This Week:

- NZD Silver Bottom is Here – Technical and Sentiment Analysis

- Freegold and the Mechanism of the Gold Reset

- Tax Freedom Day Falls Later Again This Year in New Zealand

- Zimbabwe Contemplates Restoring its Own Currency with Gold Backing

SPECIAL EXPIRES THURSDAY 25 MAY

Canadian Silver Maples Monster Box – Bonus Deal

$14,680 for 500 x 1oz Canadian Silver Maples fully insured via Fed Ex directly to you anywhere in New Zealand or Australia.

+ Free Glove Box Survival Kit valued at $69 with any order of 500 or more 1oz silver coins.

Looking like an excellent time to buy today as silver looks to have bottomed out.

Read on to hear about that…

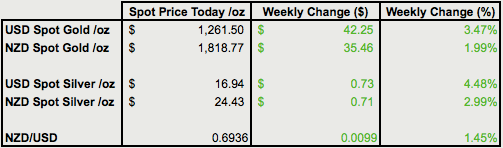

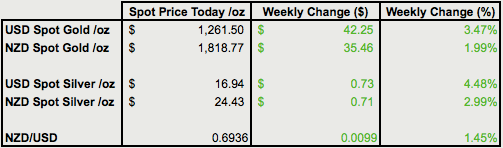

Prices and Charts

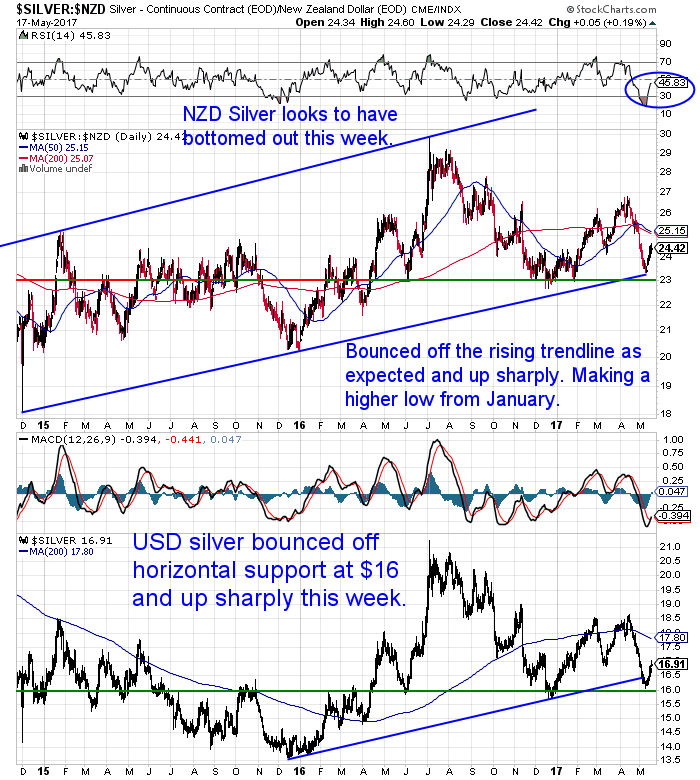

NZD Silver Bottom is Here

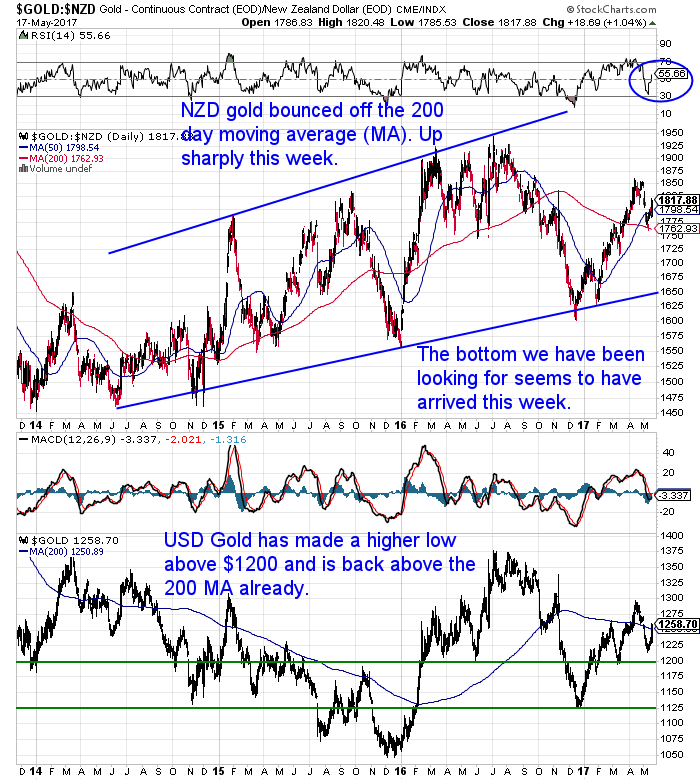

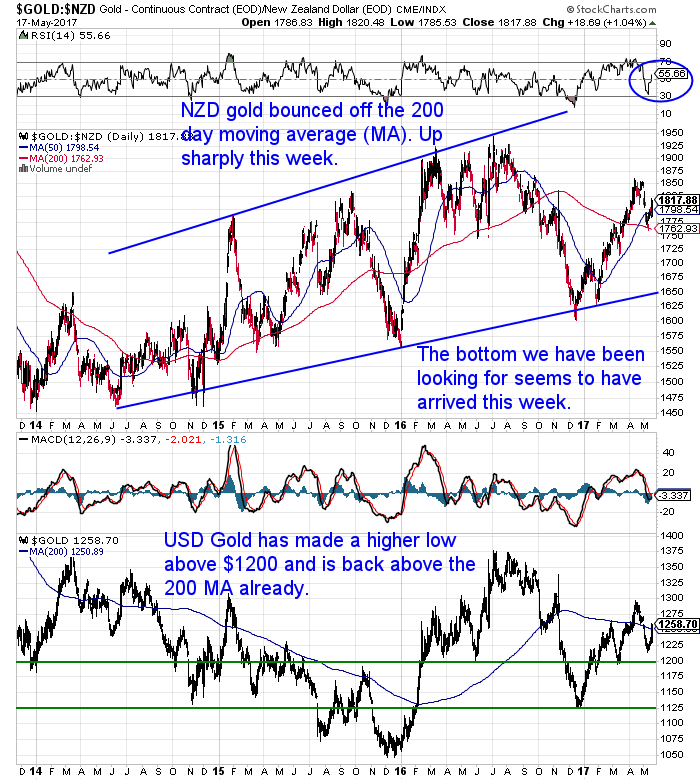

The bottom in silver we have been watching for looks to have arrived this week. And gold may well have also bottomed out during the past few days. NZD gold is up 2% from a week ago. Bouncing off the 200 day moving average (MA) around $1760.

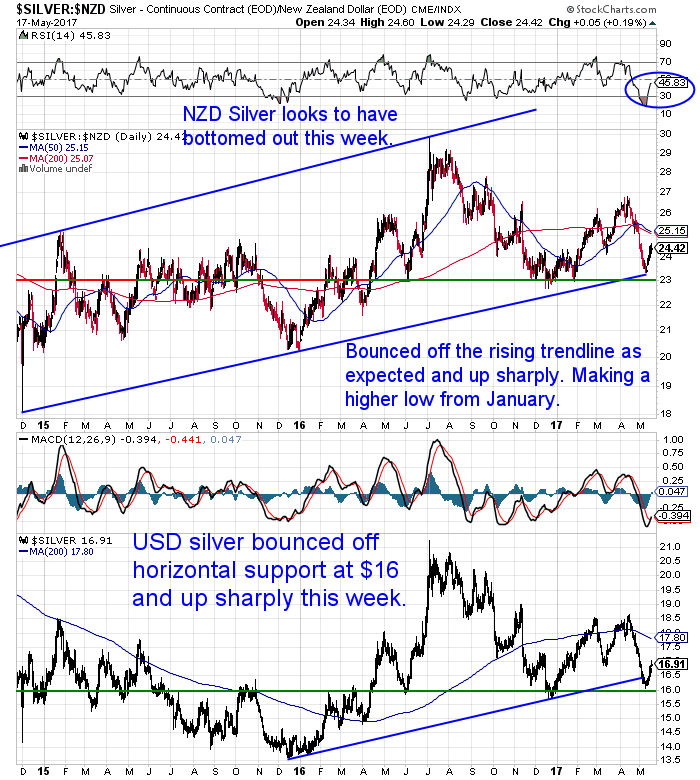

As we suspected it might last week, silver in NZ dollars bounced off the rising blue trend line. NZD silver is up 3% from last week.

Our feature article today looks at the technicals for NZD silver so no need to comment further on that here.

