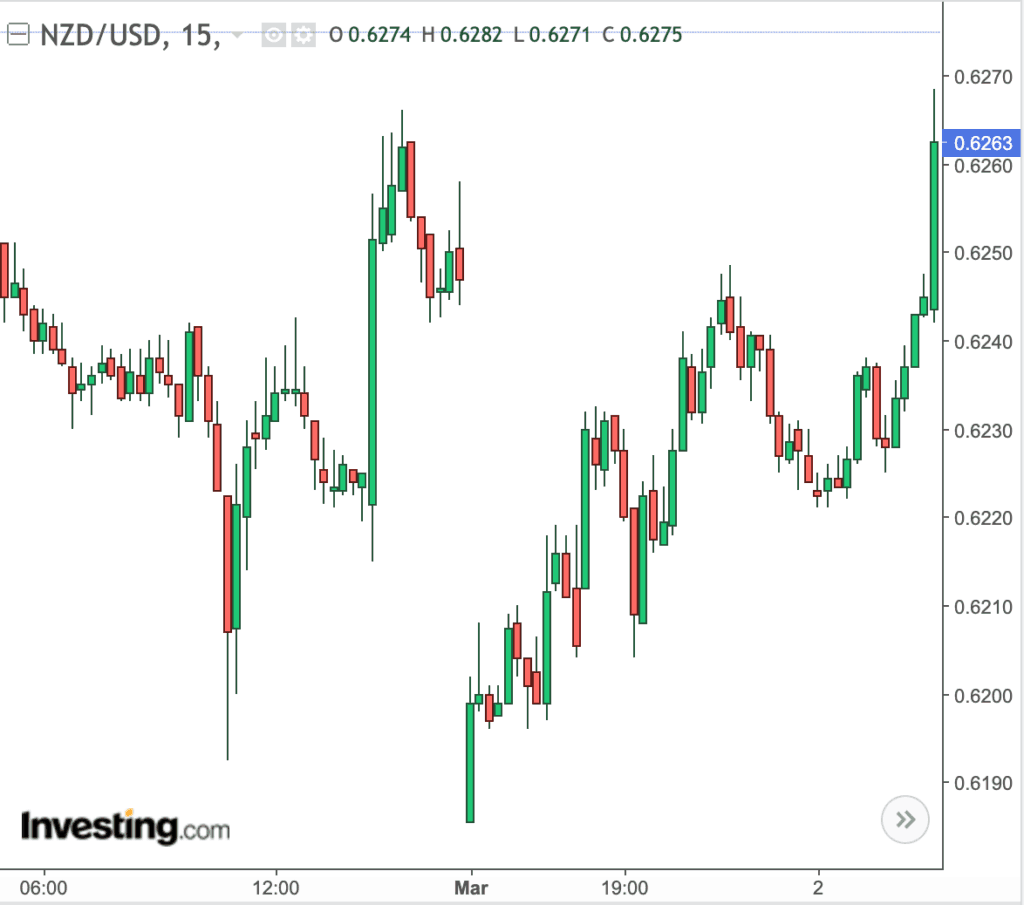

The New Zealand dollar plummeted briefly below 0.6200 before recovering.

Source: Investing.com

Since then the NZ dollar had staged somewhat of a comeback. Getting back above 0.6300 in the first few days of March.

