|

Gold Survival Gold Article Updates:

Nov. 27, 2014

This Week:

- Just How Well Capitalised are New Zealand Banks?

- Wealth Taxes on the Horizon

- Reminder: There is no deposit insurance in NZ banks

Prices and Charts

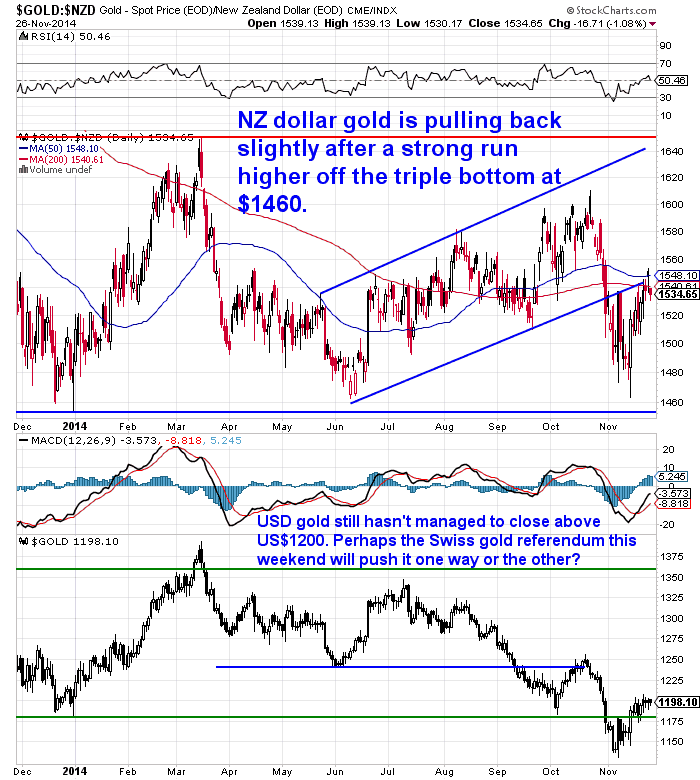

Both metals have moved up steadily since last week. Gold in US dollars is up $16.35 or 1.38% to $1198.50.

While in NZ dollars gold is up $15.02 or 1% to $1522.48.

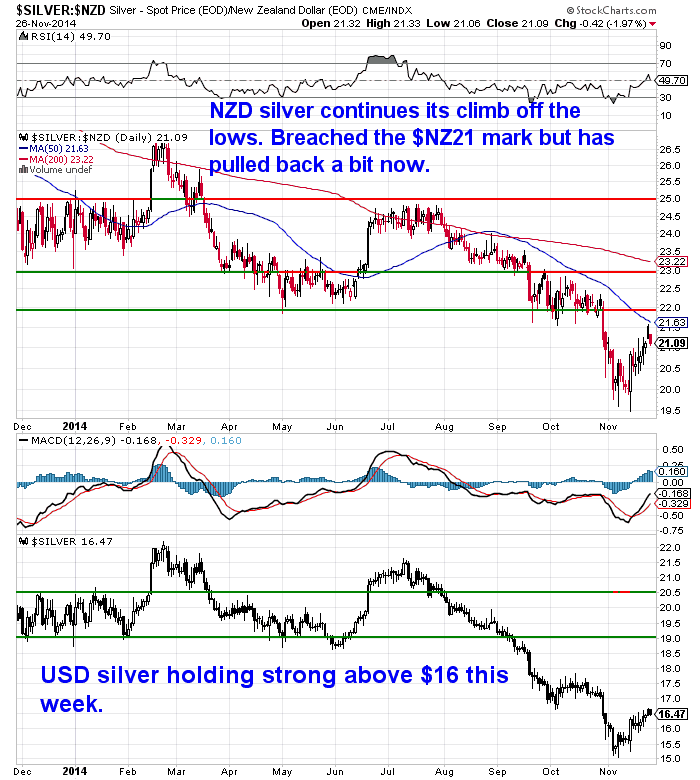

Silver in US dollars is up 44 cents to $16.60 from a week ago. Or in percentage terms up 2.7%.

