This Week:

-

NZD Gold and Silver Back Close to the Mid Year Lows

-

Silver to Do Better Than Gold After QE3&4?

-

QE Infinity +

-

Market Manipulations

Sorry this is late and rather long today but as it’s the last day to order for one of our suppliers we’ve been flat out and have run out of time to edit. If you want the best priced local NZ silver then you only have an hour left to order this year…

NZD Gold and Silver Back Close to the Mid Year Lows

Well the high kiwi dollar is frustrating exporters. If you’re a holder of gold or silver odds are it’s frustrating you too. However if you’re a prospective buyer of bullion then it is doing you a favour, as the high dollar continues to align with weaker USD denominated gold and silver prices to produce cheaper gold and silver prices for NZ buyers.

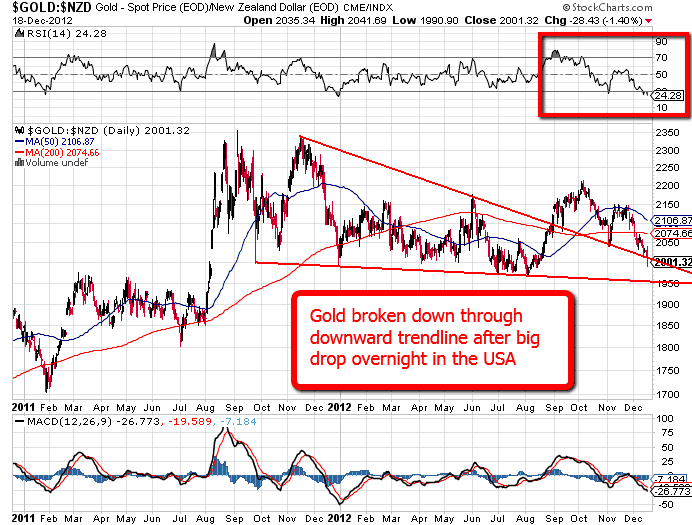

For NZD gold, today the price is pretty well as cheap as it was during the lows of the year back in July and August with today’s spot price under NZ$2000 at NZ$1986. We are in oversold territory according to the RSI. However of course as we’ve mentioned many times before the price can stay oversold (and overbought) for much longer than we might expect. The price has also just dipped below the downtrend line that we have been above since the start of September. The question only time will tell is this just a head fake with a bounce to come or a sign of a further fall?

Speaking of overbought, that is exactly where the NZD has been. So as mentioned last week this could mean we are due for a drop lower in the NZD and therefore a corresponding rise in the NZ dollar prices of gold and silver. We are only just down slightly off the highs from earlier in the week and only just out of overbought territory so it’s still wait and see.

However the other factor to consider is will the USD prices of gold and silver hold around these levels?

Below is the USD gold chart. You can see it is close to oversold now with the RSI approaching 30, so odds would favour a bounce from here. However we’d have to temper that comment with the fact that trading volumes in the gold paper markets are pretty low at the moment and will likely get even lower over the Christmas holiday. Last year this saw a raid on the gold price with the low coming just before New Years day where gold briefly hit US$1525. The 2 red lines we’ve drawn in with the big arrow between them show that there is a bit of space between the current price and the lows earlier in the year.

So will it gold drop lower in the next 2 weeks? That is the sixteen hundred dollar question! The current US$1670 area has seen plenty of buying so there is good support there, likely from eastern central banks. So that may well see the price hold here.

Our guess (and that is all it is), is that even if the US gold price does drop lower, the very high and overbought NZD offers a bit of protection for NZ buyers today. That is that even if USD gold falls then the prospects of a slightly lower NZD could mean the NZ gold price does not drop too much lower than where it is.

Of course that’s just our theory, it’s up to you to make your own call. As always we like to keep some powder dry for times like these when the price hits previous lows. In the long run it’s so far worked out pretty well.

How About Silver?

