This Week:

- What Does a Trump Win Mean?

- Is Inflation Going to Surprise Us?

- RBNZ Cuts Interest Rates – NZ Government Bond Rates Rise. Huh?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1751.10 | – $32.72 | – 1.83% |

| USD Gold | $1277.60 | – $20.49 | – 1.57% |

| NZD Silver | $25.31 | – $0.14 | – 0.55% |

| USD Silver | $18.47 | – $0.05 | – 0.27% |

| NZD/USD | 0.7296 | + 0.0019 | + 0.26% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1690 |

| Buying Back 1kg NZ Silver 999 Purity | $784 |

Well. That was an action packed 24 hours!

As a “surprise” (at least to the mainstream media both in the US and here) Trump win looked likely, it seemed like the world was going to end. Share Markets tumbled across the globe and gold spiked sharply higher.

Then today we wake up to see everything apparently back to how it was. Sharemarkets have had snap-back rallies. Gold has dropped back to where it was prior to yesterday. What to make of it all?

We’ll come back to that shortly.

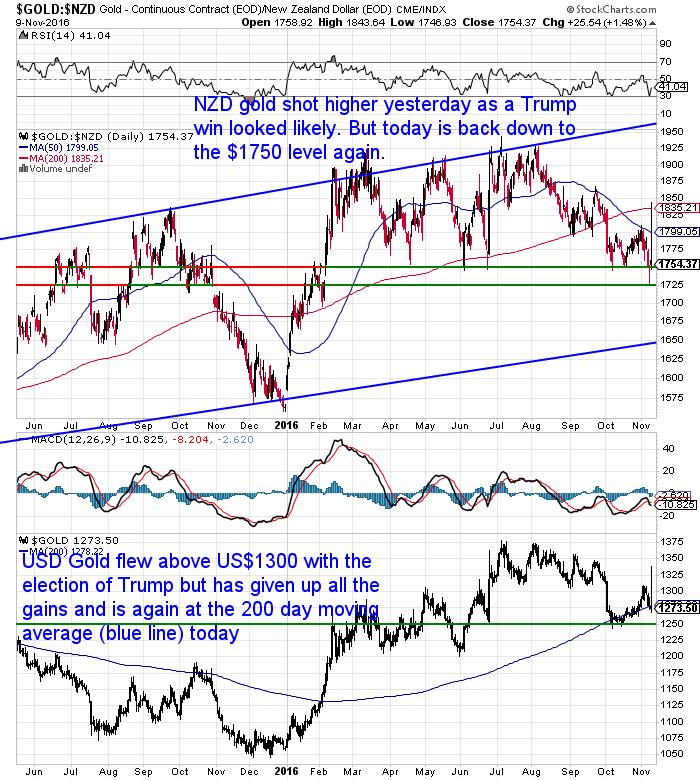

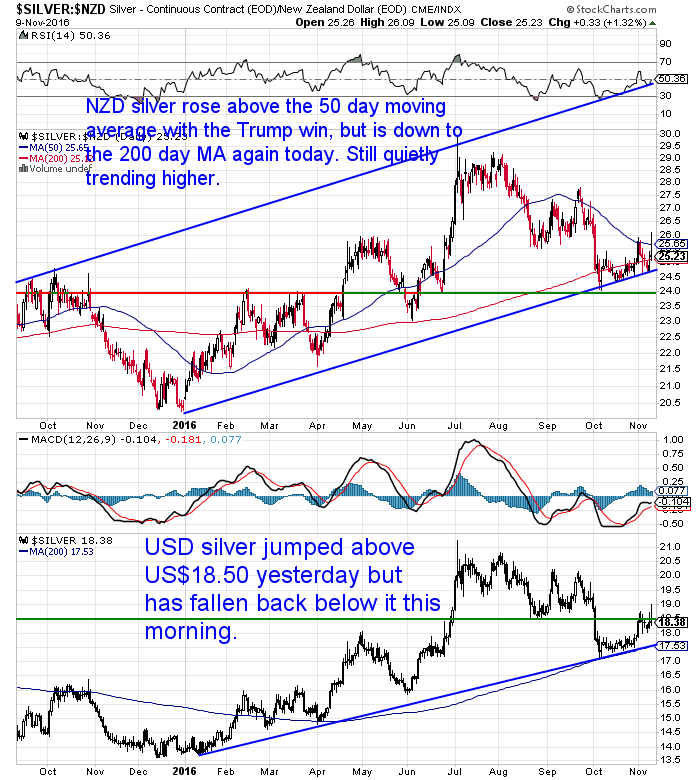

The charts show just how volatile things were yesterday and overnight.

