Gold Survival Gold Article Updates:

29 January 2015

This Week:

- RBNZ takes a leaf out of the Fed’s book

- US Dollar topping out – Kiwi due a bounce?

- What Impact will ECB money printing have on gold?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1755.63 | $41.63 | 2.42% |

| USD Gold | $1286.00 | – $9.61 | – 0.74% |

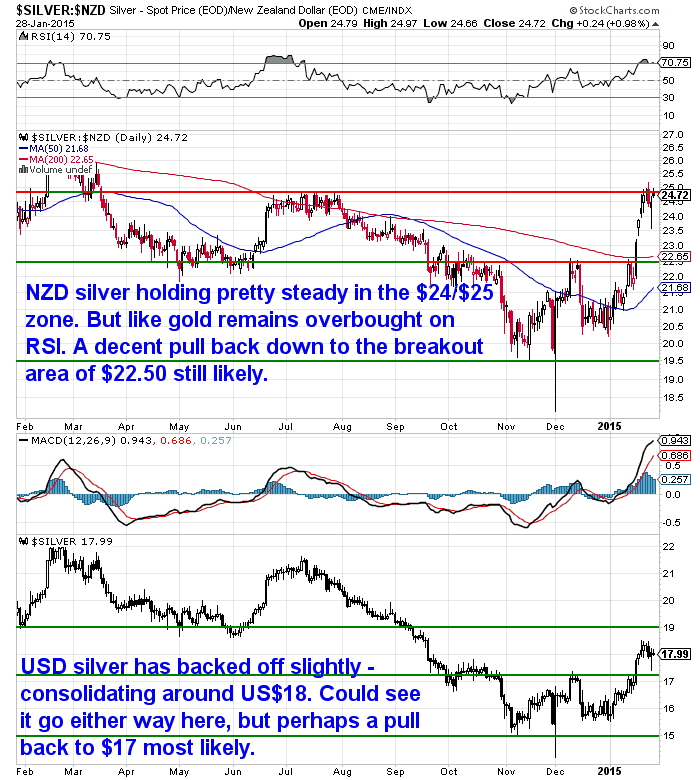

| NZD Silver | $24.57 | $0.46 | 1.90% |

| USD Silver | $18.00 | – $0.22 | – 1.20% |

| NZD/USD | 0.7325 | – 0.0234 | – 3.1% |

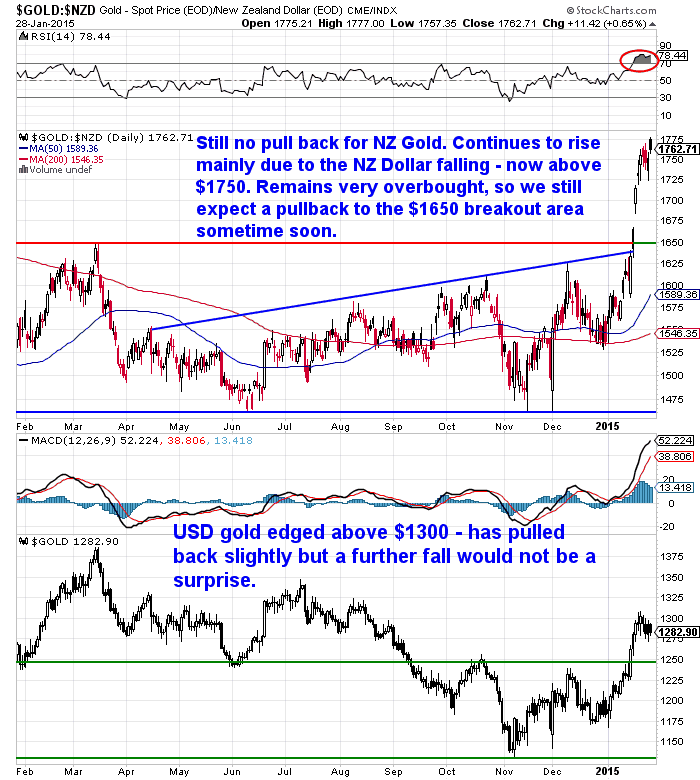

Local gold and silver prices have jumped again from last week. So much for our call to look out for a fall!

As you can see above NZD Gold is above $1750 – another 18 month high and a 2.2% rise from a week ago. With it so overbought a pull back still looks on the cards – perhaps to where it broke out from – around $1650.

NZD Silver is much like gold – holding pretty steady at the moment. But it too is overbought so due to dip back down from here.

RBNZ takes a leaf out of the Fed’s book

As noted in the gold chart the rise in local precious metals prices has been mainly due to the falling Kiwi dollar – actually nose diving more like. With it falling over a cent this morning.

Why was that?

Most likely due to the Reserve Bank (RBNZ) announcement. After all what else moves markets these days other than central banks?

The RBNZ appears to be taking a leaf out of the US Federal reserve book. They’re firmly sitting on the fence now. Saying that “we expect to keep the OCR on hold for some time. Future interest rate adjustments, either up or down, will depend on the emerging flow of economic data.”

Which is quite a departure from all the previous announcements where it was a case of when, not if, interest rate rises were coming. As we’ve been saying for some time we thought the bank economists were premature in expecting rates to be so steadily increased. We don’t think the global economy could handle it.

