Gold Survival Gold Article Updates

August 02, 2013

This Week:

- Gold Backwardation and Negative GOFO – What does it all mean?

- Ned Naylor-Leyland on Gold Backwardation

- And More

Sorry we missed last weeks update. We were hoping to finish our latest article on gold backwardation and negative Gold Forward Offered Rates (GOFO), so held off emailing last week. But alas we drowned in various and differing opinions on the topics and have only just managed to finish this off earlier today.

It’s fair to say this is a fairly complex topic touching on how the New York futures and London over the counter (OTC) gold markets work, what these indicators are, and what they may mean. But as you may have read already elsewhere the previous times backwardation and negative GOFO have occurred have preceded important bottoms in gold, so we think they are worth spending some time on.

It’s quite a lengthy piece where we look at various opinions on the these 2 topics and then give our own conclusions at the end.

Hopefully we’ve broken them down enough for someone new to precious metals to understand, but it should offer plenty of thoughts also for those who have already read a bit on these topics.

Please leave us a comment at the end with your thoughts or if you have any questions on the topic and we’ll see what we can tell you!

We also have quite a few articles posted on the site, one of which is a video of and a brief update written by Ned Naylor-Leyland which also touches on this topic of backwardation. This update by Naylor Leyland looks at the price plunge in April and events leading up to it and is one of the best things we’ve read in recent months. So that is a must read too.

So given our GOFO article has plenty of content and there are 5 others also to pick from, we’ll keep this email very short and let you scroll down and then you can click through to the website and read them.

However, first you may want to read our commentary from this mornings daily price alert (go here if you don’t already receive these and want to sign up for them):

——

Price Action in Gold and Silver Overnight

Overnight in the markets, gold jumped to $1338.55 in Asian trade before falling as low as $1306.20 in early New York trade. Then after the fed statement announcement, gold bounced back up to close at $1323.22 for a loss of .32%.

The Fed statement for the Q2 GDP report came in at 1.7% compared to expectations of 1.0%, but then in the same breath revised Q1 GDP figures down from 1.8% to 1.1%. These government statistics agencies are complete pathological liars as the figures are always revised at a later date. Same goes for unemployment numbers.

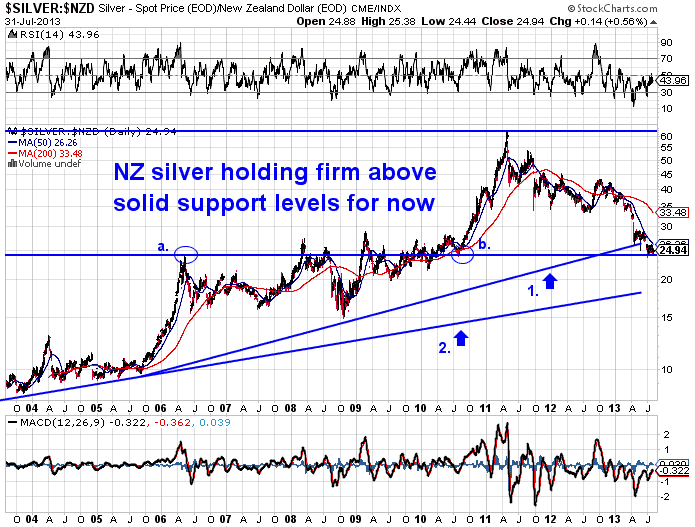

Silver dropped to $19.39 early in New York trade, but then rallied higher to $19.85 for a gain of .25%.

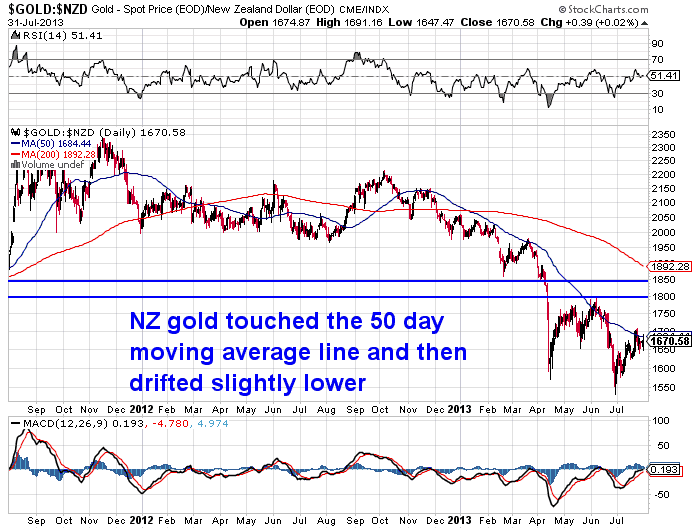

Here in New Zealand with the kiwi slightly weaker on .7972, gold fell $15 to $1659.83 per ounce while silver fell $5 to $800.52 per kilo, or up 9 cents to $24.90 per ounce.

Todays price for a box of 500 x 1oz Canadian Silver Maples delivered to your door via FedEx, fully insured is $14930. Delivery is now estimated at 2 weeks.

Approx cost for 5 x 1kg silver delivered and insured

Local NZ silver 99.9% in 5 x 1kg amounts or more is now available for spot plus 7% plus ingot charge of $13.80 and delivery is about a week away.

So if you’re after 5 x 1kg (160.75oz) today delivered and insured to your door, the cost is around $4373 or $27.20 per ounce and ready around the 30th July next week.