The Kiwi dollar has taken the shine slightly off the rises in the metals. As it is also up around 1 cent from a week ago. But we wonder whether it will be able to sustain this rise at the moment. As the NZ dollar has failed to get above the 50 day MA since March.

Would you like some assistance with timing your entry into and your eventual exit from gold and silver? Then you may want to

meet our “secret” investment advisor. You can learn more about who he is… And how you could benefit from his uncanny ability to enter and exit not just the precious metals markets but many other markets too, at just the right time.

So go here to learn more now.

NZD Silver Bottom is Here – Technical and Sentiment Analysis

Checkout our feature article this week. You’ll get:

- Technical analysis with short and long term silver charts

- An update on the silver to gold ratio.

- Sentiment analysis

- Plus Commitment of Traders (COT) report analysis

Tax Freedom Day Falls Later Again This Year in New Zealand

Do you know what we missed last week?

The celebration of the day we pay are no longer “working” for the government.

That is what is known as Tax Freedom Day. It fell six days later than it did last year, according to the number crunchers at Staples Rodway.

“The total amount Kiwis paid in taxes has increased by 9.5 per cent year-on-year, more than double the increase of last year, alongside a 5.1 per cent increase in nominal GDP,” said Staples Rodway’s Mike Rudd.

…In 2008, Staples Rodway declared May 21 was Tax Freedom Day.

In 2012, it fell on April 27.”

Source.

So after falling it appears to be extending out again in recent years.