NZD gold shot up above $1835 late yesterday. But then fell all the way back down to $1750 this morning.

Silver was very interesting to watch. It didn’t rise as sharply as gold. But today it also hasn’t fallen back so far. It is sitting just on the 200 day moving average and above the rising trendline. Unlike NZD gold, NZD silver continues to quietly trend higher over the past month.

The NZ Dollar has held up fairly well. Despite all the predictions of how Trump presidency would be so bad for us down here, the Kiwi is not far off its September highs today.

Now back to the election

We’ll try to keep it brief as we’re pretty over it too.

Why did everything reverse course today after the doom and gloom end of the world predictions on the mainstream last night?

Alexander Green reckons:

- “Pundits promised that a Trump victory would destabilize financial markets. Upon hearing a more gracious version of the president-elect than expected, however, the markets decided that perhaps this wasn’t going to be an Armageddon scenario after all.

- To be fair, we are only a few hours past the election being called for President-elect Trump as I write this on Wednesday morning. The markets also have been comforted by a major supporting factor — Republicans kept control of both houses of Congress.

- Also, we can expect a kick-start of volatility in the short term for two main reasons. The markets are going to parse every move and every announcement of the Trump administration transition team as it gets into full gear. In addition, from what we have seen of candidate Trump, President-elect Trump will be anything but boring…”

- Source.

What Will Trump Mean?

The answer seems to be “Who knows?” Trump was suitably vague in much of what he said.

As we said a couple of weeks ago it probably didn’t matter who won. The US will continue along its preordained path.

Bill Bonner summed this up this morning:

- “As we predicted, Americans got the president they deserved. Now, “no dream is too big.” No nightmare is out of bounds, either.

- Dow futures fell as much as 800 points as news spread and investors thought the end of the world had come.

- But here at the Diary, we were serene. We had mocked both candidates… and mooned the sacred rite of democracy – the election itself.

- Why?

- …no matter who wins, the insiders make the important decisions.

- …but now the voters are complicit in every fool, fraudulent, and criminal act of the government; they are responsible for things they can’t possibly understand or control.

- …and the election provides a cloak of respectability under which the Deep State can get away with murder.”

- Source.

While Trump’s election may have been a revolt against the US establishment, David Stockman certainly doesn’t believe he is a cure for the USA’s ills:

- “…it’s way too late for orderly reform and incremental change. The essence of last night’s thunderbolt — Brexit 2.0 on steroids– is that the ruinous rule of the existing Wall Street/Washington establishment has been repudiated and ended.

- But there is nothing to replace it. Donald Trump has no coherent program at all — just a talent for name-checking the symptoms and rubbing them raw.

- So as I said on Fox Business last night at about 11:30 PM, when I called the election for Trump long before the networks could bring themselves to face the truth, the election is over and the nation’s long nightmare has just begun.

- For months and years to come, the Imperial City will be ungovernable and the nation will be racked with fiscal, financial, political and even constitutional crisis. By kicking the can in a ruinous direction for decades, America implicitly opted eventually for the bleeding cure.

- The giant stock market bubble will now crash. The stock-price obsessed C-suites of corporate America will now panic and begin pitching inventory and workers overboard. We will be in an official recession within 6 months. The Federal budget will plunge back into trillion dollar annual deficits very soon.

- Accordingly, Washington will descend into permanent warfare over the debt ceiling and an exploding $20 trillion public debt. Any notion of a Trump economic revival program — even if it could now be confected—will be stillborn in the financial and fiscal chaos ahead.

- And most important of all, the almighty Fed will be stranded high and dry — out of dry powder and under political attack like never before from angry politicians and citizens alike.

- The jig is up.”

But it certainly looks like Trump will give an “economic revival” a good nudge!

His speech last night mentioned the infrastructure building program he has talked about. He is certainly not looking like constraining spending.

This leads in nicely to a theme of the articles we have posted on the website this week.

