Prices and Charts

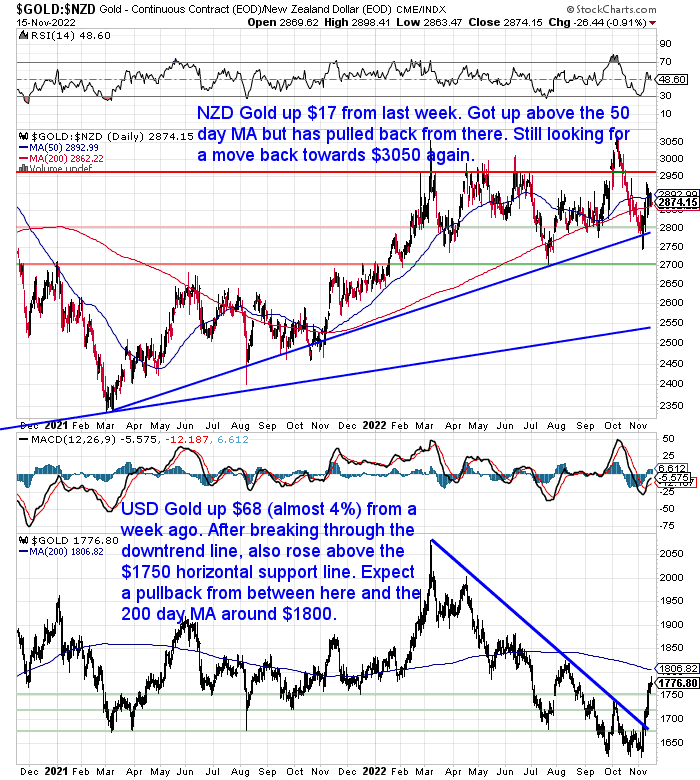

NZD Gold Pulling Back After Sharp Run Higher

Gold in NZ Dollars is up $17 from 7 days ago. It got up close to $2950 but it has pulled back a little from there. Now sitting just above the 200 day moving average (MA). We’re still watching for a move back towards the $3050 high from October and March.

Conversely, gold in USD terms has had a strong run higher. Having broken above the downtrend line, it’s up nearly 4% from a week ago. USD gold is now approaching the 200 day MA around $1800. So the odds are high we’ll see a pullback from around there with the RSI getting into overbought territory.

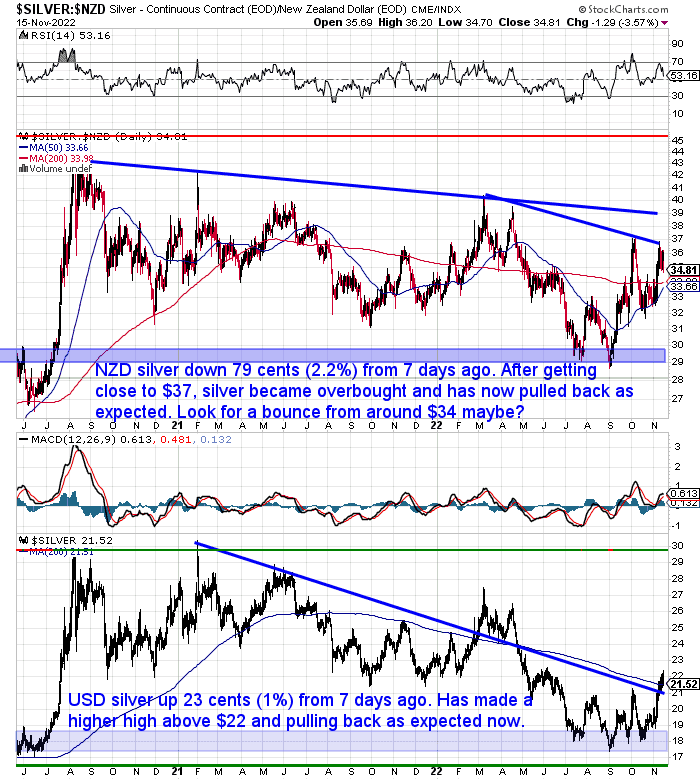

NZD Silver Down Over 2%

Meanwhile silver in NZ dollars is down over 2% from last week. Solely care of the much stronger Kiwi dollar. After getting up close to $37 silver became overbought and has now pulled back as we thought it might. We’re now watching for a possible bounce up from where the 50 and 200 day MA’s converge at around $34.

Silver in USD has continued its run higher. Getting above the 200 day MA, it looks to be making a higher high above $22. Pulling back now as expected. Watching for a higher low maybe around $20?

