What are you experiencing? Pleasure or Pain?

It probably depends on whether you own any gold or silver already (and also when you purchased it), or whether you’re intending to buy some in the near future.

If you’ve bought in the past 2 years you could be experiencing some pain as you may well be underwater currently. Whereas if you’re looking to buy gold or silver currently, you’re likely experiencing some pleasure at the prospect of getting more bullion for your money now.

In either case you’re probably interested in what the prices of both precious metals are likely to do from here.

After many complaining (including us) that the gold and silver markets have been boring of late with a long period of sideways action, we certainly can’t claim that to be the case right now.

No doubt you’re aware of the sharp fall at the end of last week in gold and silver prices. This, perhaps not coincidentally, arose during the week long Chinese New Year holiday when there is less demand for precious metals. This fall also continued overnight Wednesday and for New Zealand buyers it has been amplified by the kiwi dollar also continuing to strengthen.

Gold in New Zealand dollar terms is currently at levels not seen since August 2011. Silver is not down so far but still at prices not seen since August 2012. So there has been action over the past week aplenty alright.

Both metals are well into oversold territory currently so the odds are that this is a bottom and prices will bounce higher from here, but the $64 Trillion dollar question is whether it will be THE bottom or just a short term bounce before a further fall?

As usual it beats us! But we’ll have a guess for what it’s worth.

Gold?

Gold looks at more risk of a further sell off than silver to us. Why? For one because silver has held up better so far than gold and is yet to break through last year’s lows. So silver has support not far below current prices. Whereas for gold it is a bit murkier with respect to where the next levels of support are since it has fallen through the NZ$1900 mark already. $1850 is the next level of support.

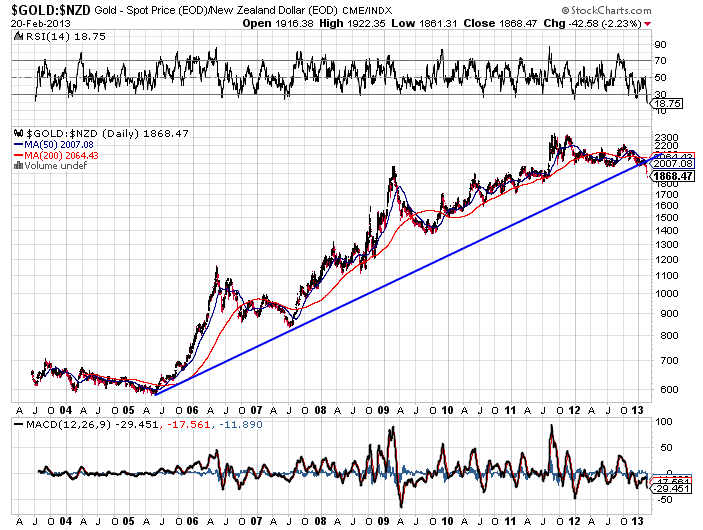

Also the long term NZ Dollar daily gold chart below shows the price just dipping through the long term uptrend line. Trouble is as it’s only just dipped below this, so could be a “head fake” before actually moving higher. No way to know for sure. But the fact that it’s below the trendline could be a sign of further weakness ahead.

Conversely the RSI indicator at 18.75 is the most oversold it has been throughout the past 10 years, so hence our earlier thoughts that a bounce is now due.

Silver?

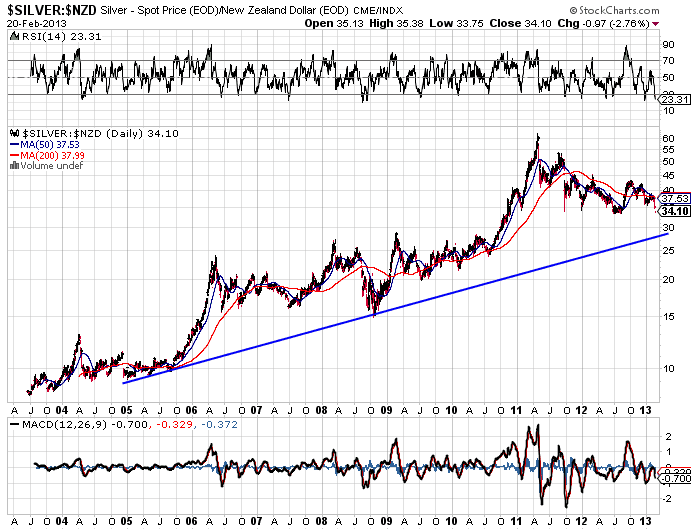

Looking at the long term chart of silver in New Zealand dollars we can see the price is currently some way above the long term trendline, so it could fall a fair way yet and still be in an uptrend. But NZD silver too is well into overbought territory on the RSI indicator.