In our feature article we ask:

Is Inflation Going to Surprise Us?

It seems like a Trump presidency could well crank up the spending and finally kick off a surprisingly high level of inflation.

Jim Rickards also agrees with this sentiment:

James Rickards: Huge Inflation Coming With Coming Economic Meltdown

So while gold may not have popped even higher today, a further rise in the months ahead looks likely.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

LAST DAY FOR THIS DEAL…

Get a FREE bucket of freeze dried fruit or veges (Up to $316 value)

Get a FREE bucket of freeze dried fruit or veges (Up to $316 value)

When you purchase 2 buckets of Mains and Breakfasts.

Long Term Bond Rates Still Rising

The other theme we’ve been tracking lately is the bond market and interest rates. Here’s another article on this topic:

The Bond Market Is Unraveling… Here’s Where You Should Put Your Money Today

Bill Bonner has also noticed that perhaps the bond market has changed trend and we are at the beginning of a rising interest rates cycle:

- ‘Fake money caused fake and fragile growth. In effect, the feds’ fake money created a hothouse economy… protected from the real world by artificial money lent at artificially low rates. You see plants that look lush and green, leafy and fulsome. But they couldn’t survive a single night outside in the real world.

- …And when the cycle turns – when credit markets tighten – the hothouse glass cracks. And then shatters. The gentle climate of mutually supported fakeness turns to bitter-cold reality. Higher interest rates put pressure on the whole system.

- Customers lose their houses, their jobs, and their cars. Store parking lots are empty. Their cash registers are silent. Sales go down. Profits tumble. Stock prices collapse.

- Unable to pay their corporate debts, the companies default. Bond prices – for all but the best bonds – fall. Spreads widen.

- A heads-up: The first cracks have already appeared. Since its low this warm summer, the yield on the 10-year Treasury note – a key bellwether for borrowing costs across the economy – has risen 37%. We may – finally, after 35 years – have seen the bottom in bond yields, the end of the bull market in bonds that began in 1981.

- The wind may be picking up. Make sure you have a scarf.”

If you want some specifics of the impacts of these rising borrowing costs then check out this excerpt:

- “Rarely do we investors get a market that we know is overvalued and that approaches such clearly defined limits as the bond market now. That is because there is a limit as to how negative bond yields can go. Their expected returns relative to their risks are especially bad. If interest rates rise just a little bit more than is discounted in the curve it will have a big negative effect on bonds and all asset prices, as they are all very sensitive to the discount rate used to calculate the present value of their future cash flows.

- That is because with interest rates having declined, the effective durations of all assets have lengthened, so they are more price-sensitive. For example, it would only take a 100 basis point rise in Treasury bond yields to trigger the worst price decline in bonds since the 1981 bond market crash. And since those interest are embedded in the pricing of all investment assets, that would send them all much lower.

- Those words are from the most successful hedge fund manager of all time — Ray Dalio. When he speaks, we listen.

- There is now more than $13 trillion — that’s trillion with a “T” — of global debt that offers investors a guaranteed loss if held to maturity. Investors are now partaking in what can only be described as the largest game of “Greater Fools” in the economic history of man.”

- Source.

RBNZ Cuts Interest Rates – NZ Government Bond Rates Rise. Huh?

So what about here in New Zealand?

Well the Reserve Bank cut the Overnight Cash Rate to a new record low 1.75. Largely as a result of persistently weak inflationary pressures. (See how the aim is to get inflation up still).

What was the impact?

The dollar didn’t fall much. Even though a “decline in the exchange rate is needed”.

The BNZ said it won’t pass on the interest rate cuts to borrowers. Saying it needs overseas funding to fill the gap between borrowers and depositors.

But what most won’t have noticed and hasn’t been reported is that even on a day when short term interest rates were cut, 10 Year NZ government bond rates actually rose.

Here’s a screenshot from Bloomberg this morning:

The Yield has risen 0.244 which is a rise from the day before of 8.94%.

Looking back to the low of August, NZ 10 Year Government bonds interest rates have risen from 2.143% to 2.951%. That is an increase in the interest rate of 37.7%.

So how can this happen when the RBNZ just cut the OCR?

Because these government long bonds are not so easily controlled. The market still has its way with them and it seems to be saying that the days of low long term interest rates are ending.

