|

Gold Survival Gold Article Updates:

May. 29, 2014

This week:

- Where to now for both metals?

- Shanghai Gold Exchange Considers International Exchange

- Barclays fined $44 Million for Suppressing Gold Prices

- NZIER chief economist agrees: Rents not rising in line with house prices in Auckland

- GST On Platinum?

After doing nothing price wise for the past month, there has been a bit of action this past week in precious metals land. What with reports that China has approached foreign banks and gold producers to participate in a global gold exchange in Shanghai, a US$44 million fine for Barclays for gold price manipulation, and then a plunge in prices at options expiry to top it all off yesterday.

We wondered whether the attention the London gold and silver fixes were getting might have put the manipulators off their usual practices and we might have seen prices hold at recent levels, but obviously not!

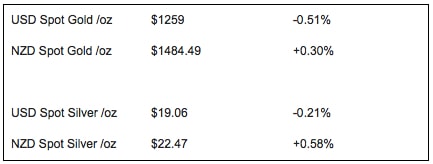

Overnight Tuesday gold fell beneath recent support at US$1280, and then last night fell to as low as US$1256. But a weaker NZ dollar has dampened some of this fall for us here in New Zealand. Particularly overnight where the NZ prices actually rose while the USD prices for gold and silver dropped a bit further.

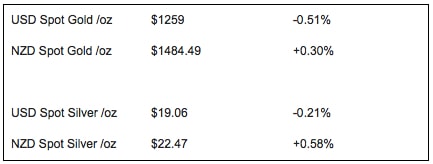

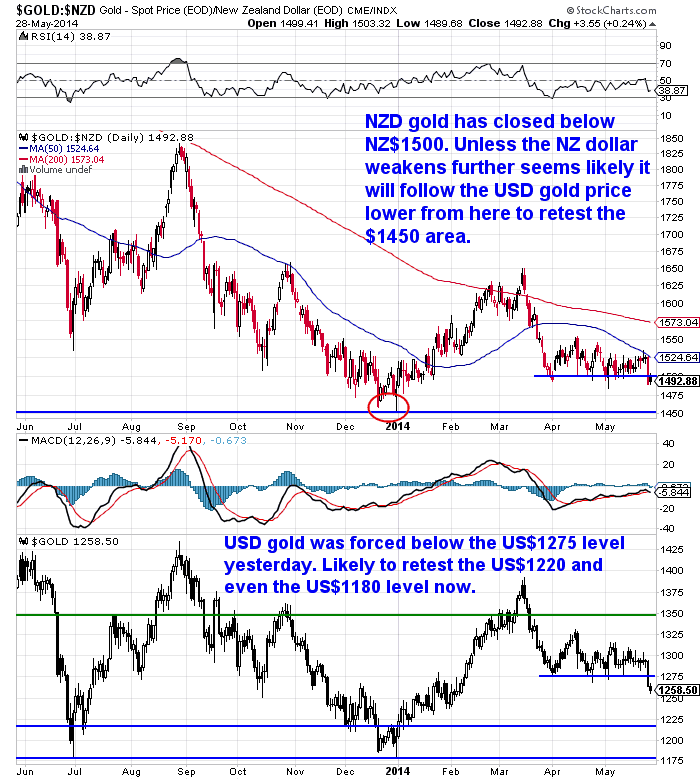

You can see this clearly in the table below from our Daily Price Alert this morning. It shows today’s gold and silver spot prices and percentage change from yesterday in both US and NZ dollars:

(If you’re looking at purchasing gold and/or silver currently then consider signing up for our daily price alert here. Each week day you’ll be emailed prices and charts making it easier to track good times to buy.)

Casting our eye back from a week ago now.