How do we compare to other places in the OECD?

In Australia Tax Freedom Day fell on 13 May. Last year, it was 9 May.

Like Australia here in New Zealand the recent trend has been for Tax Freedom Day to occur later and later in the year. In other words, every year you are paying more and more taxes to the government.

But it’s actually worse in many other countries. For example in the UK, Tax Freedom Day is on 3 June. While in France, it arrives on 29 July.

Things are slightly better in the USA where it actually falls a little earlier on 23 April.

So interesting to know how long the average Kiwi has to work for each year before they have finished paying their “fair share”.

What made us choke on our corn flakes this morning though was this comment from the authors of a book just out “Tax and Fairness”. Urrg. Two words that don’t belong together.

“We need to understand taxation as the price we pay for a civilised society. It is not an unjustified impost from a tyrannical government, as libertarians argue; it is the contribution we choose to make through our democratic institutions ensuring that each of us is enabled to flourish, and live a good life,” Russell and Baucher said.

“Proudly paying our taxes is a sign that we believe in our own capacity to create a flourishing society that gives all New Zealanders fair opportunities. We should smile when we pay our taxes.”

Source.

Count us as one of those crazy libertarians then please!

Income taxes have only been around for the past 100 or so years and are the least fair form of taxation.

Here’s a question for the authors.

if we get to “choose to make” these “contributions”, why does the IRD have us fined and/or imprisoned if we “choose” not too?

If you smile when you pay your taxes you need your head read. They are anything but fair.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

<

Never worry about safe drinking water for yourself or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions and has time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

Zimbabwe Contemplates Restoring its Own Currency with Gold Backing

Almost a year ago we published a couple of articles outlining a visit Doug Casey had to Zimbabwe.

Casey and Nick Giambruno discussed the concept of Zimbabwe having gold as their currency with a number of Zimbabwe government members. Who also surprisingly had a good understanding of Austrian Economics.

“They’ve been interested in using a gold backed currency or a gold standard since the 1990s. But we wanted to make it very clear they should not use a gold standard or anything like that. A gold standard, for those who don’t know, is when a government issues paper money and promises to redeem it for gold.

Well, nobody is going to trust Zimbabwe to keep that promise. So we told them to simply use gold as money.”

Well perhaps some of this discussion actually sunk in. This headline appeared in the Zimbabwean Herald this week: Gold Reserves to Anchor Local Currency

“Government is working on a plan to establish a gold reserve set to anchor the introduction of a local currency when the right time comes for the return to the Zimdollar”.

Since the Zim government is flat broke it may take a while.

They have to mine the gold from government mines first. Who knows whether they’ll be successful at that.

Then there is the fact that they sound like they are going to have a gold backed currency rather than just using gold. Will anyone trust it?

It would be a strange perverse outcome if Zimbabwe was able to introduce a gold backed currency. But as GATA’s Chris Powell said we’ll see what the Bank for International Settlements has to say about that though.

Don’t hold your breathe waiting for anything even remotely like a gold backed currency to come to New Zealand though. Create you own “gold reserves” (and silver reserves) to back/offset any fiat currency you hold in the banks.

Request a quote today by:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles:

|

|

Wed, 17 May 2017 9:43 PM NZST

Yep we’re going to say it. Silver in NZ dollars looks to have bottomed. We’ll show you why from a technical and sentiment perspective a NZD silver bottom looks likely to us. Plus why there could be some hefty moves for silver ahead. NZD Silver Technicals To us silver in New Zealand Dollars or even for […]

|

|

|

Wed, 17 May 2017 1:16 PM NZST

If you have been around the precious metals world for some time you’ve likely come across the writings of the pseudonymous, Another, then Friend of Another (FOA) and in more recent years Friend of a Friend of Another (FOFOA). All writing about the concept of “freegold”. There is quite a rabbit hole to dive down […]

|

|

|

Mon, 15 May 2017 11:50 AM NZST

Lately we’ve been reporting how little interest there has been in purchasing gold and silver in recent months. This article from John Kim backs this up and expands upon why the demand to buy gold from retail buyers is always so low at times like this. He also looks at why the Chinese movement […]

|

|

|

Fri, 12 May 2017 11:22 AM NZST

Owning gold and silver is an excellent way of getting some of your money out of the system. Here’s another way you can push back against governments and internationalize yourself without leaving home… Your Newest, Most Powerful Tool of Subversion By Nick Giambruno Murray Rothbard often described the government as a “gang of thieves writ large.” […]

|

|

|

Fri, 12 May 2017 3:49 AM NZST

This Week: Is Silver Bottoming Out? IMF Says NZ Needs Bank Depositor Haircut Exemption of $10,000 Silver Versus the World (and Exter’s Inverted Liquidity Pyramid) SPECIAL TODAY Canadian Silver Maples Monster Box Bonus Deal Minimum order to buy is 500 silver coins. Looking like an excellent time to buy today as you can see in […]

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Note: For local gold and silver orders your funds are deposited into our suppliers bank account. We receive a finders fee direct from them. Pricing is as good or sometimes even better than if you went direct.

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

- To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

- To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.