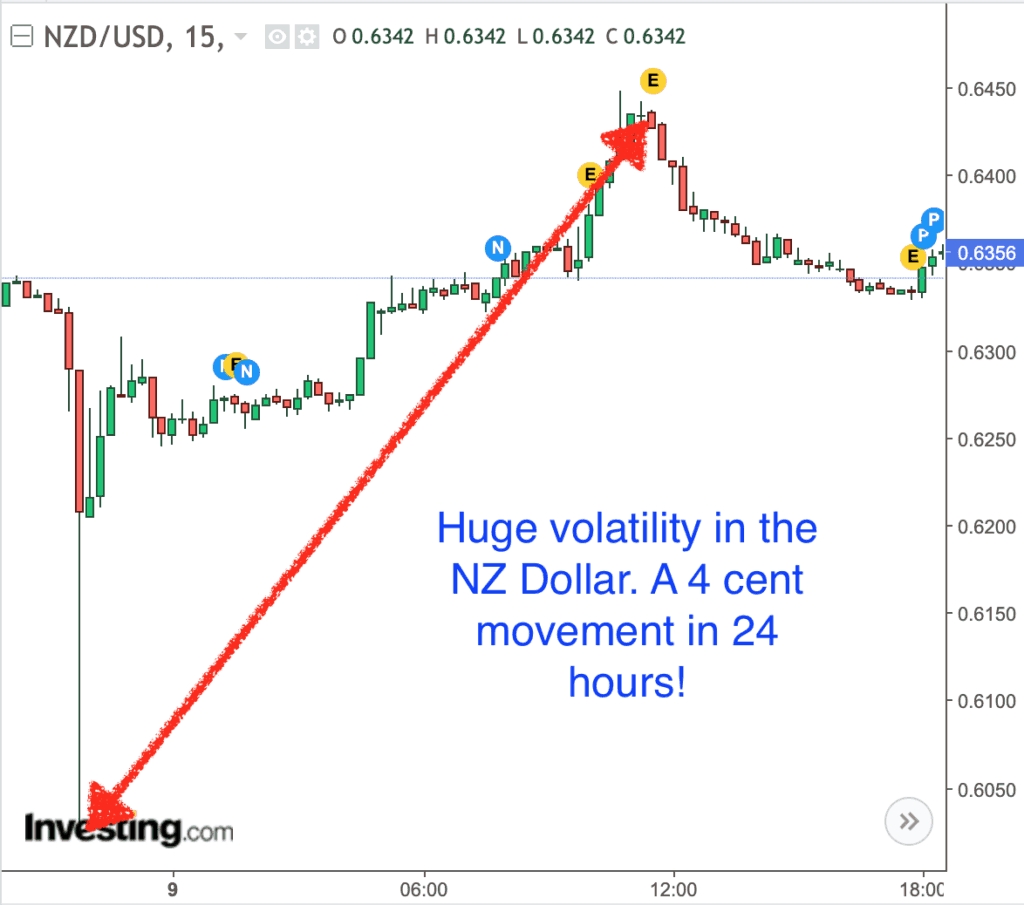

However on the 9th March, the Kiwi had another plunge. Dipping again to briefly touch 0.6050, before staging a quick recovery. This was as oil plunged 25%. Currently the NZ dollar is back above 0.6300 after rising 4 cents! Huge volatility.

The New Zealand Dollar Fell Throughout 2018 and 2019 Too

The recent fall comes on the back of the New Zealand dollar also spending most of 2018 and 2019 dropping too.

In March 2019 the Reserve Bank of New Zealand (RBNZ) did a surprise about face on interest rate rises.

Announcing that an interest rate cut was likely to be the next move they made. This was a marked change from previous announcements where the NZ central bank had said the next move could be either up or down.

“Economists believe the Official Cash Rate could be cut as soon as May or August, following the Reserve Bank’s comments last week. The RBNZ shocked the market last week by stating the next OCR move is “likely to be down”, due to weak growth here and overseas.”

Source.

Of course, since then we have seen the Official Cash Rate (OCR) actually cut twice to a record low 1.00%.

Why Did the NZ Dollar Fall in Recent Years?

Throughout 2018 and 2019 the falls in the New Zealand dollar have been due to some perceived negative news for the New Zealand economy:

- Low inflation – to central bankers this indicates they will need to stimulate the economy. i.e. lower interest rates.

- The reduced likelihood of interest rate rises – in fact the likelihood of cuts meant the N.Z. dollar was less attractive compared to some other currencies to overseas investors. As they could find higher interest rates elsewhere.

- Worsening business sentiment – this also pointed to the likelihood of interest rates being cut.

Why Has the NZ Dollar Been Falling in 2020?

After a recovery in the last quarter of 2019, the New Zealand Dollar started 2020 by falling again.

