|

Gold Survival Gold Article Updates:

December 18,2014

This Week:

- How Low Interest Rates are Keeping Your Wages Low Too

- Ronald Sterferle: How much longer can gold price intervention go on?

- Austria: The next cab out of the rank in gold repatriation

NOTE: This email was written yesterday but due to issues/fixes with our mailing sending service did not get delivered. We have updated the spot prices and product prices at the end of the email. But the charts and pricing in the email body compare yesterdays prices to last weeks. However the New Zealand dollar spot prices have not changed much since yesterday.

Also if you’ve had trouble receiving our emails lately hopefully these changes from our mail sending service will improve deliverability from now on. Thanks for your patience.

Prices and Charts

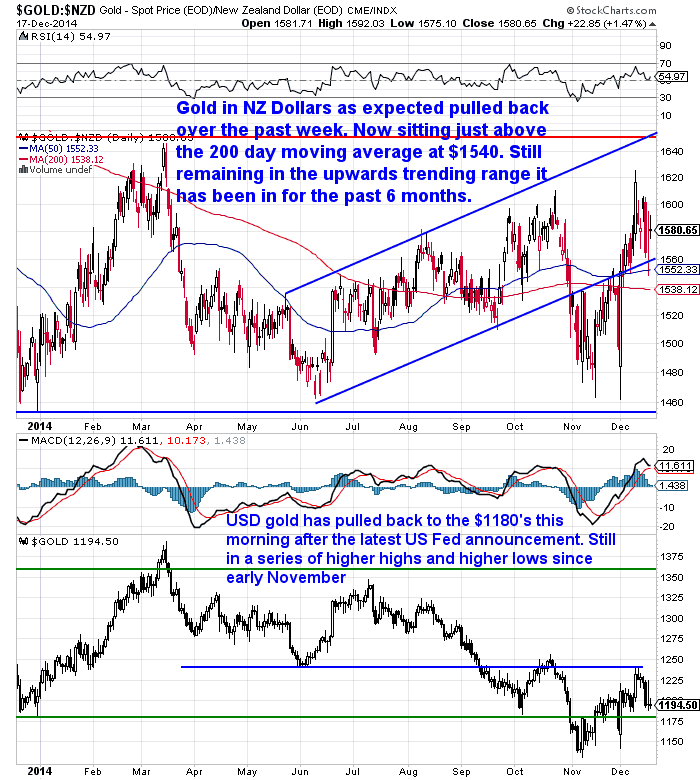

As expected last week, gold in NZ dollars moved lower during the past 7 days was. Down $28.98 or 1.83% to $1547. It now sits just above the 200 day moving average, but remains within the confines of the uptrend it has been in since June.

Gold in US dollars is down $37.89 or a hefty 3.08% to $1189.33 compared to a week ago.

A multitude of reasons have been given including the likelihood of Russia selling its gold reserves to shore up the ruble. Not that likely in our opinion.

And the expectation of the Fed dropping the phrase to keep borrowing costs near zero for a “considerable time,” in its announcement today. It did do this but merely replaced it with some gobbledygook “that it can be patient in beginning to normalize the stance of monetary policy”.

That looks to us to be the perfect phrase to use. Why’s that?

Because it is meaningless and lets them do whatever they want whenever they want to!

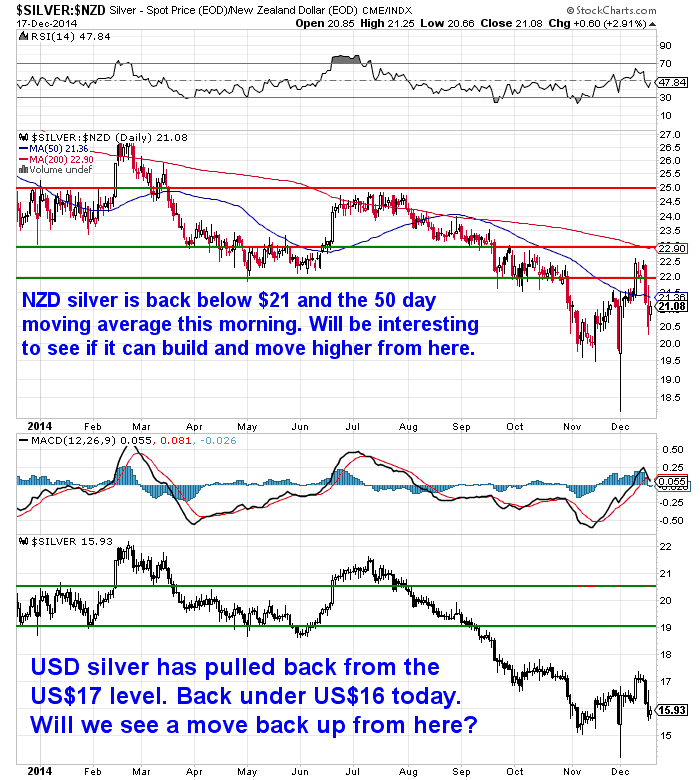

Silver has also pulled back quite sharply.