Meanwhile the Fed statement earlier this morning was very similar:

—–

“Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.”

—–

Translation: If things get better faster we’ll increase rates faster than expected. It things improve slower we’ll raise rates slower than expected.

Gee, thanks for that clarity.

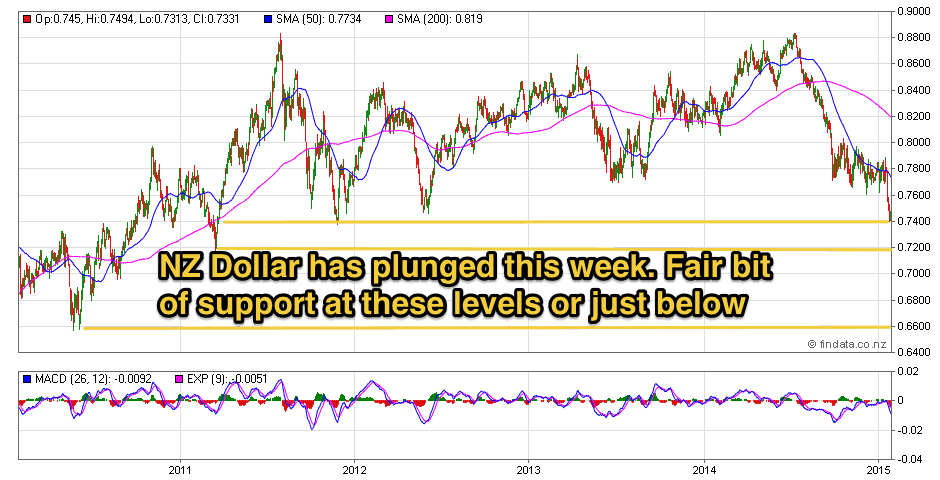

You can see in the chart below that the NZ dollar has dropped right down to 4 year lows. (actually that’s not so obvious as the chart isn’t showing this mornings fall below 0.74). So odds are we could see a further fall to around 0.72. Next stop after that is 0.66.

US Dollar topping out – Kiwi due a bounce?

However as we noted in our 2015 predictions (or guesses as we prefer to call them) we wonder if this rise in the US dollar is getting a bit long in the tooth.

There was some backup for our call that the US dollar may be getting close to a peak this week from Dr. Steve Sjuggerud:

—–

“Today may be the very top in the U.S. dollar,” I told Liz Claman on Fox Business’ “Countdown to the Closing Bell” last Friday.

The U.S. dollar has soared over the last several months. And it has now become a crowded trade.

I told Liz that no one expects the dollar to fall today… but that’s what I’m betting on.

I’m betting the long-term bull market in the U.S. dollar is ending right now.”

—–

The US dollar index has moved higher since he wrote that. But it does seem that most expect it to continue so likely that it wont.

So this fall of the USD (i.e. rise of the NZD) could create the pull back in local gold and silver prices we’ve been expecting. Conversely any fall in the USD could boost USD precious metals prices before too long. So that could propel them higher after a pull back.

What Impact will ECB money printing have on gold?

There is some evidence from past QE announcements that gold falls just afterwards. As shown by this BullionVault tweet and accompanying chart “Four out of 7 times each for $GBP + $USD price after BoE or Fed [QE announcements]”.

So odds say we are still more likely than not to see a fall in gold in the short term.

But in the long run, if history is any guide, it looks like the ECB money printing will have a positive effect on the price of gold. As we mentioned last week the National Inflation Association (NIA) shows there is a strong correlation between the ECB balance sheet and gold.

—–

“For the last nine years straight, gold has followed the ECB’s balance sheet extremely closely. In early-2006 when the ECB’s balance sheet was only worth €1.08 trillion, gold was just $613 per oz – but as the ECB expanded its balance sheet by 187% to a peak monthly average of €3.1 trillion, gold prices also soared by 187% to a peak monthly average of $1,763 per oz! Both the ECB’s balance sheet and gold began their pullbacks at exactly the same time, dipped the same percentage from their highs, bottomed together, and are now rapidly rising together!”

—–

This chart shows the NIA’s forecast of where gold will be by the time their initial QE/bond buying program is over – gold will be at a new all-time nominal high of nearly $2,000 per oz:

So if you’re looking to buy gold or silver…

Then keep a close on eye on prices for the next week or 2 as we could quite likely see a pullback in prices. Especially with recent Commitment of Traders (COT) gold futures reports showing a significant increase in the short positions of the commercial guys (Miners and end users of gold) and the long positions of the non-commercials.

Of course no guarantees – but the probability seems higher for a fall. So have your cash ready and sign up to our daily price alerts to stay informed of short term movements.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,530 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices

Spot Gold |

|

|

NZ $ 1755.63 / oz |

US $ 1286 / oz |

| Spot Silver | |

|

NZ $ 24.57 / oz NZ $ 790 / kg |

US $ 18.00 / oz US $ 578.68 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

|

Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

|

Our Mission

|

|

We look forward to hearing from you soon. Have a golden week! David (and Glenn) Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

|

The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2013 Gold Survival Guide. All Rights Reserved. |

Pingback: The Biggest News NO ONE is Talking About - Gold Prices | Gold Investing Guide