The spread of the Coronavirus has served to push the Kiwi even lower. With the expectation that NZ business will be affected by less tourists. Along with key industries such as forestry experiencing a serious loss in demand.

Why Are Interest Rates So Low and Likely to be Cut Further? And Therefore Why Might the NZ Dollar Stay Low or Go Lower Too?

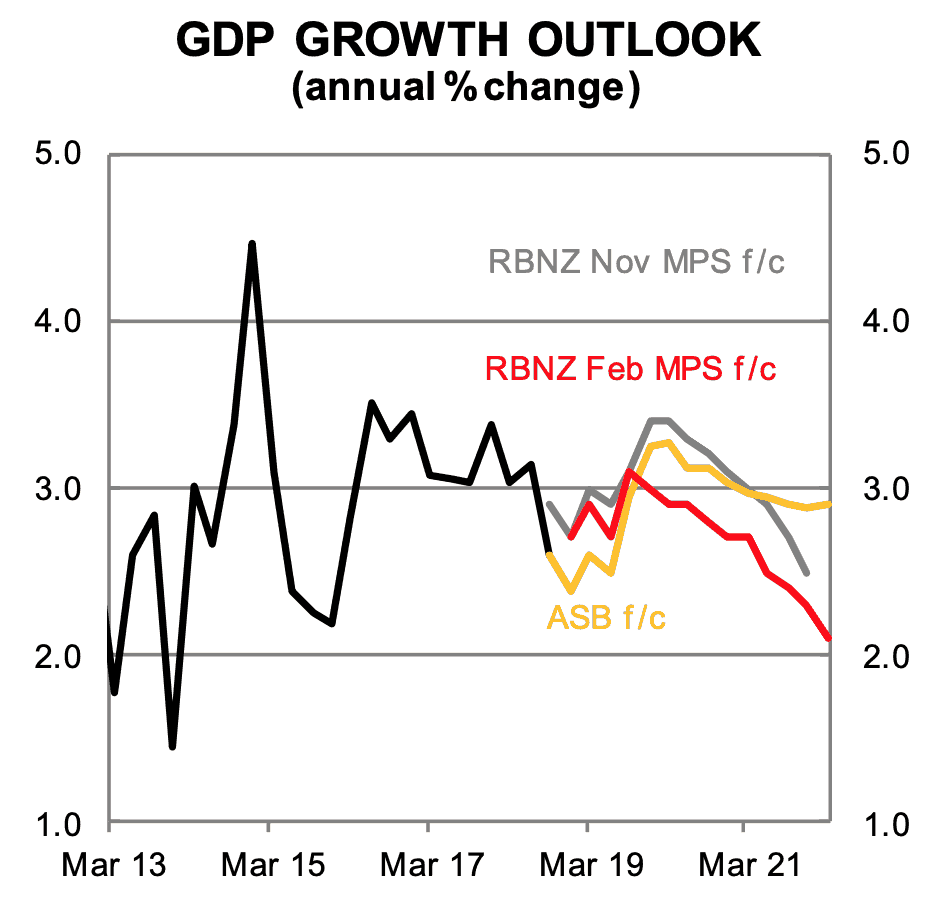

The Reserve Bank of New Zealand forecasts have been well off the mark in recent years.

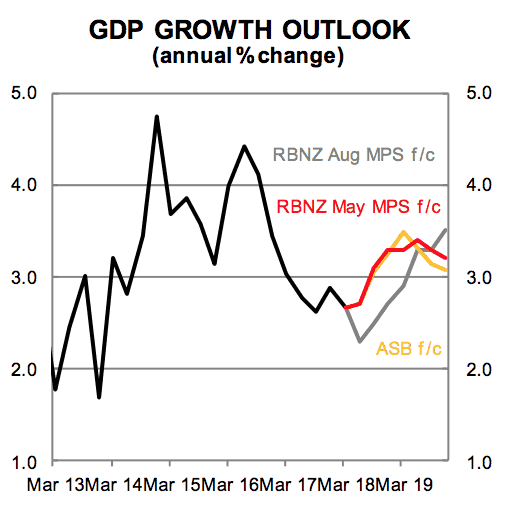

In August 2018 the RBNZ believed growth would slow in New Zealand throughout 2018. But then would get back above 3% in 2019 due to government spending and monetary stimulus. This was worse than the previous RBNZ monetary policy statement in May 2018.

