Gold Survival Gold Article Updates: Dec. 12, 2013 This Week: Gold Manipulated Upwards? Record shorts fail to push gold to new lows The Correction Isn’t Over, But Gold’s Headed to $20,000 RBNZ Forward Guidance and Other Bunkum Gold Manipulated Upwards? A bit of a turnaround from last week with gold “stop logic” […]

Tag Archives: new zealand

We now have details of the third well known gold personality to be brought to New Zealand by our friend Louis Boulanger: John Butler, Managing Partner and Chief Investment Officer of Amphora Capital based in London. John Butler will be speaking at two luncheons that are being sponsored by CFA Society of New Zealand. The […]

As we referenced in last weeks article on gold backwardation and negative Gold Forward Offered Rates, there has been plenty of talk around the interwebs of “high demand for physical gold and that this is backed up by falling COMEX inventories”. There have been arguments made that these falling inventories are signalling a soon to […]

Little old New Zealand made international news in the past week or so, with word of the intervention in foreign exchange markets by the Reserve Bank of New Zealand being reported in the likes of the Washington Post. The Post ran an article headed “In global currency war, a new front opens in the South […]

Unless you’ve been under a rock (or without broadband and TV for 3 days like me!) you will have no doubt heard about the “bail in” of banks via bank depositors in the small island nation of Cyprus. The proposal (which has since been voted down) was to tax – a.k.a. steal funds – up […]

What happens if a bank fails in New Zealand? If your bank failed tomorrow, what would happen? Who knows is the current answer. If it was a small bank the government may leave it to the statutory managers and so depositors might get wiped out completely if the bank was devoid of assets. But, if […]

Everyone Else is Printing Why Shouldn’t We? You’ve no doubt heard the Greens theory announced this week that the Reserve Bank of New Zealand (RBNZ) should print money to buy $2 billion dollars worth of Canterbury reconstruction bonds and overseas assets. Their theory being we will restock the Governments Disaster Fund and lower the NZD […]

This week we had an email from a reader (and well informed reader at that) asking about the possibility of governments confiscating citizens gold or even the possibility according to James Rickards that “the government won’t need to confiscate gold, they will deem that the citizen has made an unfair windfall profit and impose a […]

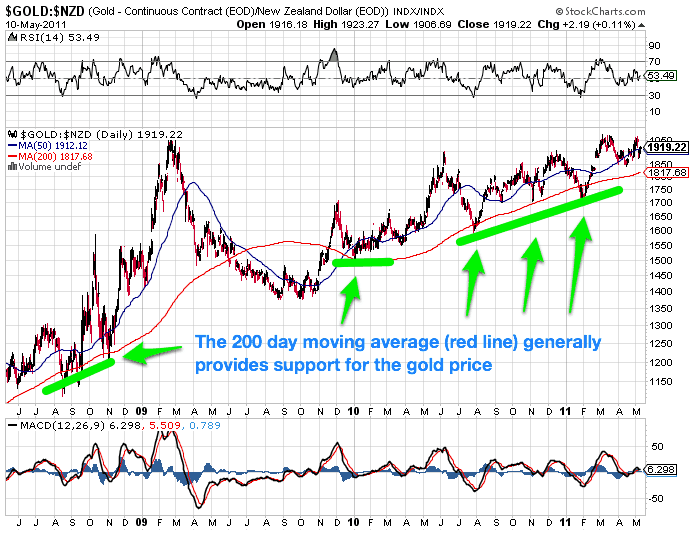

Personally we believe using technical analysis in isolation is of limited value. When markets are being flooded with printed money they won’t necessarily follow historical trends, which, in its simplest form is basically what technical analysis is. However, used in conjunction with other indicators and fundamental analysis, technical analysis has its place. Say you’ve done […]