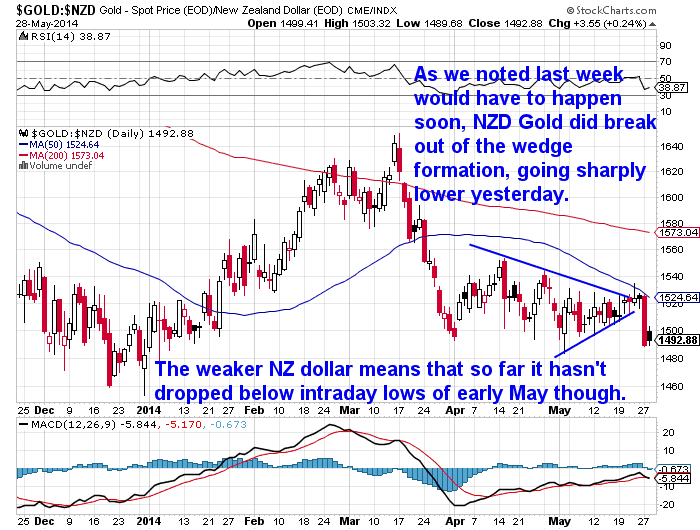

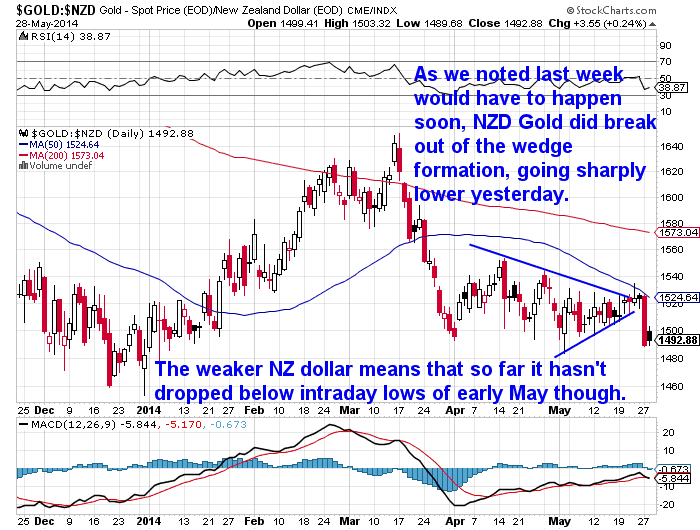

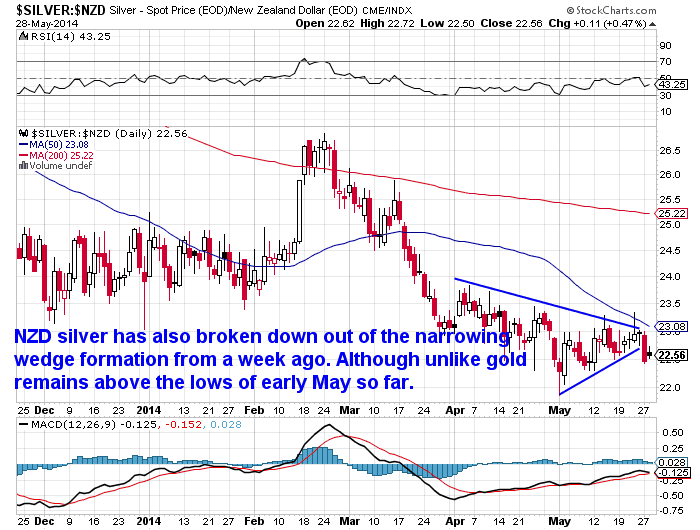

The spot price for gold in NZ dollars is down $25.51 or 1.69% to $1484.49 per ounce. Breaking down out of the wedge formation that we mentioned last week had to happen soon.