Below was the ASB and RBNZ forecast as of August 2018:

Source. ASB

But the situation deteriorated after August 2018. Instead of growth picking up after 2019, the bank and central bank forecasts were then for growth to fall. The RBNZ said down towards 2%.

However as you can see from the 2 charts above, in every monetary policy statement the forecast was lower than the one previous.

In August 2019 we said that:

“…our guess is the RBNZ and bank economists will make further adjustments lower yet in the months to come.

Despite what the government would like us to think, it is not just business confidence that is down. The New Zealand economy certainly appears to be slowing. Last year we reported that the New Zealand economy looks to have topped out and is slowing.

Reports this year are also backing this up: “Employment market goes cold”

Along with other recent headlines such as these:

- Beyond weak business confidence, there are concerning signs in the economy.

- NZ MARCH MANUFACTURING EXPANSION SLOWS TO LOWEST PACE SINCE LAST JULY

These economic numbers indicated the New Zealand economy had topped out and was slowing (possibly why the NZ dollar also topped out in 2019?).”

Refer to these reports from 2018 for more on why the NZ economy may have turned:

New Zealand in the News Around the World – For All the Wrong Reasons

Net Migration Falling – Could This Tip NZ into Recession?

NZX50 Near Highs But This Indicator Says the NZ Economy is Slowing Sharply

Corona Virus Means Further Interest Rate Cuts Now Likely

Back on the 12 February 2020 the Reserve Bank said:

“…economic growth “is expected to accelerate over the second half of 2020”, and said the outlook for the economy was brighter amid increased infrastructure investment from the government. The Reserve Bank’s forecast OCR track now has no further cuts penciled in, and has a hike forecast for 2021.

Back then we said: “It seems to us that the RBNZ forecast for an interest rate rise in 2021 looks pretty shakey at the moment.”

Source: RBNZ: CoronaVirus No Big Deal?

But on the back of rate cuts in Australia and the USA, bank economists have already started to back track. On the 4th March the ASB said interest rate cuts were likely here in New Zealand too:

“Yesterday afternoon, after the Reserve Bank of Australia’s 25bp cash rate cut, we changed our OCR forecast to predict imminent OCR cuts. Until very recently, central banks had sounded reluctant to respond – that bar has quickly dropped considerably. The US Federal Reserve’s decision this morning to cut the Federal Funds rate by 50bp between scheduled meetings has strongly reinforced that view of a low threshold for the RBNZ to act.

We have pencilled in 25bp cuts for each of the March and May meetings, taking the OCR to a fresh low of 0.5%.”

This will be quite an about face given what the RBNZ said just 3 weeks prior.

What Does the Weaker NZ Dollar Mean For New Zealanders?

A weaker New Zealand dollar is a mixed bag. Normally it’s likely to be good for tourism, making New Zealand more affordable – well to Americans at least anyway. As rising interest rates and comparatively strong growth in the USA have been sucking capital back to the USA. And so it hasn’t just been the Kiwi dollar getting weaker against the US dollar. Many other currencies have too.

However the virus is likely to reduce travel globally. So tourism probably won’t be much help in this current environment.

A weaker Kiwi will make New Zealand exports more attractive. So exporters may sell more goods.

But conversely, anything New Zealand imports will be more expensive. And we are back to importing more than we export with the balance of payments deficit recently widening to the worst in a decade. Fuel is likely to get more expensive (although yesterdays oil plunge may make up for that) and consumer goods will cost more.

So overall a weaker NZ dollar is not great for the average man or woman in the street.

Where to Now for the Kiwi Dollar?