Silver is a bit of a different story to gold in that todays price is only down to the lows from early November. We’re still a way off the mid year lows yet. But today the RSI has just hit oversold so odds also favour a bounce higher from here for silver in NZ dollars.

The same caveat mentioned above for gold applies to silver also. That is, that while close to oversold in US dollar terms we are a fair way off lows for the year. So there is always the chance of a further fall.

Silver to Do Better Than Gold After QE3&4?

We mentioned a few weeks back that silver had been doing surprisingly well. A chart we saw in the latest newsletter of our favourite investment letter writer, Chris Weber, is very interesting in regard to this outperformance of silver compared to gold. We’d not seen it anywhere else so perhaps you haven’t either?

The chart clearly shows that the gold to silver ratio has dropped after the previous money printing announcements by the US Fed. Or rather silver has risen faster than gold after QE1 and 2. So now with a further QE announcement will silver continue to outperform gold perhaps?

QE Infinity +

Speaking of QE, of course at the end of last week the worst kept secret was made official. That the Fed was going to continue to purchase $45 billion per month of long term US Government bonds and notes that was previously known as Operation Twist. But now this will be via pure money printing instead of selling short dated securities to offset the purchase of the longer dated ones.

No doubt by now you’ll have also heard about the wording the Fed added with regards to unemployment and inflation rates. That was that this money printing will continue “at least as long as the unemployment rate remains above 6-1/2 per cent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 per cent longer-run goal, and longer-term inflation expectations continue to be well anchored.”

So this was a big move in that instead of an airy fairy date in the future, they have now tied the printing to inflation and unemployment. They are targeting 2.5% inflation which is higher than say our reserve bank or the Bank of England who both aim to devalue their currencies each year via 2% inflation. And the 6.5% unemployment rate is likely to be a way off being reached too. We saw in a bullionvault email that “since 1948, US unemployment has averaged 5.8%. It stood at 7.7% in November, and it has stood at or below 6.5% in only 550 of the last 780 months.” So it’s going to take some doing particularly when any new jobs being created will also likely bring back some of the “discouraged” unemployed who are no longer counted in the statistics.

And of course there is no guarantee they will stick to these targets. The name of the game is after all devaluation. The only way to reduce the debts of the US is by making them worth less via a devalued currency. And so creating $1 trillion extra a year likely will help them in this aim. They really don’t have any choice since the Fed is now buying so many treasuries if they stopped interest rates would likely rise and they simply cannot afford that.

Global Printing to Continue

It seems we are in for an ongoing global co-ordinated money print too. This week saw Shinzo Abe elected in Japan and he is ringing changes at the BoJ and doubling their inflation target from 1% to 2%.

Then there is also talk in the UK of “GDP targeting” as an alternative to the current inflation targeting. So in other words to print money with a view to creating economic growth rather than targeting inflation of say 2%. A load of bunkum of course. But probably one that makes sense to central bankers to follow given that GDP itself is an artificial construct where increases in government spending and the like will show as an improvement in GDP. Seems like a good excuse for long term money printing in ever greater amounts.

“The Daily Telegraph understands that senior Government figures are privately pressing the George Osborne, Chancellor to consider giving the Bank a new target of increasing the size of the economy.

Mr Osborne is also being urged to push the Bank of England to expand its controversial Quantitative Easing programme to find new ways to inject more new money into the financial system.

Questions about the Bank’s instructions from the Government were put in the public domain this week by Mark Carney, who will next year replace Sir Mervyn King as Governor.

Under rules set by the Labour Government in 1998, the Bank is currently under instructions to keep inflation at around 2 per cent. It has no formal orders from the Government to target economic growth.

Mr Carney, currently head of the Bank of Canada, this week suggested that it might be better for central banks to target the size of the economy instead of the rate of inflation.”

Market Manipulations

So it makes sense with announcements and discussions of money printing going on the world over that the powers that be would want to keep gold down for now.