As we’ve said many times before technical analysis is just a bit of a guide to try and determine lower risk purchase zones and is a long way from infallible.

So is the Gold Bull Dead?

We wish we saw more headlines proclaiming that it was, as that would be a solid indicator that a definite bottom is in.

Something we read in the latest issue of our favourite newsletter writer Chris Weber, really rang true. He pointed out that there is a great deal of talk of Currency Wars at the moment with the Japanese being the latest to actively and openly devalue their currency. Competitive devaluation has become quite widely reported in the mainstream. And while you might logically think that this should be gold and silver positive, the fact is that often many significant moves happen while the metals are flying under the radar. So perhaps we are still not quite in that category yet, hence a further fall will have just about everyone give up on them and set the stage for the next rise.

But sentiment is already very negative towards gold. An article in MoneyMorning recently commented:

Mark Hulbert of Marketwatch notes that Hulbert Gold Newsletter Sentiment Index (HGNSI), which ‘reflects the average recommended gold-market exposure of a subset of short-term gold timers’ has been -3.3% over the last four months. ‘You have to go back as far as 1991 to find another four-month period in which the average HGNSI reading was this negative,’ he says. In 1991, gold was $360 an ounce.

Bloomberg sentiment readings are almost as extreme. Its measure of positive sentiment – CMSEGSBL – stands at 32%. It has reached these levels before, but usually only at market lows – once in 2004, twice in 2008, 2009, 2010 and 2011.

Bloomberg’s measure of negative sentiment – CMSEGCBR – stands at 59%. It has only been this high three times 7– once in 2009, once in 2010 and once in 2011.

So What Has Changed?

Only the price of the metals for now. None of the fundamental factors for buying gold and silver have changed. Governments continue to add to their debt levels – including our own. They continue to debase their currencies. All this will come home to roost eventually.

So to summarise, it seems we have gotten the dip in prices that we mentioned was possible in our article at the start of the year.

But there’s a good chance they could still go lower from here. The current fall is still less than 20% below the highs of NZ$2300, so is still less than the fall in 2009 which was 30%.

For the US dollar gold price, support lies at $1520 which is still a way below the current price of $1556, so it wouldn’t be surprising to see a retest of that in the near future.

If that occurs the question then is what will the NZD/USD exchange rate do? With RBNZ Governor Wheeler on Wednesday discussing currency intervention we saw the NZ dollar dip that night. But possibly that is just a temporary pause in the ongoing uptrend of the Kiwi.

So the trouble we have currently is all the talk is of USD gold and silver prices and we have to try and factor in how the kiwi dollar will move as well. Everyone thinks it will keep going up. We can understand the arguments as it why it will too. If everyone else is engaged in money printing then their currencies will be weaker, so ours should be stronger. However when everyone thinks one thing that’s usually when the opposite occurs. Are we at that extreme yet in positive sentiment for the kiwi dollar? Perhaps not, but at some point in the future the kiwi will also take it’s turn at losing some value we reckon and precious metals are our protection against that eventually happening.

So to Buy or Not to Buy?

As always that depends on whether you already have any precious metals and when you bought them.

We stick by the mantra of always keeping some “powder dry” for times when the price falls. When the prices are rising steadily it’s difficult to imagine them falling markedly lower, and so tempting to go “all in”. Conversely when prices are falling as currently it’s hard to imagine that they will go higher from here so hard to buy at times like these.

So our theory remains we buy a bit and keep a bit in reserve in case of further falls. Nothing worse than seeing cheaper prices and having no fiat funds with which to make a purchase. Or trying to pick the bottom and missing out altogether. Picking the bottom simply comes down to luck not skill.

If you think now is a good time to purchase a tranche of gold and/or silver then get in contact on 0800 888 465. Or see our order page for latest pricing.

Pingback: Gold Sentiment is Very Low | Gold Prices | Gold Investing Guide

Pingback: Is it Time to Sell Gold or Silver? | Gold Prices | Gold Investing Guide

Pingback: What is Causing the Falling NZD Gold Price? | Gold Prices | Gold Investing Guide

Pingback: Pleasure or Pain? Where to Now for Gold and Silver in New Zealand Dollars? | Gold Survival Guide