In US dollars it is down $1.32 or a chunky 7.7% to $15.78.

While in NZ dollars silver is down $1.43 to $20.53, or in percentage terms down 6.5%.

We mentioned last week that the NZ government surplus could be in trouble due to the lower whole milk powder prices. This was proven to be the case with Treasury numbers released this week. Mr English remains the optimist expecting to still get pretty close. But with things remaining sluggish with our main trading partners we have our doubts still.

This may well be the reason the NZ Dollar has dropped again this week. Down 1 cent on a 7 days ago. Today it sits at 0.7688.

Austria: The next cab out of the rank in gold repatriation

It seems it’s a case of another week another central bank gold repatriation. Last week we shared and discussed an article entitled The Mother Of All Bank Runs! This looked at how we are witnessing a number of countries asking for their gold to be returned home. These include Germany, the Netherlands and, most recently, Belgium. Along with French presidential candidate Marine Le Pen also bringing up the possibility of French gold being repatriated.

Well, this week the discussion has turned to how Austria are also considering repatriating gold currently stored with the Bank of England.

Koos Jansen gave a good summary of what Austria have been up to and he finished off with this comment:

—–

“It looks like Austria is taking it step by step, just like The Netherlands did. First there was some discussion in politics about the official gold reserves and then actions are being taken behind the scenes, in the case of Austria they started to allocate their gold. The fact concrete actions already have been taken since July 2013, tells me there is a significant probability more will follow; such as repatriating gold from London.

Given the ‘risk of a high concentration at the Bank of England’, the examiner advise to ‘rapidly evaluate all possibilities of a better dispersion of the storage locations’… The central bank has not ruled out such a relocation. The existing gold storage concept would be reviewed, potentially it will bring parts of the stored gold in the UK to Austria, OeNB experts have stated.

Bear in mind The Netherlands not even talked about repatriating openly while preparing it. Who knows how many countries are preparing or discussing repatriating behind closed doors at this moment.”

Source.

—–

Indeed who knows how many. This central bank gold “bank run” has the potential to be very significant. Who knows why they are all choosing to do it now? Could they know something the rest of us don’t about just what gold is held where, by whom or perhaps rather by how many? The central planners may also be worried about gold leasing and how many claims there are on the gold they think they own.

The day may come when we see a last ditch scramble to bring your gold home. Of course we won’t have to worry here because NZ doesn’t have any gold! See: How much gold does the Reserve Bank of New Zealand have?

Ronald Stoeferle: How much longer can gold price intervention go on?

Speaking of Austria, Austrian resident Ronald Stoeferle was posed a number of questions by readers of goldsilverworlds.com recently.

By the way, check out our summary of Ronni’s presentation here in Auckland last year if you’re unfamiliar with his excellent “In Gold We Trust” report:

Summary: Ronald Stoeferle’s Auckland, NZ, Presentation. Saturday 14/9/2013

One of the most popular questions was on the organized effort by large banks, acting as agents for Western central banks, to suppress the price of gold. In particular, the question how long this suppression can continue?

—–

“Answering the question for how long this can go is quite hard. The “powers to be” are able to control markets and situations for much longer than most of us believe. Gold market interventions, directly or indirectly, can go on for a long time, but not indefinitely. Stoeferle believes the final arbiter will be the physical market. In other words, when interventions will result in an exaggerated distortion, a physical shortage is very likely, and it will rebalance the market by driving prices (much) higher. Alternatively, would a collapse in the monetary system occur, gold could be invoked by central planners to rebalance the system.”

Source.

—–

Ronnie is a really bright guy and while probably one of the youngest gold analysts around his opinion is worth keeping an eye on. So check out the full article if you’ve got a moment. He answers questions on:

- The recent gold price weakness, and, related to that, possible triggers which could reverse the downtrend.

- The short and long term outlook for gold

- The implications of competing digital currencies like bitcoin.

- The possible future structure of the global monetary system including the IMF’s plans for introducing SDRs

Best not to wait for the central planners to decide on whether gold fits into the new monetary system, as by then it will be too late.

Local gold and silver suppliers will shut down over the Xmas / New Year break for a couple of weeks, so you won’t be able to purchase locally refined bullion until after the New Year holiday. However we will still have options to buy during this period. So if you see any price weakness (which is not uncommon at this time of the year) then get in touch.

Free delivery anywhere in New Zealand and Australia

Todays price for a box of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured is $12,405 and delivery is now about 7-10 business days.

|