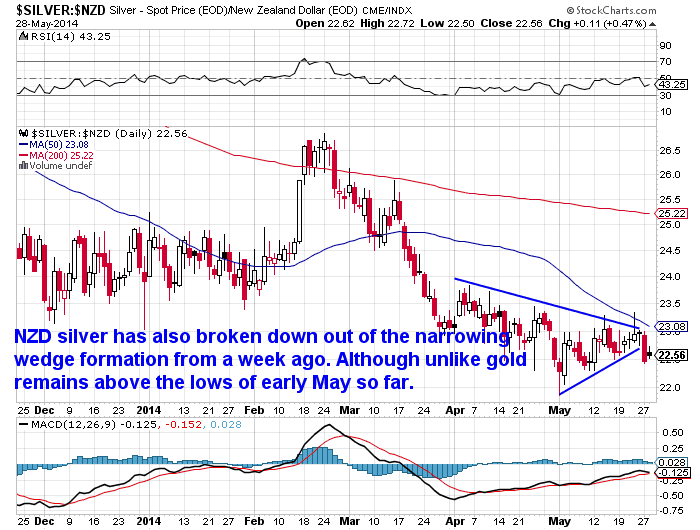

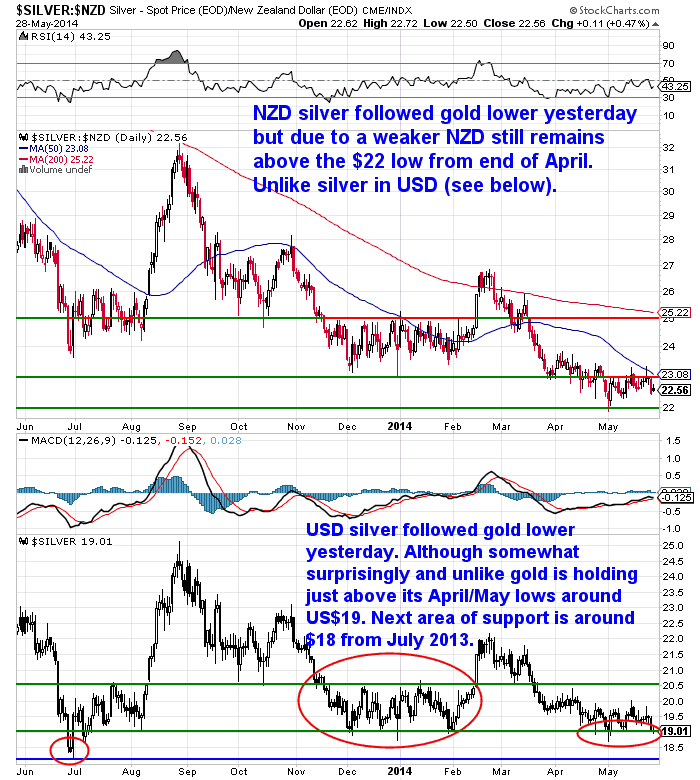

While silver in NZ dollars is down 24 cents or 1.05% from last Thursday. But unlike gold has not yet reached the lows of early May.

So where to now for both metals?

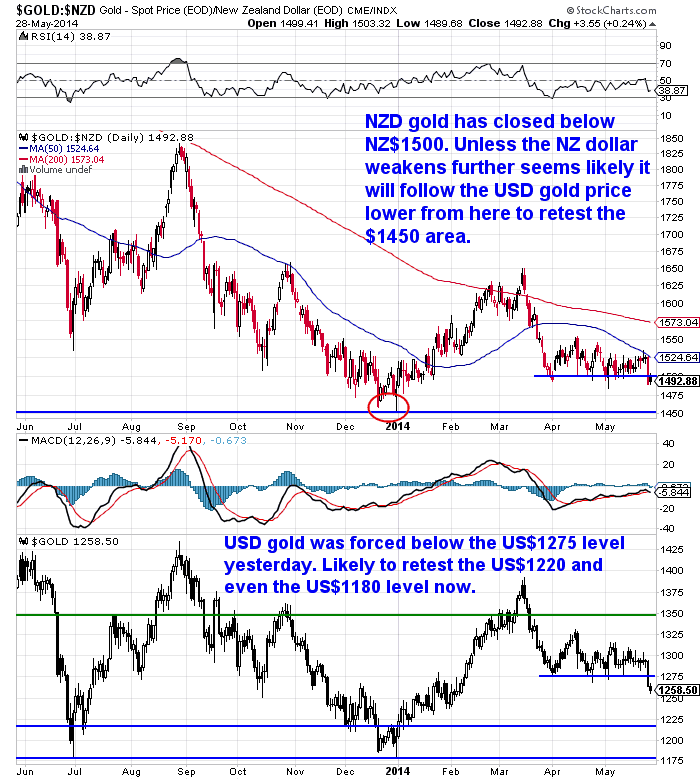

The chart below has the NZD gold price at the top and the USD price in the bottom half. We can see the USD price of gold has clearly broken below support at US$1275. Now that they’ve managed to trip the stop losses that would have been in place around there, it’s likely we’ll head lower from here. Maybe to the US$1220 or even US$1180 lows.

