Here’s the latest from “our favourite billionaire” Hugo Salinas Price. This piece is short and acts as a bit of an introduction to a much older article of his on the topic of global trade and structural imbalances as a consequence of the current credit based global monetary regime. If you like this piece we recommend you read (or even re-read) his earlier article: The Gold Standard | Generator and Protector of Jobs.

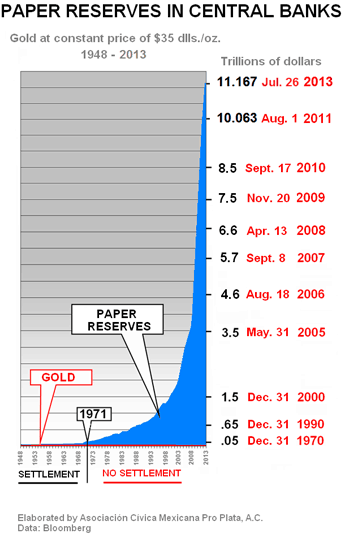

International reserves, excluding gold, as reported by Bloomberg, courtesy of Doug Noland at www.prudentbear.com on July 26, 2013, stood at $11.167 Trillion dollars.

International reserves, excluding gold, are mainly made up of dollar and euro holdings.

On August 1, 2011, holdings amounted to $10.063 Trillion dollars.

On year later, holdings had increased to $10.450 Trillion dollars, an increase of $387 billion dollars.

In the most recent twelve months, holdings have increased by $717 billion dollars, to the present level of $11.167 Trillion dollars.

International reserves increase when importing countries cannot pay for their imports with exports; in other words, when the importing countries have “trade imbalances” and make up the trade imbalance by sending (mainly) either dollars or euros to the exporting countries.

Evidently, the importing countries or areas are falling behind in their capacity to pay with their own products, for the products of the exporting countries. The amount of dollars and euros (and other reserve currencies) which they had to send to the exporting countries increased by 85% in the last twelve months, over the sum which they sent the previous twelve months, i.e. from August 1, 2011 to July, 2012.

The increase in “International Reserves Excluding Gold” from 1971 to the present – 42 years – has been spectacular.

It is important to note that “International Reserves” are invested in diverse Bonds, prima facieevidence that trade imbalances have not been settled since 1971. Settlement happens when a debt is paid. If a country owns Bonds, it is a holder of debt and has not been paid. Had the trade imbalances been settled, International Reserves would be not much different from what they were in 1971.

“International Reserves” thus represent credit which the exporting countries of the world have granted to the importing countries which use dollars and euros as money; when these countries tender dollars or euros in “payment”, they are not settling any debt; they are simply running up more debts with the exporting countries. $11.167 Trillion dollars and counting. The Reserves earn interest – they are invested in Bonds – and so the Reserves must also grow, as interest earned accumulates.

It is in the nature of things – rerum natura – that any quantity cannot increase indefinitely. In the nature of things, there are limits. In other words, “trees do not grow to the sky”.

When and how will this increase in the debt of the importing countries to the exporting countries find a limit?

It appears that the few hundred men who are running this world are confident that this game – for it is truly a game – will not end anytime soon, and that is all these potentates care about: “Aprés moi, le déluge” or “Devil take the hindmost” is their motto.

It is no wonder that the Chinese are buying gold hand over fist. The Indians likewise, are scrambling for gold. Russia and other nations in the East are stocking up. No official announcements anywhere, but actions speak louder than words.

10 days, 10 weeks, 10 months, 10 years – nobody knows. But this game is going to end, someday, and its ending will be painful. When the dust settles, a whole new world will replace the present one. We have no idea what it will look like, but it will be here, populated by humanity who will not cease to wonder: “What were they thinking?”

By Hugo Salinas Price – Originally published at Plata.com.mx

Pingback: 4 Reasons to be Bullish on Silver | Gold Prices | Gold Investing Guide

Pingback: Reader Question: “Why would a fall in the NZ dollar be a negative?” | Gold Prices | Gold Investing Guide