– Local silver 6-8 days

– Local gold 8-12 days

– PAMP silver 1kg bars in stock

– PAMP gold 1oz bars in stock

For more info on specific products please just ask.

If you reach the conclusion like Naylor-Leyland that it’s “always darkest before the dawn” then now might be a good time to add to (or start) your indestructible wealth insurance. As always get in touch.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Timing the bottom in gold |

2013-07-18 21:25:19-04Gold Survival Gold Article Updates: Jul. 19, 2013 This Week: Bernanke Returns Timing the Bottom Will Loan to Value Restrictions “work”? The Bernank gave another riveting performance this morning, the second we have been subjected to in 2 weeks. What he had to say could best be summed up by the phrase “on the […]read more… 2013-07-18 21:25:19-04Gold Survival Gold Article Updates: Jul. 19, 2013 This Week: Bernanke Returns Timing the Bottom Will Loan to Value Restrictions “work”? The Bernank gave another riveting performance this morning, the second we have been subjected to in 2 weeks. What he had to say could best be summed up by the phrase “on the […]read more… |

| Gold Sector: A Small Fish in a Big Pond |

2013-07-22 20:41:27-04Here’s an interesting piece with some very self explanatory charts showing just how small the gold market is in comparison to every other sector and also just how under valued it is currently… Gold Sector: A Small Fish in a Big Pond By Andrey Dashkov, Research Analyst Earlier in July, Jeff Clark showed in his article […]read more… 2013-07-22 20:41:27-04Here’s an interesting piece with some very self explanatory charts showing just how small the gold market is in comparison to every other sector and also just how under valued it is currently… Gold Sector: A Small Fish in a Big Pond By Andrey Dashkov, Research Analyst Earlier in July, Jeff Clark showed in his article […]read more… |

| Ned Naylor-Leyland on Gold Backwardation |

2013-07-24 22:32:24-04We read this fabulous update on the gold market from Ned Naylor-Leyland earlier this month and it was one of the best things we’ve seen on the April gold price smash. (see embed below or click the link to see the full pdf). In the past week we listened to an interview with Naylor-Leyland by […]read more… 2013-07-24 22:32:24-04We read this fabulous update on the gold market from Ned Naylor-Leyland earlier this month and it was one of the best things we’ve seen on the April gold price smash. (see embed below or click the link to see the full pdf). In the past week we listened to an interview with Naylor-Leyland by […]read more… |

| Despite Declining Deficit, Foreigners Aren’t Bailing the USA Out, So the Fed Will Keep QE Going |

2013-07-28 19:11:55-04The mainstream consensus that the US Federal Reserve would begin tapering off it’s money printing later in the year seems to have reduced a bit in the past couple of weeks. Bud Conrad gives a visual explanation with some great charts as to why he believes the Fed will have no choice but to keep […]read more… 2013-07-28 19:11:55-04The mainstream consensus that the US Federal Reserve would begin tapering off it’s money printing later in the year seems to have reduced a bit in the past couple of weeks. Bud Conrad gives a visual explanation with some great charts as to why he believes the Fed will have no choice but to keep […]read more… |

| A (Photovoltaic) Silver Bull in China |

2013-07-29 20:40:38-04Industrial demand is the other side of the coin (from investment demand) that drives the silver market. Here is some interesting research that shows just how significant the impact from rising demand for solar panels in China could be on silver in the coming years… A (Photovoltaic) Silver Bull in China By Jeff Clark, Senior Precious […]read more… 2013-07-29 20:40:38-04Industrial demand is the other side of the coin (from investment demand) that drives the silver market. Here is some interesting research that shows just how significant the impact from rising demand for solar panels in China could be on silver in the coming years… A (Photovoltaic) Silver Bull in China By Jeff Clark, Senior Precious […]read more… |

| Should You Trust Your Instincts on Gold? |

2013-07-30 20:56:07-04Here’s a pretty level headed and matter of fact look at gold given the overwhelmingly negative opinions on it currently… Should You Trust Your Instincts on Gold? By Dennis Miller Recent events in San Francisco and at La Guardia Airport made me recall a terrifying experience years ago. It was my last flight of the […]read more… 2013-07-30 20:56:07-04Here’s a pretty level headed and matter of fact look at gold given the overwhelmingly negative opinions on it currently… Should You Trust Your Instincts on Gold? By Dennis Miller Recent events in San Francisco and at La Guardia Airport made me recall a terrifying experience years ago. It was my last flight of the […]read more… |

| Gold Backwardation and Negative GOFO – What does it all mean? |

2013-07-31 22:47:53-04You may have heard the term backwardation discussed in the gold market recently. We’ve posted a number of articles on this topic in the past few years ourselves with the likes of: Antal Fekete: Gold Backwardation and the Collapse of the Tacoma Bridge Prof Fekete Interviewed by Max Keiser on Gold Backwardation Gold Backwardation Now […]read more… 2013-07-31 22:47:53-04You may have heard the term backwardation discussed in the gold market recently. We’ve posted a number of articles on this topic in the past few years ourselves with the likes of: Antal Fekete: Gold Backwardation and the Collapse of the Tacoma Bridge Prof Fekete Interviewed by Max Keiser on Gold Backwardation Gold Backwardation Now […]read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1659.83 / oz | US $1323.22/ oz |

| Spot Silver | |

| NZ $24.90/ ozNZ $800.52/ kg | US $19.85/ ozUS $638.17/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$870.36

(price is per kilo only for orders of 5 kgs or more)

(delivered and insured)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Our Thoughts on Declining Comex Gold Inventories -