In NZ dollars this could equate to a retesting of the $1450 lows from the last days of 2013. But will of course depend on whether the NZ dollar weakens even further as we’ve been expecting it to. The lower Whole Milk Powder (WMP) prices and forecasts announced this week may well prompt the RBNZ to ease up on interest rate rises which in turn could nudge the NZ dollar lower.

Roger Kerr makes a good argument for this saying “the FX markets are waiting to be told that the NZ economic fundamentals have weakened”

—–

“The Kiwi dollar has recoiled from its highs of 0.8770 to trade 2.6% lower at 0.8540. However, WMP prices have dropped 23%, thus the NZ dollar still has a long way to catch up.

There is nothing to suggest that WMP prices will recover anytime soon, indeed increased European milk powder supply onto the globally traded market later in the year as regulatory restraints are removed points to even lower prices.

A major risk to New Zealand’s economic fortunes is unfolding before our eyes.”

—–

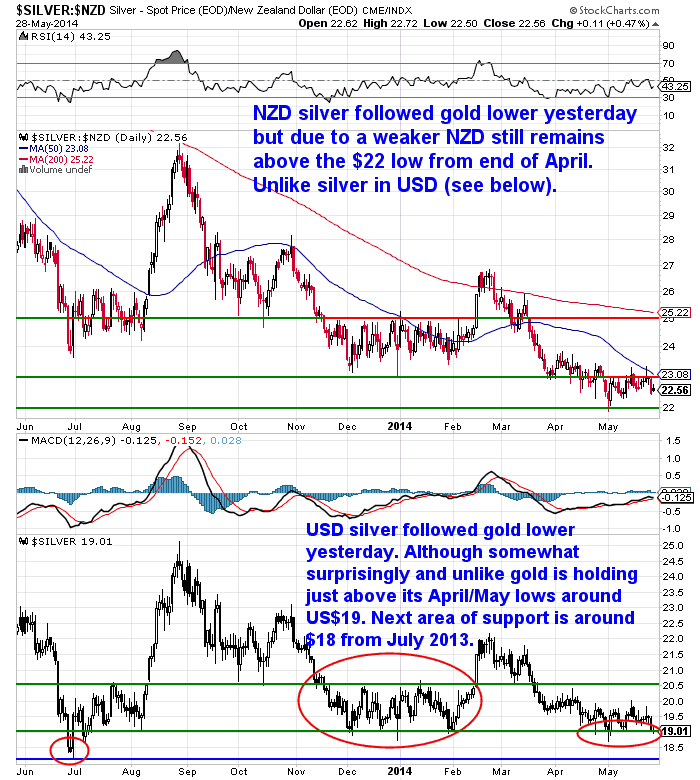

Looking at silver now, it was very interesting to note that it has held up better than gold so far. In US dollar terms silver is holding just above its lows from last month and earlier this month. While in NZ dollars it is still 50c per ounce above the lows of a month ago.

We’re not sure exactly what to make of this. Will it play “catch up” with gold now and fall faster or is its relative strength saying it won’t go much lower?

Shanghai Gold Exchange Considers International Exchange

As already mentioned big news this week was that Shanghai Gold Exchange is looking at a new international exchange with physical contracts initially and then derivatives later on.

Worth a read here.