Jim Sinclair and also John Williams over at shadowstats.com both this week alluded to government interventions in markets. John Williams said, “In response to the QE3 expansion, initial market reactions in U.S. dollar and gold trading appears to have been muted by direct market interventions, possibly co-ordinated by the President’s Working Group on Financial Markets, which has the ability to intervene in any market, at any time, as it deems necessary. Such was discussed by Alan Greenspan when he was Federal Reserve Chairman.”

Another theory is that the likes of China and Russia who are consistent gold buyers might use hedge funds to keep the price low and allow them to keep buying at artificially low levels. Who knows, but it means we get further chances to buy alongside them if true.

We haven’t read much of Chris Martenson for a while, but this week he too voiced his opinion on the Feds latest money printing announcement and how the markets appear to be “broken” and manipulated. He is… “more convinced than ever that this all ends in one of the most disruptive financial and currency events ever seen on this planet. And while the repercussions will be felt by all, taking prudent action while there is still time can greatly improve our individual odds of weathering them safely.”

This Weeks Articles

As always intros and links to the articles posted on the site this week are at the end of this email.

Christmas Hours

Today is the last day to order local silver at the cheapest rate for 5kgs or more. Tomorrow (Thursday) is the last day to order for our other main local supplier before they both shut up shop and refineries for 2 weeks. So if you want to get in before the holidays it’s today or tomorrow only for local silver and gold.

However we still have another supplier for PAMP and for some coins. So if we do get further weakness over the holidays and you want to buy, just drop us an email, phone etc, and we’ll let you know what products we have on offer.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Where to Now for the NZ Dollar? |

| 2012-12-12 04:56:46-05This week: Silver Seasonality: Good Times are Here? Where to Now for the NZ Dollar? Gold Supply Deficit Looming? Trading Hours for Christmas Since last week both metals in NZ dollars are slightly lower. Gold is $2039 per ounce versus the $2061 it was last week. Silver is at $39.28 per ounce down not far off […] read more… |

| The US Continues Along an Alarming Continuum |

2012-12-18 05:22:13-05With the re-election of Obama it’s worthwhile looking at what the impacts of his continuing rule will be on the USA. Given the US dollar is the global reserve currency it behooves us to follow what the US is doing closely to see how what they do might filter it’s way down to us… The […] 2012-12-18 05:22:13-05With the re-election of Obama it’s worthwhile looking at what the impacts of his continuing rule will be on the USA. Given the US dollar is the global reserve currency it behooves us to follow what the US is doing closely to see how what they do might filter it’s way down to us… The […]read more… |

| The Essential Newbie Guide for Buying Gold & Silver |

2012-12-18 05:37:58-05If you’re new to the world of gold and silver J.S. Kim gives a good run down on some of the major points of interest and discussion… Bankers have engaged in a huge misinformation campaign against gold and silver to deliberately keep people out of buying physical gold and physical silver and the best mining […] 2012-12-18 05:37:58-05If you’re new to the world of gold and silver J.S. Kim gives a good run down on some of the major points of interest and discussion… Bankers have engaged in a huge misinformation campaign against gold and silver to deliberately keep people out of buying physical gold and physical silver and the best mining […]read more… |

| Is There a Best Way to Return to a Gold Standard? |

2012-12-18 16:24:47-05There has been increasing discussion over the past year of a “return to a gold standard”, even so far as the US Republican party using it as an election issue recently. In this article Terry Coxan looks at some of the options for a gold standard. Personally we’d hope we don’t see a “return” to […] 2012-12-18 16:24:47-05There has been increasing discussion over the past year of a “return to a gold standard”, even so far as the US Republican party using it as an election issue recently. In this article Terry Coxan looks at some of the options for a gold standard. Personally we’d hope we don’t see a “return” to […]read more… |

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Weaker NZD Supports NZ Gold and Silver Prices | Gold Prices | Gold Investing Guide