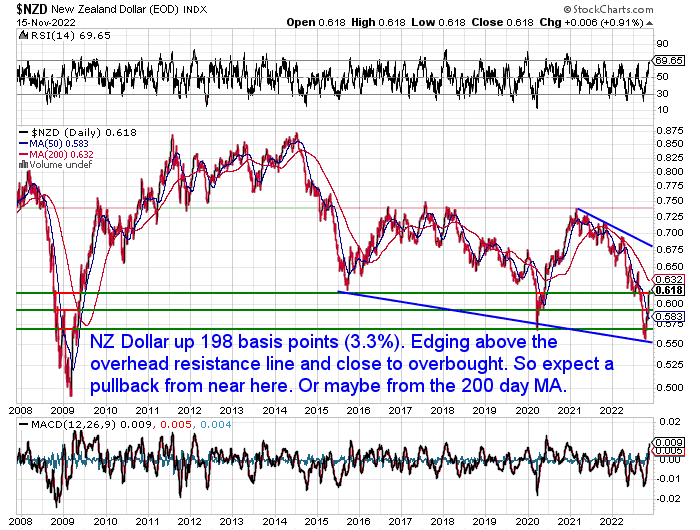

NZ Dollar Surges By 3.3%

As noted already, the Kiwi dollar has had a strong week. It has surged higher by almost 200 basis points or 3.3%. It has edged above the green horizontal resistance line, but is now approaching overbought on the RSI (above 70). So we should expect a pullback from between here and the 200 day MA at 0.63.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Are Rising Interest Rates Starting to Cause Problems in the Interest Rate Derivative Market?

Back in September the exit of Liz Truss as U.K. P.M. was likely caused by what are called interest rate derivatives…

“Basically pension plans appear to have been caught in doom-loop of margin calls on interest rate derivatives that forced them into dumping longer-maturity UK gilts, and spurred the Bank of England into intervening today.”

Source.

So the BoE began buying UK gilts (i.e. government bonds) to stop interest rates rising further. That in turn made Truss’s debt funded tax cuts start to look a rather bad idea. The rest as they say is history.

But what exactly are interest rate derivatives? How big could the risk be to the global economy?

We’ve been following the global derivative balloon for many years. It is these interest rate derivatives that appear to be the biggest risk.

So this week we have: Derivatives – a Beginner’s Guide to “Financial Weapons of Mass Destruction”.

You’ll discover:

- What is a Derivative?

- The History and Origin of Derivatives

- Why Interest Rate Swaps are the Dominant Derivative

- Interest Rate Derivatives Could be the Source of Big Trouble

- 2022 Interest Rates Rises Causing Problems?

- What Do These Derivatives Mean for New Zealand?

- NZ Bank Derivatives Have Grown Too

- How to Protect Yourself from Derivative Risk?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Counterparty Risk – Interest Rate Derivatives vs Silver

The trouble with derivatives is the risk of contagion. As each derivative has a counterparty to it.

As we explain in this week’s article above, they don’t necessarily “net” each other out. One side could collapse while the other side remains in force. If contagion occurs suddenly the global financial system could be at risk.

But we won’t know about this until it’s too late. That’s why it’s better to be years too early than a moment too late when protecting yourself from these long tail/outlier risks.

For more on counterparty risk see: Why Gold Bullion is Your Financial Insurance (& How It’s Still Not Too Late to Buy)

Gold is the obvious choice to protect yourself from counterparty risk.

However silver could play a bigger role than many would think…

Silver Allocation of 4% to 6% Optimal In Investment Portfolio

A new report by OxfordEconomics & The Silver Institute advocates a significantly higher allocation to silver by institutional & individual investors than most would expect.

“While silver’s price movements are often closely correlated with gold, Oxford Economics’ analysis suggests that silver’s return characteristics are sufficiently different from gold to make it a valuable diversification tool that deserves its own portfolio commitment. With over half of global silver demand used in industrial applications, the price of silver tends to be more sensitive than gold to trends in the global industrial cycle, contributing to its higher volatility. Moreover, silver is likely to benefit from an increasingly positive structural demand outlook over the medium term, given its use in many green technologies, indicating that we may be entering a period where the gold-silver price ratio shifts back in favor of silver.

Based on their projections for asset returns, Oxford Economics investigated the potential behavior of silver relative to other asset classes and its role in an optimal portfolio over the next decade. This analysis suggests an even higher optimal portfolio allocation to silver of around 6 percent would be warranted over this period.”

Full report available here.

Get in touch if you need help building your silver to 4% to 6% of your investment portfolio.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|