Koos Jansen has been following this and gives a good run down regarding the rising powers of Russia and China in the East and the impact of this new international exchange:

—–

“Russia’s central bank bought 28 metric tonnes of gold in April

Russia is setting up a joint currency with Belarus and Kazakhstan

Russia dumps record amounts of US treasuries

Russia closes an energy deal with China worth $400 billion (amongst 40 other business contracts)

Putin says Russia and China need to secure their gold and currency reserves

China openly calls for de-Americanization of the world

China, Russia, Iran and 21 other countries bolster cooperation to promote peace, security and stability in Asia

China is buying assets all over the globe and investing in infrastructure in Africa and West Asia

China is importing unprecedented amounts of physical gold

The SGE international board will be another blow to the US dollar hegemony, as more people around the world will hold renminbi, use the renminbi for trading gold and China will have more power in pricing gold, though the international board’s pricing power can only be wholly exploited when the renminbi is fully convertible.”

Source.

—–

So without doubt this is big news. We actually received a question on this topic from a client yesterday:

—–

“Hi Guys,

Have you seen this on Ed Steers? http://www.caseyresearch.com/gsd

With London “fix” under fire, China seeks bigger sway in gold trade

His comment was ……….“One has to wonder if the daily gold “fix” is about to be passed from one set of price fixers to another. “

Was wondering what you make of this move by the Central Bankers?

Cheers

P.

—–

Here was our reply:

—–

“Two schools of thought on it I guess.

1. Makes sense that the Chinese would want to have more input into setting the price given the gold they are amassing. As Ed infers they would likely be happy to assist with keeping the price down for a while yet to enable them to get more.

In fact when we met Chris Powell of GATA last year he was pretty sure the Chinese had a hand in the price smack down last year.

If the Chinese have more control in the pricing this will let them choose to some extent when they would prefer to let the price rise to its truer value. Perhaps a little way down the track yet.

Alternatively…

2. The Chinese and Russians are not the opposition that we are led to believe they are in the West. Those who control the central banks also control the Russian and Chinese too. So all this is part of their game to create a dialectic and an image of 2 sides when really they have a foot in both camps. G Edward Griffin’s, Creature from Jekyll Island pretty clearly showed this was the case in the 1st and 2nd World Wars, with the financiers playing both sides for their personal profit. So who’s to say it is any different now?

Either way it seems it is still a significant point that could result in a truer reflection of pricing given it is currently dominated by COMEX futures and the London Fix rather than physical buying.”

My 1.5 cents anyway!

Cheers

Glenn.”

——-

NZIER chief economist agrees: Rents not rising in line with house prices in Auckland

The NZIER chief economist this week also observed that rents are not rising in line with house prices in Auckland as we featured last week in “Housing shortage in Auckland not backed up by rising rents”.

Although he just says it is “investor driven” without getting to the crux of the matter which is that it is driven by record low interest rates. Source.

GST On Platinum?

Also following on from last weeks email, where we featured an article on The Birth of a New Bull Market in Platinum and Palladium, we had a question from a reader on the topic of GST on these.

The answer:

99% pure platinum is exempt from GST just like gold and silver.

Whereas Palladium is not classed as “fine metal” by the IRD so does attract GST.

We have a local supplier that sells platinum but not palladium for this reason. That is there is no real demand here in NZ with having to pay the extra 15% GST on palladium. However if you wanted to purchase palladium we can bring it in from offshore still.

Let us know should you require a quote for either.

Likewise if you’re after gold and silver. We are getting close to the lows again in NZ dollars for both so likely a good entry point long term. As always consider keeping some “powder dry” in case we go lower yet.

This Weeks Articles:

Housing shortage in Auckland not backed up by rising rents |

2014-05-22 01:10:07-04 2014-05-22 01:10:07-04

Gold Survival Gold Article Updates: May 21, 2014 This Week: London Silver Price Fix to End & What it Means; Housing shortage in Auckland not backed up by rising rents; Reader Question on Gold & Silver Manipulation |

Barclays fined $44 Million for Suppressing Gold Prices. Help Launch our “End Gold Price Manipulation Now!” Campaign

|

2014-05-22 01:10:07-04

2014-05-22 01:10:07-04 2014-05-27 18:27:54-04

2014-05-27 18:27:54-04