While silver in NZ dollars is up 48 cents or 2.33% to $21.09. Just held back a bit due to a slightly stronger kiwi dollar.

Just How Well Capitalised are New Zealand Banks?

This weeks feature article looks at just how well capitalised New Zealand banks are? Along with what the implications might be if they’re not quite as solid as the RBNZ would have us think. We also look at a little reported action that occurred at the G20 in Brisbane in regard to how depositors funds are being reclassified globally. This weeks feature article looks at just how well capitalised New Zealand banks are? Along with what the implications might be if they’re not quite as solid as the RBNZ would have us think. We also look at a little reported action that occurred at the G20 in Brisbane in regard to how depositors funds are being reclassified globally.

Just How Well Capitalised are New Zealand Banks?

Wealth Taxes on the Horizon (and more financial repression)

Something we commented on in this weeks feature article is that the “powers that be” do seem to be quietly planning for a Financial Crisis Mark II.

In a recent King World News piece by Ronnie Stoferle he warned that wealth taxes look likely to be coming before too long and gave a number of examples of early warnings including:

- Discussion of exit fees on bond funds by US Fed

- Expropriation of private pension funds in Poland

- And Italy taxing incoming cross border money transfers 20% retroactively.

Wealth Taxes on the Horizon

On top of these we’ve now seen Commerzbank become the first major German bank to impose negative interest rates on big deposits. The move won’t affect ordinary savers – only major corporate or institutional clients will be charged. However there was use of the word “currently” in quotes from various banks. i.e. We have no plans currently to tax smaller depositors, meaning we may do later on?

The Wrath of Draghi: Biggest German Banks Impose “Negative Interest Rates”

Ronni has alluded to this in his past excellent “In Gold We Trust” reports as being something to expect as part of the “financial repression” to force savers into riskier investments with the aim to generate “growth”. So it is yet another “brick in the wall” so to speak.

Reminder: There is no deposit insurance in NZ

Also as we note in this weeks feature article, New Zealand unlike many nations doesn’t have any deposit insurance on bank deposits of any size. An ex IMFer who conducted the review reckons the NZ treasury and Reserve Bank should rethink it’s advice not to have any deposit insurance.

—–

“A review of the Treasury’s fiscal policy advice has recommended the government’s financial adviser revisits its work on deposit insurance in tandem with the Reserve Bank, saying the issue remains a concern in the unlikely event of a major bank failure…

“The absence of a limited deposit insurance mechanism and the degree of concentration of the banking system still give cause for concern about the fiscal risks of a potential failure of one or more banks,” Ter-Minassian said in her report. “These concerns are reinforced by the precedent of the blanket deposit guarantee extended by the Government in the wake of the global financial crisis.”

Last month, the Reserve Bank’s head of prudential supervision Toby Fiennes said the central bank’s task to manage system wide risk meant that it was willing to allow individual entities to fail to avoid risks posed by moral hazard, where a party will take more risk as it won’t bear all of the consequences, and inefficiency.

At a media conference following the release of its six monthly financial stability report, central bank governor Graeme Wheeler today said the bank recommended against deposit insurance because the scheme doesn’t tend to work well in jurisdictions such as New Zealand with a high concentration of banks, and was better suited to places like the US, which have a large number of smaller lenders and a relatively high rate of failure.”

—–

In our view deposit insurance is merely about confidence anyway. It might keep some deposits in the banks for a bit longer in the event of a GFC Mark II. The current monetary system is based purely upon confidence anyway. So it’s not surprising someone previously from the IMF would recommend something to help maintain that confidence.

If you don’t have quite as much confidence in the banking and global financial system as the central bankers would like you too, then you might want to consider grabbing some financial insurance in the form of physical gold and silver.

Free delivery anywhere in New Zealand and Australia

We’ve got free delivery anywhere in New Zealand or Australia on a box of 500 x 1oz Canadian Silver Maples. Delivered to your door via UPS, fully insured is $12650 and delivery is now about 7-10 business days. |