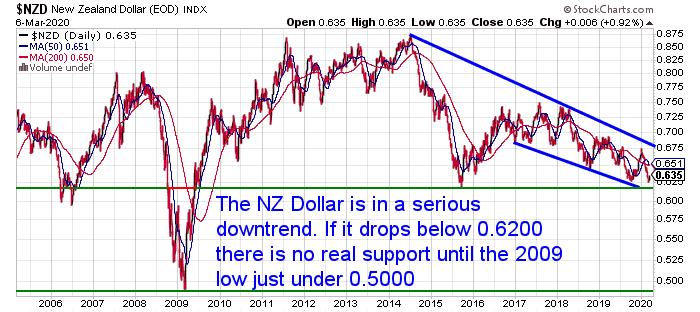

As noted already, the New Zealand dollar has spent most of 2018 and 2019 falling, as news surrounding the NZ economy worsened.

It looked like the Kiwi was staging a recovery in late 2019. But we are now back near the 2019 lows.

The odds currently favour an even lower dollar in the medium term. Due to likely lower interest rates to come.

The next line of support is just below 0.62. This is the 2015 low.

But, if the 0.62 to 0.60 area is broken, there is no major support until the 2009 lows at 0.50!

What to Do About a Weaker NZ Dollar?

If the New Zealand dollar weakens further, your everyday costs in New Zealand will likely rise. So what do you do to protect yourself?

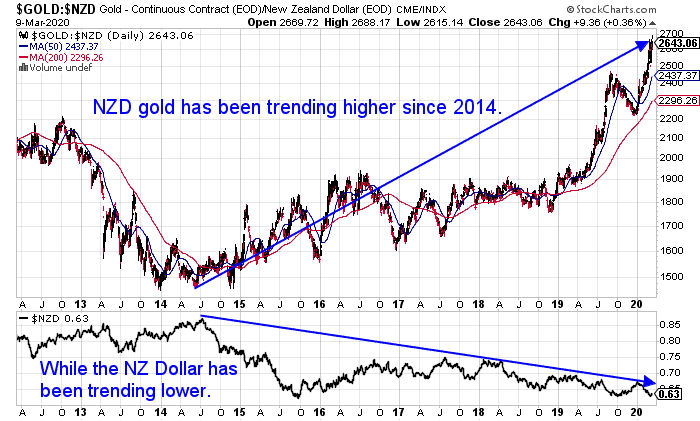

Gold as a Hedge Against the Falling NZ Dollar

You could hold US dollars as a hedge against the NZ Dollar dropping. However as all currencies are being devalued in the long run (including the US dollar), buying precious metals like gold and silver can act as an excellent long term hedge against a falling New Zealand dollar.

The chart below clearly shows how buying gold in New Zealand since 2014 has (more than!) made up for the falling New Zealand dollar. (The NZ Dollar is down roughly 28%, while Gold in NZ dollars is up about 80%).

You can learn more about buying gold in our 19 Nuggets of knowledge ebook. Download that for free here.

Read more: Why Buy Gold? No Fiat Currency Lasts Forever – What About the NZ Dollar?

Editors Note: This post was originally published 14 August 2018. Updated 18 April 2019 to include new reports that have impacted the NZ dollar. Last updated 10 March 2020 with the latest charts and reports.

Pingback: Silver and the US Dollar: Will History Rhyme?

Pingback: The RBA is Destroying The Australian Economy…and No One Cares. Is the RBNZ Destroying the New Zealand Economy Too? - Gold Survival Guide

Pingback: First Time Buyer Question: How is Gold Going to Trend in the Next 6 Months? - Gold Survival Guide

Pingback: A Lower NZ Dollar Isn’t All It’s Cracked Up to Be - Gold Survival Guide

Pingback: New: The Beer to Gold Ratio! - Gold Survival Guide

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide

Pingback: The 2019 Top 5: Our Most Read Articles of 2019 - Gold Survival Guide

Pingback: Gold - Once Again Best Friend in a Bear Market - Gold Survival Guide

Pingback: RBNZ Joins the Fed in the Race to The Bottom! - Gold Survival Guide