The fact that local banks aren’t passing on rate cuts is testament to the fact that their cost of borrowing from offshore is rising.

As Bill Bonner said above when this cost of credit begins to rise it sets off problems for companies that rely upon cheap credit to keep them afloat.

Here in New Zealand our model of borrowing to buy houses that always go up, also relies upon the falling cost of credit. Once interest rates start to rise here there could be problem.

Of course that’s not to say this will happen overnight.

The RBNZ will probably do all they can to stop this happening.

We could yet see further cuts in the OCR from the central bank yet. But it does appear the trend of ever falling interest rates may be coming to an end.

As we conclude in our feature article this week:

- “Those with large debt positions, who haven’t done their sums on the impact of higher interest rates, would also take this change in trend squarely on the chin.

- We’ve written a number of times before how rising interest rates can actually be positive for gold.

- Are we perhaps heading for an eventual repeat of the stagflation of the 70’s? Low growth, higher inflation and interest rates (but lower real (after inflation) interest rates, and higher gold and silver prices?”

- Source.

Prepare accordingly now.

Get in touch if you have any questions about the buying process. David is only too happy to answer them.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

James Rickards: Huge Inflation Coming With Coming Economic MeltdownThu, 10 Nov 2016 9:19 AM NZST  Earlier this week we wrote the below article. It featured thoughts from a number of alternative commentators, and even Alan Greenspan, on how inflation may be just starting to poke it’s head above the parapet. Is Inflation Going to Surprise Us? Someone else who looks to be leaning to point of view that inflation will […] Earlier this week we wrote the below article. It featured thoughts from a number of alternative commentators, and even Alan Greenspan, on how inflation may be just starting to poke it’s head above the parapet. Is Inflation Going to Surprise Us? Someone else who looks to be leaning to point of view that inflation will […]

|

Is Inflation Going to Surprise Us?Tue, 8 Nov 2016 4:48 PM NZST  Throughout most of the world, the last 7 or 8 years has delivered what appears to be very low levels of what is known as “consumer price inflation”. Sure house and other asset prices have risen in many parts of the globe. But these get conveniently stripped out of or “substituted” from most government measures […] Throughout most of the world, the last 7 or 8 years has delivered what appears to be very low levels of what is known as “consumer price inflation”. Sure house and other asset prices have risen in many parts of the globe. But these get conveniently stripped out of or “substituted” from most government measures […]

|

An Upside Surprise for Precious Metals From US Election?Mon, 7 Nov 2016 1:24 PM NZST  This Week: 3 Current Positives for Gold An Upside Surprise for Precious Metals From US Election? A Perfect Storm Has Formed in the Gold Market These Three Major Catalysts Are Poised to Send Gold to the Moon Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1783.82 + […] This Week: 3 Current Positives for Gold An Upside Surprise for Precious Metals From US Election? A Perfect Storm Has Formed in the Gold Market These Three Major Catalysts Are Poised to Send Gold to the Moon Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1783.82 + […]

|

Why Gold Will Jump at Least 7% After Election DayMon, 7 Nov 2016 11:51 AM NZST  In our subscriber only email newsletter last week we said: “So to us the odds of another Brexit-like surprise outcome seem to be much closer than most would expect. If Trump wins we will likely see a jump in volatility in the sharemarket. That is already happening after the FBI investigation announcement. If gold’s correction has […] In our subscriber only email newsletter last week we said: “So to us the odds of another Brexit-like surprise outcome seem to be much closer than most would expect. If Trump wins we will likely see a jump in volatility in the sharemarket. That is already happening after the FBI investigation announcement. If gold’s correction has […]

|

The Bond Market Is Unraveling… Here’s Where You Should Put Your Money TodayFri, 4 Nov 2016 1:47 PM NZST  Back in September we discussed the possibility that the bond prices might have changed trend from up to down. Or put another way that long term bond yields or interest rates may be at the start of a trend change to higher interest rates: Has the Bond Bubble Popped? Interest Rates to Rise? Impact on Gold […] Back in September we discussed the possibility that the bond prices might have changed trend from up to down. Or put another way that long term bond yields or interest rates may be at the start of a trend change to higher interest rates: Has the Bond Bubble Popped? Interest Rates to Rise? Impact on Gold […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |